Tired of EAs that look flashy on paper but melt down the minute the market gets spicy? Same. That’s why Nibelung Assistant v4 EA V1.0 (MT4) focuses on disciplined entries, layered risk control, and a realistic workflow you can actually maintain. Whether you scalp, swing, or just want a clean, automated helper that doesn’t overtrade, this EA brings structure to your chart… without a 60-page manual, lol. In this blog, you’ll get the full picture: how it works, recommended settings, backtesting tips, and a practical setup to keep your equity curve calm even when spreads widen or volatility spikes. Let’s dive in, coz momentum doesn’t wait.

What Is Nibelung Assistant v4 EA? (Overview)

Nibelung Assistant v4 EA V1.0 is an MT4 Expert Advisor designed to automate entries and manage trades with rule-based precision. It’s built around three pillars:

- Signal Discipline – Trades fire only when criteria stack up (trend + momentum + volatility), not just one green light.

- Capital Protection – Position sizing is dynamic, SL/TP are structured, and max exposure is capped.

- Adaptable Profiles – You can run it in conservative mode for prop-style risk or let it stretch a bit on personal accounts.

The philosophy here isn’t “set & forget & pray.” It’s set, monitor, and iterate—with parameters that make sense and don’t conflict. The EA avoids reckless martingale; instead, it prefers measured scaling (optional), trailing logic when trend extends, and news-aware timing so you don’t catch random spikes.

Best for: Traders who want a steady, rules-first EA that can adjust to EURUSD, GBPUSD, XAUUSD, and USDJPY without rewriting the whole plan. If you’ve struggled with bots that win for two weeks then vanish your month, this style of EA is a breath of fresh air.

Key Features You’ll Actually Use

- Structured Signal Engine: Combines trend, momentum, and volatility filters to reduce random entries.

- No Martingale by Default: Optional micro-scaling only when the trend confirms; otherwise 1× risk.

- Dynamic Position Sizing: Risk-percent model keeps lot sizes proportional to your balance.

- ATR-Anchored Stops: SL/TP calibrate to market speed (so a crazy candle doesn’t toss you out instantly).

- Smart Break-Even + Trail: Lock in once price moves your way; then trail to ride extended trends.

- Session Awareness: Option to trade London/NY sessions only for better liquidity and tighter spreads.

- Spread & Slippage Guards: Skip entries when conditions go out of bounds (Friday close, huge spreads, etc.).

- News Timing Control: Pause trading around high-impact events (customizable buffer).

- Multi-Pair Capable: Run on major FX pairs and gold (recommended lists below).

- Drawdown Cap: Stop-trade mechanism if daily or absolute drawdown hits your safety limit.

- Dashboard & Alerts: On-chart stats with optional push/email alerts (handy when you’re away).

- Prop-Friendly Presets: Conservative templates aligned to typical evaluation rules.

Recommended Pairs & Timeframes

- EURUSD, GBPUSD, USDJPY → M15 / M30 / H1

- XAUUSD (Gold) → M15 / H1 (consider wider SL due to volatility)

Installation & First-Time Setup (MT4)

- Copy Files: Download the EA file → open MT4 → File → Open Data Folder →

MQL4/Experts→ paste. - Refresh & Attach: Restart MT4 or right-click Expert Advisors → Refresh. Drag Nibelung Assistant v4 EA onto your chart.

- Allow Algo Trading: Check “Allow live trading” and “Allow DLL imports” if required.

- Broker Conditions: Use a low-spread, low-slippage broker; ECN accounts are ideal.

- Chart Prep: Keep charts clean—no conflicting EAs/indicators doing their own trade mgmt.

- Load Preset: Start with the Conservative set file (if available) or follow the base settings below.

- Demo First: Always test on demo (1–2 weeks). Then go small on real.

Base Settings (A Practical Starting Point)

- Risk Percent per Trade:

0.5%(prop-friendly), up to1%for personal accounts - Max Concurrent Trades per Pair:

1(optionally2on majors) - Stop Loss (ATR-based):

1.5–2.2 × ATR(14); gold tends to need 2.0+ - Take Profit (RR):

1.5R–2Rtarget; enable trailing to capture trend legs - Break-Even Trigger: At

+0.8R(or 60–70% of TP distance) - Trailing Step: ATR step or fixed

8–20points on majors; wider on gold - Max Daily Drawdown Halt:

3–5%(EA stops opening new trades for the day) - Trading Sessions: London + NY; disable Asia if you dislike slow chop

- Spread Filter: Reject entries above your pair’s typical average by 1.5×

- News Buffer: Pause

15–30 minpre/post high-impact news

How the Strategy Thinks (Under the Hood)

- Trend Filter: Higher-timeframe MA slope + price location determines directional bias.

- Momentum Check: Short-TF oscillator or candle range expansion validates entry timing.

- Volatility Gate: ATR/standard deviation ensures the market is “awake,” not flatlining.

- Entry Logic: Confirms confluence, then places 1 trade with SL/TP set at order open.

- Management: Break-even & trailing logic activate only when momentum persists, preventing over-tight stops early on.

- Exit Failsafe: If conditions flip hard (e.g., momentum diverges + spread explosion), the EA can flatten in profit-protection mode.

