Parasite EA V5.4 MT5 — AI-Driven Order-Flow Mirroring for USDJPY & US500

If you’ve ever wondered how institutions seem to catch momentum before everyone else, Parasite EA V5.4 for MT5 is designed to get you closer to that playbook. Built on recent AI methods, the EA “listens” for footprints of large buy/sell activity and aims to piggyback those flows with swift execution, minimal latency, and rules that keep risk in check. You get a focused scope—time frames M5 to M30 and symbols USDJPY & US500—so you’re not spreading your account thin across noisy markets. Below, you’ll find a practical breakdown of how the bot works, key features, setup steps, and sensible risk practices so you can hit the ground running (on demo first, of course).

What Is Parasite EA V5.4 MT5?

Parasite EA V5.4 is an automated trading system for MetaTrader 5 that detects unusual surges in volume, velocity, and liquidity imbalances—signals that often accompany big-player activity. Instead of casting a wide net of random entries, the EA focuses on institutional-like behavior replication: identify where momentum is likely to persist, jump in quickly, and manage risk so losing streaks don’t spiral.

- Supported time frames: M5, M15, M30

- Optimized symbols: USDJPY, US500 (S&P 500 index CFD)

- Style: Momentum/order-flow mimicry with adaptive AI filters

- Who it’s for: Traders who want a rules-driven, lower-discretion approach on two highly liquid markets

Why USDJPY & US500?

Both symbols are liquid and frequently show clean directional bursts when institutions reposition.

- USDJPY often trends with rate-differentials and macro news, producing strong sessions around Tokyo/London overlaps.

- US500 (index CFD) reacts to U.S. equity flows, economic releases, and earnings momentum—ideal for a system that senses large orders and follows through.

How Parasite EA “Reads” the Tape (Conceptually)

While we don’t have the raw code here, Parasite EA’s logic can be summarized as:

- Signal Detection

The EA scans micro-bursts in price/volume, spread changes, and order-book-adjacent signals (via price action proxies). Spikes in these metrics hint that “someone big” is moving size. - Confluence Filters

It won’t chase every flicker. The AI layer filters for repeatable patterns—think momentum that builds across several candles, not a single tick jump. Volatility normalization helps keep entries consistent across M5–M30. - Execution & Management

Once confluence hits, the EA places a trade with pre-defined SL/TP logic and optional breakeven/partial exit rules. If the burst stalls, risk is cut; if it runs, the EA looks to lock gains without overtrading. - Adaptive Risk Controls

Position sizing adapts to account balance and recent volatility to avoid oversizing into choppy periods.

Key Features You’ll Actually Use

- AI-assisted order-flow mimicry to follow institutional footprints rather than random entries.

- Low-latency execution focus to capture the early part of momentum bursts.

- Time-frame flexibility (M5–M30) for faster scalps or steadier intraday moves.

- Symbol-tuned logic for USDJPY and US500 so you’re deploying where the strategy shines.

- Adaptive position sizing based on volatility and equity.

- Protective stop-loss on every trade to guard against tail risks.

- Optional breakeven / trailing logic to reduce give-back after a strong move.

- Session awareness (recommended): favor active market sessions for cleaner signals.

- News awareness (recommended): you can pause around red-flag events to avoid slippage spikes.

- Detailed logs & alerts to understand what the EA is doing and why.

Recommended Trading Conditions

- Broker: Low-spread, fast-execution MT5 broker with reliable liquidity on USDJPY and US500.

- Account Type: ECN/RAW preferred for tighter spreads; standard works, but watch costs.

- Leverage: Use responsibly; the EA’s risk controls help, but leverage is a double-edged sword.

- VPS: If your home internet is unstable or far from the broker’s servers, a VPS can reduce latency.

- News Filter: If your platform/toolset allows, pause the EA a few minutes before major releases.

Time Frames & Symbols: How to Choose

- M5 (fastest): Best when markets are trending or reacting to fresh catalysts; more trades, higher noise.

- M15: Balance between signal quality and frequency; a solid all-rounder.

- M30 (calmer): Fewer entries, typically higher quality; good when markets are directional but not frantic.

USDJPY Tips: Tokyo open to London overlap often provides the cleanest bursts.

US500 Tips: U.S. session (including the open) is the prime window; volatility can spike, so size prudently.

Setup & Configuration (Quick Start)

- Install Files

- Copy the EA file into:

MQL5/Experts/ - Restart MT5 or right-click Navigator → Refresh.

2. Attach to Chart

- Open USDJPY or US500 on M5, M15, or M30.

