Hilo Indicator V3.1 MT5 – A Complete Review

If you’re someone who trades trends or simply wants a cleaner way to spot whether the market is heading up or down, the Hilo Indicator V3.1 MT5 might be exactly the tool you’ve been looking for. Traders often get stuck because they're juggling too many indicators, too many signals, or too many false setups. The Hilo Indicator V3.1 simplifies this mess with just one job—showing you the dominant direction of the market using clean, color-coded lines. Nothing fancy, nothing confusing.

In this blog post, I’ll break down what the indicator does, why it’s effective, how it behaves on the AUDUSD H1 timeframe, and how traders use it for entries, exits, trend confirmation, and overall market structure. And don’t worry—this is a plain text format exactly as you requested.

Introduction: Why Trend Direction Matters

Every trader knows that “the trend is your friend,” but identifying it in real-time is not always easy. Candles can get noisy, price can whip around support/resistance zones, and false breakouts can confuse even experienced traders. This is where trend-following indicators help, and among them, the Hilo Indicator V3.1 MT5 stands out for its simplicity.

Instead of drawing dozens of lines or generating complicated dashboards, the indicator uses:

- A blue line below price to show bullish momentum

- A blue line above price to show bearish momentum

- Additional dots that act as temporary support or resistance

The entire system works visually, so even beginners can adapt quickly.

What Is the Hilo Indicator V3.1 MT5?

The Hilo Indicator V3.1 for MetaTrader 5 is a trend-following technical indicator that uses a smoothed line placed either above or below current price to signal trend direction. Because the line shifts based on candle structure, traders can instantly identify whether the market is:

- Bullish

- Bearish

- Consolidating

- Shifting direction

The indicator is intentionally simple. You won’t find overly complex settings or parameters, and that’s one of the reasons traders like it. It is primarily used to:

- Confirm trend direction

- Filter bad trades

- Time entries with trend bias

- Identify trend continuation or reversal points

- Remove market noise

It works on all currency pairs, metals, and even indices—but the example that many traders prefer is the AUDUSD H1 timeframe, which we’ll explore later.

