Long Grid Remaining Candle Time EA V1.16 MT5 — Smart Grid Trading on Gold

Platform: MetaTrader 5 (MT5)

Symbol: XAU/USD (Gold, 2-digit pricing only)

Timeframe: M5

Minimum Deposit: $100 (with 1:500 leverage)

Recommended Deposit: $1,000 (with 1:500 leverage)

Account Type: Hedging

Broker Recommendation: Pepperstone or any broker offering low spreads on gold

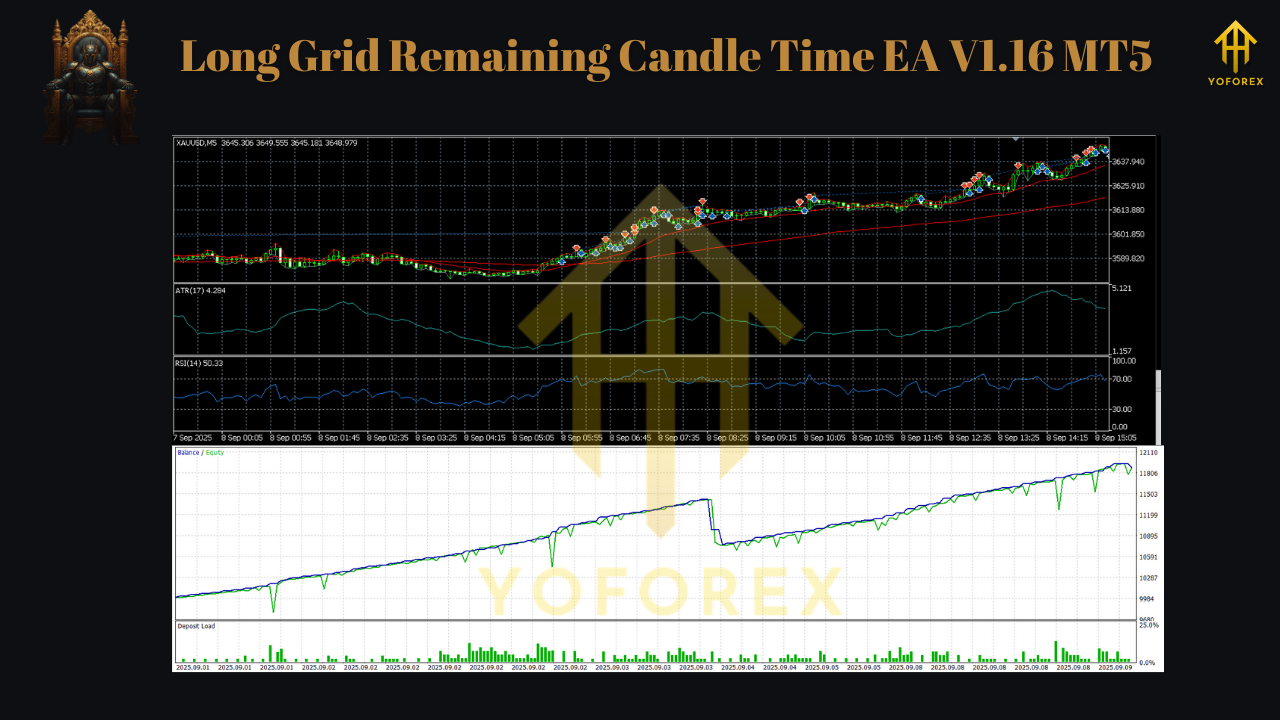

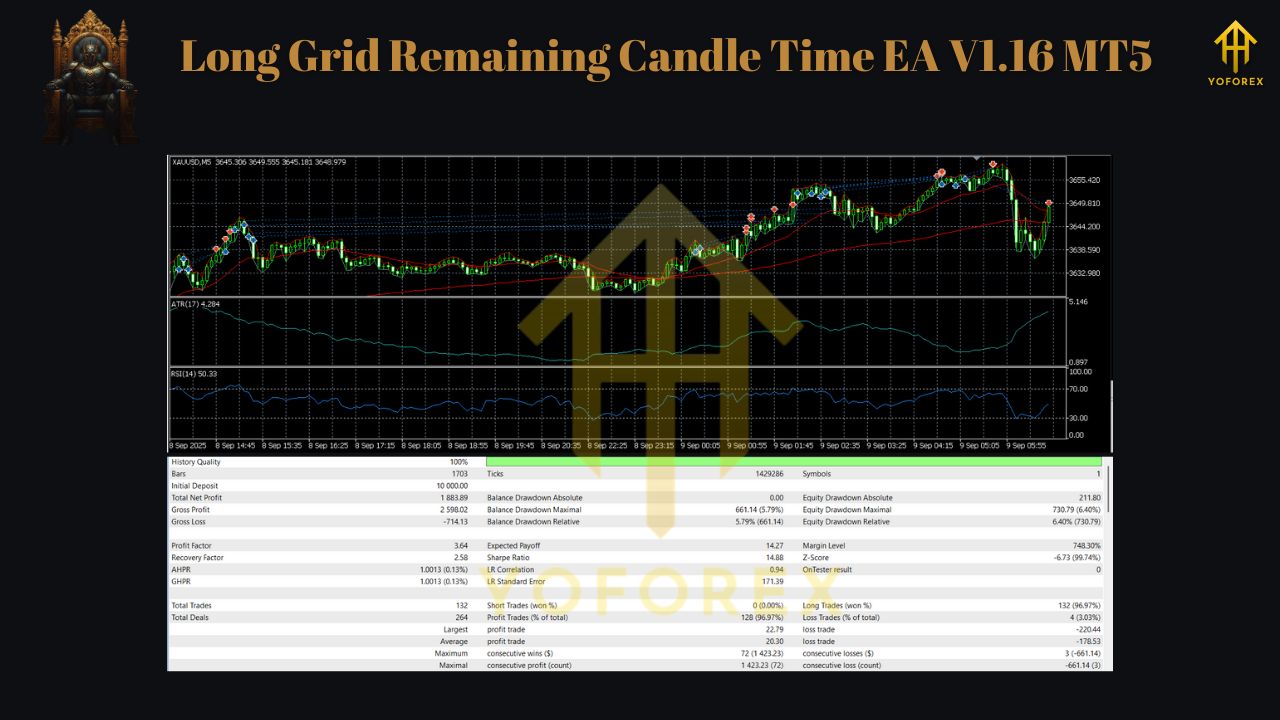

The Long Grid Remaining Candle Time EA V1.16 is a precision-built Expert Advisor that runs exclusively on XAU/USD (2-digit pricing). It combines compound interest technology with a grid trading framework, but avoids reckless overtrading by only executing positions under optimal conditions. Designed for stability and long-term growth, the EA focuses on quality entries rather than daily frequency.

Key Features

- Compound Interest Growth

Trades are designed to scale profitably by reinvesting gains, creating accelerated capital growth over time. - Built-In Protection

Includes maximum loss protection to safeguard accounts from catastrophic drawdowns. - M5 Timeframe Precision

Operates on the M5 chart of Gold for tighter execution, efficient entries, and better control. - Selective Trading Logic

Focuses on quality setups only — it doesn’t open trades every day, but waits for strong opportunities. - Plug & Play Simplicity

