Mahumucha EA V2.95 for MT5 is designed for traders who want to capture reliable trend moves while managing risk with precision. Whether you're trading EURUSD, GBPUSD, or XAUUSD (Gold), this fully automated EA adapts to market volatility using a dynamic trend-following strategy that adjusts stop losses, take profits, and position sizes based on current market conditions. No martingale, no grid, and no over-leveraging—just disciplined, rules-based trading.

Below is your trader-first breakdown of how Mahumucha EA works, what’s new in V2.95, recommended settings, installation steps, and risk playbook. Plus, you’ll get SEO-ready meta data for easy use on your website or blog.

What Is Mahumucha EA V2.95?

Mahumucha EA V2.95 is a MetaTrader 5 Expert Advisor designed to trade major FX pairs and gold by identifying trend-following opportunities. The EA uses a combination of trend detection algorithms (using indicators like EMA, SMA, and ATR) to place trades and dynamically adjust them based on market volatility. This ensures that the system stays responsive to changing market conditions while keeping risk in check.

Who it’s for

- Traders who want trend-following automation with a focus on risk management

- Users who want to automate entries, exits, and position sizing based on live market conditions

- Traders who prefer no martingale/grid strategies, with adjustable risk settings

- Anyone who wants real-time control over position sizing, stop loss, and take profit levels

Best fit pairs and timeframes

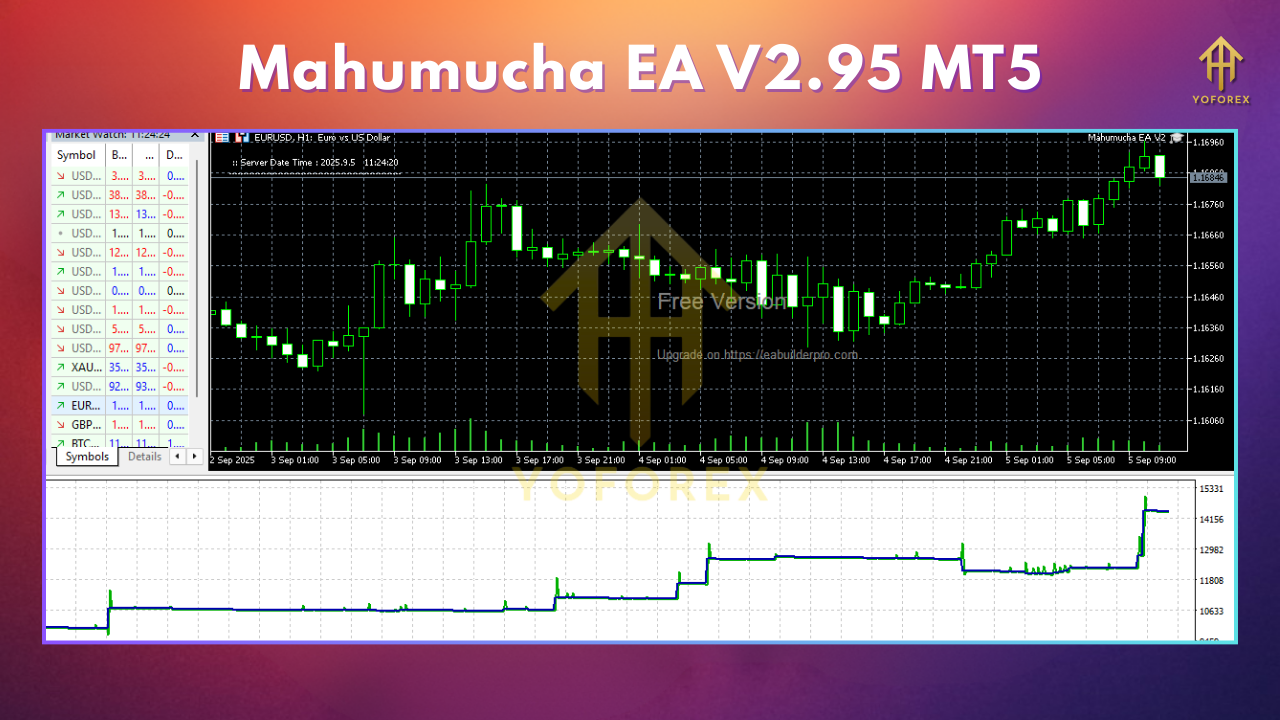

- EURUSD, GBPUSD, XAUUSD (Gold)

- Timeframes: M15–H1 for FX majors, M30–H1 for gold (you can adjust for higher timeframes if you’re comfortable with lower-frequency trades)

What’s New in V2.95?

- Enhanced trend detection: Improved algorithm for spotting strong trends and reducing false entries during sideways movement.

- Dynamic ATR-based stops: Stop-loss and take-profit levels are now more volatility-sensitive, adjusting based on real-time market conditions.

- Smarter position sizing: The system now takes into account both market volatility and account equity, ensuring optimized lot sizes based on risk tolerance.

