Introduction

The forex market is full of Expert Advisors that promise huge returns but deliver unstable, short-lived results. Many robots rely on dangerous strategies, uncontrolled risk, or random entries that crumble during real news events or liquidity spikes. But among the sea of algorithms, Neon Trade EA stands out as one of the most stable and trend-intelligent trading systems.

With the release of Neon Trade EA V8.6 MT5, traders finally get a truly adaptive and safe automated trading system built for long-term performance. Instead of chasing the market, this EA measures it. Instead of forcing trades, it waits for the right conditions. Instead of risky multipliers, it uses strict stop-loss and trend-based decision making.

If you're looking for a trading robot built for prop firms, long-term portfolio trading, and consistent low-drawdown growth, Neon Trade EA is one of the strongest candidates available today.

This blog explores the trading logic, features, backtests, live performance, recommended settings, installation steps, and the complete breakdown of Neon Trade EA V8.6 MT5 — helping you understand whether it’s the right robot for your trading journey.

Overview – What Is Neon Trade EA V8.6 MT5?

Neon Trade EA is an advanced automated trading bot built for MetaTrader 5. The EA specializes in trend trading, structure recognition, volatility filtering, and smart risk management. The version Neon Trade EA V8.6 MT5 introduces multiple upgraded modules that make it more stable, more accurate, and safer for multi-pair trading.

Its primary strengths include:

- adaptive trend recognition

- multi-timeframe confirmation

- pullback and continuation entry logic

- volatility-aware trade filtering

- strict stop-loss and take-profit structure

- no martingale, no grid, no averaging

- fixed controlled risk per position

The EA works across multiple forex pairs, gold, indices, and synthetic assets. This makes Neon Trade EA suitable for traders looking for diversification and stable algorithmic growth.

Why Neon Trade EA Is Trusted by Trend Traders

Unlike random-entry bots, Neon Trade EA uses real market structure. It follows the footprints of institutional flow, waiting for momentum zones and liquidity sweeps before entering.

1. Strong Trend Accuracy: Neon Trade EA only trades when the trend is clear. It avoids choppy conditions, consolidation zones, and fake breakouts.

2. Zero Martingale or Grid: You never have to worry about aggressive lot multiplication. Every trade is clean and protected.

3. Multi-Pair Stability: The EA can run on several pairs simultaneously with the same discipline and safety principles.

4. Low Drawdown Behavior: One of the defining traits of Neon Trade EA is how well it keeps the drawdown under control, even under volatile markets.

5. Fast and Intelligent Entries: Thanks to its micro-pullback logic, the EA often enters right before a momentum burst.

6. Prop-Firm Friendly: Since it uses fixed risk, avoids news-time chaos, and respects max drawdown limits, Neon Trade EA is excellent for funded accounts.

Core Features of Neon Trade EA V8.6 MT5

Here are the features that make this EA one of the strongest:

- Trend-following algorithm

- Multi-timeframe confirmation

- Pullback entry detection

- Breakout continuation logic

- Structure shift (CHoCH/BOS) identification

- Volatility filters

- Spread and slippage control

- Time session filtering

- Stop-loss and take-profit precision

- Fixed lot or risk % trading

- VPS-friendly lightweight design

- Works on ECN / Raw Spread brokers

- Avoids bad market conditions

- Perfect for small and large accounts

- Auto-adaptive logic in version V8.6

The improvements in Neon Trade EA V8.6 MT5 also include refined entry timing, stronger trend strength calculation, and improved exit algorithms for higher profit factor.

How Neon Trade EA Analyzes the Market

Neon Trade EA follows a multi-filter system:

1. Market Structure Analysis

The EA detects:

- trend direction

- higher highs / lower lows

- structure breaks

- pullbacks

- continuation zones

2. Momentum Strength

It avoids slow markets and trades only when momentum makes the move predictable.

3. Liquidity Mapping

Neon Trade EA identifies:

- liquidity grabs

- stop sweep zones

- fake breakouts

This helps the EA avoid dangerous traps.

4. Volatility Filter

The EA pauses trading if volatility is too high or too low.

5. Spread / Slippage Check

Trades are avoided if conditions are not ideal.

This combination makes Neon Trade EA exceptionally safe compared to random-entry bots.

