Mastering the KDJ Indicator V1.0 on MT4: A Comprehensive Guide for Forex Traders

The forex market is a dynamic playground for traders, but success requires the right tools. Among the plethora of technical indicators, the KDJ Indicator V1.0 for MT4 stands out as a versatile tool for identifying overbought/oversold conditions, trend reversals, and entry/exit points. Whether you’re a scalper, swing trader, or long-term investor, this guide will help you leverage the KDJ Indicator to maximize profits while managing risks—even with a minimum deposit of $100.

What is the KDJ Indicator V1.0?

The KDJ Indicator, short for Kaufman’s Adaptive Moving Average – Dynamic Jurik, is a hybrid oscillator combining elements of the Stochastic Oscillator and Moving Average Convergence Divergence (MACD). Its V1.0 version optimizes parameters for modern forex markets, offering enhanced sensitivity and accuracy.

Key Features:

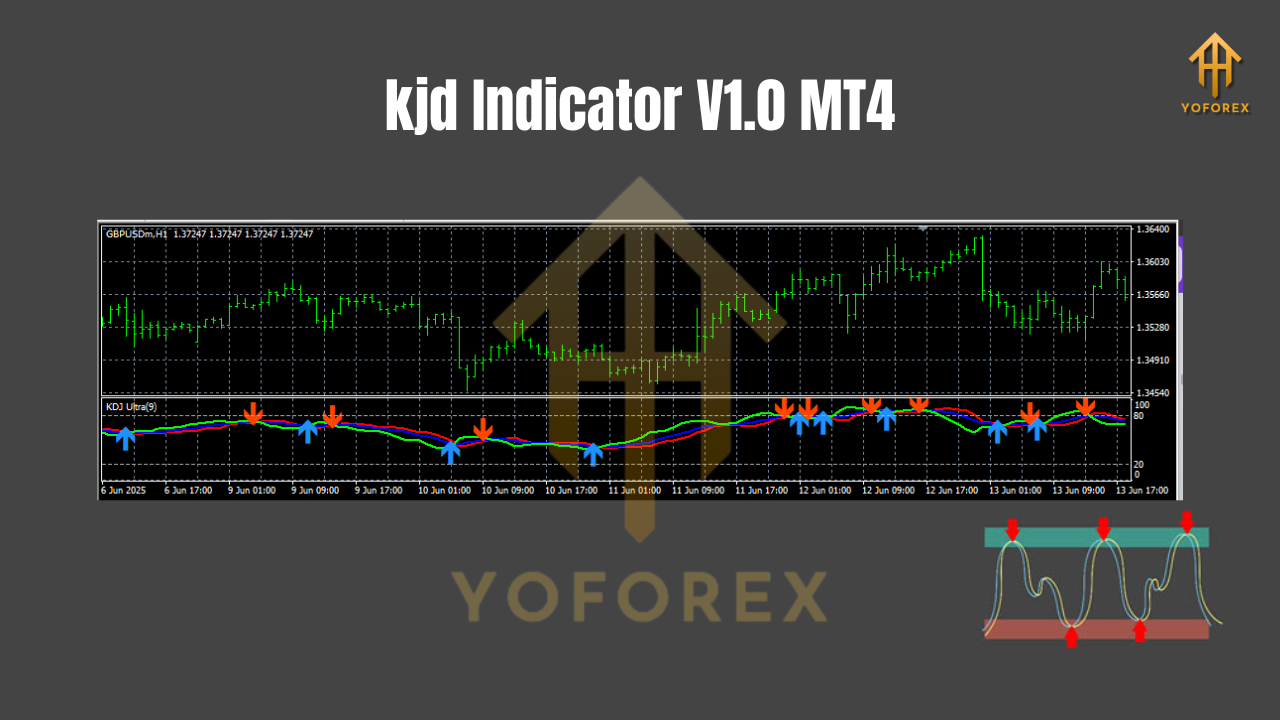

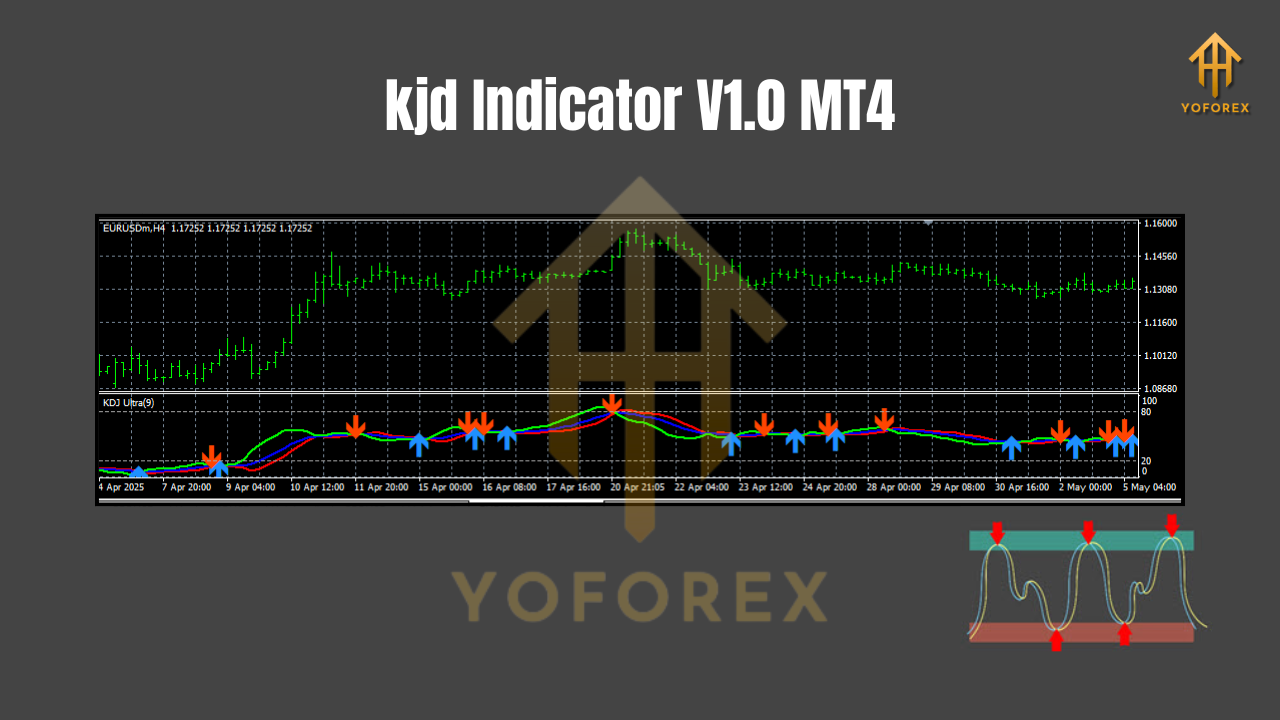

- Three Lines: %K (fast line), %D (signal line), and %J (momentum line).

- Overbought/Oversold Levels: Default thresholds are 80 (overbought) and 20 (oversold).

- Customizable Parameters: Adjust periods, smoothing, and deviation to suit your strategy.

Why Use the KDJ Indicator V1.0 on MT4?

MT4 is the world’s most popular forex trading platform, and integrating the KDJ Indicator V1.0 into your workflow offers:

- Real-Time Analysis: Monitor currency pairs like EUR/USD, GBP/JPY, or AUD/USD across timeframes (M15 to H4).

- Multi-Timeframe Compatibility: Align short-term trades with broader market trends.

- Low-Cost Entry: Start with a $100 minimum deposit to test strategies risk-free.

How the KDJ Indicator Works: A Step-by-Step Breakdown

1. Calculating the KDJ Lines

- %K: Compares the closing price to its range over a specified period (e.g., 14 days).

Formula: - %D: A 3-period moving average of %K (the signal line).

- %J: A momentum line calculated as .

