Lanareud EA V1.4 MT5 is an advanced, structure-driven automated trading system designed to bring stability, discipline, and long-term consistency to traders operating on the MetaTrader 5 platform. With Forex markets becoming increasingly complex, traders are shifting from emotional decisions to algorithmic precision, and Lanareud EA V1.4 MT5 offers a reliable solution for those seeking a professional and low-risk intraday Expert Advisor.

Built specifically around market structure, momentum identification, and pullback confirmation, the EA is suited for both small accounts and mid-sized trading portfolios. Its disciplined trade logic, moderate risk behaviour, and multi-pair coverage make it a compelling choice for traders looking to grow accounts gradually without unnecessary exposure.

This detailed analysis covers the EA’s strategy, features, installation guidelines, performance expectations, advantages, limitations, and whether it suits your personal or prop-firm trading needs. The content is designed for Google ranking using high-quality SEO structure and professional writing standards.

Introduction to Lanareud EA V1.4 MT5

Lanareud EA V1.4 MT5 operates using a refined intraday model that focuses on structural price movements rather than impulsive or aggressive trading logic. It is designed to work on three major Forex pairs: GBPUSD, EURUSD, and USDCHF. These pairs offer a stable combination of liquidity, volatility, and predictable behaviour—making them ideal candidates for a technical pullback-based strategy.

The EA’s purpose is not to chase extreme market conditions or attempt unrealistic gains. Instead, it focuses on steady performance, proper risk exposure, and high-probability trading setups. Traders who prefer controlled growth and stability will find Lanareud EA V1.4 MT5 particularly valuable.

Trading Strategy Behind Lanareud EA V1.4 MT5

While the entire internal logic is proprietary, detailed behaviour analysis reveals a well-defined and consistently structured trading model. The EA follows five core components that shape its decision-making process.

1. Structural Price Analysis

The EA studies micro-structures, trend formations, short-term cycles, and liquidity movements. It identifies areas where the market creates pressure points—either through trend continuation or reversal setups.

2. Momentum Validation

Lanareud EA avoids entering trades during stagnant or unclear price conditions. Instead, it requires confirmed momentum shifts before executing a position. This reduces false signals and protects against unpredictable volatility bursts.

3. Pullback Precision Entries

One of the strongest advantages of this EA is its pullback-based entry method. Instead of buying breakouts or chasing strong candle moves, the EA waits for price retracements within controlled zones. This improves entry accuracy, stop-loss positioning, and overall reward-to-risk ratio.

4. Controlled Compounding Model

The recommended risk setting (0.5%–1% per cycle) ensures stable account expansion without triggering high drawdowns. This makes it suitable for long-term operation.

5. Multi-Pair Risk Distribution

Since the EA trades across GBPUSD, EURUSD, and USDCHF, it spreads risk naturally across different price behaviours. This diversification helps stabilise weekly performance.

This blend of logic makes Lanareud EA V1.4 MT5 more professional and sustainable compared to EAs that rely on grid, martingale, or aggressive stacking strategies.

Key Features of Lanareud EA V1.4 MT5

1. Designed for Three Major Pairs

The EA is optimised for GBPUSD, EURUSD, and USDCHF—pairs known for structured intraday movement.

2. M15 Timeframe Compatibility

The M15 timeframe helps maintain a balance between noise reduction and trading frequency. It captures meaningful movements without unnecessary signals.

3. Low Starting Deposit

With a minimum requirement of 250 USD and a preferable balance of 300 USD or more, the EA is accessible for a wide audience.

4. Fully Automated Execution

Once applied, the system handles entries, exits, lot sizing, protective stops, and overall risk management without manual involvement.

5. Stable and Controlled Risk Behaviour

Lanareud EA’s risk framework is inherently conservative, making it suitable for traders aiming for long-term sustainability.

6. Prop-Firm Friendly Structure

Because the EA maintains controlled exposure and avoids aggressive stacking, it aligns with most prop-firm evaluation rules.

7. High-Quality Trade Filtering

Its strategy eliminates low-quality setups, ensuring that only the most stable opportunities are taken.