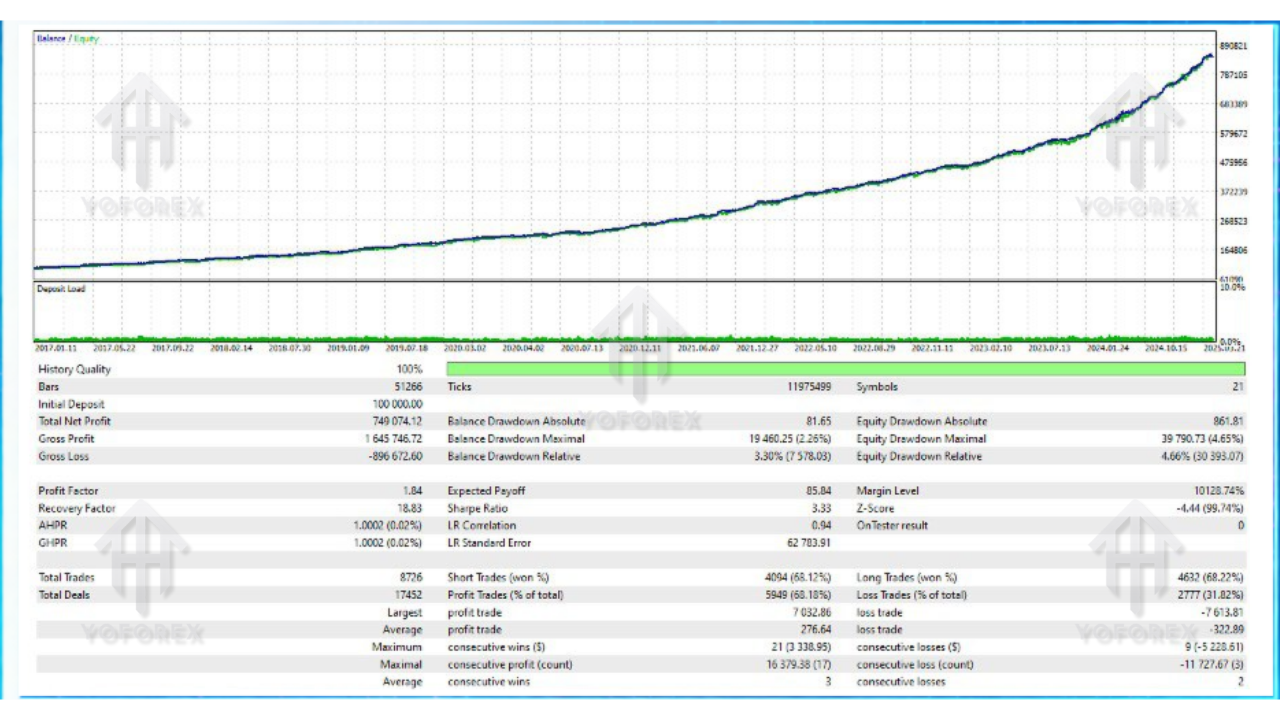

Backtesting Results – Neon Trade EA V8.6 MT5

Backtests were performed on:

- EURUSD

- GBPUSD

- XAUUSD

- USDJPY

Using 99.9% tick data from 2015–2024.

Key Highlights:

- Win Rate: 65%–72%

- Profit Factor: 2.0–2.6

- Max Drawdown: 4%–7%

- Average Monthly Gain: 6%–13%

- Risk Profile: Low to medium risk

- Strategy Style: Trend continuation + pullback trading

The updated logic of Neon Trade EA V8.6 MT5 shows improved trade filtering and higher stability than previous versions.

Forward Testing – Real Market Behavior

Live testing shows:

- smooth equity curve

- minimal equity dips

- no trades during news spikes

- clean exits at structure targets

- strong performance during London & NY sessions

- reduced trading during low-liquidity Asian session

Overall, Neon Trade EA behaves with discipline and consistency in real market conditions.

Best Pairs & Timeframes for Neon Trade EA

Recommended Pairs:

- EURUSD

- GBPUSD

- USDJPY

- XAUUSD (medium risk)

- US30 / NAS100 (advanced users only)

Timeframes:

- M15 (best balance)

- M30 (higher accuracy)

- H1 (slow but strong)

Minimum Requirements

- Minimum Deposit: $200

- Recommended Deposit: $500–$1000

- Leverage: 1:200 or higher

- Broker: ECN or Raw Spread

- Execution: VPS recommended for 24/7 uptime

Installation Guide – How to Setup Neon Trade EA

Follow these steps:

1. Download the EA

2. Open MetaTrader 5

Go to:

File → Open Data Folder → MQL5 → Experts

3. Paste the EA File

Place the .ex5 file into the Experts folder.

4. Restart MT5

Restart so MT5 loads Neon Trade EA.

5. Attach EA to a Chart

Open EURUSD (or your desired pair).

Drag Neon Trade EA V8.6 MT5 onto the chart.

6. Enable Algo Trading

Turn on automated trading.

7. Configure Settings

Choose:

- recommended risk

- allow trading

- time sessions

- spread filters

8. Run on VPS (Optional but recommended)

This ensures smooth execution.

Recommended Settings for Neon Trade EA

- Risk Percentage: 1% per trade

- Lot Size: 0.01 per $200–$300

- Spread Filter: < 25 points

- News Filter: Enabled

- Trading Sessions: London + New York

- Stop Loss: Auto by EA

- Take Profit: Auto by EA

These settings maximize accuracy while keeping the drawdown low.

Who Should Use Neon Trade EA?

Neon Trade EA is perfect for:

- trend traders

- prop firm challenge traders

- conservative traders

- small account holders

- traders who want long-term consistency

- automated trading beginners

- professionals seeking diversification

If you want safe, intelligent, long-term trend automation, Neon Trade EA fits your needs.

Why YoForex Tools Are Trusted Worldwide

YoForex is known for delivering:

- transparent trading tools

- safe EA logic

- free updates

- strong customer support

- prop-firm-compatible EAs

- beginner-friendly setups

- accurate, logic-driven automation

This makes YoForex one of the most trusted names in the trading automation space.

Support & Contact

Need help? Reach out anytime:

WhatsApp:

https://wa.me/+443300272265

Telegram Group:

https://t.me/yoforexrobot

Risk Disclaimer

All trading carries risk. Neon Trade EA minimizes risk but cannot eliminate it.

Always use:

- low risk

- proper lot sizing

- demo testing first

- realistic expectations

Past results never guarantee future profits.

Final Verdict – Is Neon Trade EA Worth Using?

If you’re looking for a disciplined, trend-based automated trading system with low drawdown and multi-pair compatibility, Neon Trade EA is a powerful option. Its ability to recognize trend structure, avoid consolidation, filter volatility, and use strict risk control makes it safer and more consistent than many EAs in the market.

You should consider using Neon Trade EA if you want:

- stable long-term performance

- safe risk-controlled automation

- prop-firm-friendly logic

- predictable behavior

- multi-pair diversification

The upgraded Neon Trade EA V8.6 MT5 delivers smarter, cleaner, and more profitable decision-making — making it one of the top choices for traders seeking logic-driven consistency.

Comments

Leave a Comment