Pharaoh Gold EA V1.07 MT4 — A disciplined breakout bot for Gold traders who value equity protection

If you trade XAUUSD regularly, you already know the drill: huge moves, fakeouts, spreads widening at the worst moment… it’s a love–hate thing. Pharaoh Gold EA V1.07 MT4 steps in exactly there—with a clean, disciplined breakout logic and strict risk control. It runs during high-liquidity hours only, uses fixed lot sizing (no funny business like martingale), and focuses on consistency over drama. If you’re tired of bots that overtrade or “revenge” trade, this one’s built to keep you calm and the account protected, coz that’s what really matters long term.

Quick facts (at a glance):

- Platform: MT4 (Expert Advisor)

- Primary market: XAUUSD (Gold) + supports “any” pair (user-tested first, please)

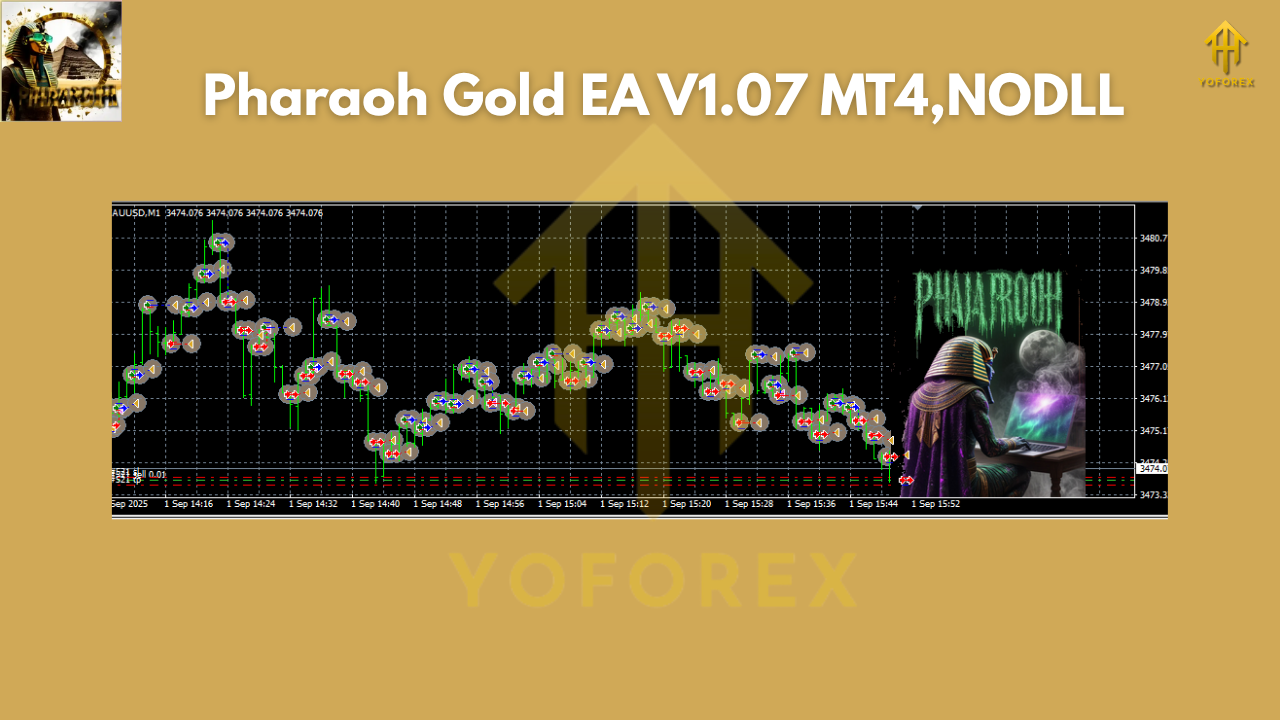

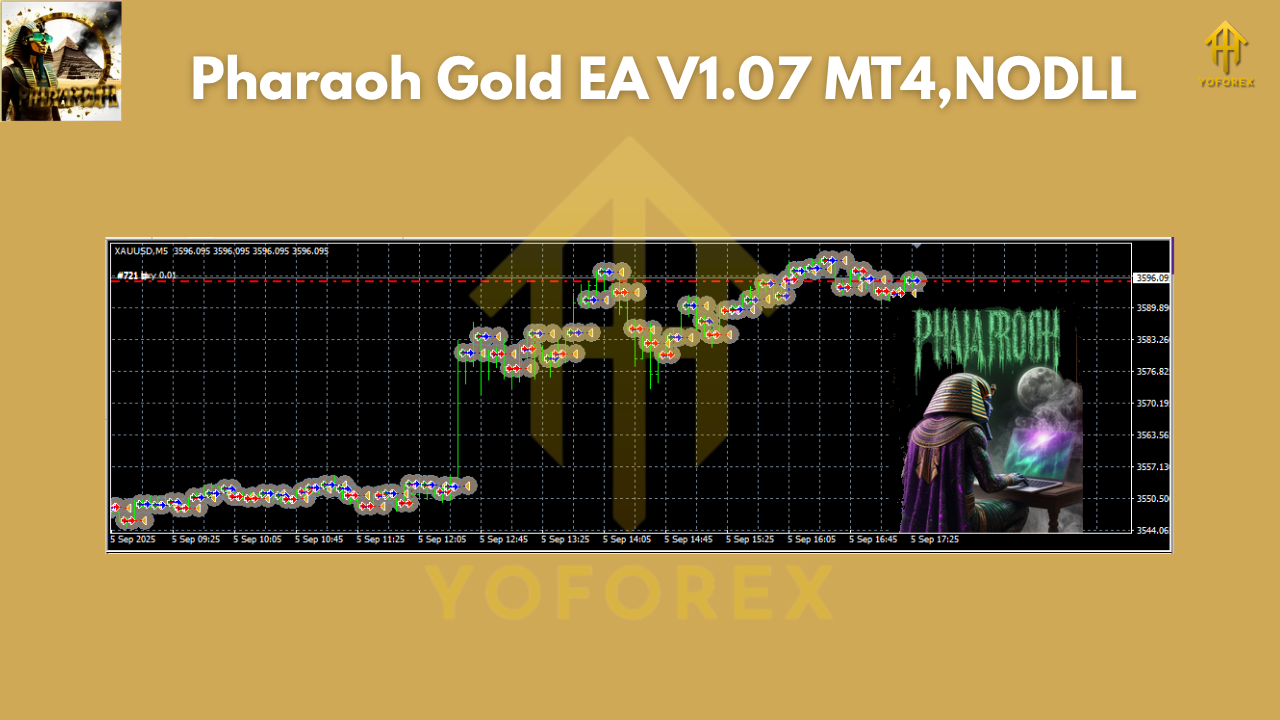

- Time frames: M5 (primary) + any (verify per pair)

- Minimum / Recommended deposit: $200

- Core style: Breakout entries in high-liquidity windows with fixed lots and strict SL/TP

Why Pharaoh Gold EA?

Breakout strategies can be powerful on Gold—when you control execution. Pharaoh Gold EA centers on that idea: trade only when the market is most liquid (typically around London and New York overlap), keep lot sizes steady, and avoid compounding small mistakes into big ones. The result is a robot you can actually supervise without babysitting every tick. You’ll set it up, let it scan for clean breaks, and rely on explicit risk rules.

Who is it for? Traders who:

- Want mechanical discipline (no martingale, no grid, no averaging into doom).

- Prefer fixed-lot exposure for clean risk budgeting.

- Trade M5 on XAUUSD, but occasionally explore other symbols/timeframes after proper testing.

- Value account protection and steady process over chasing flashy daily returns.

How the strategy works (in plain English)

