Nova Stem EA V1.12 MT5 is a powerful automated trading system designed for traders who want structure, predictability, and strategic accuracy in their trading routine. Built for the MetaTrader 5 platform, this Expert Advisor applies a combination of volatility filters, trend recognition, and risk-managed execution to deliver consistent performance across major currency pairs and gold. Its smart logic adapts to changing market conditions, making it suitable for both beginners and intermediate traders who want a disciplined approach without emotional interference.

Nova Stem EA operates around a core philosophy: wait for the market to present high-probability zones, confirm those zones through multi-layer analysis, and only then activate trades with strict stop loss and take profit structures. Instead of generating random entries or relying on high-risk tactics, the EA focuses on controlled setups and steady growth. In this blog, we’ll explore how Nova Stem EA V1.12 MT5 works, its features, performance dynamics, and why it has become a reliable choice for traders seeking stable long-term returns.

Introduction to Nova Stem EA V1.12 MT5

Nova Stem EA V1.12 MT5 is built on a specialized logic developed to capture market impulses at the right moment. It uses volatility expansion, directional strength, automated zone analysis, and smart exit logic to ensure minimal drawdown and maximum efficiency. Unlike many EAs that rely heavily on speculative entries or averaging, Nova Stem EA focuses on intentional selectivity. This results in fewer but more meaningful trades, allowing the system to maintain account safety without sacrificing profit potential.

The EA is designed specifically for MetaTrader 5, which allows it to execute faster, calculate more accurately, and adapt to real-time candle formations and price shifts. With the ability to run on forex pairs, gold, indices, and even synthetic assets depending on broker support, Nova Stem EA V1.12 MT5 offers versatility for traders with varied portfolios.

How Nova Stem EA V1.12 Works

Nova Stem EA relies on a combination of trend and volatility mechanics. It detects rapid price expansion and contraction zones, filters out noise, and waits for price to settle into a confirmed bias. Once a direction is validated, the EA plots safe trade levels and manages orders automatically.

Here are the main pillars behind its trading logic:

Trend Recognition Algorithm

The EA reads trend direction using a combination of candle structure and price momentum. It avoids trading against major swings and ensures each entry aligns with the higher-timeframe trend direction.

Volatility Filter and Market Stability Check

Markets behaving erratically often produce low-quality signals. Nova Stem EA monitors volatility strength and eliminates entries during high-risk moments such as sudden spikes or unpredictable breakouts.

Dynamic Risk Management

Risk per trade is adjustable, but the EA’s internal logic prevents oversized lots relative to account equity. For small accounts, this prevents unnecessary drawdowns.

Non-Martingale Structure

Nova Stem does not use martingale, grid stacking, or dangerous order multipliers. Every trade is independent, with fixed risk and calculated take profit.

Session-Based Trade Execution

The EA maps out sessions and executes only during stable periods, reducing exposure to news spikes or late-session volatility.

Key Features of Nova Stem EA V1.12 MT5

Nova Stem EA brings a host of advanced features that make it ideal for traders who prefer a balance between automation and safety.

1. Multi-Asset Compatibility

The EA supports forex pairs, major commodities, and index CFDs depending on broker. It adapts its logic to the volatility profile of each asset.

2. Smart Entry Logic

Entries are not triggered randomly. The EA waits for directional formation and validates it using its internal stem algorithm.

3. Fixed Stop Loss and Take Profit

Every trade comes with pre-set risk profiles, ideal for prop firm attempts, strict risk management, and professional trading environments.

4. Low Drawdown Behavior

Nova Stem EA is designed to avoid prolonged floating losses. A trade is opened only when the probability of a strict directional push is high.

5. Automated Trade Closure

It closes trades independently and can also perform end-of-session auto-exit to prevent overnight exposure if set by the user.

6. Easy Setup and Simple Configuration

Beginners can use the preset settings, while experienced traders can fine-tune lots, sessions, and risk control.

