Gold—the timeless asset that traders and investors have relied on for centuries. In the ever-evolving world of forex trading, gold continues to be one of the most sought-after commodities. However, trading XAU/USD manually can be a daunting task, especially when the market's volatility and unpredictability keep traders on their toes. That’s where the Mint Gold Expert Advisor V1.0 MT4 comes into play, revolutionizing the way gold is traded.

Imagine an automated system that monitors the market 24/7, analyzes trends, makes decisions, and executes trades—all without you lifting a finger. The Mint Gold EA does exactly that, using cutting-edge algorithms to harness the full potential of gold trading while minimizing the risks associated with manual trading. In this blog post, we’ll dive deep into the features, strategies, and installation process of Mint Gold EA V1.0, showcasing why it’s a game-changer for both new and experienced traders in the gold market.

What is Mint Gold Expert Advisor V1.0 MT4?

The Mint Gold Expert Advisor V1.0 is a fully automated trading robot developed for the MetaTrader 4 (MT4) platform. Unlike generic EAs that trade multiple currency pairs, this EA is optimized exclusively for XAU/USD, ensuring tailored strategies and settings for gold trading.

Key Features:

- Platform Compatibility: Built for MT4, a widely used trading platform.

- Asset Specialization: Exclusively designed for trading gold (XAU/USD).

- Timeframe Optimization: Best suited for the M5 (5-minute) timeframe, capturing short-term price movements.

- Risk Management: Integrated Stop Loss (SL), Take Profit (TP), and Trailing Stop functionalities to safeguard capital.

- User-Friendly Interface: Easy installation and setup, making it accessible for both beginners and experienced traders.

Trading Strategy and Logic

The Mint Gold EA employs a combination of trend-following and reversal strategies to identify optimal entry and exit points.

1. Trend-Following Strategy

- Indicator-Based Signals: Utilizes indicators like Moving Averages and MACD to determine the prevailing market trend.

- Trade Direction: Opens buy positions in an uptrend and sell positions in a downtrend, aligning with the market's momentum.

2. Reversal Strategy

- Overbought/Oversold Conditions: Monitors indicators such as RSI to detect potential reversal points.

- Counter-Trend Entries: Executes trades when the market shows signs of reversing, aiming to capitalize on price corrections.

3. Risk Management

- Stop Loss: Predefined levels to limit potential losses.

- Take Profit: Targets set to secure profits once a certain price level is reached.

- Trailing Stop: Adjusts the stop loss as the market moves in favor of the trade, locking in profits and minimizing losses.

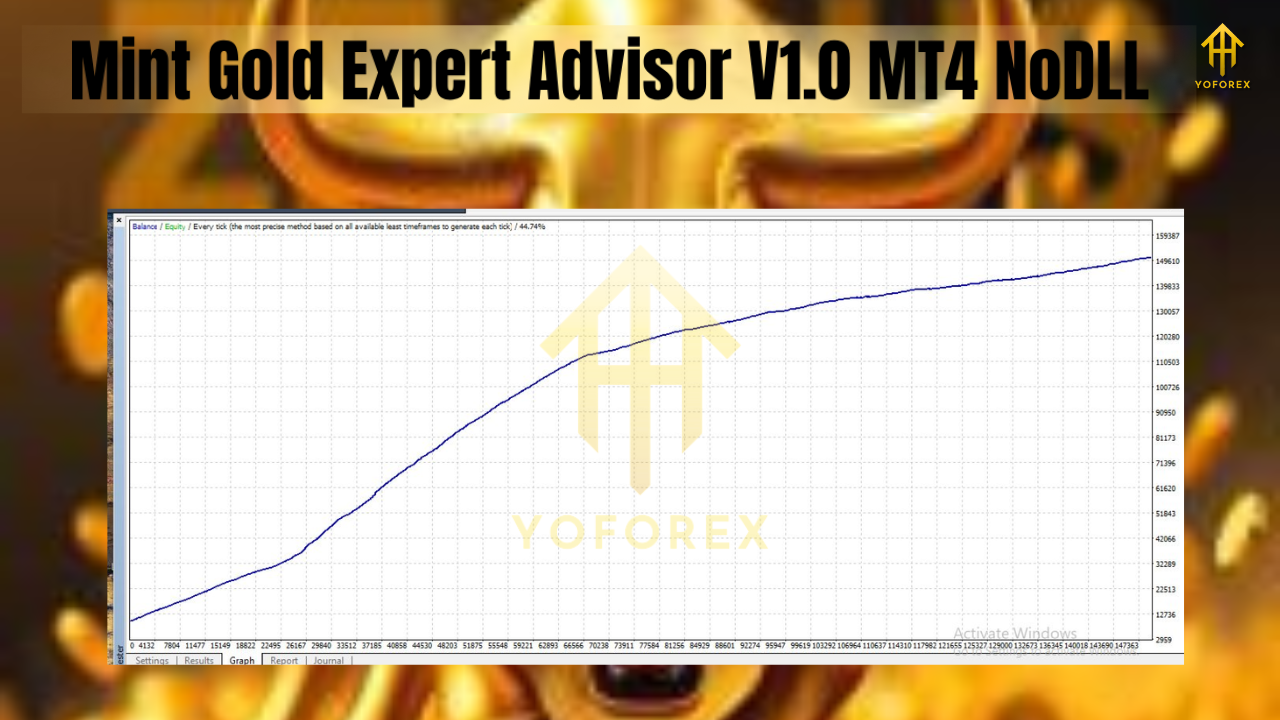

Performance and Backtesting

While specific backtest results for the Mint Gold EA V1.0 are not publicly available, it's essential to understand the significance of backtesting in evaluating an EA's performance.

Importance of Backtesting:

- Historical Performance: Assesses how the EA would have performed in past market conditions.

- Optimization: Helps in fine-tuning settings for better performance.

- Risk Assessment: Identifies potential drawdowns and profit factors.

Recommended Backtesting Practices:

- Timeframe: Conduct tests over extended periods, such as 1–2 years, to account for various market conditions.

- Data Quality: Use high-quality historical data to ensure accurate results.

- Realistic Settings: Apply realistic spread and slippage values to simulate live trading conditions.

Advantages of Using Mint Gold EA V1.0

- Automation: Reduces the need for constant market monitoring.

- Consistency: Executes trades based on predefined rules, minimizing emotional decision-making.

- Adaptability: Suitable for various market conditions, including trending and ranging markets.

- Capital Preservation: Integrated risk management features help protect trading capital.

Potential Limitations

- Market Conditions: Performance may vary in highly volatile or low-liquidity markets.

- Broker Compatibility: Ensure the EA is compatible with your broker's execution model and spreads.

- Over-Optimization: Relying solely on backtest results without forward testing can lead to over-optimization and poor live trading performance.

Conclusion

The Mint Gold Expert Advisor V1.0 MT4 stands out as a specialized tool for automated gold trading. Its combination of trend-following and reversal strategies, coupled with robust risk management features, makes it a valuable asset for traders looking to automate their gold trading endeavors. While it's crucial to understand its functionalities and limitations, with proper setup and monitoring, this EA can serve as a reliable companion in navigating the gold markets.

Comments

Leave a Comment