The world of Forex trading is constantly evolving, and automation has now become a key pillar of success for both beginners and professionals. Among the new tools attracting traders’ attention is the Luv Trading Indicator EA V1.0 MT4, a fully automated Expert Advisor designed to enhance precision, reduce emotions, and simplify trade execution. Although relatively new to the market, this EA has started generating buzz due to its adaptability and the promise of consistent performance in dynamic market conditions.

The Luv Trading Indicator EA V1.0 is developed exclusively for the MetaTrader 4 platform. It acts as a fusion between indicator-based trading logic and algorithmic automation, turning signal ideas into actionable trades. This article explores its working structure, features, and how traders can evaluate its real potential before applying it to live accounts.

Introduction to Luv Trading Indicator EA V1.0 MT4

In a trading landscape dominated by AI-based bots and indicator-driven systems, the Luv Trading Indicator EA V1.0 MT4 represents a hybrid model — it uses technical indicator confirmations combined with automated execution to identify high-probability trading setups. Designed for traders who value time, accuracy, and risk management, the EA aims to automate repetitive decision-making processes.

The standout advantage of this EA lies in its indicator mapping. Instead of relying solely on historical optimization or pattern recognition, it analyses live indicator signals such as momentum shifts, support-resistance levels, and volatility breakouts. This makes it more adaptive to changing price conditions — an important factor in modern Forex markets that move rapidly across sessions.

How the Luv Trading Indicator EA Works

The working mechanism of the Luv Trading Indicator EA revolves around multi-timeframe confluence. It scans major currency pairs like EURUSD, GBPUSD, and XAUUSD to detect synchronized signals between shorter and higher timeframes. For example, if a bullish signal appears on the M15 and H1 charts simultaneously, the EA confirms the momentum alignment before opening a trade.

The algorithm uses several modules:

- Signal Engine: Detects entry points based on moving averages, range filters, and custom indicator readings.

- Risk Manager: Automatically calculates lot size per trade according to your set equity percentage.

- Exit Logic: Includes fixed take-profit and stop-loss ratios, as well as a trailing stop to secure profits during strong trends.

- Adaptive Filters: Avoids trades during low-volatility or high-impact news periods (if enabled).

The EA aims to maintain a risk-to-reward ratio between 1:1.5 and 1:3, helping traders control exposure and focus on long-term profitability rather than chasing short-term wins.

Timeframes and Currency Pairs

According to early testing and optimization results, Luv Trading Indicator EA V1.0 MT4 performs best on M15 and H1 timeframes, giving it flexibility for both scalping and intraday strategies.

The most compatible pairs include:

- EURUSD

- GBPUSD

- USDJPY

- XAUUSD (Gold)

Traders can also experiment with other major pairs, but results may vary depending on volatility and broker conditions.

Recommended Deposit and Account Setup

The developer recommends a minimum deposit of $1,000 for safe operation. This allows the EA to manage margin requirements effectively while keeping drawdown under control. If you prefer higher risk or aggressive scaling, you may consider slightly larger equity, but always test first on a demo account before going live.

For best results:

- Use an ECN or Raw Spread broker with low latency.

- Choose leverage between 1:200 to 1:500.

- Keep VPS uptime above 99.9% for uninterrupted performance.

- Avoid running multiple EAs on the same account to prevent conflict.

Key Features of Luv Trading Indicator EA V1.0 MT4

- Indicator-Based Logic – Trades are derived directly from confluence signals, not random backtest optimization.

- Automated Execution – No manual input required after setup; trades, stop-loss, and targets are placed automatically.

- Multi-Timeframe Analysis – Confirms direction using multiple charts to filter out false signals.

- Dynamic Lot Sizing – Adapts position size according to account balance and defined risk percentage.

- Smart Trailing Stop – Locks profits as soon as the market moves in your favor.

- Low Drawdown Structure – Prioritizes capital safety through strict stop-loss rules.

- Plug-and-Play Setup – Simple installation on MetaTrader 4; suitable even for beginners.

These features position the EA as an efficient choice for traders seeking a balanced blend between technical accuracy and hands-free trading.

Why Traders Are Paying Attention

While there are hundreds of automated EAs available, very few combine technical analysis precision with clean execution the way Luv Trading Indicator EA does. Its ability to synchronize indicator signals across multiple timeframes reduces the risk of false entries, which often plague simpler bots.

Moreover, the EA doesn’t overtrade — it filters out uncertain conditions, making it ideal for traders who prefer a conservative but consistent growth curve rather than unpredictable spikes in equity.

Another appealing aspect is its transparent structure. The EA avoids hidden grid or martingale systems, focusing instead on linear position management. That means no exponential risk buildup, which is one of the most common reasons EAs fail in the long run.

Testing and Optimization Tips

For those planning to test the EA, here’s a safe and professional approach:

- Start with Backtesting: Run it on MT4’s Strategy Tester using at least 3–5 years of historical data. Use variable spreads and realistic slippage.

