Hydra Signals Indicator – Complete Guide for Traders

If you’ve been struggling with messy charts, confusing signal systems, and endless guesswork around entries or exits… the Hydra Signals Indicator might feel like a breath of fresh air. This tool is designed for traders who want straightforward, visual, easy-to-follow buy and sell signals based on real market momentum. It works on MT4 and can be used across multiple timeframes, but most traders prefer M1, M5, and M15 because it’s built to identify short-term movements, reversals, and momentum continuation setups.

This indicator is often used by day traders and scalpers who want quick decisions without overcomplicating things. And yeah, while it’s simple on the surface, the logic behind it is meant to help you filter weak trades and highlight strong momentum plays — which honestly makes trading way less stressful. Let’s break down everything you need to know.

Introduction

The forex market moves fast, sometimes too fast for inexperienced traders to catch good opportunities. And even advanced traders, tho skilled, can get distracted or overwhelmed by too many indicators running at once. The Hydra Signals Indicator tries to fix that problem by combining directional arrows, momentum confirmation, and trendline cues into a single visual system.

You basically wait for a colored arrow, see if the momentum indicator matches, set your stop loss, and ride the move for either your target pips or the opposite signal. That’s it. No rocket science, no messy chart overload.

This guide will walk you through how it works, how to use it, risk tips, strategy ideas, and everything else you need to trade it properly.

How the Hydra Signals Indicator Works

The Hydra Signals Indicator uses a layered logic approach:

