Iconic Breakout Pro EA V15.5 MT5 – Precision NAS100 Breakout Strategy

Introduction

In the world of automated trading, most systems excel under ideal conditions but falter when the market behaves unpredictably. A sudden liquidity jump, wide spreads, or a major news event can cause many EAs to fail. That’s why the Iconic Breakout Pro EA V15.5 MT5 was created—not just as an “idea EA,” but as an operating system built for repeatable market conditions, with a focus on the NAS100 during the US session.

This EA is designed to manage risks intelligently while capturing breakout opportunities, especially in the NAS100 index. Its built-in momentum detection and prior day high/low strategy ensure precision, while its Daily Loss Guard feature keeps your capital safe even during unpredictable market events.

Overview of Iconic Breakout Pro EA V15.5 MT5

The Iconic Breakout Pro EA V15.5 MT5 is designed specifically for NAS100 trading during the US market open, using the prior day’s high/low levels for breakout setups. It’s a rules-based trading engine that focuses on capital protection before taking risks, with features like padded stop orders, OCO (one cancels the other) order handling, and a daily loss cap to ensure no one day wipes out your account.

Key Features

- Platform: MT5

- Category: Expert Advisor (EA)

- Pair Focus: NAS100 (US100/USTEC)

- Timeframe: Optimized for M5

- Version: 15.5 – enhanced for safer execution and better risk management

- Risk Management: Daily Loss Guard, padded stop orders, and strict SL/TP settings

This EA is built with discipline in mind, ensuring that only the most calculated trades are executed. It doesn’t gamble on every move—it waits for the market to meet specific conditions.

Key Features of Iconic Breakout Pro EA V15.5 MT5

- NAS100 Session Focus – Optimized for the US market open, targeting breakout opportunities.

- Prior-Day High/Low Module – Detects breakouts above the previous day’s high or below the low.

- Precision Breakout Logic – Uses calculated stop orders with risk management.

- Daily Loss Guard – Stops trading for the day if a specified loss limit is reached.

- OCO Order Handling – One order fills, the other is canceled to prevent risk stacking.

- Non-Martingale Strategy – No grid or averaging-down; only calculated risk.

- Smart Execution – Spread filters, margin checks, and StopsLevel/Freeze awareness.

- Minimalistic GUI – Clean dashboard for traders to view session parameters and performance.

- No Speculation – Focuses only on measurable and repeatable market dynamics.

- Highly Secure Risk Management – Stop-loss, take-profit, break-even, and trailing stops are all built-in.

How It Works

The Iconic Breakout Pro EA operates under strict rules and discipline:

- Measure: The EA scans for the prior day’s high/low levels and identifies potential breakout zones.

- Deploy: When market conditions meet the set rules, the EA places a padded stop order just outside the range.

- OCO Handling: The EA places one trade, and the opposite side is canceled (One Cancels the Other, or OCO).

- Risk Control: Stops, targets, and trailing stops are applied to every trade, with break-even levels once certain profits are locked.

- Daily Loss Guard: If the daily loss threshold is reached, no more trades are placed, protecting the account.

This structure ensures disciplined execution without “gambling” on market moves. It works within a defined window of time, which limits exposure to unpredictable market behavior.

