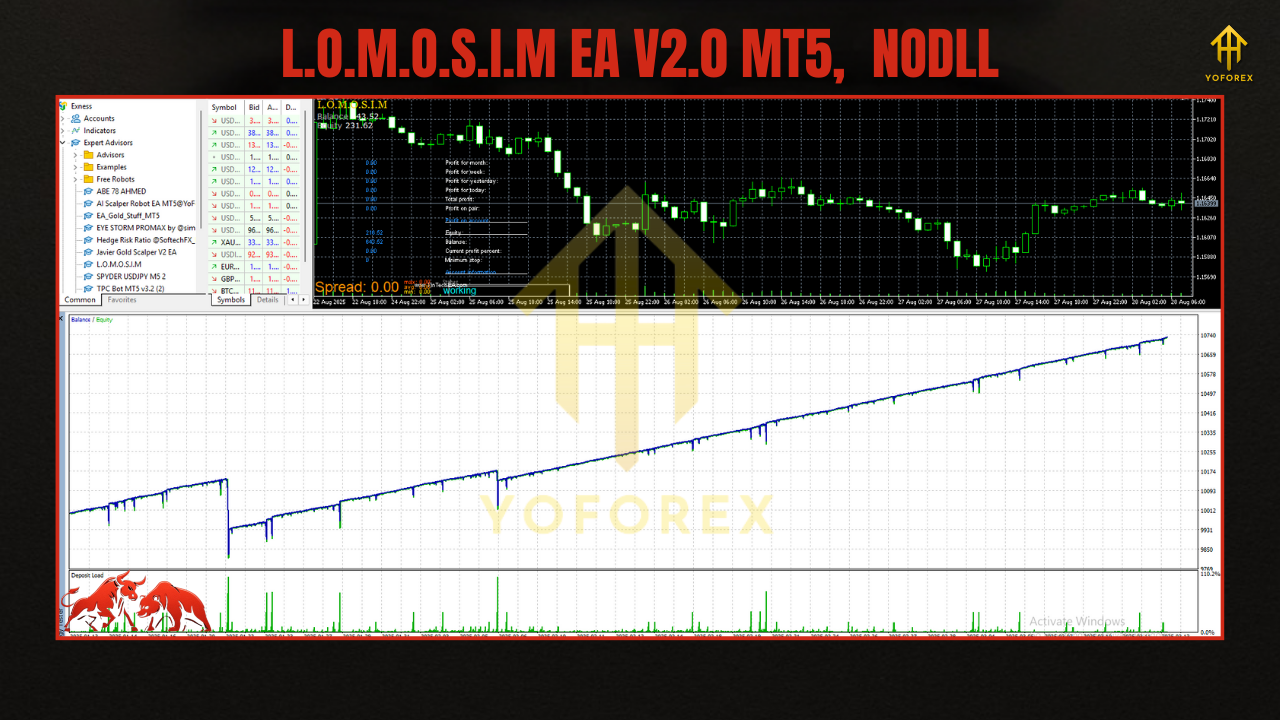

Some robots dump trades onto your chart and hope for the best. Others barely pull the trigger and miss clean moves. L.O.M.O.S.I.M EA V2.0 for MT5 aims for the sweet spot—Layered Order Management with Optimized Scaling & Intelligent Mitigation—so you participate when the structure is right, keep risk contained when it’s not, and grow steadily without resorting to martingale.

Below is your trader-first walkthrough: how the strategy thinks, what’s tuned for MetaTrader 5, recommended settings, install steps, and a no-nonsense risk playbook you can actually follow.

What Is L.O.M.O.S.I.M EA V2.0 (MT5)?

L.O.M.O.S.I.M is a confluence-driven MT5 Expert Advisor that waits for:

- Trend alignment,

- Sane volatility (ATR-aware), and

- Price-action confirmation (break–retest / decisive close / engulf).

Only after all three gates does it place an initial position. If the move proves itself, the EA can lightly layer additional entries into strength (never to rescue losers) under strict exposure caps. The goal is simple: capture trend continuation while keeping risk small and predictable.

- Best markets: EURUSD, GBPUSD, USDJPY; optional XAUUSD (Gold)

- Timeframes: M15–H1 for majors; M30–H1 for Gold (balances cost vs. quality)

- Account: ECN/Raw spread preferred; VPS strongly recommended

Why the MT5 Version?

- Faster tester with tick-by-tick realism (multi-threaded, better modeling for variable spread & slippage)

- 64-bit stability and improved resource handling for multi-chart deployments

- Cleaner symbol specs for metals/indices; easier to tune lot steps & tick values

- Smoother event handling for news/session windows and log diagnostics

Key Features (V2.0)

- Confluence engine — Trend baseline + momentum + structure confirmation

- ATR-aware stops — SL sizes adjust with current volatility; no one-size-fits-all nonsense

- No martingale, no grid — Optional light scale-ins only on fresh confirmation

- Equity guard & daily stop — Auto-pause new entries when floating DD or daily loss hits your limit

- Spread/slippage caps — Skips entries in hostile execution conditions

- Session & news windows — Prefer liquid hours; optionally block around CPI/NFP/FOMC

- Partial TP & trailing — Lock some gains at +1R; trail the rest behind ATR/swing

- Readable logs — Clear “why” for entries, exits, vetoes (perfect for optimization)

How the Strategy Works (Under the Hood)

1) Direction First

A dual-MA baseline (e.g., medium + slow) with a light momentum read decides whether longs or shorts are even allowed. Counter-trend chops are filtered out.

