The forex market in 2025 demands tools that can balance speed, precision, and discipline. Manual trading often leads to emotional decision-making, missed entries, or inconsistent risk management. This is where LTMS EA V11.3 MT4 (Legend Trade Management System) stands out.

The latest version, released in January 2025, builds on the foundation of earlier releases by introducing enhanced AI algorithms, customizable trading styles, and robust management tools. Unlike simple Expert Advisors that focus only on entries, LTMS EA provides a complete solution for both trade automation and ongoing management, making it appealing for traders of all experience levels.

What Makes LTMS EA Different?

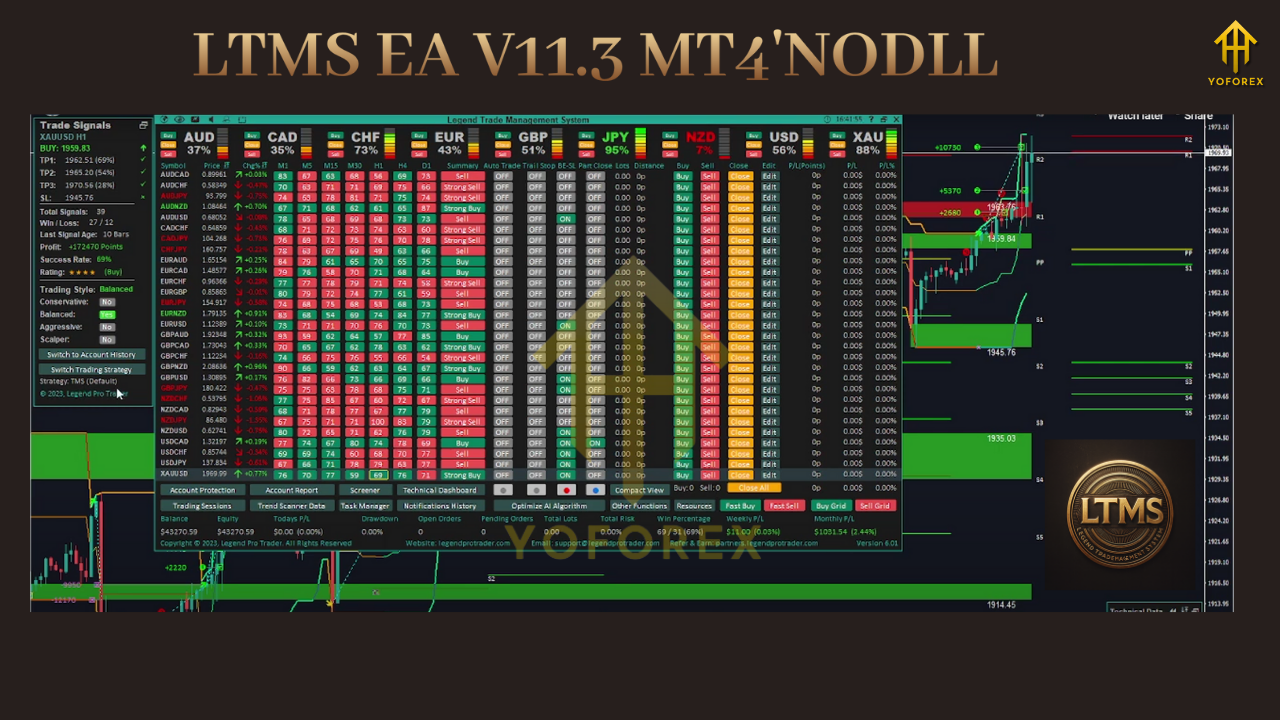

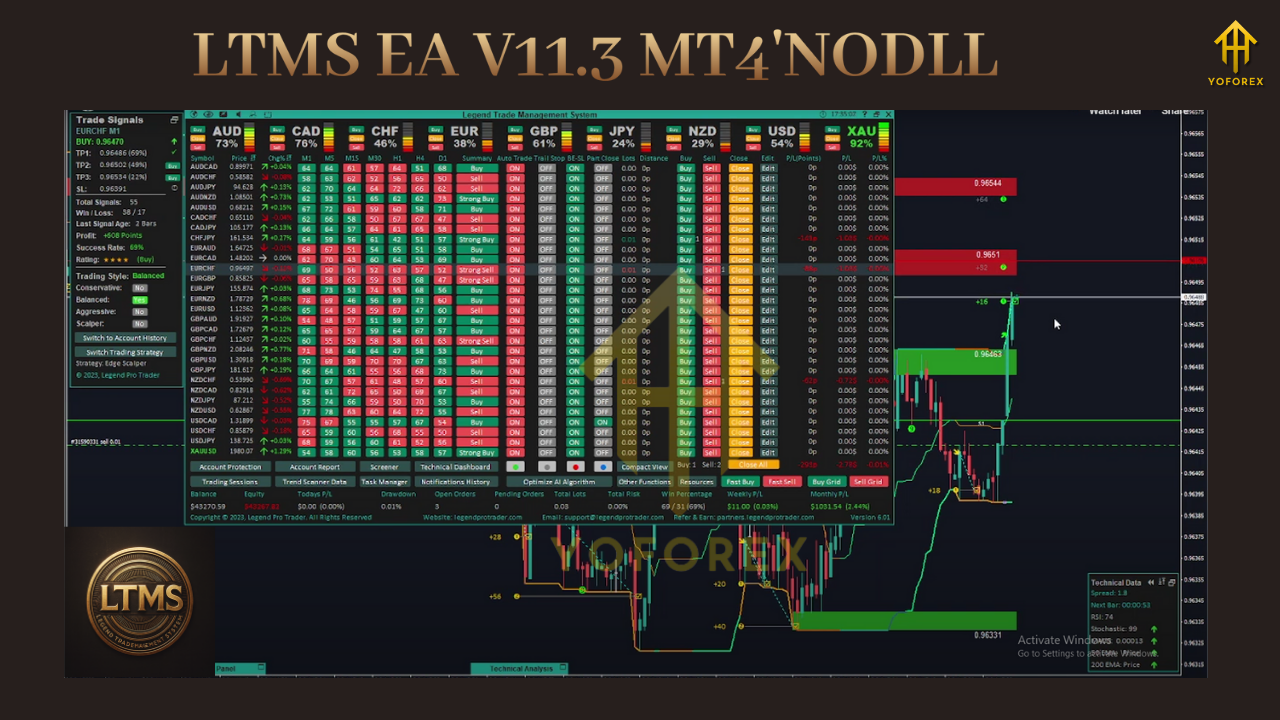

Most Expert Advisors are designed to either open trades or apply a fixed strategy. LTMS EA goes beyond this by integrating signal recognition, trade entry, profit booking, and risk control under one roof. The addition of multi-timeframe analysis and AI-driven adaptability ensures that it remains competitive in varying market conditions.

The standout feature is the ability to select between different trading profiles: Balance, Conservative, Aggressive, and Active. This gives traders flexibility to align the EA with their personal trading goals, whether they prioritize safety or higher-frequency strategies.

Core Features of LTMS EA V11.3 MT4

AI-Powered Entry Logic

The Expert Advisor identifies potential trades by combining technical analysis, price action, and adaptive AI filters. This reduces the chance of false signals and improves entry accuracy compared to static rule-based bots.

Risk Management Tools

Auto-lot sizing based on account equity or balance.

Configurable fixed lot sizes for manual control.