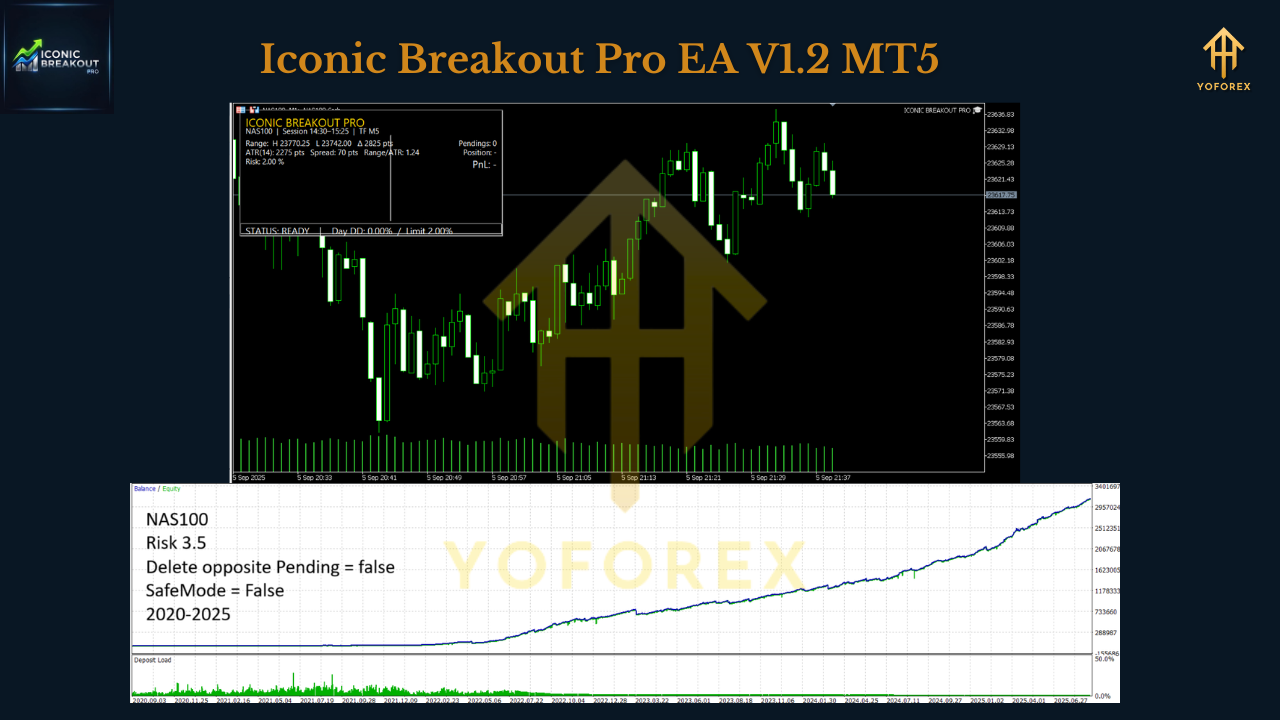

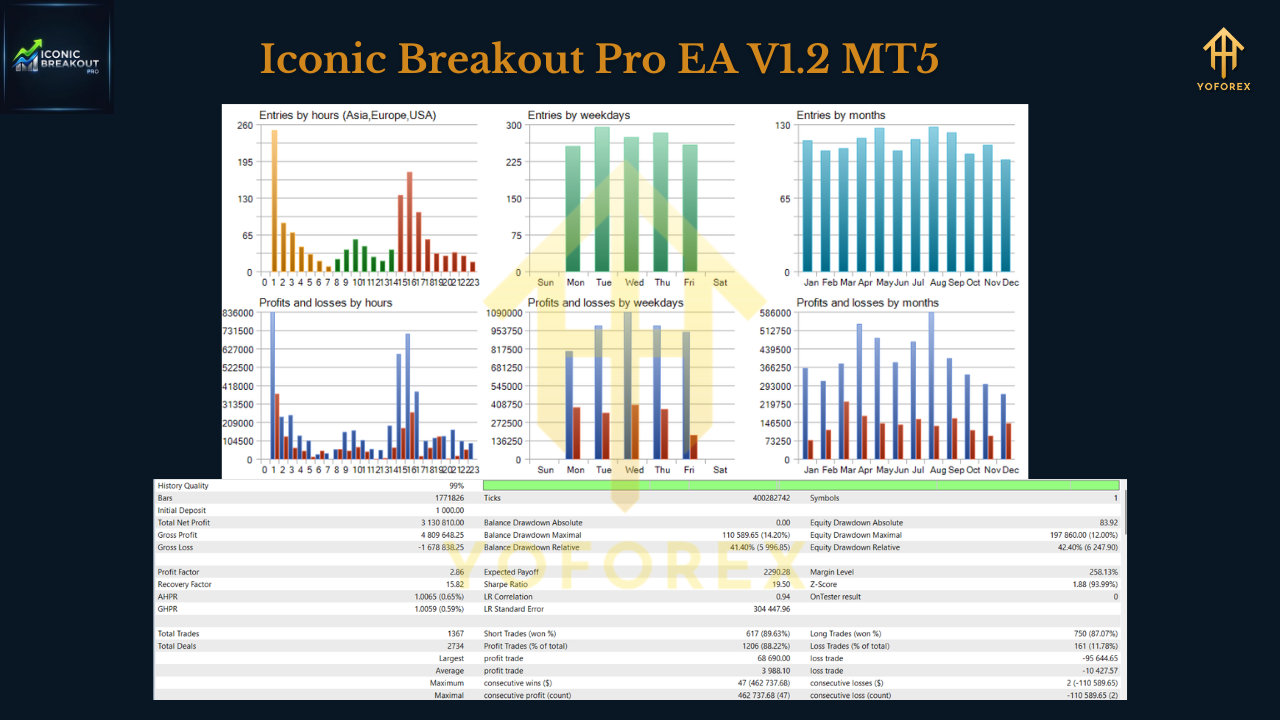

Backtest & Performance Insights

Backtests conducted from 2020–2025 on NAS100 (with 99% tick quality) revealed:

- Profit Factor: Approximately 2.28

- Trades Executed: Around 1,837 trades

- Win Rate: Approximately 75%

- Expectancy per Trade: $2,291

- Maximum Intraday Drawdown: 16–17%

- Maximum Losing Streak: 5 trades

- MFE/MAE: Positive sloping regression (winners run, losses contained)

These results show that the Iconic Breakout Pro EA generates consistent profits over weeks and months, not just quick wins. The edge comes from time, structure, and discipline, not speculative strategies.

Installation & Setup Guide

To install and start using the Iconic Breakout Pro EA V15.5:

- Download the EA file.

- Open MetaTrader 5.

- Click File → Open Data Folder.

- Navigate to MQL5 → Experts and paste the EA file.

- Restart MT5.

- Open the NAS100 chart on M5 timeframe.

- Attach the EA and adjust your session window settings for the US open.

- Set your risk parameters, daily loss cap, and OCO handling.

Why Traders Choose Iconic Breakout Pro EA

The Iconic Breakout Pro EA stands out because of its:

- Structured Approach: Focuses on repeatable, measurable setups, not speculation.

- Risk Management: Built-in Daily Loss Guard and OCO handling minimize exposure.

- No Martingale/Grid: Avoids the dangers of high-risk strategies.

- US Session Focus: Perfect for capturing NAS100 breakout opportunities during high liquidity.

- Professional Execution: Clean, operator-grade execution with minimal errors.

It’s ideal for traders who value discipline, structure, and safety in their trading.

Best Practices for Using Iconic Breakout Pro EA

To get the most out of this EA:

- Use a low-spread ECN broker for NAS100.

- Run it on a VPS (<20ms latency) for 24/5 performance.

- Start with demo testing to fine-tune your settings and verify behavior.

- Stick with 1–2% risk per trade for optimal long-term results.

- Use the daily loss guard to avoid unnecessary risk during bad days.

Support

The developers offer regular updates and direct support for best performance.

Call to Action

The Iconic Breakout Pro EA V15.5 MT5 is a highly disciplined breakout system for NAS100, designed to operate under strict risk management rules. If you’re looking for a structured, repeatable system to capture breakout opportunities in the US session, this EA is a great choice.

Download Iconic Breakout Pro EA today and start trading with confidence, backed by an intelligent risk-managed approach.

Join our Telegram for the latest updates and support

Comments

Leave a Comment