Meta PX EA V15.0 MT4 has become a name circulating among Forex traders who are constantly searching for automated solutions that can manage trades efficiently. While it is not widely documented across the usual marketplaces, traders remain curious about its potential. This article provides a detailed beginner-friendly breakdown of what Meta PX EA might offer, how to evaluate it, and the key points to keep in mind before using it in a live trading environment.

Introduction

The foreign exchange market is full of Expert Advisors (EAs) claiming consistent profits with minimal human involvement. Meta PX EA V15.0 for MT4 is marketed as one of these advanced robots. But with little concrete data available, traders must rely on structured evaluation, critical thinking, and risk management to determine whether such tools can genuinely deliver results.

This guide will walk you through:

- What Meta PX EA V15.0 MT4 is

- How automated trading works

- Claimed features and possible strategies

- Risks and precautions

- Practical tips for testing and using EAs

Understanding Meta PX EA V15.0 MT4

Meta PX EA is an Expert Advisor designed for the MetaTrader 4 platform, one of the most popular trading terminals worldwide. Its version number “15.0” suggests several updates and iterations, potentially aimed at improving stability, refining strategies, and enhancing performance.

Although there are no official vendor records or detailed technical descriptions available publicly, one can assume that this EA follows the general blueprint of algorithmic trading bots: scanning the markets for trade setups and executing entries and exits automatically based on coded logic.

Why Traders Seek EAs Like Meta PX EA

The attraction of trading robots lies in their ability to:

- Operate without emotions like fear or greed

- Run 24/5 across different trading sessions

- Execute trades at precise price levels with no hesitation

- Follow risk-management rules strictly when programmed correctly

For beginners, the idea of an EA that does the “heavy lifting” is highly appealing. But expectations should always be balanced with caution.

Potential Features of Meta PX EA V15.0

Since the EA does not have transparent documentation, its claimed features can only be outlined in terms of what such a robot should ideally offer:

- Automated entry/exit logic based on technical indicators or price patterns

- Adjustable risk parameters including lot size, stop loss, and take profit

- Support for multiple pairs or specific focus such as GBPUSD, EURUSD, or XAUUSD

- Money management system to balance risk and reward

- Backtesting capability to test strategies on historical data before live use

Common EA Strategies It Might Employ

While we cannot confirm the strategy of Meta PX EA V15.0, most EAs rely on one or more of the following:

- Trend following – Entering trades along with prevailing market direction.

- Breakout trading – Opening positions when price breaches support or resistance levels.

- Scalping – Quick, short-term trades for small profits across volatile markets.

- Martingale or grid systems – Increasing position size after losses to recover, though these carry higher risk.

- Indicator confluence – Combining tools such as Moving Averages, RSI, or Bollinger Bands to confirm signals.

Understanding whether the EA uses risky strategies like martingale is crucial before committing real funds.

The Risks Involved

Automated trading robots are not guaranteed money-making machines. Traders must recognize the risks before deploying Meta PX EA V15.0 or any EA:

- Over-optimization: EAs often perform well in backtests but struggle in live conditions.

- Market regime changes: Strategies can fail when volatility shifts or when trending markets turn sideways.

- Hidden risk systems: Grid or martingale systems may produce profits in calm markets but can blow accounts in strong trends.

- Broker limitations: Execution delays, spread changes, and slippage all impact EA performance.

How to Evaluate Meta PX EA V15.0 Safely

If you are considering testing this EA, follow these steps:

- Install on Demo First – Run it on a demo account to observe how it behaves in real-time.

- Check Customization Options – Ensure you can adjust lot sizes, risk levels, and trade frequency.