- Improved risk management: More precise risk controls, including better handling of drawdown recovery with equity guard and daily loss stop.

- Slippage and spread control: The EA now offers more granular slippage control and spread filtering, preventing orders from being executed in unfavorable conditions.

- MT5 performance improvements: Faster execution and less resource consumption, perfect for multi-chart trading setups.

Key Features (V2.95)

- Trend-following strategy: The EA uses EMA/SMA indicators combined with momentum filters to identify high-probability trends.

- ATR-based stop loss & take profit: Stop losses and take profits are dynamically adjusted according to market volatility.

- No martingale, no grid: Risk management is based on dynamic position sizing and pre-set risk %—no random or risky strategies.

- Real-time risk management: Automatically adjusts position size based on account equity and current market volatility.

- Equity guard: Prevents further trading after a certain drawdown threshold is hit, protecting your capital.

- Daily loss stop: Stops trading automatically if a pre-set daily loss limit is reached.

- Partial TP and trailing stops: Partial profits can be taken at +1R or other set thresholds, and the remainder can be trailed based on ATR or other indicators.

- Optimized for FX majors and XAUUSD: This EA is especially good for EURUSD, GBPUSD, and XAUUSD, but can be adapted for other pairs.

- Granular slippage & spread control: Filters out unfavorable conditions, such as high spread or slippage.

How the Strategy Works (Under the Hood)

1) Trend Identification

The system starts by detecting the directional trend using EMA/SMA combinations. If the trend is strong, the system looks for pullbacks or continuations to enter trades.

- EMA (fast): Short-term trend detection.

- SMA (slow): Long-term trend detection.

- Momentum filter: Ensures that trades are only executed when the market momentum is in line with the trend.

2) Risk Management (ATR)

The system calculates dynamic stop loss and take profit levels based on ATR (Average True Range) to adapt to current market volatility. For high volatility, the stop loss will be wider; for low volatility, the stop loss will be tighter.

3) Position Sizing

Position sizes are automatically calculated based on the account equity and volatility. The system uses a fixed risk % per trade and dynamically adjusts lot sizes to ensure that you are not overexposing yourself on a single trade.

4) Entry Triggers

- Trend Continuation: The EA enters trades when a pullback within a trend is confirmed by a breakout of the recent high/low.

- Trend Reversal: The EA uses higher timeframe confirmation to catch trend reversals with stronger momentum.

5) Exit Triggers

- Take Profit (TP): The system sets a dynamic TP based on ATR and market conditions.

- Partial TP: If the price moves in your favor, the EA will automatically take partial profits at +1R (or another customizable value) and then trail the remainder.

6) Equity Guard & Daily Loss Stop

To protect your capital, the EA includes an equity guard that stops trading if the floating drawdown exceeds a pre-set threshold. Additionally, a daily loss stop ensures the system stops trading for the day if a pre-set percentage of your account is lost.

Recommended Settings (Starter Template)

Environment

- Broker: ECN/Raw-spread with consistent liquidity

- VPS: Yes (stable uptime and low latency for multi-chart setups)

- Leverage: 1:200–1:500 (keep risk sizing in check)

Symbols & Timeframes

- EURUSD / GBPUSD / USDJPY: M15–H1

- XAUUSD: M30–H1 (if gold spreads are manageable)

Risk Controls

- Risk per trade: 0.5%–1.0% (new users: 0.5%)

- Max concurrent positions (all charts): 3–5

- Daily loss stop: 2%–3% (auto-pause after daily loss threshold)

- Equity guard (floating DD): 5%–8% (auto-pause after drawdown)

Execution Filters

- Max spread: 10–20 points for major pairs, 30–50 points for XAUUSD

- Max slippage: 1–3 points

- Sessions: Focus on London/NY overlap

- News filter: Optional (use 15–30 minutes before high-impact news)

Stops & Targets

- SL: 1.5×–2.5× ATR or beyond the last clean swing

- TP: 1.5R–2.0R baseline; partial at +1R, then trail remainder

Ready-Made Profiles

A) Conservative (H1 Trend Following)

- Risk 0.5% | SL 2.0× ATR | TP 1.5R | partial at +1R | ATR trail

- Sessions: London/NY | News filter ON

B) Standard (M15 Active)