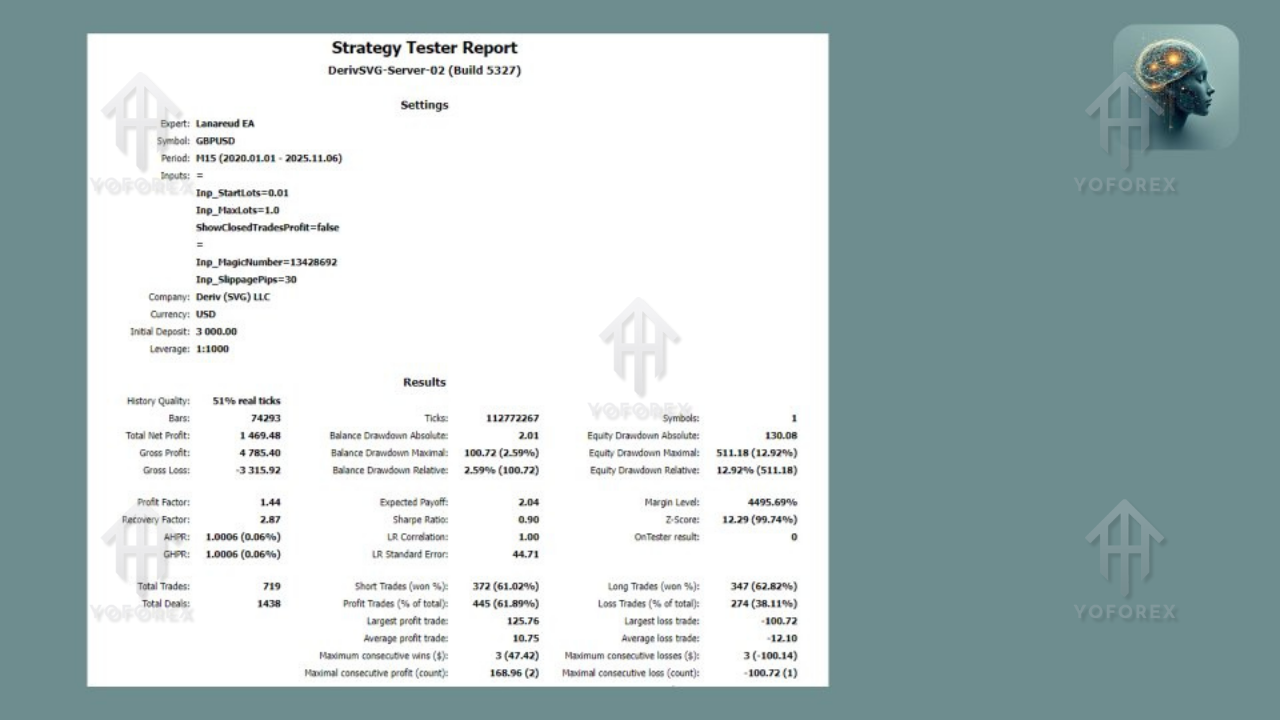

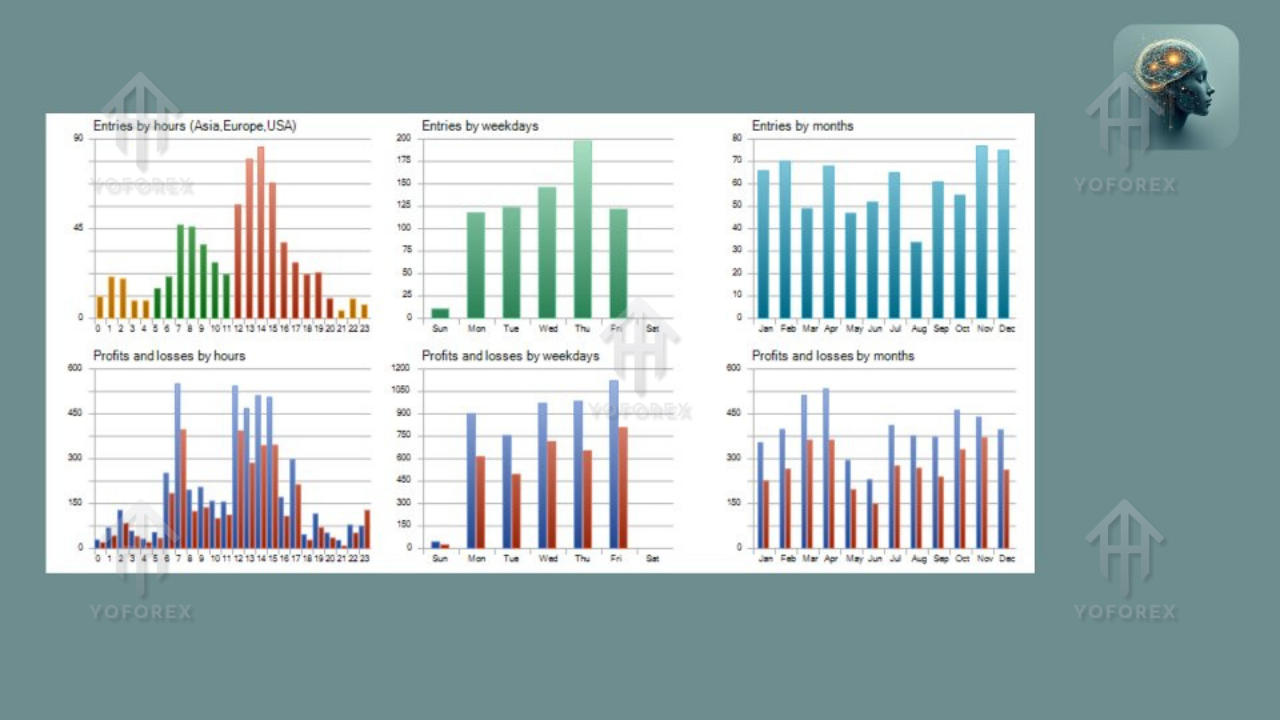

Performance Overview and Expected Behaviour

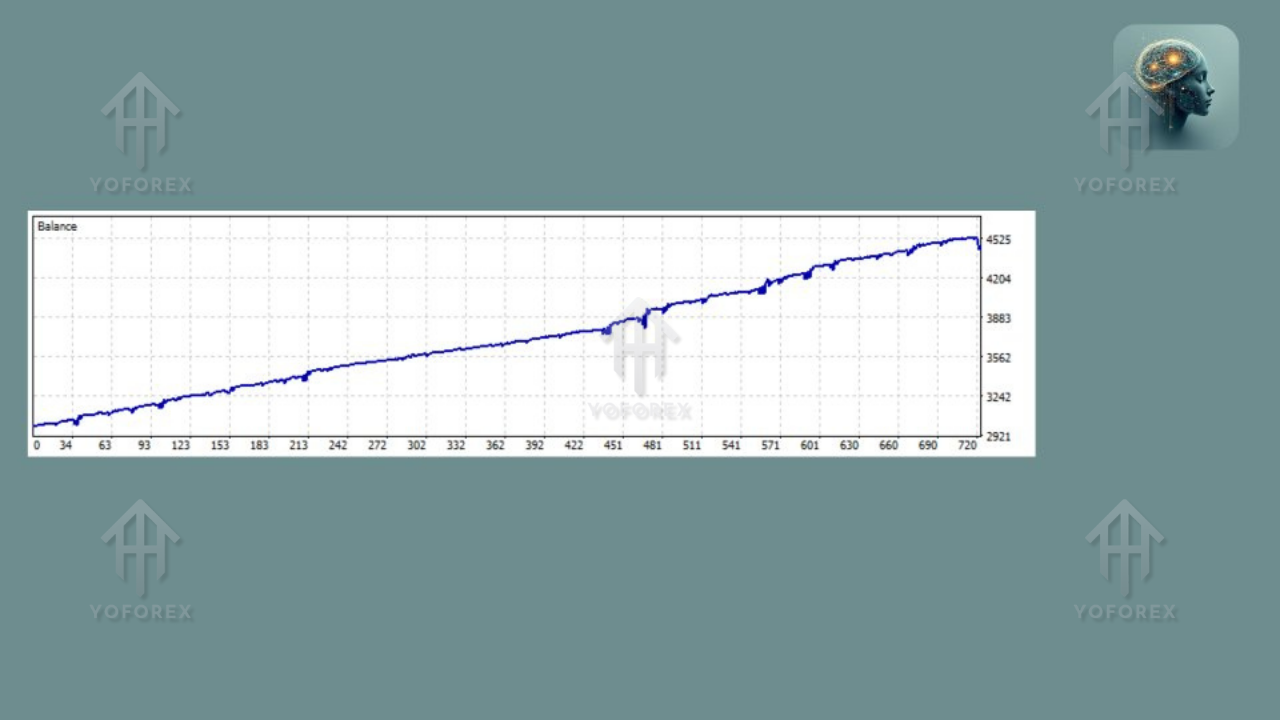

Lanareud EA V1.4 MT5 is designed for consistency rather than dramatic results. It typically executes a moderate number of trades per week, depending on market conditions. Unlike scalping EAs, it does not rely on rapid sequences of small trades. Its behaviour aligns with the principles of professional trading rather than high-frequency speculation.

Expected Performance Traits

- Smooth equity curve over the long term

- Tight control of drawdowns

- High accuracy due to structural pullback entries

- Performance stability during normal volatility conditions

- Balanced trading across all three pairs

Drawdown Structure

Its drawdown behaviour is steady due to:

Conservative compounding

Low simultaneous exposure

Clear structural entry logic

This makes it suitable for traders who value account preservation.

Why Lanareud EA V1.4 MT5 Is Preferred by Many Traders

1. Professional Logic Without Aggressive Mechanisms