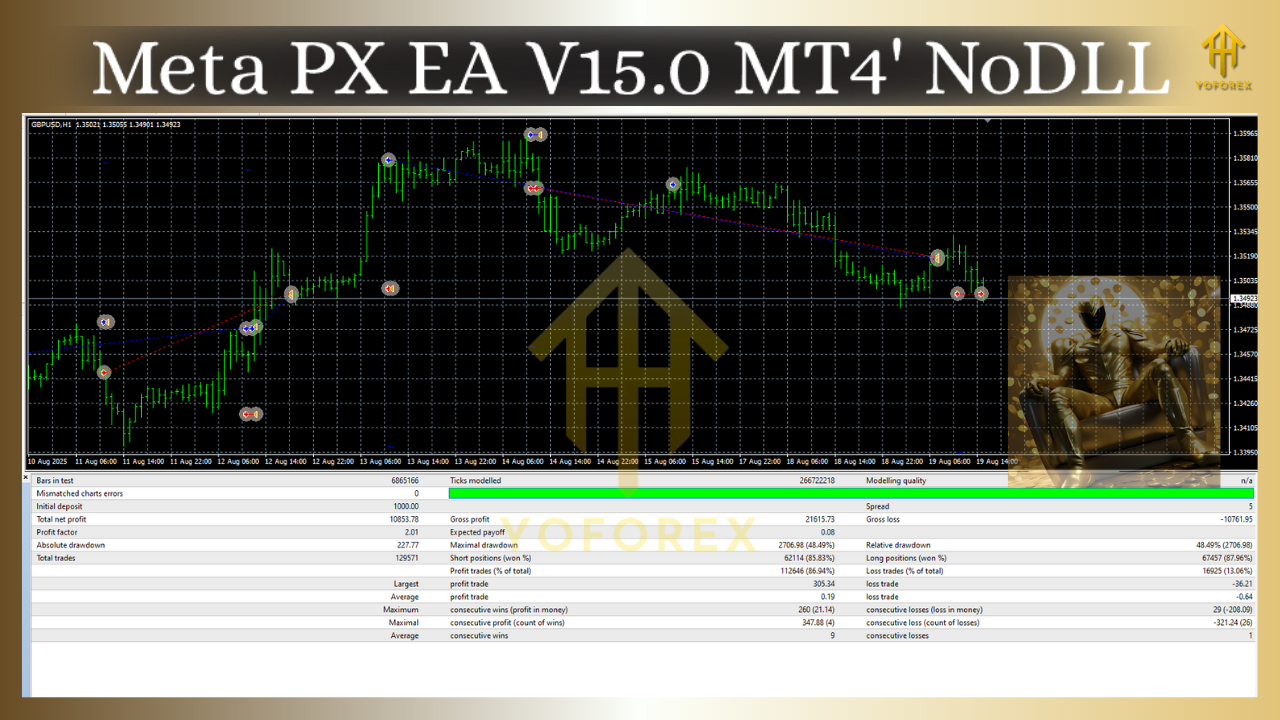

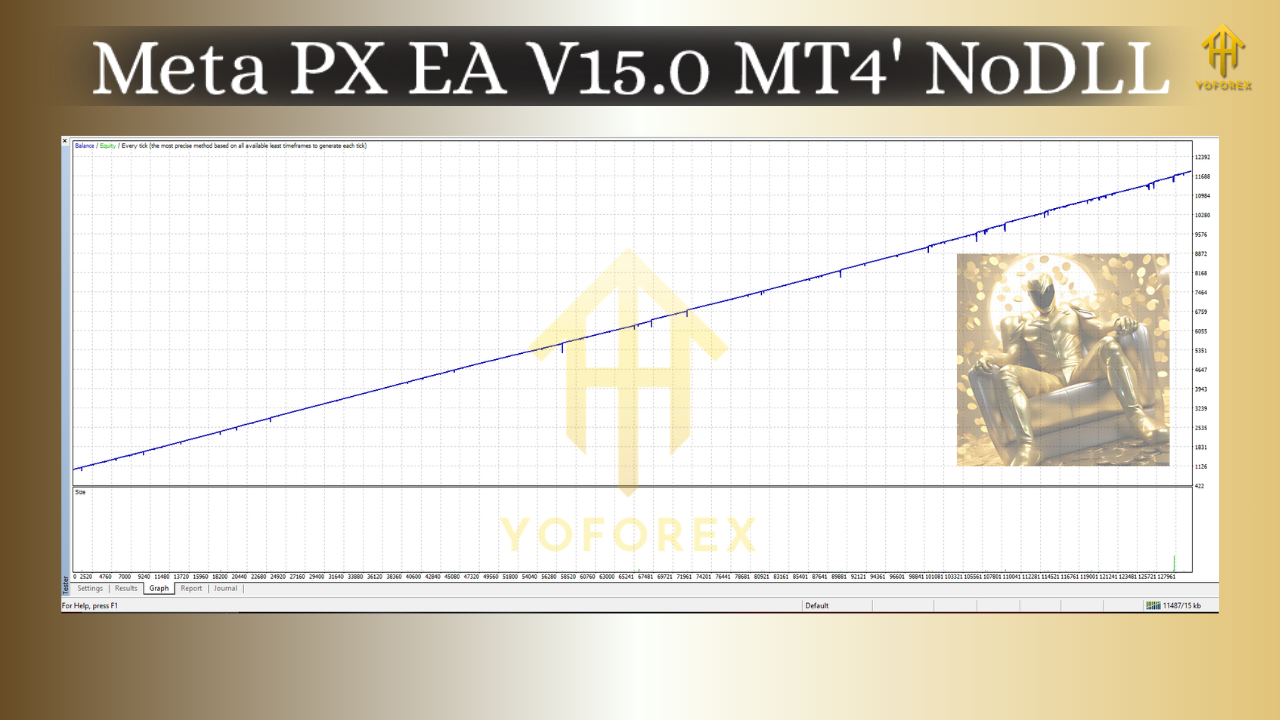

- Backtest Thoroughly – Use MT4’s strategy tester to simulate results across multiple years.