No complex optimization required. Just attach to XAU/USD 2-digit chart and let it run. - Optimized Stability

Refined codebase ensures low resource usage and long-term reliability on live and prop accounts.

Requirements & Recommendations

- Symbol: XAU/USD (must be 2-decimal pricing).

Not compatible with 3-decimal gold brokers.

- Broker: Pepperstone or any reputable low-spread ECN/STP broker for gold.

- Deposits & Leverage:

- Minimum: $100 (with 1:500 leverage).

- Recommended: $1,000 (for smoother performance & risk balance).

- Minimum leverage: 1:100 (optimal = 1:500).

- Account Type: Hedging accounts only.

- VPS: Recommended for 24/5 uptime and low latency execution.

Why It Works

Unlike aggressive grid bots that spam orders, Long Grid Remaining Candle Time EA V1.16 uses a timed-candle approach to align grid placements with higher-probability price behavior. By prioritizing fewer but higher-quality trades, it reduces exposure and increases consistency. Combined with compound growth mechanics, it’s designed for traders who want steady equity growth without constant monitoring.

Example Workflow

- Attach EA to XAU/USD (M5 chart, 2-digit).

- EA monitors market conditions → opens grid positions only when aligned with rules.

- Trades are sized with compound interest logic.

- Built-in loss protection ensures account safety.

- Positions are managed automatically with controlled exits.

Pros & Cons

Pros

- Built specifically for Gold (XAU/USD).