2) Volatility Gate (ATR)

The EA estimates a practical stop (typically 1.5×–2.5× ATR). If implied SL is absurdly wide (or unrealistically tiny), the setup is skipped—you’re not forced into bad math.

3) Structure Confirmation

Entries require proof: break–retest, decisive close beyond a micro-level, or a clean engulf that actually clears indecision. No confirmation = no trade.

4) Layered Management (Non-Martingale)

If price pushes in your favor and prints a new confirmation, the EA may add a small layer—never to average down losers. All layers sit inside your Max Layers and exposure rules.

5) Lifecycle Control

- Partial TP around +1R (configurable)

- Trailing behind ATR or last swing

- Equity guard / daily stop to pause new entries if conditions deteriorate

Recommended Settings (Starter Template)

Environment

- Broker: ECN/Raw-spread, consistent liquidity

- VPS: Yes (24/5 stability & low latency)

- Leverage: 1:200–1:500 (leverage isn’t an edge—risk sizing is)

Symbols & Timeframes

- EURUSD / GBPUSD / USDJPY: M15–H1

- XAUUSD (optional): M30–H1 (metals spreads & slippage can be chunky)

Risk Controls

- Risk per trade: 0.5%–1.0% (beginners: 0.5%)

- Max layers per symbol: 2–3 (keep it modest)

- Max concurrent positions (all charts): 3–5

- Daily loss stop: 2%–3% (auto-pause until next session)

- Equity guard (floating DD): 5%–8% (pause new entries until recovery rule)

Execution Filters

- Max spread: tune per symbol (e.g., EURUSD ≤ 15–20 points; XAUUSD ≤ 35–60 points, broker-dependent)

- Max slippage: 1–3 points (align to your tick size)

- Sessions: Favor London/NY overlap; avoid rollover

- News block (optional): 10–15 min before/after high-impact releases

Stops & Targets

- SL: 1.5×–2.5× ATR or just beyond last clean swing

- TP: 1.5R–2.0R baseline; partial at +1R then trail the remainder

Installation & Setup (MT5)

- Copy the EA: Place

LOMOSIM_EA_v2_0.ex5intoMQL5/Experts/(File → Open Data Folder). - Restart MT5 and confirm under Navigator → Experts.

- Enable Algo Trading (toolbar).

- Attach the EA to the target chart (one symbol per chart).

- Inputs: Load your preset or apply the starter template above.

- Permissions: Allow DLL imports only if you’re using a calendar/news module.

- Forward-test on demo for 1–2 weeks to validate real spreads, slippage, fills.

Backtesting & Optimization (MT5 Edge)

- Use Every tick based on real ticks if available for realistic modeling.

- Test variable spread; fixed spreads make results look prettier than reality.

- Include event windows (CPI/NFP/Fed) in your review; even if you don’t block them, understand the slip risk.

- Optimize lightly: trend baseline period, ATR multiplier, and structure sensitivity. Then forward-test—coz perfect params usually break out-of-sample.

Risk Management Playbook (Print This)

- Small, constant risk (0.5%–1.0%) beats yolo sizing—always.

- Respect circuit breakers (daily stop, equity guard). They save the month.

- Watch costs: if spreads/slippage creep, reduce risk or pause.

- Avoid curve-fit fever: what wins last month often fails next quarter.

- Withdraw periodically (if live) to keep effective risk aligned as equity grows.

FAQs

Does L.O.M.O.S.I.M use martingale or a recovery grid?

No. It can lightly add to winners on fresh confirmation within your exposure cap. It never averages down losers.

Will it trade every day?

Not guaranteed. Skipping subpar conditions is part of the edge.

Minimum deposit?

Run any size on demo. For live, many start around $500–$1,000 with 0.5% risk and a VPS, then scale slowly.

Best timeframe?

H1 is calmer and cost-tolerant. M15 is more active but more sensitive to spreads/slippage. For Gold, M30/H1 typically balances quality vs. cost.

Disclaimer

Trading Forex/CFDs involves risk. Past performance isn’t indicative of future results. Always forward-test on demo, keep risk conservative, and never trade money you can’t afford to lose.

Call to Action

Want layered entries that reward confirmation instead of hope? Install L.O.M.O.S.I.M EA V2.0 on MT5, run the starter template on demo, and watch it across sessions. When fills and behavior look steady, go live gradually—tight risk, clear rules, and let the confluence logic do the heavy lifting.

Comments

Leave a Comment