Pro Gold EA MT4 Review: Basket Exit Strategy for XAUUSD

If you’re tired of robots that micromanage every single position and still blow up when gold spikes, you’re going to like this. Pro Gold EA V1.0 MT4 takes a very different approach: instead of treating each order as its own island, it manages the whole XAUUSD basket as one portfolio and then exits collectively. That single design choice changes a lot—psychology, risk control, recovery, and how profits are captured on a choppy metal like gold.

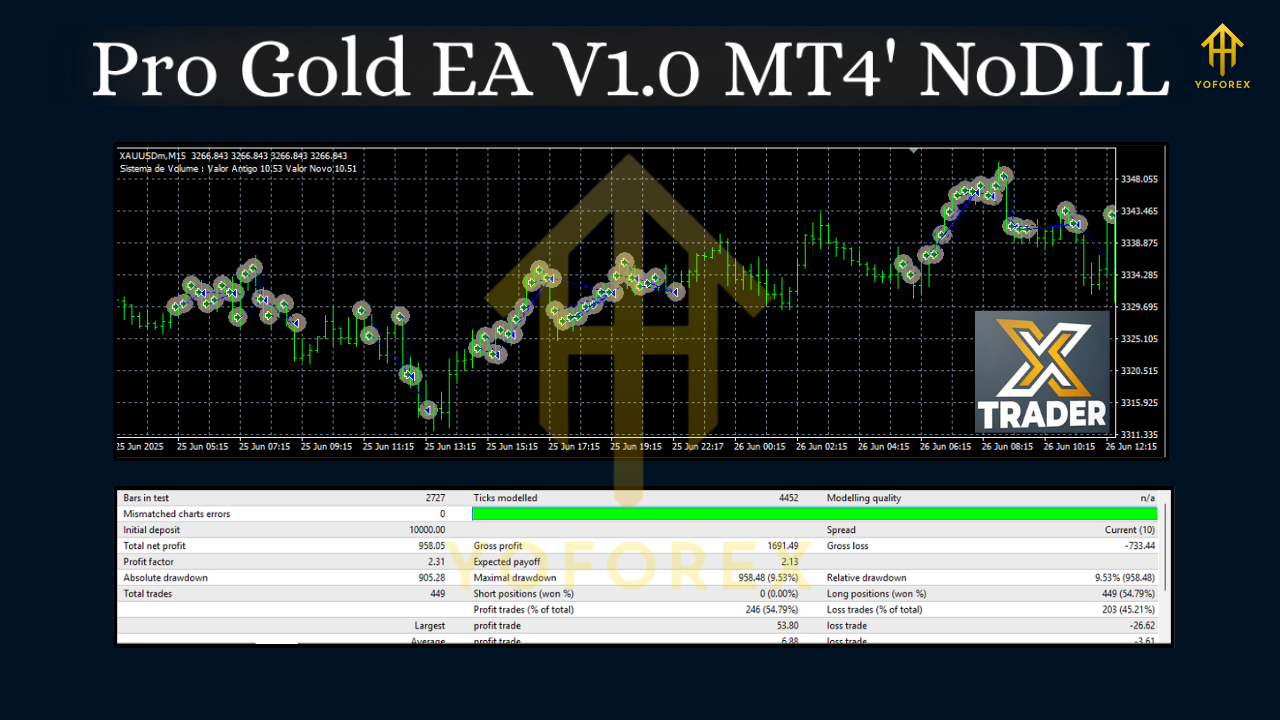

Right up front, the team behind the EA reports 287.92% verified gains with an 85% win rate on live accounts, alongside a 57.68% maximum drawdown that reflects an aggressive risk profile. Translation? It can hit hard on good streaks, but you need to respect the risk and configure it sensibly. This is not a set-and-forget money printer. It’s a tool—powerful when used right, painful if you ignore risk. Let’s dive in.

What makes Pro Gold EA different?

Most bots slap a stop loss on each trade and hope for the best. Pro Gold EA looks at your XAUUSD exposure as a single “story” unfolding across multiple entries. It’s like being the manager of a whole squad rather than yelling at one player. That collective portfolio exit means the EA can:

- Smooth out noise by treating small positions as contributors to one outcome.

- Allow staggered entries to improve average pricing without hard martingale scaling (you control position sizing; no forced step-ups).

- Exit the entire basket together when a target condition is met, locking in the net result rather than picking winners and losers piecemeal.