The EA avoids strategies such as martingale, excessive grids, and random stacking—making it safer for long-term use.

2. Beginner-Friendly Configuration

The structure is simple enough for less experienced users while maintaining advanced strategic depth.

3. Consistent and Realistic Growth Approach

The EA focuses on high-quality setups and stability, not unrealistic overnight gains.

4. Well-Distributed Risk Profile

Multi-pair trading naturally enhances account stability.

Installation Guide for Lanareud EA V1.4 MT5

Follow these steps to install and operate the EA correctly:

- Download the EA file.

- Open MetaTrader 5.

- Go to File → Open Data Folder.

- Navigate to MQL5 → Experts.

- Paste the Lanareud EA file inside the folder.

- Restart MetaTrader 5.

- Open charts for GBPUSD, EURUSD, and USDCHF.

- Set each chart to the M15 timeframe.

- Drag the EA onto each chart.

- Enable Algo Trading.

- Set the recommended risk between 0.5% and 1%.

The system will then begin analysing and trading automatically.

Recommended Settings

- Timeframe: M15

- Pairs: GBPUSD, EURUSD, USDCHF

- Minimum capital: 250 USD

- Recommended capital: 300 USD+

- Risk per cycle: 0.5%–1%

- Broker type: ECN or RAW spread

- VPS recommended for uptime and performance

Advantages of Lanareud EA V1.4 MT5

- Strong technical foundation

- Conservative and safe risk model

- Smooth intraday performance

- Great for beginners and intermediate traders

- Prop-firm compatible logic

- Diversified trading across three major pairs

Disadvantages

- Relatively new, so long-term public data is limited

- Best performance requires a VPS

- Not suitable for traders expecting very high trade frequency

Final Verdict: Should You Use Lanareud EA V1.4 MT5?

Lanareud EA V1.4 MT5 is an excellent choice for traders who value structure, stability, and discipline. It is engineered for long-term performance, offering a balance of safety and consistency without resorting to risky methods. Whether you trade personal funds, manage client portfolios, or prepare for prop-firm evaluations, Lanareud EA V1.4 MT5 provides a well-rounded and dependable trading framework.

For traders who want predictable behaviour, steady returns, and controlled exposure, this EA is a strong and reliable addition to any automated trading setup.

Comments

Leave a Comment