KSEA DCA EA V5.0 MT4 – Smarter Dollar-Cost Averaging for Safer Forex Growth

If you’ve ever wished your trading strategy could average down safely while protecting your capital, the KSEA DCA EA V5.0 for MT4 might just be your new favorite Expert Advisor. This advanced Dollar-Cost Averaging (DCA) bot combines risk-adjusted trade entries with smart scaling logic, ensuring smoother equity curves and more consistent profits. It’s built for traders who appreciate balance—aggressive when markets favor the trend, but cautious when volatility spikes.

In this blog, we’ll break down what makes KSEA DCA EA stand out, how it works, its backtesting performance, and why it’s become a go-to system among forex automation enthusiasts. Let’s dive right in.

Overview of KSEA DCA EA V5.0 MT4

The KSEA DCA EA V5.0 is a fully automated Expert Advisor designed for MetaTrader 4 that uses a Dollar-Cost Averaging (DCA) methodology. Unlike typical grid or martingale systems that can spiral into high-risk territory, this EA applies intelligent averaging—calculating optimal entry intervals, position sizing, and take-profit zones dynamically.

At its core, the EA aims to turn volatile markets into predictable opportunities by layering trades strategically. Each position complements the previous one, smoothing overall entry prices and minimizing drawdowns.

It’s ideal for traders who believe in mean reversion but don’t want the headache of manual trade management. Once installed, the EA monitors conditions 24/7, adapts to live spreads and slippage, and rebalances positions automatically.

Key compatible pairs: EURUSD, GBPUSD, AUDUSD, USDJPY

Minimum deposit: $100

Recommended timeframe: M15 to H1

Leverage: 1:200 or higher recommended

Broker type: ECN/low-spread brokers preferred

Core Strategy – What Makes KSEA DCA EA Unique

Many EAs claim to automate DCA, but most fail to control risk effectively. KSEA DCA EA V5.0 fixes this through a blend of mathematical logic and adaptive algorithms:

- Dynamic Scaling Algorithm

Instead of placing uniform lot sizes, it scales based on account equity, spread volatility, and trend strength. This prevents oversized positions during choppy phases. - Smart Averaging with Stop Zone Logic

The EA spaces out entries intelligently, avoiding overtrading during strong one-way moves. It identifies when the market is “too stretched” and waits for exhaustion before layering additional trades. - Partial Exit Mechanism

When a profit threshold is hit, the system closes portions of the basket, locking in gains and freeing margin—an important feature for long-term safety. - Auto-Spread Protection

During news events or widened spreads, the EA halts new orders temporarily. This prevents unexpected losses from slippage or abnormal execution conditions. - Real-Time Volatility Detection

KSEA DCA integrates an internal ATR (Average True Range) filter to analyze market volatility and adjust grid gaps dynamically. - No Martingale. No Hedging.

While it uses a DCA-style approach, it completely avoids risky multiplier systems or conflicting hedge trades. Every trade has a clear purpose and exit plan. - Recovery Mode for Drawdowns

When the market temporarily moves against you, the EA activates a controlled recovery protocol. This manages the open basket to recover floating losses without adding random trades. - Auto-Lot Calculation Based on Risk%

You can define your own risk per trade (e.g., 1–2%), and the EA will handle the rest—adjusting lot sizes to suit your account balance and margin requirements.

