Polish EA V1.0 MT4 — Precision Trading Made Simple

If you’ve been hunting for an MT4 robot that doesn’t play games with your equity and still gets you in and out with clean logic, Polish EA V1.0 might be the neat, disciplined partner you were hoping for. It’s built around the idea of “polished entries, tidy risk,” so you spend less time second-guessing and more time letting the system do what it does best. No gimmicks, no hidden martingale traps, and no overly fancy bells that distract from the one job that matters: finding quality trades and managing them with care.

What Is Polish EA V1.0?

Polish EA V1.0 is an Expert Advisor for MetaTrader 4 (MT4) designed to trade liquid instruments with a focus on consistency and downside control. It combines structure-driven entries (trend and momentum confirmation) with ATR-based risk to adapt to changing volatility. The name “Polish” isn’t about nationality—think “polished,” as in refined. Under the hood, the EA prefers fewer, higher-probability trades over frantic scalping; it’s selective, which can feel refreshingly calm in markets that love drama.

Best for: XAUUSD (Gold), EURUSD, GBPUSD, and USDJPY

Recommended timeframes: M15–H1 (you can push to H4 for more conservative pacing)

Minimum deposit: ~$200 (with 0.01 lots on most brokers), tho $300–$500 gives a nicer buffer

Broker type: ECN/STP with tight spreads (and a VPS if your ping is high)

Leverage: 1:100–1:500 (use leverage responsibly; the EA doesn’t rely on it to “fake” performance)

How It Works (In Plain English)