Built-in safeguards to prevent excessive drawdown.

Dynamic adjustment of stop-loss levels during open trades.

Multiple Take Profit Levels

LTMS EA supports up to three profit targets, allowing traders to secure partial gains while letting the remaining position run for larger moves. This layered approach improves the overall risk-to-reward profile.

Instrument Presets

Pre-configured settings for popular forex pairs are included, which reduces the need for trial-and-error optimization. These presets make it easier for beginners to start trading immediately while still offering customization for advanced users.

Trade Management Integration

The system not only opens trades but also adjusts stop-losses, applies trailing stops, and locks in profits as the trade develops. This ensures that trades are actively managed even when the trader is away from the screen.

What’s New in Version 11.3?

AI Algorithm Enhancement: Improved recognition of high-probability setups.

Training Mode: Ability to train the EA according to your preferred style—whether you prefer conservative trades or a more aggressive approach.

Performance Fixes: Stability issues from older versions have been resolved, leading to smoother execution.

This update focuses on giving traders more control while improving overall reliability.

Practical Use Cases

LTMS EA V11.3 MT4 can fit into different trading styles:

Scalpers: By choosing the aggressive profile, the EA reacts quickly to short-term opportunities.

Swing Traders: The balance mode is better suited for those holding trades for hours or days.

Risk-Averse Investors: Conservative settings help maintain stability with smaller trade sizes and tighter stops.

Prop Firm Traders: The system’s strict risk controls may help traders meet funding requirements.