- Drag Parasite EA V5.4 onto the chart.

- Enable Algo Trading in MT5.

3. Input Settings (Typical)

- Risk per trade: 0.5%–1.0% of account balance to start (keep it modest).

- Max open positions: 1–2 per symbol to prevent stacking risk.

- Stop-loss: Strategy default (don’t widen arbitrarily to “survive”).

- Take-profit / Trailing: Start with defaults; test breakeven/partial exits on demo to match your style.

- Trading sessions: Focus on your symbol’s active market hours.

4. Optimization (Optional, on Demo)

- Forward-test default parameters for 2–4 weeks.

- Adjust risk and session windows only after observing live conditions.

Risk Management That Won’t Keep You Up at Night

- Small fixed risk per trade: 0.25%–1.0% is a sensible lane.

- Daily loss cap: Stop the EA if you hit, say, 2% daily drawdown. Protect capital first.

- Weekly trading plan: Decide which sessions to trade; not every hour is equal.

- No revenge trading: Don’t increase lot size after a loss. Let the EA do its job.

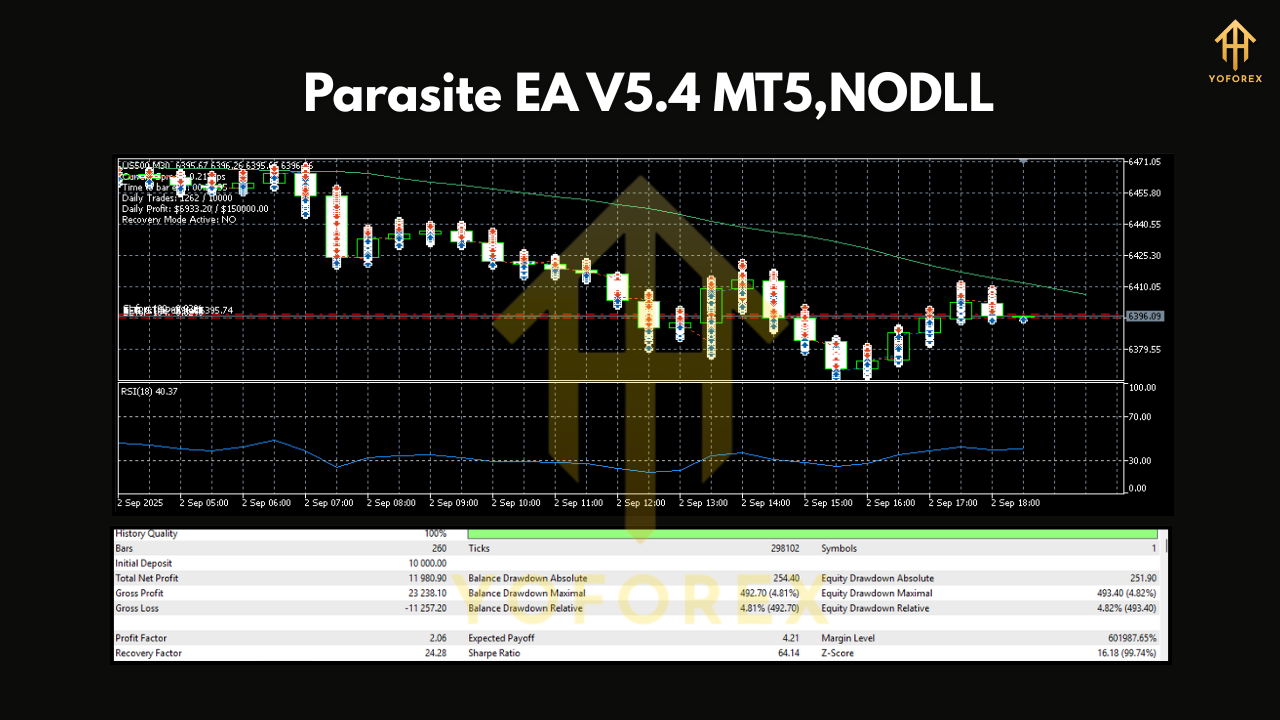

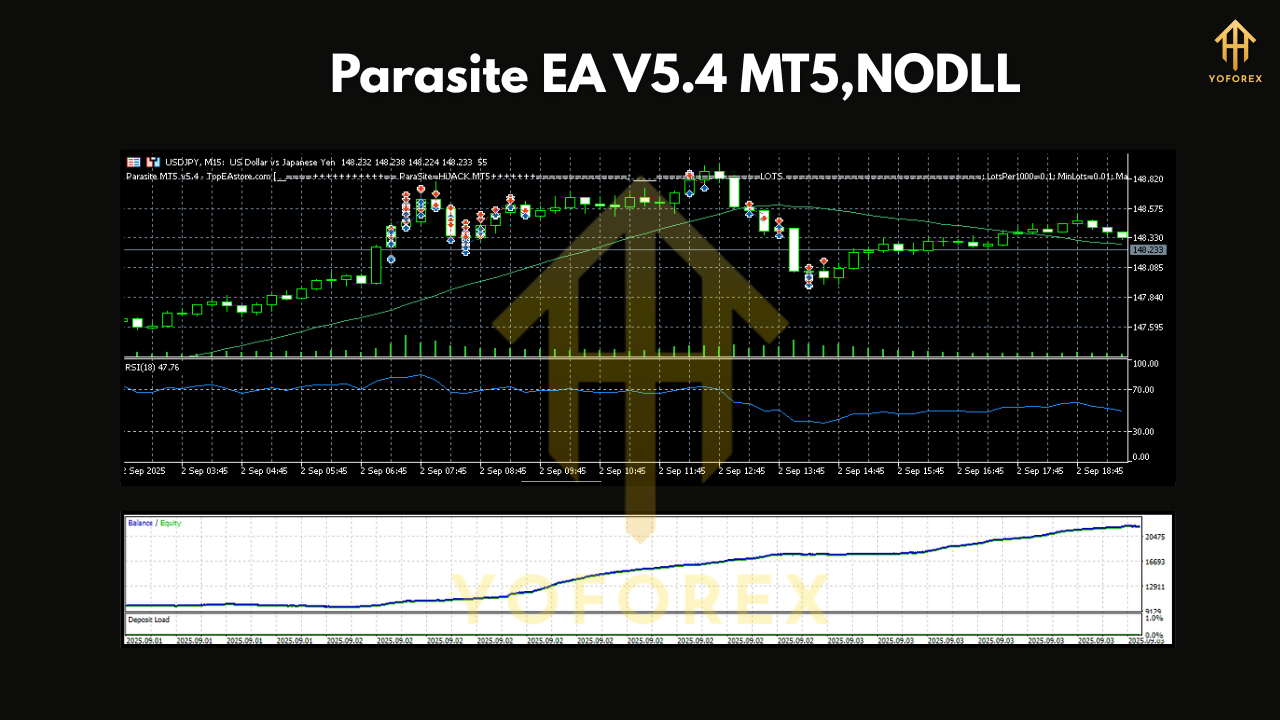

Backtesting & Forward Testing

Backtests can be helpful, but for an EA that reacts to flow and microstructure, forward testing is gold. If you do backtest:

- Use tick data with variable spread and realistic slippage.

- Test across at least 2–3 years for USDJPY and multiple macro cycles for US500.

- Validate on different time frames (M5, M15, M30) and compare equity curves.

- After backtests, forward test on a demo account for several weeks to observe execution quality, spread behavior, and how the EA handles newsy spikes.