- Risk 0.6% | SL 1.7× ATR | TP 1.4R | partial at +1R | ATR trail

- Spread/slippage caps tighter

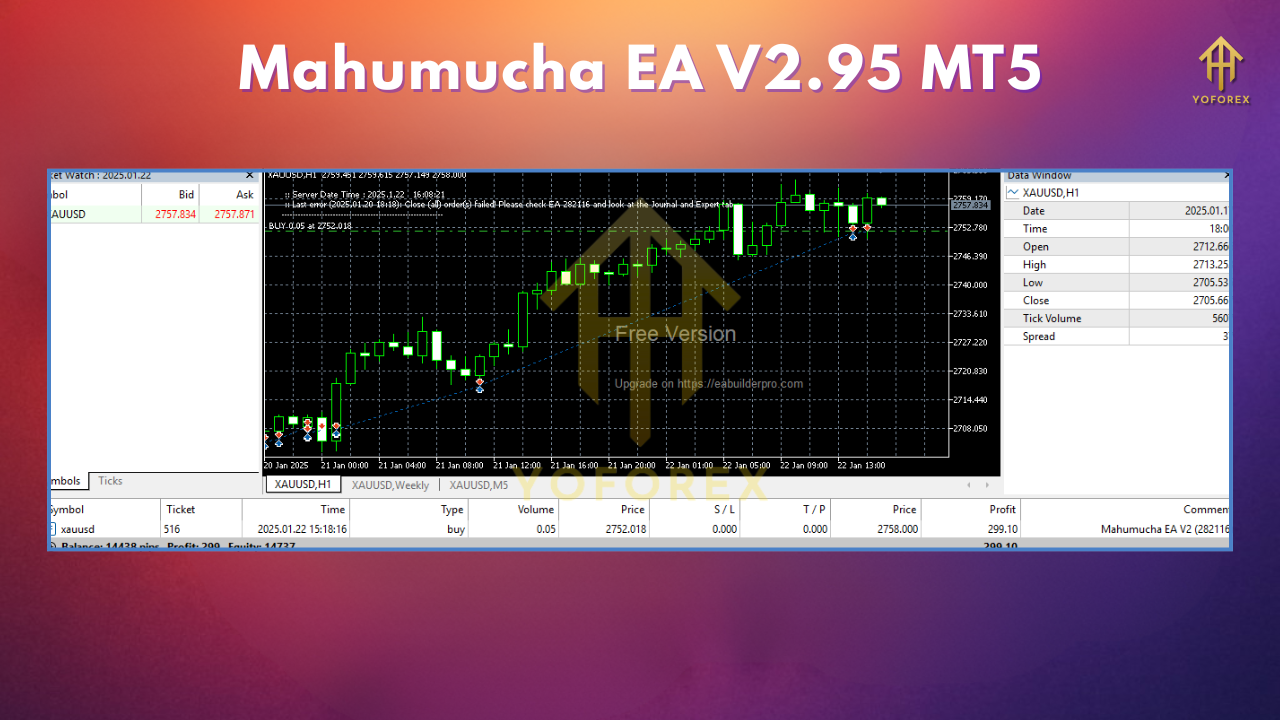

C) Gold (XAUUSD)

- Risk 0.5% | SL 2.3× ATR | TP 1.6R | partial at +1R | swing trail

- Higher spread veto; extend news block to 20–30 min

Installation & Setup (MT5)

- Copy

Mahumucha_EA_V2_95.ex5intoMQL5/Experts/. - Restart MT5 → check Navigator → Experts.

- Enable Algo Trading on the toolbar.

- Attach the EA to each symbol chart (one symbol per chart).

- Inputs: Load the Conservative or Standard profile above or adjust settings manually.

- Permissions: Allow DLL imports only if using a calendar/news module.

- Forward-test on demo for 1–2 weeks to validate spreads, slippage, and fills.

Backtesting & Optimization Tips

- Use tick-quality data with variable spread; fixed spreads make results look smoother than they should be.

- Include event windows (CPI, NFP, FOMC) in your test to see slippage risk.

- Test across multiple weeks (trend, range, volatile) to ensure you understand how the EA performs in different market regimes.

- Walk-forward: Optimize on Period A, test on Period B—avoid overfitting.

Risk Playbook (Print This)

- Tiny, constant risk (0.5%–1.0%) beats hot-and-cold sizing—always.

- Daily stop & DD guard are non-negotiable.

- Cost discipline: If spreads/slippage creep up, reduce risk or pause.

- Avoid curve-fitting: “Perfect” params usually break next week.

- Withdraw periodically (if live) to keep effective risk aligned.

- FAQs

Does Mahumucha EA use martingale or grid?

No. It uses dynamic position sizing based on risk % and ATR stop distance. No averaging down or grid recovery.

Can I use it with any symbol?

It works best on EURUSD, GBPUSD, and XAUUSD, but you can tweak it for other pairs. Adjust the ATR settings and spread/slippage caps accordingly.

Will it trade every day?

Not guaranteed. The EA only trades when it identifies strong trends with manageable volatility. If the market is too choppy, it will skip.

Minimum deposit?

Demo any size. For live trading, start with $500–$1,000 and 0.5%–1% risk.

Disclaimer

Trading Forex/CFDs involves risk. Past performance is not indicative of future results. Always forward-test on demo, keep risk conservative, and never trade money you can’t afford to lose.

Call to Action

Want to automate your trading with real-time risk control? Install Mahumucha EA V2.95 on MT5, run the Conservative or Standard profile on demo, and track performance for a few sessions. When execution looks solid, scale gradually—tight risk, clear rules, and let the system do the heavy lifting.

Comments

Leave a Comment