2. Interpreting Signals

- Bullish Crossover: %K crosses above %D below 20 (oversold zone).

- Bearish Crossover: %K crosses below %D above 80 (overbought zone).

- Divergence: Price makes a new high, but %K fails to follow (bearish signal), or vice versa.

Setting Up the KDJ Indicator V1.0 on MT4

- Download & Install:

- Get the KDJ Indicator V1.0 from trusted sources (e.g., MetaQuotes Market).

- Drag and drop the

.ex4file into MT4’sMQL4/Indicatorsfolder.

2. Customize Parameters:

- Period: Adjust the lookback period (default: 14).

- Slowing: Smoothens %K (default: 3).

- Deviation: Filters false signals (default: 0.02).

3. Apply to Chart:

- Right-click the chart > Indicators > KDJ V1.0.

Best Currency Pairs & Timeframes for KDJ V1.0

While the KDJ works on any pair, these are optimal choices:

- Major Pairs: EUR/USD, GBP/USD, USD/JPY (high liquidity, tight spreads).

- Commodity Pairs: AUD/USD, NZD/USD (volatility during commodity news).

- Timeframes:

- Scalpers: M15-M30 for quick trades.

- Swing Traders: H1-H4 for capturing trends.

5 Profitable KDJ Strategies for MT4 Traders

Strategy 1: Classic Overbought/Oversold Setup

- Entry: Buy when %K crosses above %D below 20. Sell when %K crosses below %D above 80.

- Stop Loss: Set 20 pips below/above the recent swing.

- Take Profit: 1:2 risk-reward ratio.

Strategy 2: Divergence Trading

- Bullish Divergence: Price hits a new low, but %K forms a higher low.

- Bearish Divergence: Price hits a new high, but %K forms a lower high.

Strategy 3: KDJ Crossover with Trend Lines

- Combine KDJ crossovers with trendline breaks for confirmation.

Strategy 4: Scalping with KDJ and Volume

- Use on M15 charts with volume spikes to filter high-probability trades.

Strategy 5: KDJ + Moving Average Filter

- Trade only when price is above a 50-period SMA (bullish trend) or below (bearish trend).

Case Study: Turning $100 into $500 with KDJ V1.0

Scenario: A trader with a $100 deposit uses the KDJ Indicator on EUR/USD H1.

- Strategy: Classic oversold buy signals with 1:2 risk-reward.

- Results:

- 10 winning trades (50 pips each) = +500 pips.

- 5 losing trades (30 pips each) = -150 pips.

- Net Profit: 350 pips ≈ $350 (assuming 1:10 leverage).

Key Takeaway: Discipline and risk management (1-2% per trade) are critical.

Common Mistakes to Avoid

- Ignoring Market Context: The KDJ works best in ranging markets. Avoid using it in strong trending conditions.

- Overtrading: Stick to your strategy—don’t chase every signal.

- Neglecting Risk Management: Never risk more than 2% of your $100 deposit per trade.

Advanced Tips for KDJ V1.0 Users

- Combine with RSI: Use RSI to confirm overbought/oversold levels.

- Backtest: Use MT4’s Strategy Tester to optimize parameters.

- Monitor Economic News: Avoid trading during high-impact events (e.g., Fed announcements).

Is the KDJ Indicator V1.0 Right for You?

The KDJ Indicator V1.0 is ideal for:

- Traders with a $100 minimum deposit looking to start small.

- Those who prefer simplicity and actionable signals.

- Scalpers and swing traders who value precision.

Not recommended for:

- New traders without a solid understanding of technical analysis.

- Traders seeking “get-rich-quick” schemes (no indicator guarantees profits).

Final Thoughts: Unlock Your Trading Potential

The KDJ Indicator V1.0 on MT4 is a powerful tool when used correctly. By combining its signals with risk management and market analysis, even traders with a $100 minimum deposit can build a profitable strategy. Start by paper-trading, refine your approach, and scale your account sustainably.

Join our Telegram for the latest updates and support

Comments

Leave a Comment