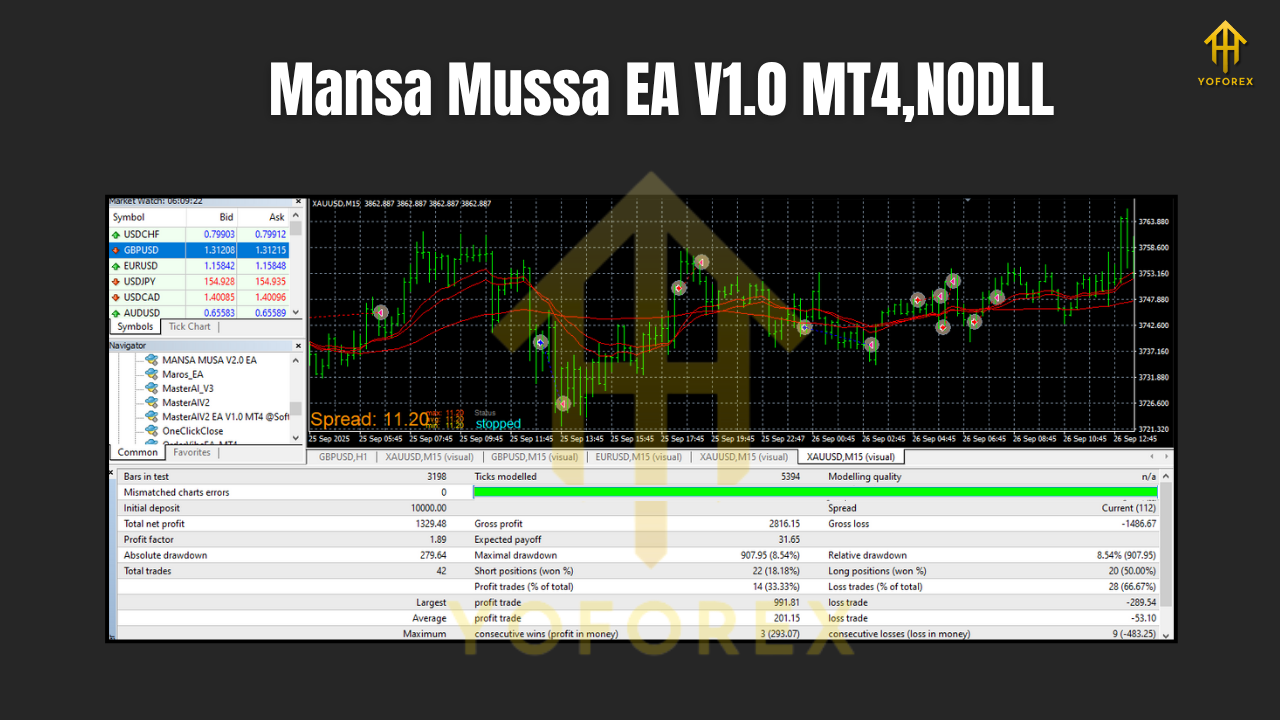

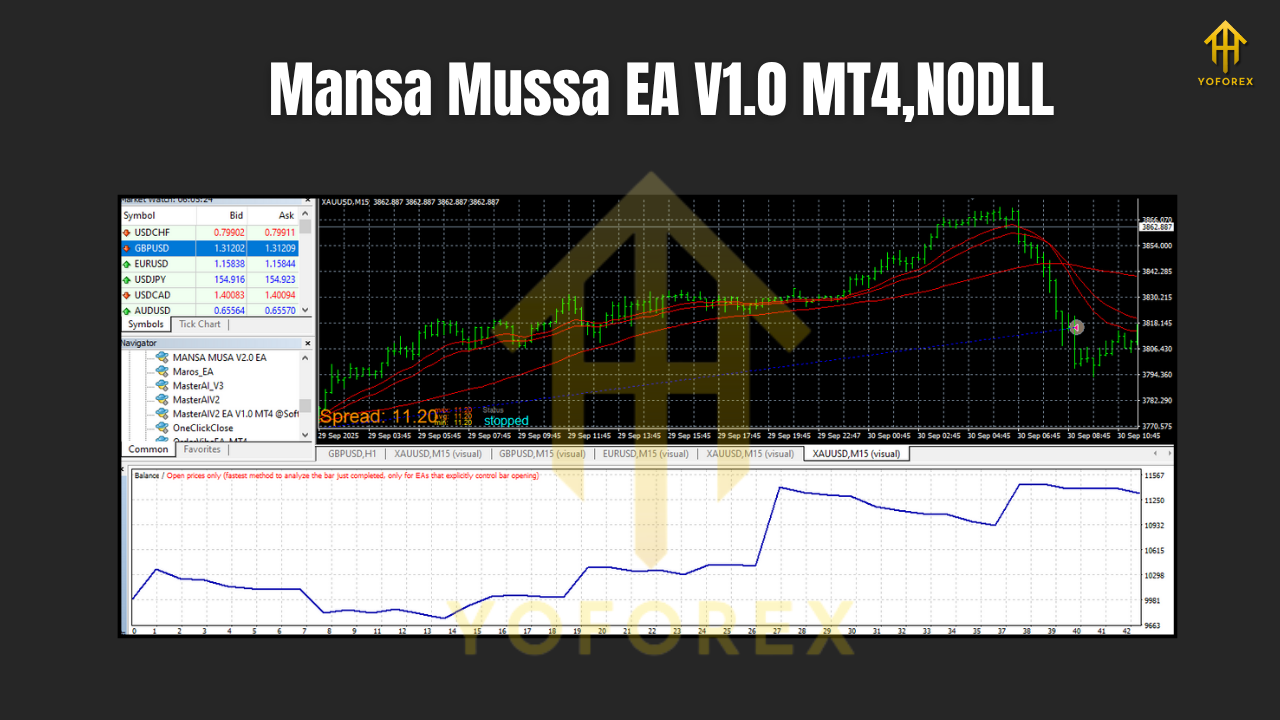

Mansa Mussa EA V1.0 MT4 – Smart Martingale & Scalping Power For Your Forex Trades

If you’ve ever blown an account coz of emotional entries, revenge trades, or poorly managed martingale grids, you’re not alone. Many traders love the idea of “scalping + recovery” but hate the stress, right? That’s where Mansa Mussa EA V1.0 MT4 comes in.

This Expert Advisor is built for traders who want to combine aggressive opportunity-taking with strict risk control. It uses a strategic mix of martingale and scalping techniques, runs on popular major pairs, and is optimized for M15 and H1 timeframes. With a minimum deposit of just $100, it’s accessible for small accounts while still offering serious potential for growth if used wisely.

In this blog, we’ll break down how the EA works, the pairs and timeframes it supports, the type of trader it suits, and some practical tips so you don’t just plug it in blindly and pray.

What Is Mansa Mussa EA V1.0 MT4?

Mansa Mussa EA V1.0 MT4 is an automated trading system designed for MetaTrader 4 that combines scalping entries with a carefully structured martingale-style recovery mechanism. Instead of randomly opening a million trades, it follows logic-based rules to enter, scale, and exit positions.

Supported Pairs:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

- USDCAD

Recommended Timeframes:

- M15 – for more frequent trades and short-term scalps

- H1 – for more stable, medium-term setups with fewer but stronger signals

Minimum Deposit:

- $100 (for conservative risk and small lot sizes)

The core idea is simple:

Let the EA catch high-probability scalping opportunities, and if the market goes against the first entry, the EA uses controlled martingale steps to recover and exit with net profit whenever possible.

How Mansa Mussa EA Trades the Market