Who Will Love Parasite EA?

- Momentum-friendly traders who prefer joining confirmed moves over picking tops/bottoms.

- Busy professionals who want a structured, automated approach on two high-quality markets.

- Risk-aware users who value disciplined SL/TP logic over “hope & hold.”

Limitations (So You’re Not Surprised)

- Chop can hurt: In range-bound micro-chop, signals may degrade. Session filters help.

- News spikes/slippage: Fast prints can slip. Pausing during red news mitigates this.

- Symbol scope: It’s tuned for USDJPY & US500; applying to exotics may dilute performance.

Final Notes & Best Practices

- Start on demo to learn the rhythm.

- Keep risk per trade small and add size only after consistent results.

- Re-evaluate settings monthly. Markets evolve; your parameters should, too.

- Remember: Past performance does not guarantee future results. Trade responsibly.

Quick Specs Recap

- Platform: MetaTrader 5

- EA: Parasite EA V5.4

- Markets: USDJPY, US500

- Time Frames: M5, M15, M30

- Edge: AI-assisted replication of institutional order-flow behavior

- Core: Swift entries, protective stops, adaptive sizing, session-aware trading

Call to Action

If you’re looking to convert institutional footprints into a rules-driven plan on USDJPY and US500, Parasite EA V5.4 MT5 gives you a crisp, focused framework. Get it running on demo, let it prove itself, then scale thoughtfully. Smart risk, smart sessions, steady hands—that’s how you make an AI assistant actually work for you.

Comments

Leave a Comment