Hedge EA V3.03 MT5 – Deep Review of This Powerful Hedging Bot for 2025

If you’ve been trading for a while, you already know how tough the market gets when volatility spikes, trends flip, or price moves sideways for days. And honestly, even seasoned traders struggle to keep the balance between risk and reward — coz the market never behaves exactly how you want it to. This is exactly the reason why hedging-based EAs like Hedge EA V3.03 MT5 have become super popular lately.

This Expert Advisor uses a structured hedging strategy to open opposite-direction trades during volatility, recover from floating losses, and smoothen the equity curve even when the market goes wild. In this detailed review, we’ll explore how Hedge EA V3.03 MT5 works, what makes it different, and whether it's a good fit for your trading style.

Let’s dive in…

What Is Hedge EA V3.03 MT5?

Hedge EA V3.03 MT5 is an automated MetaTrader 5 Expert Advisor built around the classic but effective hedging + grid recovery methodology. The EA aims to take advantage of market movements by opening trades in both directions, securing profits from volatility rather than relying only on trend continuation.

Compared to typical trend-following bots that fail in ranging markets, this EA performs quite well in difficult price conditions where price whipsaws between support and resistance. It uses a combination of:

- Dual-direction order placement

- Grid-style cost averaging

- Configurable spacing between orders

- Optional stealth mode for hidden SL/TP

- Smart lot sizing to control risk

- Trade-recovery algorithm

If price reverses, the EA hedges the position, reducing drawdown pressure and allowing it to wait for the next profitable zone.

It’s not a “magic bot,” but it’s definitely one of the more refined hedging tools that allow traders to automate complex trade management without sitting on charts all day.

Why Hedging Works for Many Traders

Hedging is an age-old risk-balancing technique used by swing traders, gold traders, and even institutional accounts, but doing it manually…? That’s difficult, confusing, and prone to emotional mistakes.

Hedge EA V3.03 MT5 does this automatically — and quickly — opening offsetting trades whenever the market behaves unexpectedly.

The logic is simple but effective:

- If the market goes against the initial position → EA opens a hedge trade

- If ranging conditions occur → both sides can close in profit

- If the market trends strongly → grid recovery handles the losing side

This is why many traders prefer hedging EAs — they’re less dependent on perfect entries and more focused on long-term recovery & volatility harvesting.

Core Features of Hedge EA V3.03 MT5

Below are the main features that define the EA and make it stand out from similar bots:

1. Dual-Side Trading Logic

The EA opens both buy and sell positions based on volatility triggers, allowing it to capture profit from whichever side moves stronger.

2. Smart Grid Algorithm

Grid spacing is fully customizable — you can choose tight grids for high-frequency setups or wider grids for safer, slower trading.

3. Hedging Protection Layer

Whenever a trade goes into floating loss beyond a threshold, the EA opens a hedge position to balance exposure.

4. Stealth Mode

Stops and targets are hidden from the broker. This helps avoid stop-hunts or slippage issues.

5. Multiple Trading Modes

The EA often comes with options such as:

- Conservative mode

- Legacy mode

- Stealth mode

- Recovery mode

Each mode adjusts the aggressiveness of the grid.

6. Configurable Risk Controls

Users can set:

- Initial lot size

- Multiplier for additional trades

- Distance between orders

- Max orders

- Equity protection

7. Works on All Major Pairs

But most traders prefer using it on pairs with smooth volatility like:

- EURUSD

- GBPUSD

- USDJPY

- XAUUSD (for advanced users)

8. Automated Trade Recovery

If the market keeps pushing in one direction, the EA gradually hedges and balances exposure until a profitable exit becomes possible.

9. MT5 Optimized Execution

Slippage handling and faster processing help the EA perform better compared to older MT4 versions of hedging bots.

10. User-Friendly Dashboard

Shows floating profit, active grids, drawdown percentage, and more.