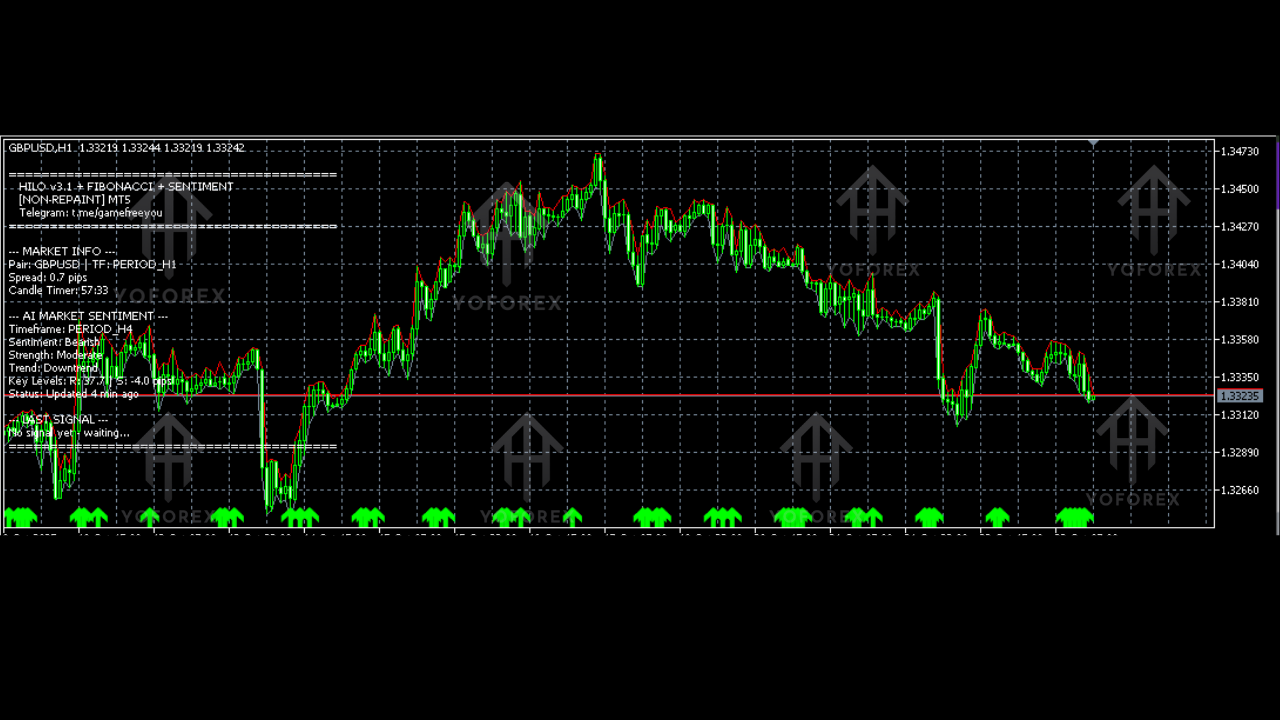

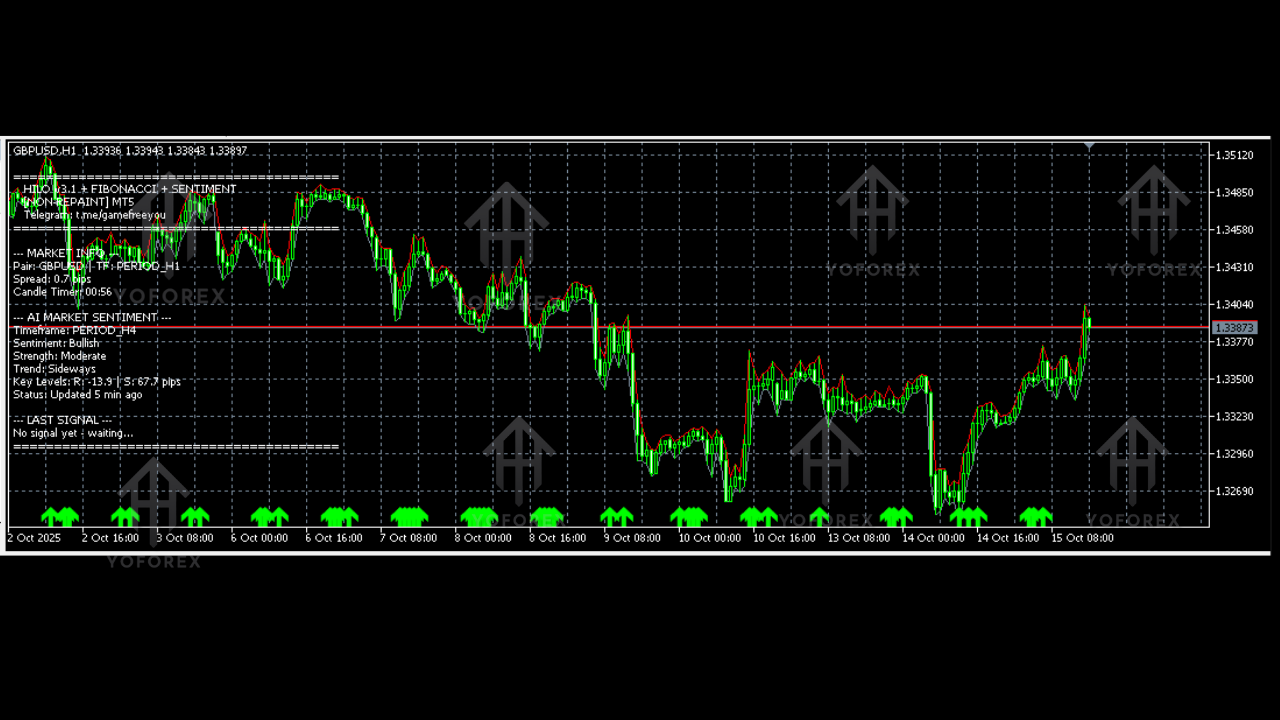

How the Hilo Indicator Shows Trend Direction

One of the biggest advantages of Hilo Indicator V3.1 is how visually clear it is. The system is based on two core behaviors:

1. Blue Line Below Price = Bullish Trend

When the market is trending up, the indicator places the line below the candles, acting like a dynamic support zone. This shows the bullish bias is in control.