- Use dynamic basket-level TP/SL logic—so a volatile spike doesn’t randomly close one order and leave the rest stranded.

This portfolio logic suits gold because XAUUSD can trend beautifully then mean-revert aggressively. Managing exposure as a unit lets the system adapt to both modes.

Headline performance (and what it means)

- 287.92% verified gains: This suggests long compounding cycles or high risk, or both. Great—but don’t chase the number blindly.

- 85% win rate: High hit rate can lull traders into over-risking; you still need a plan for the 15% that don’t win.

- 57.68% max drawdown: That’s heavy. It confirms the EA can run hot. If you’re conservative, start smaller and cap daily risk.

Bottom line: The EA can deliver outsized results, but only if you size correctly and accept drawdown cycles. If “sleep-at-night” is your vibe, dial down risk; if you’re a growth-at-all-costs trader, you’ll probably love the aggression.

Who is this EA for?

- For traders who:

- Focus on XAUUSD and want a system that thinks in baskets.

- Prefer letting the EA manage exits, not babysitting each trade.

- Are okay with equity swings (because gold will throw punches).

- Not ideal for traders who:

- Want ultra-low drawdown strategies only.

- Can’t accept temporary floating losses during basket management.

- Prefer single-shot scalps with tight fixed stops on each order.

Core features (in plain English)

- Basket-level exit logic – manages all XAUUSD orders as one portfolio.

- Configurable position sizing – fixed lots or risk-based; you’re in control.

- Staggered entries (optional) – allows scaling into moves for better average price.

- Dynamic basket targets – take profits or losses across the entire set.

- News awareness (user-driven) – you can pause around red-flag events if that’s your style.

- Equity/daily stop options – cap risk per day or per equity percentage.

- Broker-agnostic – built for MT4; just choose a tight-spread gold broker.

- VPS-friendly – runs 24/5 without you hovering.

- Clear logs & alerts – see what the EA’s thinking so you’re never in the dark.

- No forced martingale – the EA doesn’t require an ever-increasing lot progression; scaling is configurable, not compulsory.

How the collective exit actually plays out

Let’s say gold whipsaws during a New York session. A typical robot might grab a few tiny wins, then eat a few ugly stops, and you end flat or worse. Pro Gold EA, on the other hand, might seed multiple small positions that reflect its directional bias; as price returns toward a median, it exits the entire basket at a net gain (or controlled loss), rather than cherry-picking which trade to close. That “all-for-one” exit removes a lot of noise and aligns PnL to the bigger picture.

Does this mean drawdown can build up? Yep. That’s part of the design. The flip side is that recovery tends to be decisive because the EA aims to resolve the entire exposure together.

Setup & recommended starting settings

You don’t need to overcomplicate the first run. Keep it clean:

- Install: Copy the EA file into

MQL4/Experts, restart MT4, and enable Algo Trading. - Chart: Attach the EA to XAUUSD (any timeframe it supports—M5/H1 tend to be common for gold workflow; pick one and stick to it for consistency).

- Lot sizing: Start small. If you’re using a $1,000 account, consider 0.01 lots as a ceiling while you learn the rhythm.

- Max positions per basket: Keep this modest initially (e.g., 3–5) to avoid oversized exposure.

- Equity stop: Use an equity-based circuit breaker (e.g., 5–8% daily or 10–15% per basket) to protect from outlier days.

- Daily profit target: Consider a soft daily target where the EA stops trading after a win day. Banking gains matters—coz giving them back hurts.

- News filter (manual discipline): If you don’t have an automated filter, pause around Non-Farm Payrolls, FOMC, CPI, or unexpected geopolitical shocks.

- VPS: If your internet is shaky, a VPS is worth it. Gold likes fast execution.

As you gain confidence, you can expand the max positions or lot size gradually. Don’t rush—consistency > speed.

Risk management that actually respects gold

Gold is not EURUSD. It gaps on headlines, runs 300 points for fun, then snaps back. To trade it smart:

- Cap per-basket exposure: Lot size × max positions should be something you can emotionally tolerate.

- Use an account-level seatbelt: Equity stops and daily loss caps prevent “revenge trading via robot.”

- Limit simultaneous baskets: Don’t run multiple conflicting systems on the same account unless you fully understand correlations.

- Don’t widen spreads with bad brokers: Choose a broker with tight XAUUSD spreads and decent liquidity during your trading hours.

- Withdraw periodically: If you hit a good run, take some off. The market owes us nothing.