- Compound interest system for growth.

- Strong built-in protections.

- Easy setup → minimal configuration required.

- Low spread broker compatibility ensures tighter performance.

Cons

- Works only on 2-decimal XAU/USD (not 3-decimal).

- Grid trading always carries inherent drawdown risk.

- Requires patience (does not trade every day).

FAQ

Q: Can I run this EA on other symbols?

A: No, it’s optimized only for XAU/USD 2-decimal brokers.

Q: Does it use martingale?

A: It uses grid mechanics with protective limits. No reckless exponential lot sizing.

Q: What’s the minimum balance?

A: $100 (1:500 leverage). For safer performance, $1,000+ is recommended.

Q: Is it prop firm friendly?

A: Yes, provided your broker supports 2-decimal XAU/USD pricing and you use moderate risk.

Q: Do I need a VPS?

A: Yes, strongly recommended for 24/5 uptime.

Final Thoughts

Long Grid Remaining Candle Time EA V1.16 MT5 is a gold-only, M5 timeframe EA for traders who prefer grid mechanics with compound growth, but without reckless overtrading. By blending candle-time entry logic, selective trading, and robust account protection, it aims for stable equity curves while staying small-account friendly (from $100) and prop firm compatible with correct risk.

Grid strategies involve higher drawdown risk. Always test in demo and use conservative settings for live trading.

Join our Telegram for the latest updates and support

Comments

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

@@OE5Mk

555????%2527%2522\'\"

555'"

555

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555mtUALNTp')) OR 949=(SELECT 949 FROM PG_SLEEP(15))--

555Qu9FZYdT') OR 346=(SELECT 346 FROM PG_SLEEP(15))--

555LaNCCU7M' OR 652=(SELECT 652 FROM PG_SLEEP(15))--

555-1)) OR 770=(SELECT 770 FROM PG_SLEEP(15))--

555-1) OR 269=(SELECT 269 FROM PG_SLEEP(15))--

555-1 OR 850=(SELECT 850 FROM PG_SLEEP(15))--

555F8N8zFIG'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

-1" OR 2+470-470-1=0+0+0+1 --

-1' OR 2+127-127-1=0+0+0+1 or 'pMWxitYT'='

-1' OR 2+342-342-1=0+0+0+1 --

-1 OR 2+574-574-1=0+0+0+1

-1 OR 2+583-583-1=0+0+0+1 --

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555'"

555????%2527%2522\'\"

@@SHgkt

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555uCRZujEn')) OR 531=(SELECT 531 FROM PG_SLEEP(15))--

555YWJUrxmw') OR 599=(SELECT 599 FROM PG_SLEEP(15))--

555Ir4FYtXJ' OR 923=(SELECT 923 FROM PG_SLEEP(15))--

555-1)) OR 144=(SELECT 144 FROM PG_SLEEP(15))--

555-1) OR 424=(SELECT 424 FROM PG_SLEEP(15))--

555-1 OR 724=(SELECT 724 FROM PG_SLEEP(15))--

555LLUAxLhm'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

555

-1 OR 2+419-419-1=0+0+0+1 --

-1 OR 2+948-948-1=0+0+0+1

-1' OR 2+307-307-1=0+0+0+1 --

-1' OR 2+512-512-1=0+0+0+1 or 'akd84EW1'='

-1" OR 2+855-855-1=0+0+0+1 --

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555'"

555????%2527%2522\'\"

@@VdKaD

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555iNbjY9C8')) OR 536=(SELECT 536 FROM PG_SLEEP(15))--

555OroRUqgS') OR 401=(SELECT 401 FROM PG_SLEEP(15))--

555mngj3iKk' OR 217=(SELECT 217 FROM PG_SLEEP(15))--

555-1)) OR 487=(SELECT 487 FROM PG_SLEEP(15))--

555-1) OR 937=(SELECT 937 FROM PG_SLEEP(15))--

555-1 OR 122=(SELECT 122 FROM PG_SLEEP(15))--

555ofXprOeJ'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

-1' OR 2+555-555-1=0+0+0+1 or 'UNfiSE8u'='

-1" OR 2+636-636-1=0+0+0+1 --

555

-1 OR 2+589-589-1=0+0+0+1 --

-1 OR 2+115-115-1=0+0+0+1

-1' OR 2+389-389-1=0+0+0+1 --

555

555

Leave a Comment