2. Blue Line Above Price = Bearish Trend

When the market turns bearish, the line shifts above the price, acting as dynamic resistance.

This makes it extremely easy to follow:

- If the line is below price → look for buys

- If the line is above price → look for sells

3. Dots Acting as Micro Support/Resistance

The indicator’s dots form alongside the trend line. These dots help traders:

- Identify small pullback levels

- Understand where price might pause

- Set potential stop-loss positions

This combination of line + dots provides a smooth yet accurate representation of market structure.

Performance on AUDUSD (H1 Timeframe)

The AUDUSD pair is known for cleaner trends compared to highly volatile pairs like GBPJPY. On the H1 timeframe, the Hilo Indicator performs exceptionally well because:

- H1 reduces noise

- Trends last longer

- Signals are more reliable

- False breakouts are less frequent

Bullish Example

When AUDUSD is in an uptrend, you’ll see:

- The Hilo blue line positioned below price

- Dots forming beneath the candles

- Smooth wave-like behavior following market structure

Traders often combine this with support/resistance or moving averages for entries.

Bearish Example

During downtrends:

- The line flips above price

- Dots appear above candles

- Rejection candles push the market downward

The indicator maintains its color and position until a significant shift occurs.

Trend Sensitivity

One of the best things about Hilo V3.1 is its sensitivity. It doesn’t repaint or lag too badly, yet it doesn’t flip with every small retracement. This makes it highly suitable for swing and positional traders.

How Traders Use the Hilo Indicator V3.1 MT5

Although simple, the indicator can be used in multiple trading styles:

1. Trend Confirmation

Before entering a trade, traders check:

- Is the line above or below?

- Are the dots forming consistently?

- Has the trend stayed stable for several candles?

This prevents emotional, rushed decisions.

2. Breakout Entries

When price breaks above the Hilo line (in case of bullish breakout), traders consider:

- Buy entries

- Continuation setups

- Pullback retests

Similarly, breakdown below the line triggers sell setups.

3. Pullback Trading

Many traders wait for price to:

- Pull back to the Hilo line

- Reject it

- Form a confirmation candle

This is often considered a high-probability entry.

4. Stop-Loss Placement

The Hilo line generally acts as a dynamic S/R zone. Traders place SL:

- Below the line in a buy

- Above the line in a sell

It gives a cleaner risk model compared to random stop placement.

Strengths of Hilo Indicator V3.1

Here are the standout advantages:

- Very easy to read

- Clean chart, minimal noise

- Works on all timeframes

- Excellent for trend traders

- Helps filter out counter-trend trades

- Suitable for scalping, swing trading, and intraday

- No calculation confusion or messy charts

- Very responsive to price shifts

It’s particularly popular among traders using smart money concepts, price action, or simple trend trading.

Limitations to Keep in Mind

No indicator is perfect. Hilo V3.1 also has some limitations:

- It may give late signals during sharp reversals

- In sideways markets, the line may flip frequently

- Better used with confluences (not standalone)

- Not a complete trading system—needs risk management

The indicator is best in trending markets; avoid over-usage in tight consolidations.

Conclusion: Is Hilo Indicator V3.1 MT5 Worth Using?

Absolutely yes—especially if you’re someone who wants quick, reliable, easy-to-understand trend confirmation. The Hilo Indicator V3.1 MT5 offers a clean way to read market direction using simple visual cues. Whether you’re trading AUDUSD on H1 or any other pair/timeframe, the workflow remains simple:

- Line below price → bullish

- Line above price → bearish

- Dots show support/resistance micro-levels

Its simplicity is its biggest strength, and traders at all skill levels appreciate how reliable it is for directional clarity. If you’ve been struggling with reading trends or want a clutter-free, actionable indicator, the Hilo Indicator V3.1 is worth adding to your MT5 toolkit.

Comments

Leave a Comment