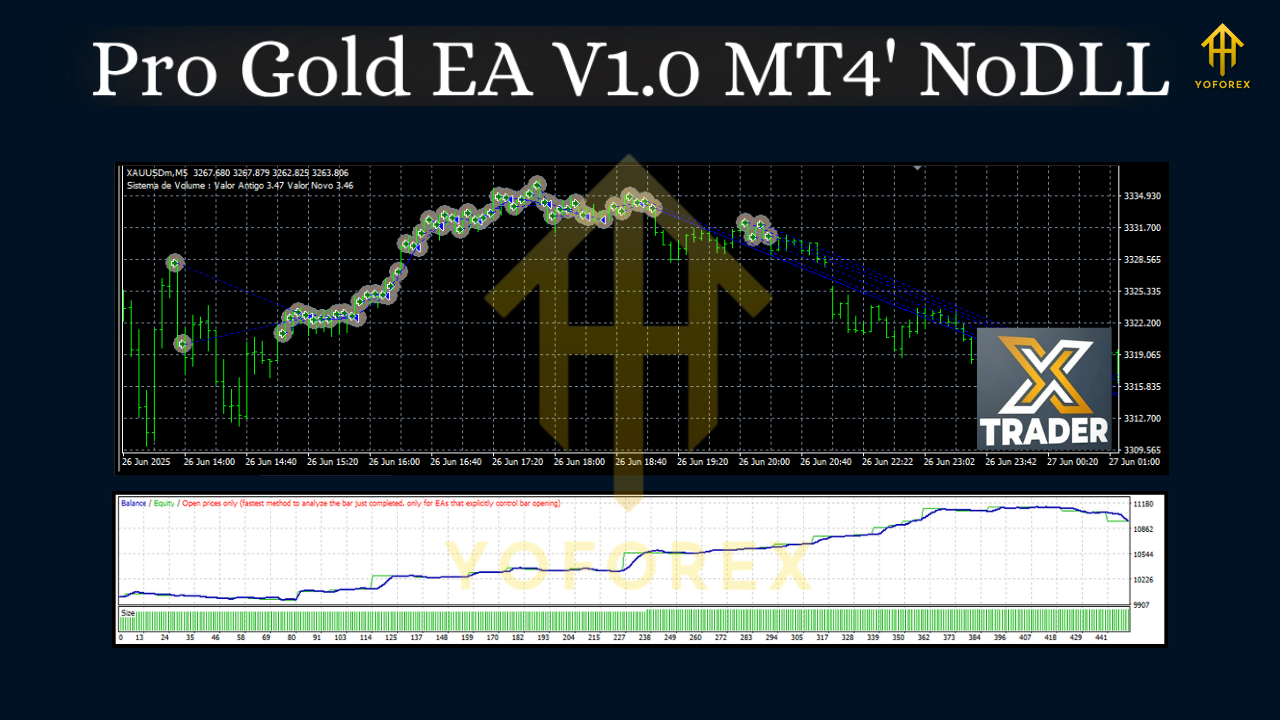

Backtests vs. live performance

Backtests are great for stress-testing logic, checking edge cases, and seeing how the EA reacts across different regimes. But gold shifts with macro cycles; live execution, slippage, and server latency matter. Here’s a sane approach:

- Backtest across multiple years (e.g., 2019–2025) with variable spread and quality tick data.

- Forward test on demo, then move to a small live account.

- Track: average basket duration, average max adverse excursion (MAE) per basket, and largest basket in lots. These tell you whether you’re pushing it.

- Compare your live stats with the marketed figures (287.92% gain, 85% win rate, 57.68% DD) and decide the risk level that suits you.

Practical pros & cons

Pros

- Basket exit logic aligns with how gold actually moves.

- High win-rate profile when conditions suit.

- Configurable scaling and safety brakes.

- Clean MT4 workflow and VPS-friendly.

Cons

- Drawdown can be significant; requires discipline.

- Not a good fit for traders who panic at floating loss.

- News spikes can challenge baskets if unmanaged.

Final thoughts (and a gentle nudge)

Pro Gold EA V1.0 MT4 is built for traders who want portfolio-style control over gold, not one-off darts. The reported 287.92% gains and 85% win rate are eye-catching, but the 57.68% max drawdown is your reminder to respect risk, start small, and grow with data. If you’ve been hunting for an XAUUSD robot that thinks like a portfolio manager, this is worth serious testing—demo first, then live with small risk, and document everything. You’ll thank yourself later, promise.

Comments

Leave a Comment