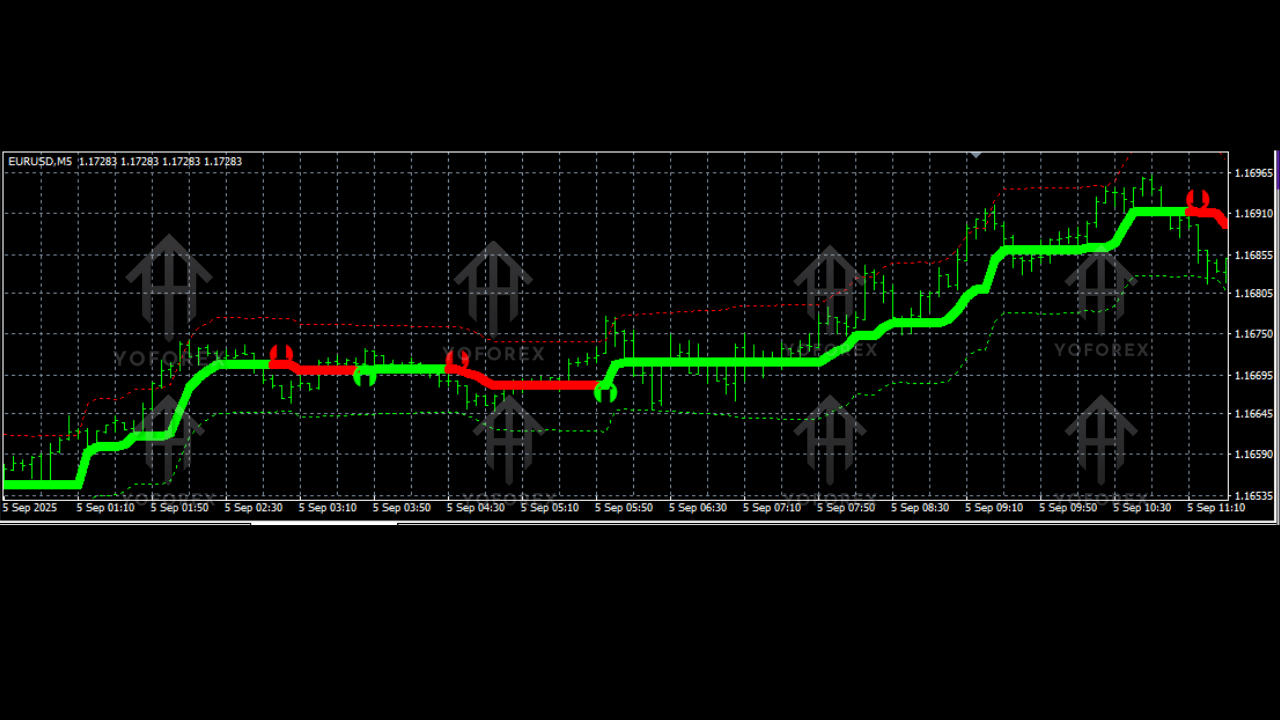

1. Green Arrow + Green Line = Buy Setup

When a green arrow appears and is connected to a green line, the indicator is signaling a potential buy zone.

But keep in mind: the buy is valid only if the green momentum bar below the chart confirms it. This prevents traders from entering into weak moves or fake reversals.

Once confirmed:

- Enter your buy position.

- Exit with your target pips or exit when a red arrow forms (opposite signal).

- You may use a trailing stop to secure profits during stronger uptrend runs.

- Stop loss should ideally be placed near the previous lower low or the nearest support level.

This confirmation rule is important coz it filters out low-probability setups and keeps the focus on stronger momentum shifts.

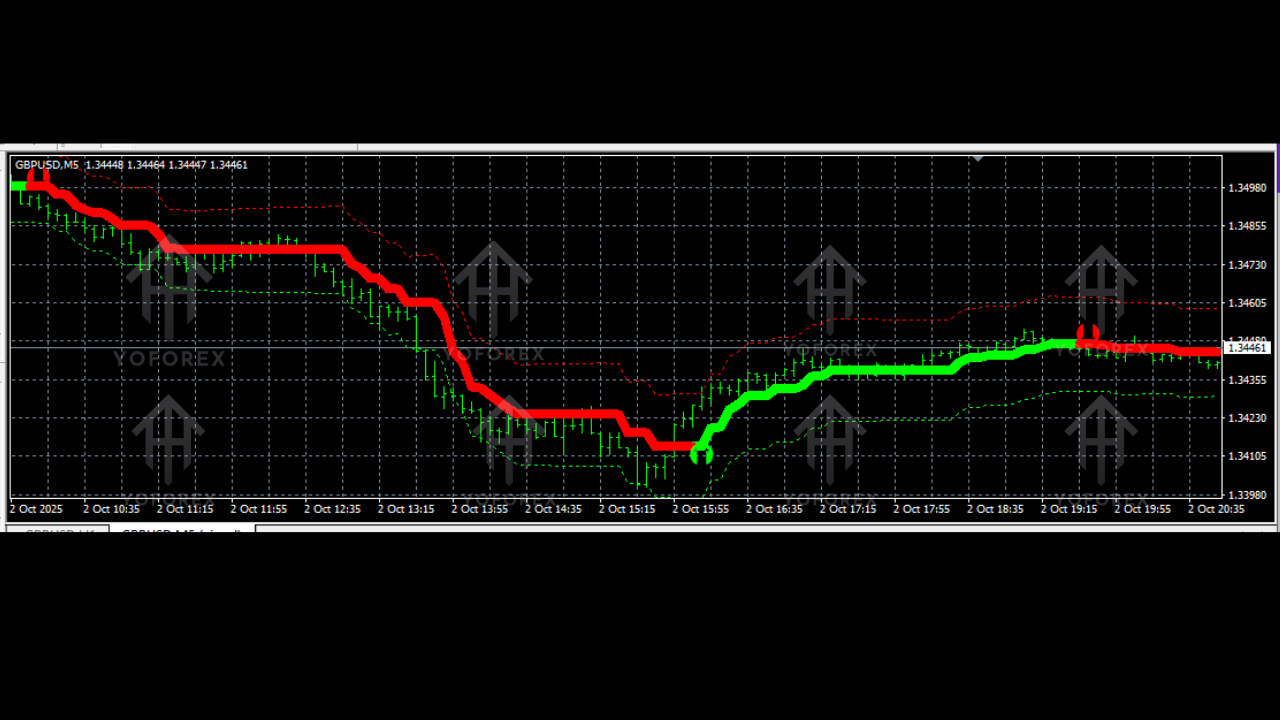

2. Red Arrow + Red Line = Sell Setup

If a red arrow appears with a red line, the indicator is pointing towards a sell opportunity.