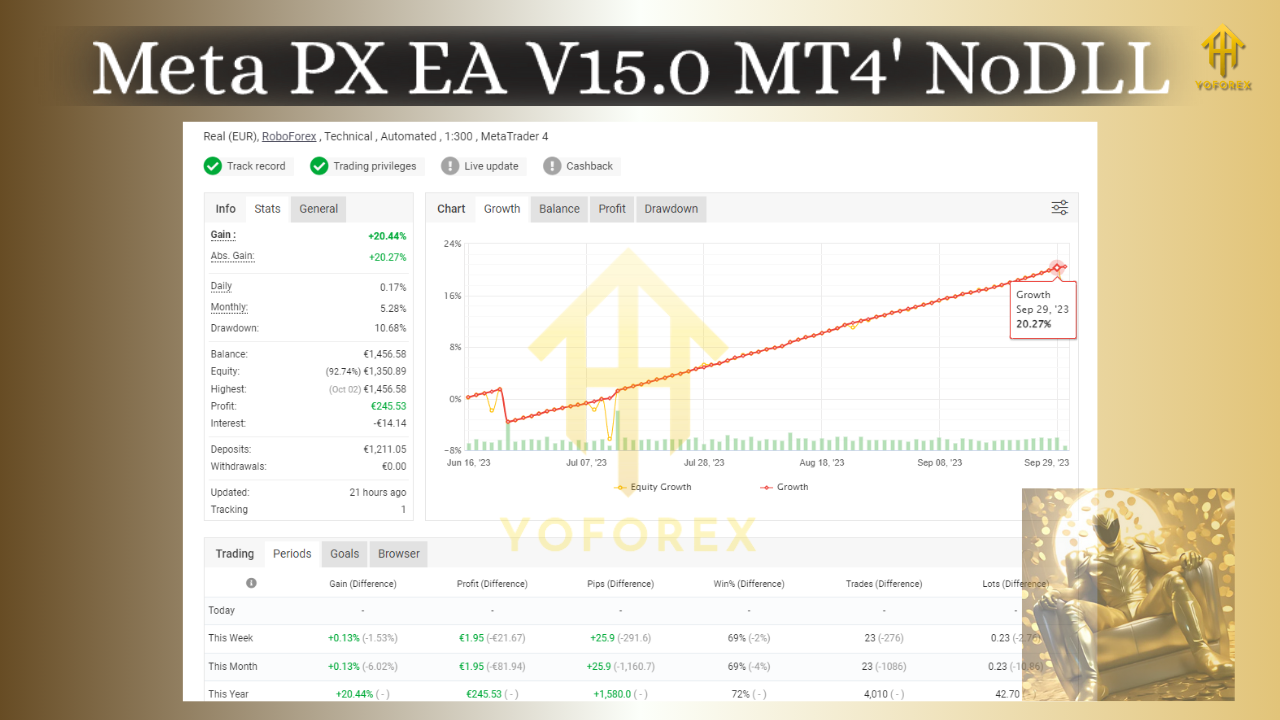

- Track Key Metrics – Look at drawdown, win rate, profit factor, and consistency.

- Avoid Over-Risking – Never trade live with large amounts initially. Start small and increase gradually if results prove stable.

Practical Example: Setting Up Meta PX EA

- Download the EA file and place it inside the

MQL4/Expertsdirectory of your MT4 terminal. - Restart the terminal, then drag and drop the EA onto a chart.

- Configure input settings like lot size, maximum drawdown, stop loss, and magic number.

- Activate “AutoTrading” to allow the EA to trade.

- Monitor the results closely over at least 30–60 days on demo before moving to live.

Should You Use Meta PX EA V15.0?

At this stage, Meta PX EA remains an uncertain option. Without reliable vendor details or verified trading records, it should not be treated as a guaranteed solution. Instead, it should be approached as an experiment for learning and testing.

EAs can be powerful allies when used wisely, but they can also introduce unnecessary risks if applied blindly. Meta PX EA V15.0 may or may not live up to expectations, and only careful evaluation will reveal its true potential.

Final Thoughts

Meta PX EA V15.0 MT4 highlights the double-edged nature of Forex automation. On one hand, it promises convenience, precision, and consistent execution. On the other, it comes with uncertainties and risks that only disciplined traders can manage.

For beginners, the best approach is:

- Learn how EAs work in theory and practice.

- Test extensively before committing real funds.

- Manage risk strictly at all times.

If you’re curious about exploring Meta PX EA V15.0 MT4, start cautiously and use it as a learning tool rather than a shortcut to instant profits.

Comments

Leave a Comment