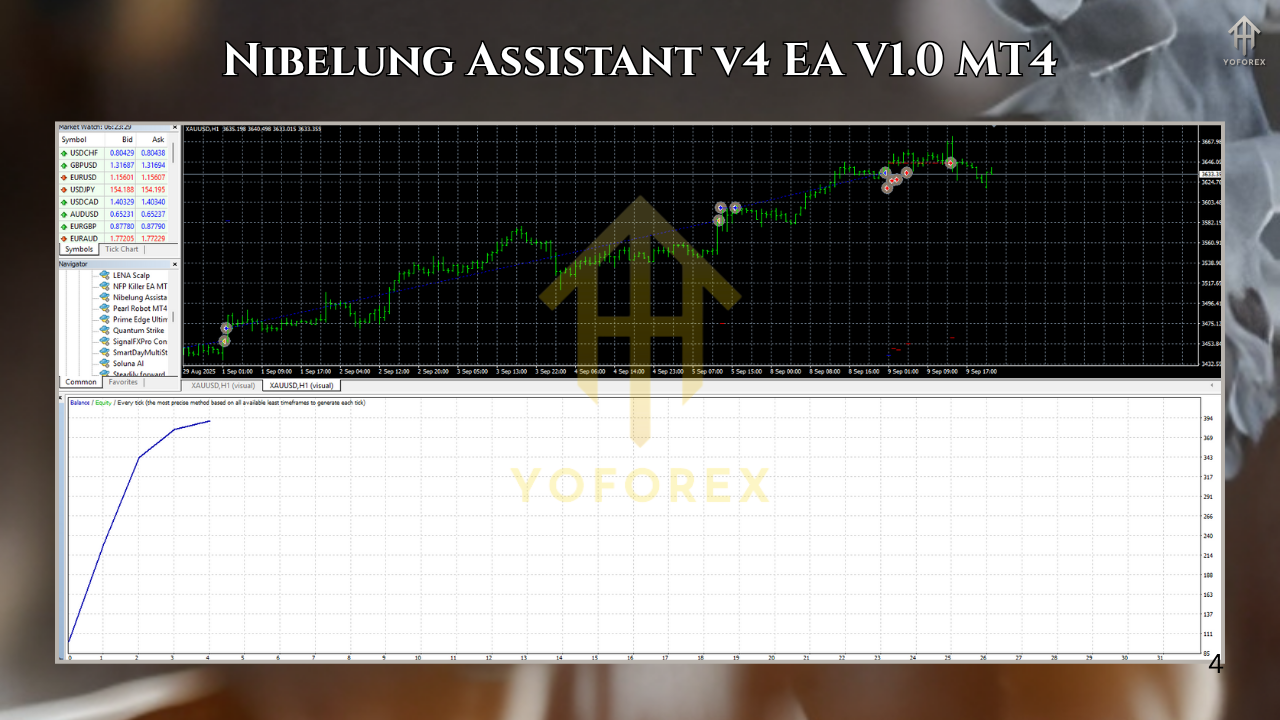

Backtesting Like a Pro (So Results Aren’t Lying to You)

Data Quality Matters: Use 99% tick data with variable spreads if possible. Enable slippage simulation; it’s closer to reality.

Time Windows: Backtest across calm, trending, and crisis periods (e.g., 2020 shock, 2022 dollar trend, mixed 2023–2024).

Pairs: Start with EURUSD (clean behavior), then validate on USDJPY (momentum) and XAUUSD (volatility).

Walk-Forward Checks: Optimize parameters on one block (say 6–9 months), then forward test the next block unchanged.

KPIs to Watch:

- Profit Factor ≥ 1.3 (conservative)

- Max Drawdown within your comfort (aim ≤ 10–15% on personal, ≤ 5–8% for prop)

- Win Rate 45–60% is healthy with 1.5–2R targets

- Average Trade Duration—don’t let it balloon during low volatility

- Consecutive Losses—ensure your daily DD cap would have cut risk in the worst week

Risk Management That Actually Saves You

- Account-Level Halt: If daily DD hits

X%, EA goes idle. No revenge trades. - Equity-Based Sizing: Lots adjust to balance; when you grow, risk stays proportional.

- Weekend Safety: Optionally disable trading late Friday—rollovers can be ugly.

- News Pause: High-impact events are optional to trade—but skipping the landmines is totally fine, tho.

- Manual Override: You can toggle the EA off mid-session if market conditions go haywire.

Prop Firm-Friendly Guidance

- Risk per Trade:

0.25–0.5% - Max Daily DD:

3%hard stop (EA enforces) - Max Overall DD: Align to the firm’s rule minus a 1–2% buffer

- Consistency: Trade 1–3 pairs; avoid massive swings in lot size

- News: Many firms prohibit news trading—use the built-in pause

Troubleshooting Quick Wins

- No Trades? Check session filter, news pause, and spread limits.

- Too Many Small Losses? Widen ATR SL slightly or restrict to London/NY.

- Slippage Spikes? Try a different server or broker; raise slippage threshold modestly.

- Drawdown Cluster? Dial risk from 1% → 0.5% per trade, re-test next week.

FAQs (Great for On-Page SEO & Schema)

Q1: Does it use martingale?

A: No by default. Optional micro-scaling exists but only with confirmed trend.

Q2: Can I run many pairs on one account?

A: Yes, but start with 1–2. Add pairs gradually to avoid overlapping risk.

Q3: Will it pass prop firms for me?

A: No guarantees. It’s designed to be prop-friendly, but rules vary. Test and adapt.

Q4: What deposit is recommended?

A: For majors, even $200–$500 can work at 0.5% risk. Gold benefits from more cushion.

Q5: VPS needed?

A: Strongly recommended for 24/5 uptime and lower latency.

Support & Disclaimer

If you hit any bug or need help tuning the parameters, reach out to your support channel or community group. Remember: past performance doesn’t guarantee future results. Trade responsibly, use a demo first, and never risk money you can’t afford to lose.

Call to Action

Ready to give it a proper spin? Download Nibelung Assistant v4 EA V1.0 for MT4 and set it up with the conservative profile first. Track your trades for two weeks, then scale risk only if the equity curve plays nice. Simple, sustainable, and seriously less stressful.

Comments

Leave a Comment