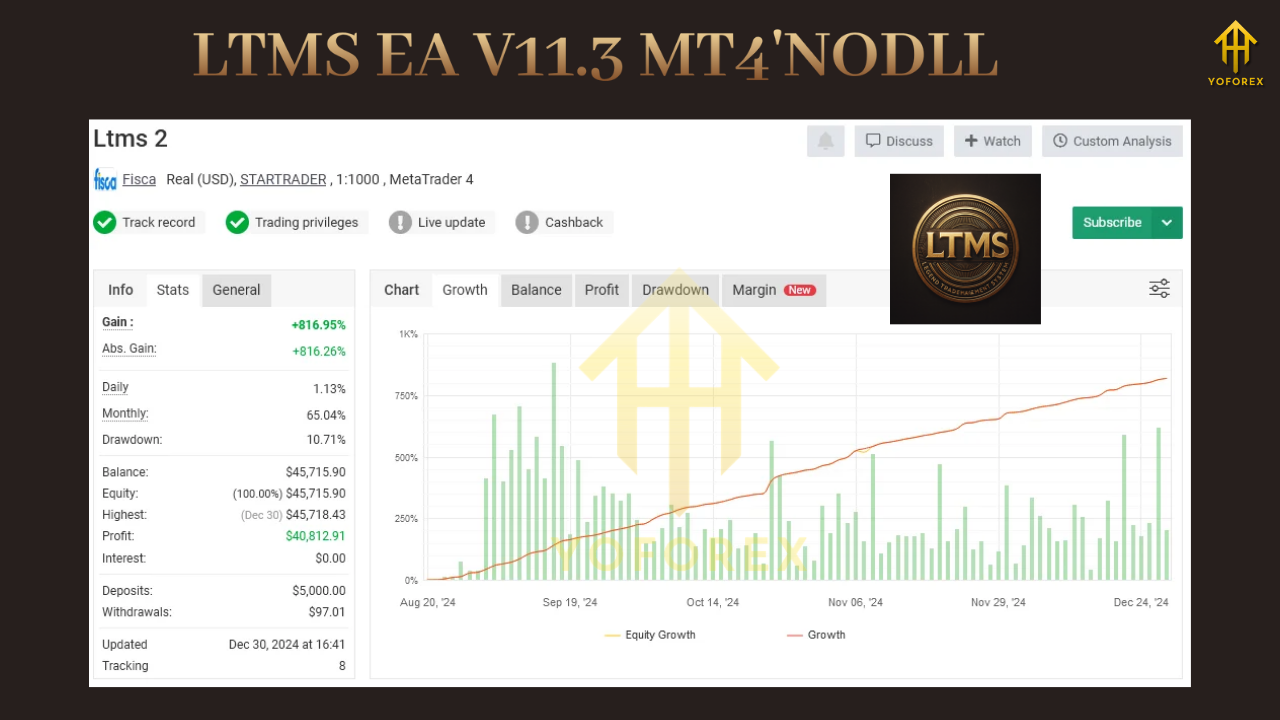

Performance Expectations

While promotional materials often highlight impressive results, realistic expectations are essential. Forward testing shows that LTMS EA can deliver consistent returns in trending markets, provided that risk settings are carefully managed. Performance may vary depending on broker execution, spreads, and account type.

Traders should run the EA on a demo account first, monitor its performance for several weeks, and only then move to a live environment with modest capital allocation.

Advantages and Limitations

Advantages

Comprehensive solution for both trade entries and management.

Flexible AI profiles for different risk appetites.

Multi-target profit booking for better control.

Easy setup with included presets.

Regular updates, with V11.3 being the most refined release.

Limitations

Results can vary across brokers and market conditions.

No public long-term verified record is available.

Requires stable internet or VPS hosting for continuous performance.

Aggressive settings may increase drawdown if not monitored.

Getting Started with LTMS EA V11.3 MT4

Install the EA – Place the file in the MT4 Experts folder and restart the platform.

Attach to a Chart – Select the currency pair and timeframe of choice.

Adjust Parameters – Choose your AI profile, set risk percentage, and enable auto-lot if required.

Run a Demo Test – Use at least a month of demo trading before going live.

Deploy on Live Account – Begin with a low lot size and increase gradually as confidence builds.

Best Practices for Success

Keep risk per trade between 0.5% and 1% for account protection.

Use a VPS server to ensure uninterrupted execution.

Regularly monitor open trades and adjust strategy profiles as needed.

Avoid overleveraging, especially when using aggressive settings.

Final Thoughts

The LTMS EA V11.3 MT4 represents a modern approach to forex automation. By combining advanced AI, customizable profiles, and strong risk controls, it offers traders a solution that adapts to different trading environments. While no system guarantees profits, LTMS EA provides the structure and discipline needed to approach trading with consistency.

For traders seeking an upgrade from traditional EAs, this version stands out as one of the most versatile releases available in 2025. Testing on a demo account and applying disciplined money management remain the keys to unlocking its full potential.

Comments

Leave a Comment