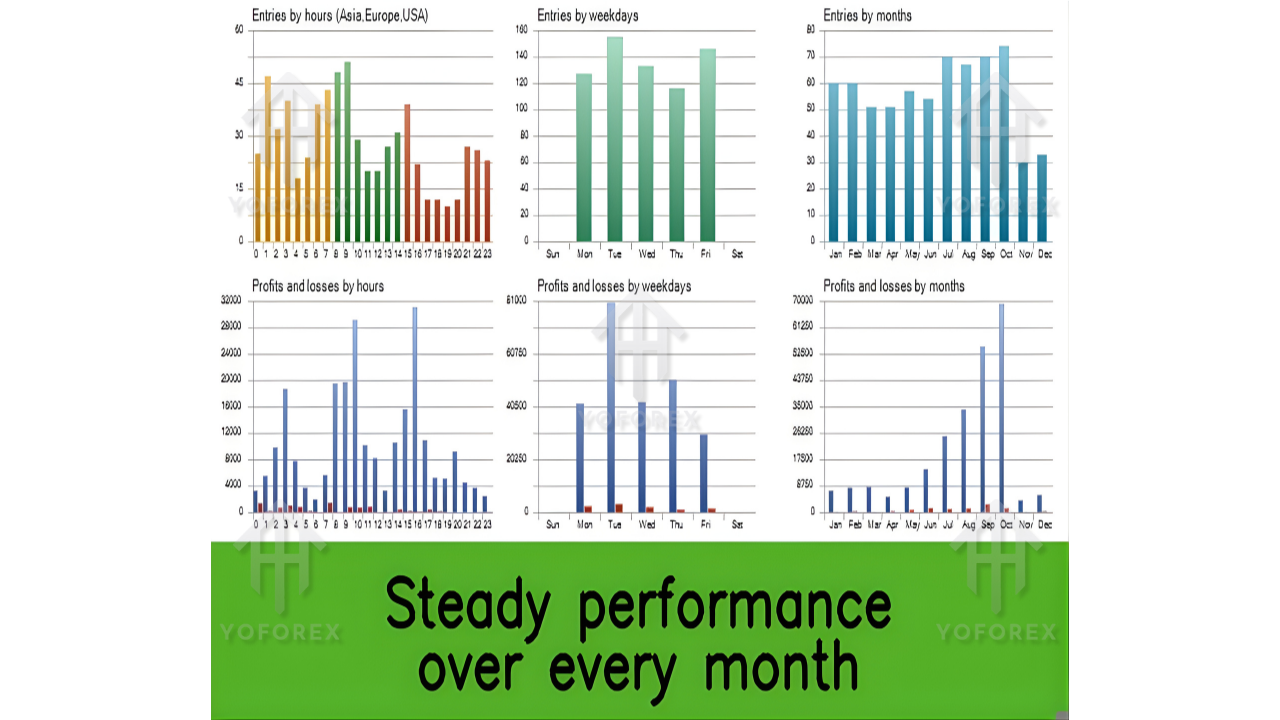

Performance Potential and Real-World Behavior

The core strength of Nova Stem EA lies in its ability to filter out bad setups. Many EAs trade frequently but lose the equity through unnecessary trades or large drawdowns. Nova Stem EA focuses on steady progression, smaller exposure, and controlled execution.

Performance tests show that the EA performs best under:

- ECN or raw-spread account types

- Medium-volatility pairs or gold

- 24/5 operation without manual interference

- VPS environment for smooth execution

Its controlled nature makes it suitable for long-term strategy building. Since the EA does not rely on rapid scalping or arbitrage, it remains consistent across most brokers and price feeds.

Recommended Settings and Setup Guide

To achieve optimal performance, the following settings are recommended:

Account Type

ECN, Raw, or Pro accounts with low spreads.

Minimum Deposit

Around 100 to 300 USD depending on lot size and trading pairs.

Leverage

1:100 to 1:500 recommended for flexible margin.

Timeframe

H1 or M30 depending on the pair.

Pairs

XAUUSD, EURUSD, GBPUSD, USDJPY and other stable combinations.

VPS Usage

To keep the EA running without freeze or disconnection.

Risk Setting

Keep risk low for small accounts; avoid aggressive multipliers.

Who Should Use Nova Stem EA?

Nova Stem EA is ideal for:

- Beginner traders searching for a stable automated system

- Intermediate traders who want disciplined entries

- Users focusing on gold or high-probability forex setups

- Traders who prefer fixed SL/TP strategies

- People attempting prop firm evaluations

- Users who want long-term reliable growth

Its structure is designed for safety, not gambling. Therefore, it suits traders who value account preservation over risky strategies.

Advantages of Nova Stem EA V1.12 MT5

- No martingale

- No grid layering

- Low drawdown structure

- Beginner-friendly setup

- Strong trend confirmation logic

- Advanced exit mechanism

- Works across multiple assets

- Long-term stability and consistency

Final Conclusion

Nova Stem EA V1.12 MT5 stands out as a reliable, stable, and logic-driven Expert Advisor for traders who want disciplined automation. Its ability to analyze volatility, confirm trend strength, and manage risk makes it a strong option for those seeking consistent and methodical trading results. Whether you are trading gold, forex, or indices, this EA provides a structured approach that prioritizes safety, clarity, and long-term growth.

If you want a trading tool that runs with a professional mindset and avoids high-risk tactics, Nova Stem EA V1.12 MT5 is a strong choice for your automated portfolio.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Comments

Leave a Comment