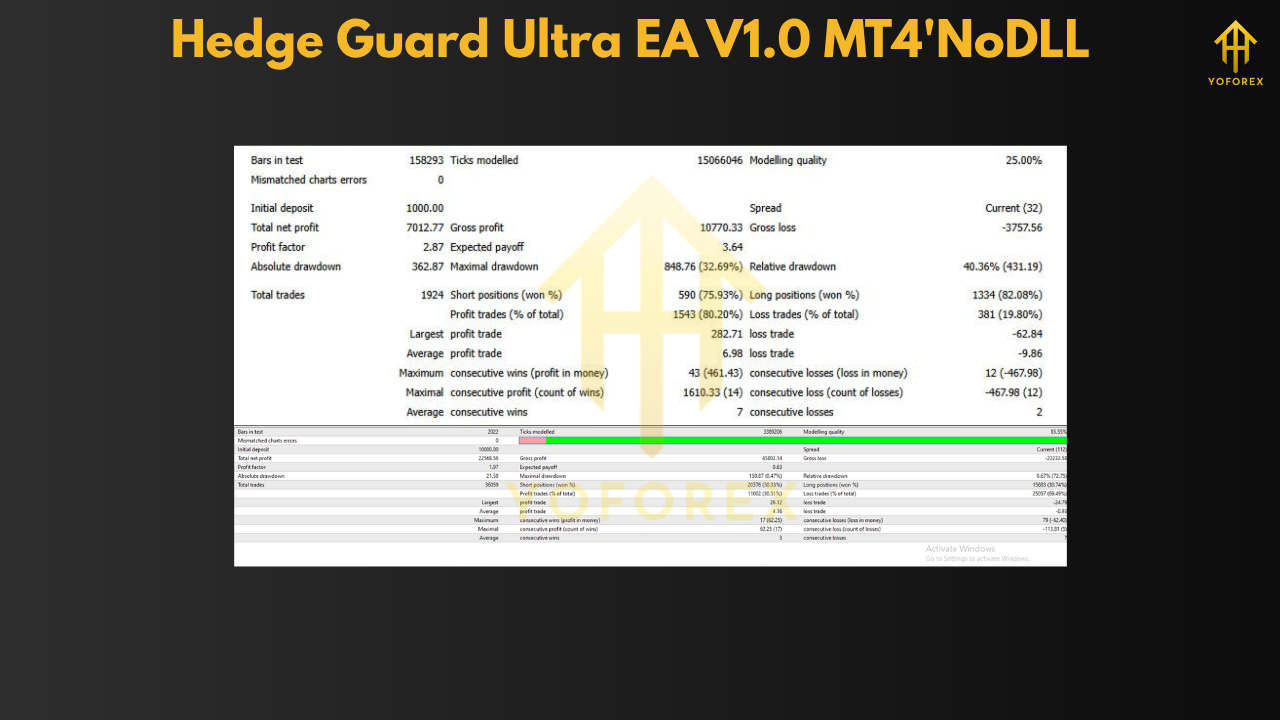

In the dynamic world of forex trading, achieving consistent profits while managing risk is paramount. The Hedge Guard Ultra EA V1.0 MT4 stands out as a sophisticated Expert Advisor designed to automate trading with a focus on precision and capital protection. Unlike traditional systems that rely on grid or martingale strategies, this EA employs a volatility-based approach, ensuring trades are executed with calculated risk and optimal timing.