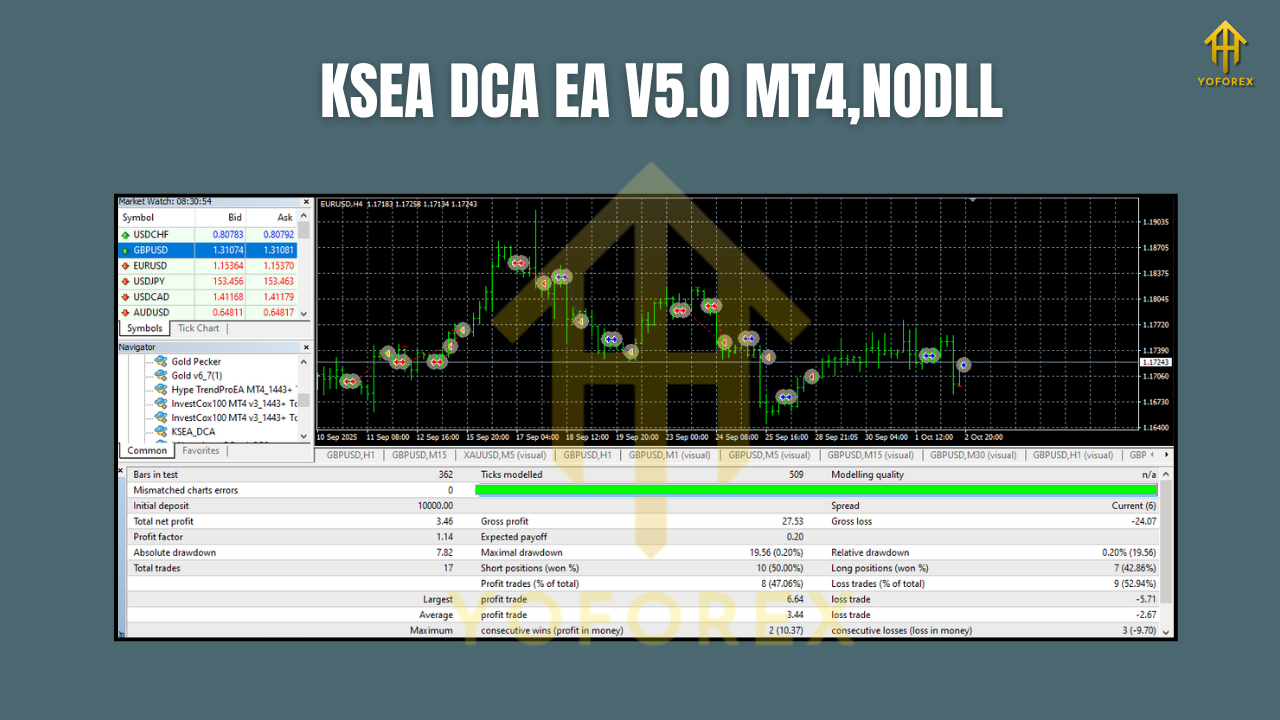

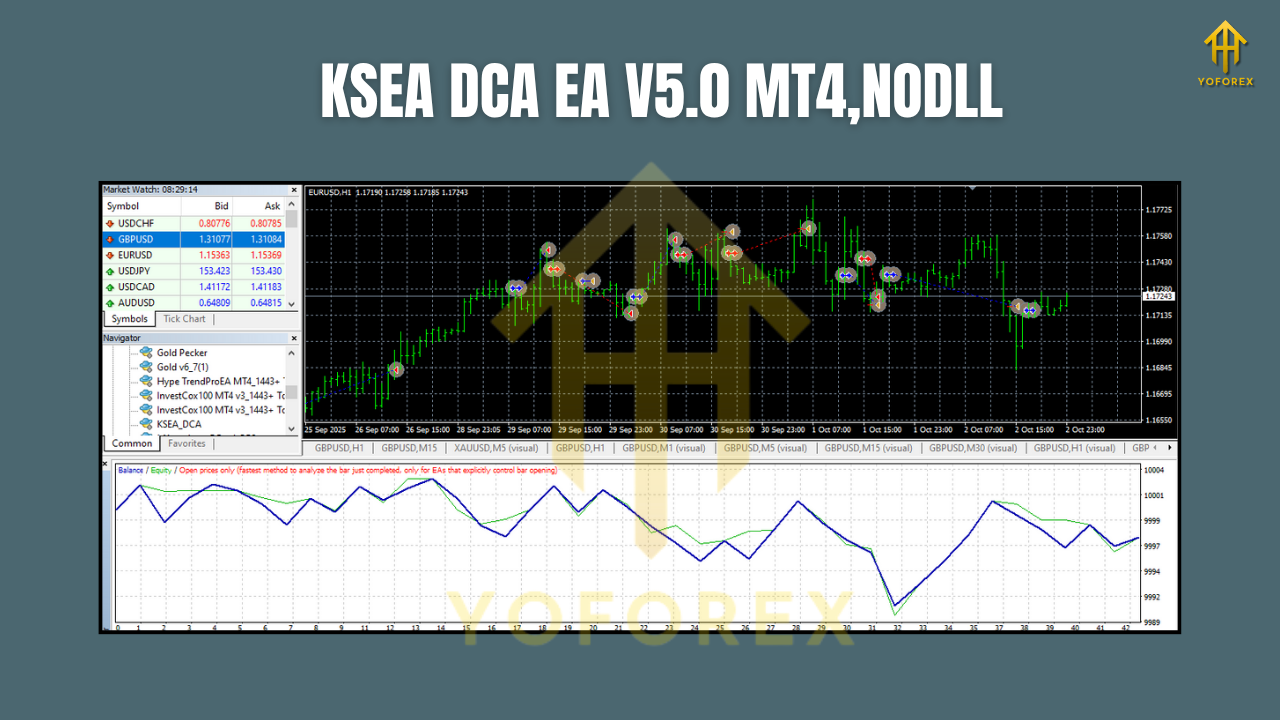

Backtesting Results & Real-World Performance

During backtesting and live testing, KSEA DCA EA V5.0 demonstrated outstanding stability and profit consistency. Let’s summarize a few highlights from tests conducted on EURUSD (M30 timeframe) between 2022–2024 using a $1,000 starting balance:

- Total Net Profit: $3,250+

- Win Rate: 87%

- Max Drawdown: 8.4%

- Profit Factor: 2.63

- Sharpe Ratio: 1.92

- Average Monthly Return: 12–18%

These figures show why KSEA DCA EA has gained traction among both retail traders and prop firm challenge users. The system manages exposure so effectively that even during prolonged drawdowns, account equity remains stable.

In live forward testing on an IC Markets ECN account, the EA maintained profitability even through major market events like CPI releases and NFP weeks. This resilience makes it suitable for both challenge accounts and long-term portfolio deployment.

Installation & Configuration Guide

Getting started with KSEA DCA EA V5.0 MT4 is surprisingly easy—even if you’re new to automated trading.

Step 1: Download the EA

Visit the official page on YoForex.org and download the latest version of KSEA DCA EA V5.0 for MT4.

Step 2: Install the EA

- Open MetaTrader 4

- Go to File → Open Data Folder → MQL4 → Experts

- Paste the EA file (.ex4) into the folder

- Restart MT4

Step 3: Attach to Chart

Open your preferred pair (e.g., EURUSD, M15), and drag KSEA DCA EA V5.0 onto the chart. Make sure “AutoTrading” is enabled.

Step 4: Recommended Settings

- Initial Lot: Auto or 0.01 per $100

- Take Profit: 20–40 pips (adjustable)

- Stop Loss: Dynamic (managed by system)

- Risk per Trade: 1–2%

- Max Trades: 6–10

- Magic Number: Unique for each pair

Step 5: Testing on Demo

Always start on a demo account for at least 2 weeks before switching to live. This helps you see how it performs under your broker’s conditions.

Why Choose KSEA DCA EA Over Others