Just like the buy setup, the sell trade is valid only when the red momentum indicator below the chart confirms the direction.

Once confirmed:

- Enter your sell trade.

- Aim for your planned target pips or wait for the opposite green signal to close.

- Trailing stop can be used to lock in profit, especially during strong downtrend phases.

- Stop loss should be placed above the nearest swing high or key resistance level.

This helps maintain a disciplined trading structure and prevents emotional decisions.

Why Traders Like This Indicator

One reason Hydra Signals Indicator is becoming popular is coz it avoids clutter and doesn’t overwhelm the user. Everything is simple:

- Arrows show entry direction

- Lines show trend alignment

- Momentum bars show confirmation

The indicator attempts to catch:

- trend reversals

- pullback re-entries

- strong directional momentum

- potential fractal-based turning points

It also removes a lot of subjectivity, making it suitable for beginner traders who struggle with chart reading.

Best Timeframes to Use

Though you can use any timeframe, the recommended ones are:

- M1 (ultra quick scalping)

- M5 (short scalping)

- M15 (strong intraday signals)

These timeframes allow the indicator to show more frequent setups while still maintaining accuracy.

Longer timeframes like H1 or H4 will work too, but signals will be fewer and more spread out.

Recommended Markets

The Hydra Signals Indicator works across forex pairs, indices, crypto, and even metals. But for best results:

- EURUSD

- GBPUSD

- XAUUSD (Gold)

- USDJPY

- NAS100

- GER40

It performs especially well during active market hours where momentum is clearer.

Entry Strategy (Step-by-Step)

Here’s a clean step-by-step method to use Hydra Signals Indicator properly:

1. Wait for the arrow

Don’t rush — the first step is simply to wait for:

- a green arrow for buy

- a red arrow for sell

2. Check the momentum bar

Below the chart, you’ll see the momentum confirmation:

- Green momentum = buy confirmation

- Red momentum = sell confirmation

If the momentum color doesn’t match the arrow, skip the trade.

3. Enter trade

Once everything aligns, enter the trade instantly.

4. Set stop loss

Use one of these three:

- previous swing high/low

- nearest support/resistance

- fixed pip stop (if scalping)

Stop loss is crucial, coz no indicator is perfect.

5. Exit strategy

You can exit using:

- target pips (e.g., 10–20 pips for M5)

- trailing stop

- opposite colored arrow

Trailing stop is great during strong trends.

Tips for Maximizing Accuracy

If you want cleaner and stronger signals, follow these tips:

+ Trade during active market sessions

London, New York, and London–NY overlap are best.

+ Avoid major news releases

High-impact news can give fake spikes.

+ Use a clean chart

Avoid combining too many indicators; Hydra is meant to stand alone.

+ Practice with a demo account

Before you go live, test your comfort level.

+ Follow trend direction

Signals that align with the overall trend are usually safer.

Common Mistakes Traders Make

Even with a clear indicator, some traders end up losing trades due to:

- entering without confirmation

- ignoring stop losses

- trading sideways markets

- using too much leverage

- closing trades too early

Avoid these mistakes and you’ll see smoother results.

Benefits of Using Hydra Signals Indicator

- Easy to understand for beginners

- Provides clear entry and exit signals

- Works on any pair or timeframe

- Includes momentum confirmation

- Suitable for scalping and intraday trading

- Reduces emotional decision-making

If you want a straightforward tool that tells you when to buy or sell without overwhelming complexity… Hydra fits well.

Final Thoughts

The Hydra Signals Indicator is not magic, but it’s a powerful assistant that simplifies charts and helps traders make disciplined, rule-based decisions. When used with confirmation, proper stop losses, and a little patience, it can significantly improve trading consistency.

Comments

Leave a Comment