Understanding Hedge Guard Ultra EA V1.0 MT4

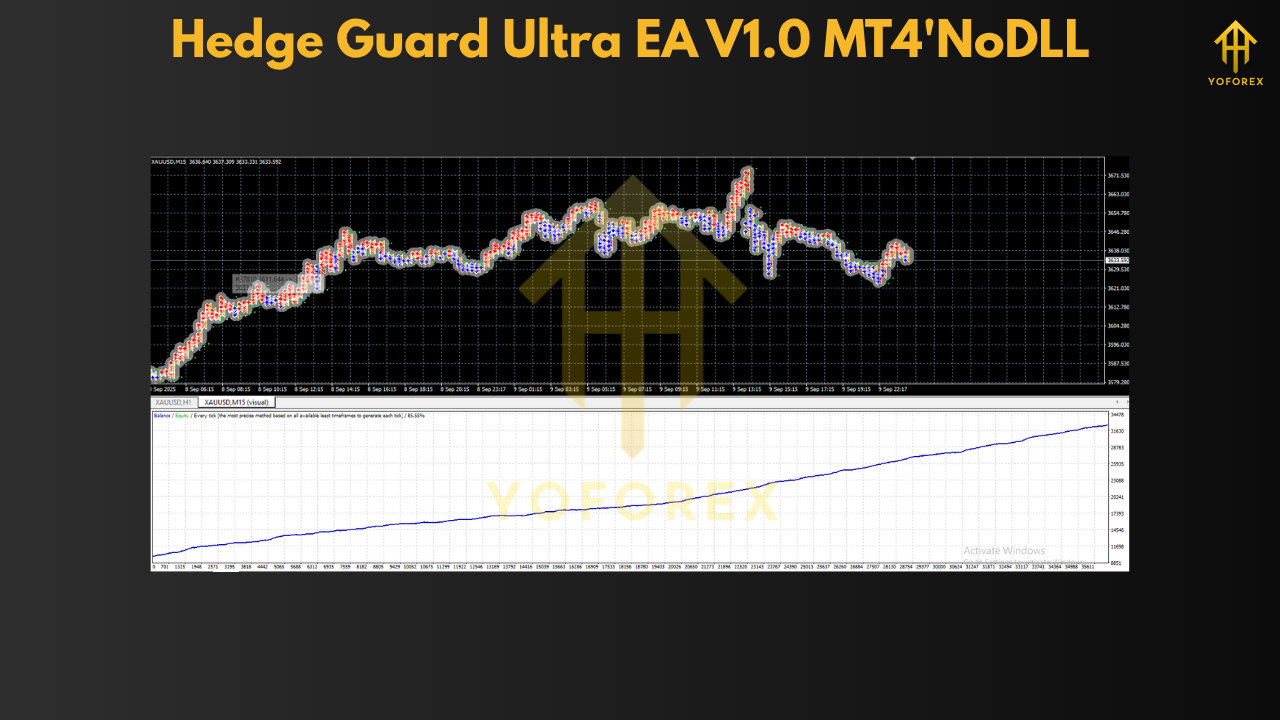

The Hedge Guard Ultra EA operates on the MetaTrader 4 platform, utilising an Adaptive True Range (ATR) algorithm to assess market volatility. This method allows the EA to determine the strength and direction of market trends, enabling it to make informed decisions about when to enter or exit trades. By dynamically adjusting its strategy based on real-time market conditions, the EA aims to minimise drawdowns and maximise potential profits.

Key features of the Hedge Guard Ultra EA include:

- ATR-Based Trend Detection: Automatically identifies bullish or bearish conditions using ATR logic to confirm trend changes.

- Smart Hedging Logic: Opens buy and sell positions strategically to reduce exposure during ranging markets while maximising gains during trends.

- Equity Protection System: Stops or reverses trading when equity drops below a user-defined percentage, helping preserve account safety.

- Trade Limiter: Restricts the number of new trades per minute to avoid over-trading and broker rejections.

- Trailing Stop Management: Automatically adjusts stop-loss dynamically based on profit level and asset type.

- Auto Symbol Compatibility Check: Ensures the traded symbol is supported by the broker before executing trades.

These features collectively contribute to a trading experience that prioritises capital preservation without sacrificing potential returns.

How It Works

The EA's operation is straightforward yet effective:

- Market Assessment: The EA continuously monitors market volatility using the ATR indicator to assess current market conditions.

- Trade Execution: Based on the volatility readings, the EA determines the appropriate action—whether to open a new position, hedge an existing one, or refrain from trading.

- Risk Management: The EA employs built-in safety rules, such as margin checks and lot size verifications, to ensure trades are executed within acceptable risk parameters.

- Trade Management: Once trades are open, the EA manages them dynamically, adjusting stop-loss levels and taking profits as market conditions evolve.

This approach ensures that each trade is executed with a clear understanding of market conditions, reducing the likelihood of unexpected losses.

Advantages of Using Hedge Guard Ultra EA

- Automated Trading: Once configured, the EA operates independently, executing trades based on predefined criteria without manual intervention.

- Risk Control: Built-in safety mechanisms help protect account equity by preventing over-leveraging and ensuring trades are executed within safe parameters.

- Adaptability: The EA's ATR-based strategy allows it to adapt to changing market conditions, making it suitable for various market environments.

- Ease of Use: Designed for both beginners and experienced traders, the EA offers a user-friendly interface and straightforward setup process.

By leveraging these advantages, traders can achieve a more consistent and controlled trading experience.

Recommended Settings

To optimise the performance of the Hedge Guard Ultra EA, consider the following settings:

- Pairs: XAUUSD, EURUSD, GBPUSD, NAS100, BTCUSD

- Timeframe: M1–M15

- Minimum Deposit: $100 (Micro account recommended)

- Leverage: 1:500 or higher

- Account Type: Hedging-enabled account

These settings are tailored to ensure the EA operates effectively across various market conditions and asset classes.

Safety First Design

The Hedge Guard Ultra EA is designed with capital preservation in mind. Unlike systems that rely on high-risk strategies, this EA employs a conservative approach, focusing on risk management and strategic trade execution. The combination of ATR-based trend detection and smart hedging logic ensures that trades are executed with a clear understanding of market conditions, reducing the likelihood of unexpected losses.

Final Thoughts

The Hedge Guard Ultra EA V1.0 MT4 offers a sophisticated solution for traders seeking to automate their trading while maintaining control over risk. It's an ATR-based strategy, combined with smart hedging and robust risk management features, that provides a balanced approach to forex trading. Whether you're a beginner looking to enter the world of automated trading or an experienced trader seeking a reliable tool to enhance your trading strategy, the Hedge Guard Ultra EA presents a compelling option.

Comments

Leave a Comment