Pharaoh Gold EA looks for range breaks that occur when the market is “awake”—think London open, NY session, and the overlap. The idea is simple: when liquidity is high, spreads are tighter and follow-through after a break is more likely. The EA seeks:

Breakout of a defined range or recent structure boundary (e.g., session high/low).

Clean execution under sensible spread/slippage conditions.

Fixed lot entries with hard stop-loss and take-profit, plus optional exit rules (like time-based close if momentum fades).

There’s no martingale, no grid stacking, and no “just one more trade” logic. If the break doesn’t stick, the stop loss takes the hit and you move on. That’s the whole point—live to trade another day.

Note: Pharaoh Gold is purpose-built for XAUUSD on M5. You can test other pairs and timeframes (the EA technically supports “any”), but forward-test first and keep risk low until you build evidence.

Key features you’ll actually use

- Breakout-first logic: Targets true moves, not chop, especially during high-liquidity windows.

- Strict risk control: Always-on stop-loss and take-profit—no averaging down.

- Fixed lot sizing: Clean, predictable exposure. Great for prop-style rules and personal risk budgets.

- Time window filter: Trades only in configured active sessions (e.g., London/NY).

- No martingale / no grid: Stability over gimmicks.

- Spread & slippage guard: Helps avoid sloppy fills during news spikes or thin liquidity.

- One-trade-at-a-time logic (configurable): Prevents over-stacking in choppy phases.

- Magic number & comments: Clear tracking per chart/instance.

- Lightweight & efficient: Designed for low overhead on typical VPS setups.

- Human-readable inputs: You shouldn’t need a PhD to configure a simple breakout bot.

Installation & first-run checklist (MT4)

- Download the EA file and place it in:

File → Open Data Folder → MQL4 → Experts. - Restart MT4 so it recognizes the EA.

- Open XAUUSD (Gold), M5 chart (use a high-quality data feed if possible).

- Drag the EA onto the chart; enable Allow live trading.

