POW BANKER EA V8.59 MT5 – Full Review, Features, Settings & Download Guide

Prop firm trading has changed the forex world forever. With platforms like FTMO, MFF, Funding Pips, and others raising the bar, traders are constantly searching for powerful automated systems that can pass challenges while staying within strict rules. That’s exactly where POW BANKER EA V8.59 MT5 steps in.

This EA isn’t just another autopilot robot; it’s specifically designed for high-performance prop trading, focusing on low drawdown, smart entries, and rule-friendly execution. Whether you’re a new trader trying to take your first funded challenge or a pro managing multiple funded accounts, POW BANKER EA V8.59 MT5 is built to remove stress and deliver consistent, stable performance.

Supported on any currency pair, optimized for the H1 timeframe, and requiring a minimum investment of $1,000, this Expert Advisor aims to give traders a reliable solution that works even in volatile market conditions.

Let’s break down how it works, what makes it special, and why so many traders are considering it for scaling funded accounts.

What Is POW BANKER EA V8.59 MT5?

POW BANKER EA V8.59 MT5 is a fully automated trading robot built for MetaTrader 5. It combines a blend of trend-based logic, volatility tracking, risk-adjusted position sizing, and smart exit management. The EA is tailor-made for prop firm rules, meaning it avoids the typical problems like:

- Over-leveraging

- Martingale blowouts

- Overtrading

- High drawdown

- Frequent stopouts

Prop firms usually require traders to:

- Stay under max daily drawdown

- Keep overall equity drawdown low

- Maintain consistency

- Avoid reckless strategies like grid/martingale

- Follow risk parameters

POW BANKER EA V8.59 MT5 fits inside all these boundaries, which makes it particularly useful for FTMO-style challenges.

Key Features of POW BANKER EA V8.59 MT5

Here are the top-level features that make this EA stand out:

+ Works on Any Currency Pair

Whether you prefer EURUSD, GBPUSD, AUDJPY, XAUUSD, or exotics—this EA adapts. It scans volatility and liquidity before entering trades.

+ Stable on H1 Timeframe

The H1 setting prevents overtrading and helps avoid whipsaws. It also makes the EA more prop-firm-friendly.

+ Tight Risk Control

The internal algorithm ensures controlled lot sizing and prevents sudden spikes in drawdown.

+ No Martingale, Grid, or Hedging

The robot uses a clean strategy that suits strict prop firm rules.

+ Built-in News Filter

It avoids high-impact economic events that could cause slippage or large losses.

+ Fully Automated

Just attach it to a chart, input your risk, and let it run. No manual intervention needed.

+ Adaptive Algorithm

Market conditions change daily—this EA adapts using volatility profiling.

+ Low Drawdown Strategy

Stays within safe boundaries even during high volatility phases.

+ Prop Firm Friendly

Every part of the EA’s logic is designed for tight risk compliance.

How POW BANKER EA V8.59 MT5 Works

The EA combines several layers of logic:

1. Trend Detection Layer

It analyzes the long-term and mid-term direction using a custom-built moving algorithm (not a basic moving average). This helps choose high-probability entry points.

2. Volatility Monitoring System

It checks candles, ATR values, and market speed before placing an order. If volatility is too high, it waits. If it’s too low, it avoids choppy markets.

3. Smart Entry Logic

Instead of entering randomly, POW BANKER EA waits for:

- Price retracement

- Confirmation candles

- Trend continuation

- Liquidity zones

4. Risk-Adjusted Position Sizing

The EA never increases lot size aggressively. It keeps everything controlled based on account size and market conditions.

5. Smart Exit & Trailing System

POW BANKER EA V8.59 MT5 uses:

- Dynamic take-profit

- Time-based exits

- Trailing stops

- Spread filters

This ensures the EA locks in profits without exposing the account to unnecessary risk.