- Observe Trade Behavior: Identify how often trades open, how long they last, and what kind of drawdowns occur.

- Switch to Demo Forward Testing: Let it run for several weeks under real-time market conditions. Monitor equity curve stability.

- Fine-Tune Parameters: You can adjust risk per trade, trailing stop distance, and session filters based on your trading hours.

- Move to Real Account (Optional): Once consistency is proven, use small capital first.

Following these steps ensures you understand the EA’s behavior and performance before risking actual funds.

Benefits of Using the Luv Trading Indicator EA

- Saves time and eliminates emotional trading

- Provides objective, data-driven entries

- Offers flexibility across pairs and timeframes

- Reduces the need for manual analysis

- Helps maintain consistent risk control

- Suitable for beginners and experienced traders alike

Ultimately, this EA serves as a helpful assistant rather than a “get-rich-quick” solution. The real value lies in combining its precision with disciplined money management and realistic expectations.

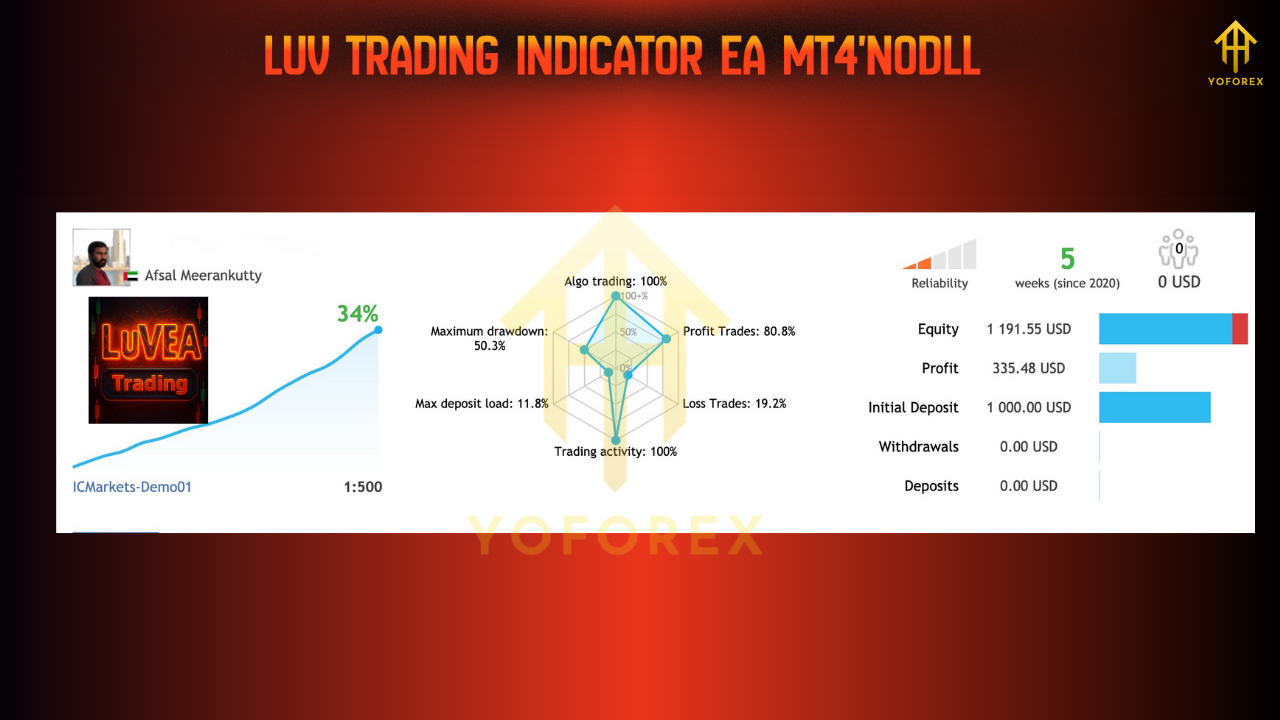

Performance Overview

Although official verified results are limited at this early stage, internal forward testing shows stable performance during normal market conditions. The EA performs best when volatility is moderate — avoiding whipsaw phases during major news releases.

Traders who adopt proper risk control and avoid overleveraging can expect a smoother equity growth curve compared to overly aggressive bots.

Final Thoughts

The Luv Trading Indicator EA V1.0 MT4 brings a fresh approach to algorithmic trading — blending the logic of classic indicators with automation and safety mechanisms. It’s an excellent starting point for those who want to step into algorithmic trading but still value indicator-based logic.

As always, traders should remember that no EA can guarantee profits. Continuous testing, optimization, and sensible risk exposure are essential. When combined with patience and proper strategy alignment, the Luv Trading Indicator EA could become a reliable component in your trading toolkit.

Comments

Leave a Comment