The strength of the Mansa Mussa EA is in how it blends entry precision with structured recovery. Here’s a breakdown in plain language.

1. Smart Market Scanning

The EA constantly scans the market on the selected timeframe (M15 or H1), using:

- Trend filters (like moving averages or directional momentum)

- Volatility conditions (so it doesn’t trade dead markets)

- Price action zones where reversals or continuations are more likely

It doesn’t just fire trades on every candle. It waits for a confluence of signals before taking a position.

2. Scalping-Based Entries

The first trade in a sequence is usually a small-lot scalping trade:

- Targets short-to-medium profit in pips

- Uses logical stop-loss levels based on recent structure

- Aims to catch fast moves on pairs like EURUSD, GBPUSD, USDJPY, etc.

When the move goes as expected, you just see quick, clean winners.

When it doesn’t… that’s where the controlled martingale logic kicks in.

3. Strategic Martingale Recovery

Unlike reckless martingale EAs that double lots endlessly until the account dies, Mansa Mussa EA V1.0 MT4 uses a capped and structured martingale approach:

- Increases lot size in limited steps only

- Uses widening or dynamic grid spacing to adapt to volatility

- Has a maximum number of recovery trades to avoid account-killing sequences

The goal is to average into a better price, so when the market snaps back even partially, the whole basket can be closed in combined profit or minimized loss, depending on your risk mode.

4. Risk Management Layer

The EA includes multiple safety tools (and you should learn them, dont just ignore settings):

- Maximum spread filter – avoids trading during wild spreads

- Daily loss or equity protection – stop trading after a specified loss

- Maximum open trades – controls exposure per pair or overall

- Optional equity-based stop to safeguard the account from extreme events

This combination of scalping + capped martingale + safety filters is what gives Mansa Mussa EA its edge.