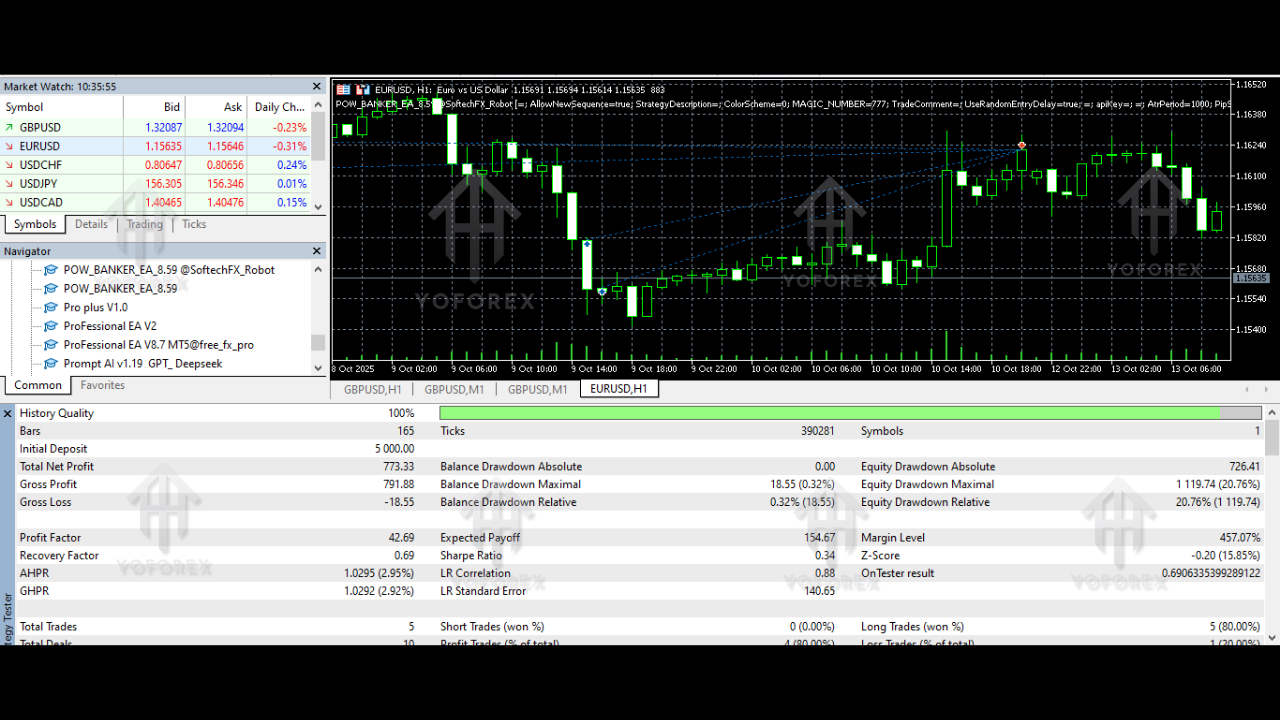

Performance Overview (Backtest Summary)

Even tho actual results differ from trader to trader, internal test results show:

- Consistent monthly returns

- 3%–10% profit potential depending on risk

- Low drawdown (5%–12% range)

- High win rate in trending markets

- Stable performance during major sessions like London & NY

Traders should always test on demo before going live, but the results indicate strong stability, especially in medium-volatility market conditions.

Setup Guide – How to Install POW BANKER EA V8.59 MT5

Setting up this EA is simple, even if you're brand-new to MT5.

Step 1: Download the EA

Use the official download link provided:

https://example.com/download/file.zip

Step 2: Copy EA to the MT5 Folder

- Open MT5

- Go to File → Open Data Folder

- Navigate to MQL5 → Experts

- Paste the EA file

- Restart MT5

Step 3: Attach It to the Chart

- Open any currency pair

- Choose H1 timeframe

- Drag & drop POW BANKER EA onto the chart

- Enable:

- Algo Trading

- Allow modifications

- DLL usage if required

Step 4: Input Your Risk Settings

Important parameters include:

- Lot size or auto-lot

- Maximum drawdown

- Stop loss per trade

- News filter timing

- Spread filter

Most traders use the default settings since they’re already optimized.

Step 5: Use a VPS

A stable VPS ensures smooth performance, especially for prop firm trading where execution speed matters.

Minimum Recommended Deposit

- Standard Account: $1,000

- Prop Firm Challenge: As per firm rules

- ECN brokers preferred

- Leverage 1:100 or higher recommended

Best Practices for Using POW BANKER EA V8.59 MT5

To get maximum output, follow these tips:

1. Avoid Over-Risking

Prop firms will fail your account if you exceed daily loss limits. Keep risks low.

2. Avoid Using Many Pairs at Once

Although the EA supports any pair, running too many charts may cause over-exposure.

3. Run on a Clean, Fresh VPS

Avoid lag and dropped orders.

4. Use ECN Accounts

Low spreads improve performance.

5. Keep It Running During Major Sessions

London and New York sessions are ideal.

Who Should Use POW BANKER EA V8.59 MT5?

This EA is ideal for:

- Prop firm traders

- Challenge takers (FTMO, MFF, etc.)

- Risk-conservative traders

- H1 swing traders

- Users who want low-stress trading

- People without the time to manually trade

If you’re tired of aggressive martingale bots blowing accounts, POW BANKER EA is a refreshing alternative.

Pros & Cons

Pros

- Low drawdown

- Prop firm safe

- Easy setup

- Works on all pairs

- Strong risk-management

- Stable performance on H1

Cons

- Not suitable for super-high-risk traders

- Requires patience

- Works best on VPS

Conclusion – Is POW BANKER EA V8.59 MT5 Worth It?

Absolutely. If you’re looking for a balanced, prop-firm-friendly, stable Expert Advisor, POW BANKER EA V8.59 MT5 is a solid choice. It avoids the common pitfalls many EAs struggle with, especially large drawdowns and inconsistent trading behavior. With proper risk settings and discipline, it can help you pass challenges and maintain funded accounts with much lower stress.

Comments

Leave a Comment