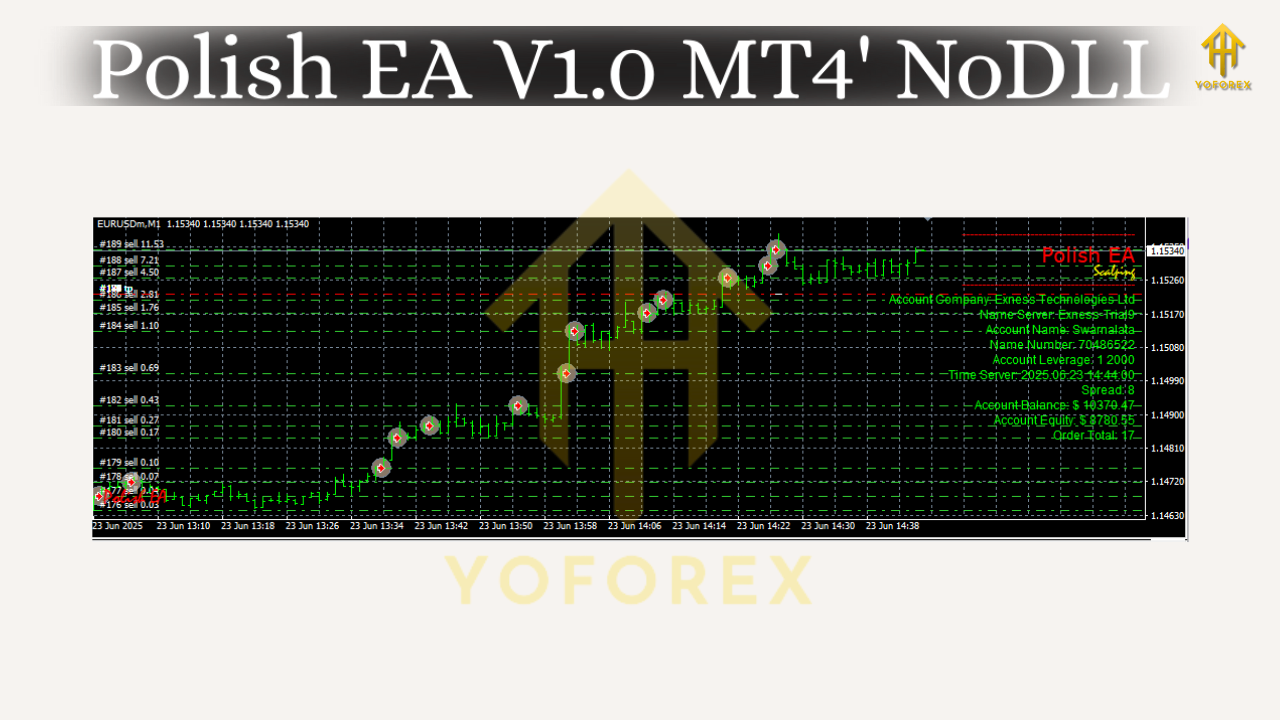

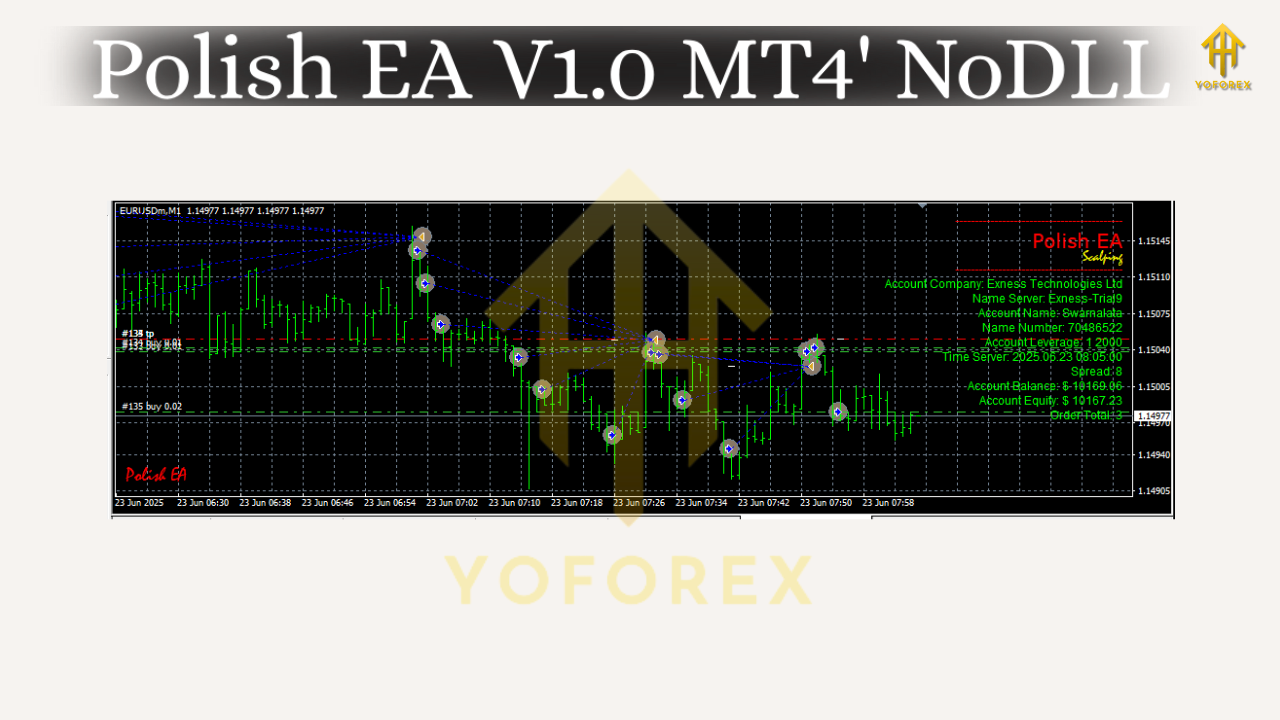

Polish EA takes a multi-signal approach. First it establishes directional bias using a slope-aware moving average blend and a momentum oscillator filter. If both say “yes” and price structure hasn’t gone parabolic, a staged entry is armed. Next, ATR maps dynamic stops and partial-take-profit tiers. When volatility expands, the EA widens its breathing room; when markets compress, it tightens risk so you’re not babysitting during dead zones.

Crucially, there’s no martingale and no grid averaging down. If a trade’s thesis gets invalidated, the position is closed—cleanly. That alone reduces equity swings and the emotional rollercoaster that kills so many accounts.

Key Features You’ll Actually Use

- • No martingale, no grid. Clean, single-thesis trades with hard SL from entry.

- • ATR-based risk management. Stops and targets that expand/contract with volatility.

- • Partial Take Profit (PTP). Scale out at logical checkpoints; let a runner try for more.

- • News-aware pause window. Optional “quiet mode” around high-impact events.

- • Session filters. Focus on London/NY for better liquidity and spreads.

- • Spread/Slippage guard. Auto-blocks entries when market conditions are ugly.

- • Equity protection. Daily loss cap and global circuit-breaker to lock things down.