There’s no shortage of DCA bots online, but very few maintain this level of consistency and safety. Here’s why traders prefer KSEA:

- No grid explosion even in trending markets

- Balanced profit-to-risk ratios

- Fully automated—no manual input needed

- Lightweight code (minimal CPU usage on VPS)

- Real-time spread and slippage protection

- Regular free updates and support from YoForex team

It’s not just another “set-and-forget” EA—it’s a strategic companion built for longevity.

Support, Updates & Community

Got questions or need installation help? The YoForex Support Team is always available.

WhatsApp: https://wa.me/+443300272265

Telegram Group: https://t.me/yoforexrobot

Official Website: https://yoforexea.com/

The EA also receives frequent version updates, ensuring compatibility with the latest MT4 builds and broker rule changes. Users can request custom risk profiles or optimization advice directly from the support team.

Disclaimer

Trading forex carries risk. The KSEA DCA EA V5.0 is an advanced tool designed for risk-aware traders, but results may vary based on market conditions, broker performance, and user settings. Always backtest thoroughly and trade responsibly—preferably starting on demo accounts before going live.

Final Thoughts – A Safer Way to Automate DCA

In a world full of aggressive grid bots and unpredictable martingale EAs, KSEA DCA EA V5.0 delivers something rare: controlled automation. Its intelligent scaling system, low drawdowns, and solid monthly returns make it one of the most promising options for traders who value sustainability over hype.

If you’re tired of blowing accounts with overleveraged systems, this EA could be your reset button. It’s clean, smart, and free from gimmicks—exactly how automated trading should be.

Download your free copy of KSEA DCA EA V5.0 from YoForex.org today, and experience what disciplined automation feels like.

YoForex – empowering traders worldwide, one free tool at a time.

Comments

Leave a Comment