Recommended Pairs, Timeframes & Capital Setup

You already know the pairs and timeframes, but let’s make it more practical.

Supported Pairs (Best Conditions)

- EURUSD – Tight spreads, high liquidity, ideal for scalping

- GBPUSD – More volatile, good for momentum runs

- USDJPY – Clean trends, smoother swing behavior

- AUDUSD – Often ranges nicely, perfect for grid-style entries

- USDCAD – Works well during US session with clear directional moves

Timeframes

- M15

- More entries

- Slightly higher risk if you use aggressive settings

- Great for active intraday traders

- H1

- Fewer but higher-quality trades

- Smoother equity curve

- Suitable if you don’t want to watch charts all day

Minimum Deposit & Lot Sizing

- Minimum deposit: $100

- For small accounts, start with 0.01 lots and conservative martingale steps.

- If you scale up to $500 or $1,000, you can gradually adjust risk, but always test in demo first.

Key Features & Benefits of Mansa Mussa EA V1.0 MT4

Here are the main reasons traders find this EA attractive:

- Automated scalping & recovery system – no need to sit 24/5 in front of the chart.

- Works on 5 major currency pairs – helps diversify and spread risk.

- Optimized for M15 & H1 – balances trade frequency and signal quality.

- Minimum deposit of just $100 – friendly for small or starting accounts.

- Controlled martingale – capped steps to avoid unlimited risk.

- Flexible risk settings – adjust lot size, max trades, daily loss, and more.

- User-friendly inputs – even beginners can set it up with basic guidance.

- 24/5 market operation – it doesn’t get tired, emotional, or distracted.

- Focus on consistency rather than “one big win” – aims for growing equity curve instead of lottery-style spikes.

- Compatible with most standard MT4 brokers – no exotic environment needed.

Risk Management & Drawdown Control

Let’s be real for a second:

Any EA that uses martingale, even a smart one, can be risky if misused. Mansa Mussa EA helps reduce that risk, but you still need to respect money management.

A few important points:

- Always start on demo – understand how the EA behaves in trends, ranges, and news spikes.

- Avoid overleveraging. Just because the EA “can” handle more lot size doesn’t mean your account “should”.

- If you’re using M15 on a volatile pair like GBPUSD, go extra conservative.

- Use the max drawdown / daily loss setting so the EA stops trading after a bad day instead of burning the account.

- Consider pausing the EA during major news if you don’t like high risk around NFP, CPI, central bank meetings etc.

The EA gives you tools. How you use them decides your survival.

Who Should Use Mansa Mussa EA?

This EA can fit multiple trader profiles, but in slightly different ways.

1. Beginners

If you’re new to trading:

- Use small lots only

- Start on demo, then move to a small live account

- Let the EA teach you how structured trading feels (entries, recoveries, exits)

2. Intermediate Traders

If you already know basics of risk and drawdown:

- You can fine-tune recovery steps and take profit levels

- Run it on 2–3 pairs instead of all 5 at once

- Combine it with your own analysis to enable/disable pairs based on market conditions

3. Advanced / System Traders

For advanced users:

- Use it as part of a portfolio of EAs

- Run it on different magic numbers on different accounts or brokers

- Backtest and forward-test to find the sweet spot between profit and max drawdown

Tips to Get the Best Results from Mansa Mussa EA

A few practical, no-BS tips to help you avoid common mistakes:

- Use a VPS so the EA runs 24/5 without interruptions.

- Don’t randomly switch timeframes every day—stick to either M15 or H1 per setup.

- Avoid trading all 5 pairs at high risk on a $100 account. That’s just asking for trouble.

- Regularly check your account history and equity curve; if a pair is performing badly for weeks, consider disabling it.

- Keep realistic expectations. It’s an EA, not magic. Slow, consistent growth > overhyped dreams.

- Every time you change settings, let it run for a few weeks before judging results.

Final Thoughts – Is Mansa Mussa EA V1.0 MT4 Worth Using?

If you’re looking for a fully automated system that:

- Trades major forex pairs

- Combines scalping entries with a structured martingale recovery

- Works on M15 and H1 timeframes

- Can start with as low as $100

…then Mansa Mussa EA V1.0 MT4 can definitely be a solid addition to your trading toolbox.

It’s not risk-free (no martingale EA ever is), but with proper lot size, smart settings, and discipline, it can help you turn chaotic, emotional trading into something much more systematic and consistent.

Comments

Leave a Comment