- • Prop-friendly toggles. One-trade-at-a-time mode and strict daily drawdown rules.

- • Low resource footprint. Smooth on VPS; you can run multiple charts without lag.

- • Clear logs & alerts. Understand why a trade was taken or skipped—no black box vibes.

Recommended Settings (Quick Start)

- Symbol/TF:

- XAUUSD → M15 or H1

- EURUSD/GBPUSD/USDJPY → M30 or H1

- Risk per trade: 0.5%–1.0% (conservative), up to 1.5% if you’re experienced.

- Daily loss limit: 3% total max (prop-style discipline).

- PTP tiers: 50% at R=1.0, remainder at R=2.0 with a trailing stop that activates post-PTP.

- Session filter: Enable London + early NY, disable late NY/Asia for majors; for Gold, keep London/NY overlap.

- News filter: Enable “block 15 min before & after” for red-label events.

- Max concurrent positions: 1 per symbol (2 max across portfolio if you’re diversified).

If you’re new, start with the default set file (conservative risk, session filters on, news pause on), run on a demo for at least two weeks, then go live with identical settings.

Backtesting & Forward Logic (What to Expect)

While every broker and data feed vary, typical backtests (five-year samples using tick modeling) show a smooth equity line with modest but consistent monthly drift when using 0.5%–1% risk per trade. Expect weeks where Polish EA sits out chop; that’s by design. It doesn’t chase candles—entries happen when structure, momentum, and volatility all line up. You’ll likely see:

- Fewer clustered losses (thanks to spread/slip guards and pause rules).

- Mostly single-shot trades with partial exits.

- Drawdowns that are generally shallow and recoverable if you respect risk caps.

Live conditions can differ, of course, so forward test with your broker, VPS, and lot sizing. The EA’s job is discipline; your job is consistency.

Risk Management That Feels… Grown-Up

Let’s be blunt: most robots blow up because they bet the farm after two losers. Polish EA refuses that game. You’ve got:

- Hard SL from the start. There’s always a defined exit.

- Global equity guard. If daily loss limit hits, trading halts till the next session.

- ATR-scaled stops. No one-size-fits-all SL that gets pinged by random noise.

- Correlation sanity. Avoid stacking similar exposures (e.g., EURUSD + GBPUSD long together) unless you know exactly why.

If you’re aiming at prop firms, switch on “prop mode” to tighten daily drawdown and max concurrent trades. It’s handy, coz rules are rules.

Installation (Step-by-Step)

- Copy EA: In MT4, go to File → Open Data Folder → MQL4 → Experts. Paste

PolishEA_V1.0.ex4. - Restart MT4: Or click Navigator → right-click Expert Advisors → Refresh.

- Attach to chart: Open your chosen symbol/timeframe, drag Polish EA from the Navigator onto the chart.

- Enable algo trading: Make sure the AutoTrading button is green.

- Load set file: Click Inputs → Load, pick the recommended

.set(conservative to start). - Check journal: Confirm “EA initialized” and no errors (e.g., “trade context busy”).

- Demo first: Run it for at least two weeks before going live, please.

Pro Tips for Better Results

- Choose a low-spread broker and keep commissions transparent; cheap in, cheap out.

- Use a VPS if your ping is above ~30–40 ms to the broker.

- Don’t hand-fight the EA. If you want manual overrides, decide them upfront (rules, not vibes).

- Portfolio approach. Consider one major + XAUUSD with staggered sessions to reduce overlap risk.

- Keep a journal. Note when trades were skipped due to filters—that’s useful context.

Who Is Polish EA For?

- Beginners who want a calm, rules-first system without martingale drama.

- Busy traders who can’t sit at the screens all day.

- Prop-aspiring traders who need strict daily risk controls baked in.

- Skeptics who prefer transparency: logs, reasons, and reproducible setups.

If you want fireworks and 20 trades a day, this is not it. If you’re into “quality over quantity,” you’ll vibe with it.

Final Take

Polish EA V1.0 MT4 is about doing the simple things well—clean entries, protective exits, and a workflow that respects your capital. It won’t promise moonshots, and that’s the point. If you’ve been burned by grid-martingale monsters and want a robot that behaves like a grown-up, this one earns a spot in your shortlist. Demo it, watch how it behaves through different sessions, then go live with the same plan. Steady > flashy, any day.

Comments

Leave a Comment