- Check AutoTrading (top bar) is green.

- Broker basics: ECN/STP with tight spreads on Gold, low latency, and reliable execution.

- VPS recommended: Keeps the terminal online 24/5 and reduces spikes due to home-internet hiccups.

Tip: Start on demo or a small cent account first. Build confidence, then scale.

Recommended starter settings (tweak as you learn)

These are practical starting points, not gospel. Always forward-test.

- Lot Size: 0.01 per $200–$300 balance on XAUUSD. Conservative traders can do 0.01 per $400+.

- Stop-Loss / Take-Profit: Start with structure-aware values—e.g., SL around recent range midpoint beyond the breakout invalidation, TP sized for ≥ 1:1 R:R. Many users prefer 1.2–2.0 R:R on breakouts.

- Trailing Stop: Off by default; test ON only after you see the strategy’s baseline behavior.

- Break-Even: Optional after partial move in your favor; try breakeven + a few points to avoid whipsaws.

- Session Times: Focus on London open and NY session overlap. Disable Asia unless you have data that says otherwise.

- Max Spread: Tighten to your broker reality on Gold (e.g., reject orders above your “normal” spread by 10–20%).

- Max Open Trades: 1 per chart as default.

- Slippage: Keep modest (e.g., 3–5 points), tune per broker.

Risk management that respects your equity

Breakout strategies win by capturing clean momentum and by quitting early when the break fails. Pharaoh Gold respects that, but your settings matter:

- Daily loss cap: Decide your max daily loss (e.g., 1–3% of equity). Once hit, stop for the day.

- Weekly guardrails: Consider a weekly loss cap to avoid over-trading bad conditions.

- Economic calendar discipline: Gold reacts violently to CPI, NFP, FOMC, Fed chair speeches. During those windows, spreads jump and direction can flip—either reduce risk or pause trading ahead of time.

- Position sizing sanity: Fixed lots make it simple—size to your real pain threshold.

- Diversification caution: If you test other pairs, don’t run ten at once on day one. Add gradually.

Backtesting approach & how to read results (the right way)

To evaluate Pharaoh Gold EA like a pro:

- Use quality tick data with variable spread if possible; Gold is spread-sensitive.

- Model recent years (e.g., 2019–present) to catch different volatility regimes.

- Check key metrics:

- Profit Factor (PF) above 1.2 with reasonable consistency.

- Max Drawdown within your personal risk tolerance.

- Expectancy per trade (average win vs. loss) and hit rate.

- Equity curve smoothness: stair-steps with pauses are normal for breakouts.

4. Forward test for 2–4 weeks on demo/cent to verify live execution, slippage, and spread behavior.

5. Don’t curve-fit: Resist over-optimizing every input to “perfect” past data; it won’t survive the future.

If your backtest looks “okayish” but forward results are lagging, look first at session times, spread filters, and slippage. Gold execution quality can make or break a breakout system.

Live-trading checklist (save this)

- Broker spreads and commissions verified during London/NY.

- VPS online, ping measured, terminal auto-restart configured.

- Session windows confirmed in your timezone.

- News days marked on your calendar.

- Daily/weekly caps set in stone (and respected).

- Backups of your

.setfiles saved.

Can I use it on pairs other than Gold?

Technically, yes—the EA supports “any” symbol and timeframe. Practically, test carefully. Gold has a distinct personality (fast, spiky); EURUSD, USDJPY, indices, or metals like Silver behave differently. If you try other markets:

- Keep lot size tiny at first.

- Adjust session times per instrument.

- Re-evaluate spread/slippage filters.

- Expect to tweak SL/TP ratios; one size doesn’t fit all.

Realistic expectations (read this twice)

Breakout systems don’t win every day. You’ll have days with no trades, days with small scratches, and days that shine when a clean trend unfolds. That’s normal. The edge comes from doing the boring things right: respecting time windows, protecting downside, and letting winners play out. If you can live with small, controlled losses while waiting for momentum, Pharaoh Gold EA will feel like a steady co-pilot rather than a wild gambler.

Final tips for success

- Keep a simple journal: date, session, spread snapshot, outcome, and a one-line note (e.g., “NY open breakout—ran 2R”). Patterns will jump out.

- Revisit settings monthly, not daily. Too many tweaks kill good edges.

- If you must optimize, do coarse sweeps (e.g., session windows and SL/TP bands), then confirm on forward data.

- Withdraw profits periodically; it keeps the psychology clean.

- And remember: past performance ≠ future results. Trade responsibly.

Call to action

If disciplined breakout trading on Gold is your thing—or you want a focused, fixed-lot bot that respects risk—Pharaoh Gold EA V1.07 MT4 is a solid starting point. Test it on demo, learn its rhythm, then go live carefully. Your edge isn’t just the code; it’s the consistency you bring to how you run it.

Comments

Leave a Comment