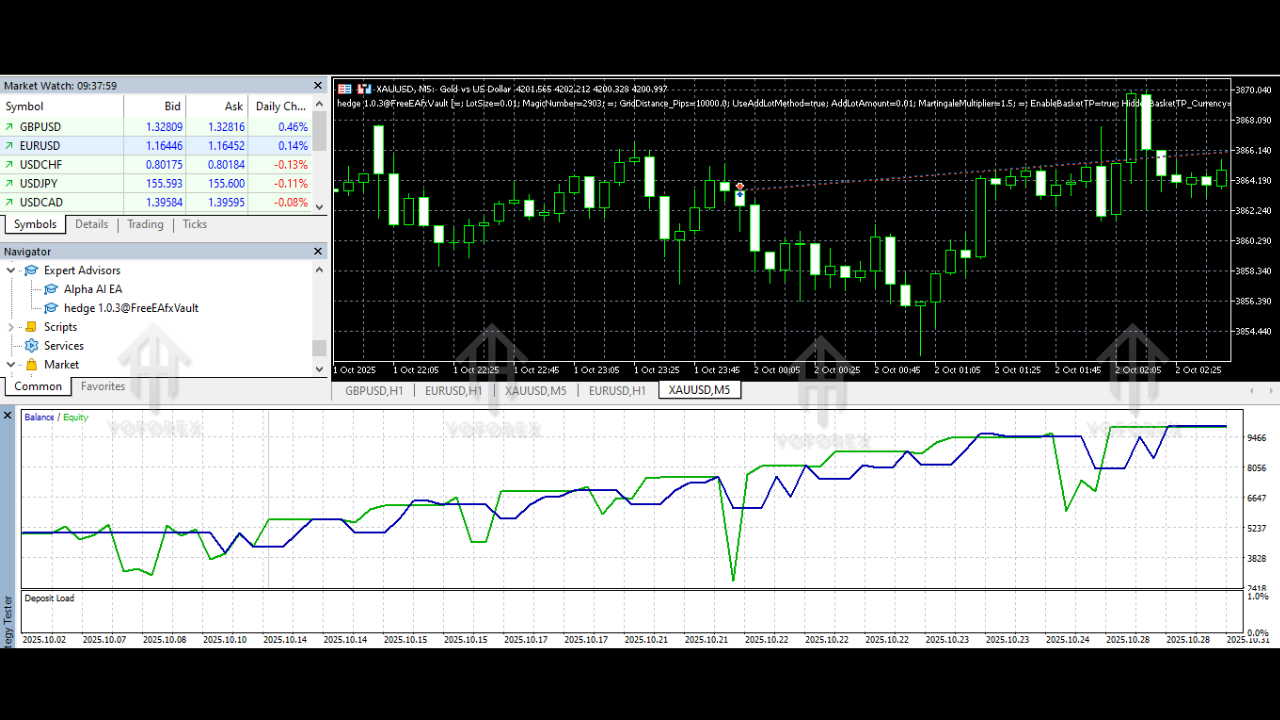

Performance Overview & Realistic Expectations

Let’s be honest — hedging EAs are not “get rich overnight” systems. They require:

- Proper lot size

- Healthy account balance

- Calm risk management

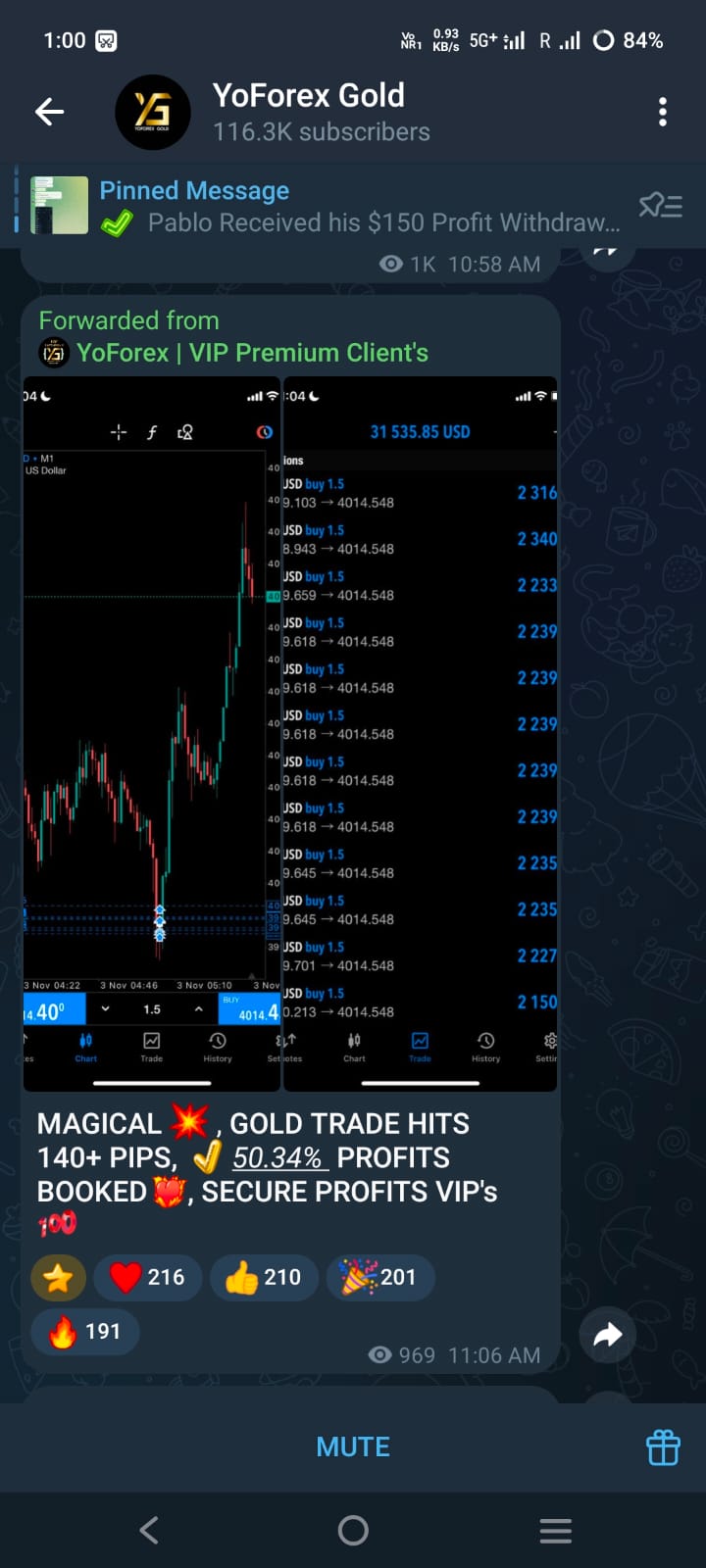

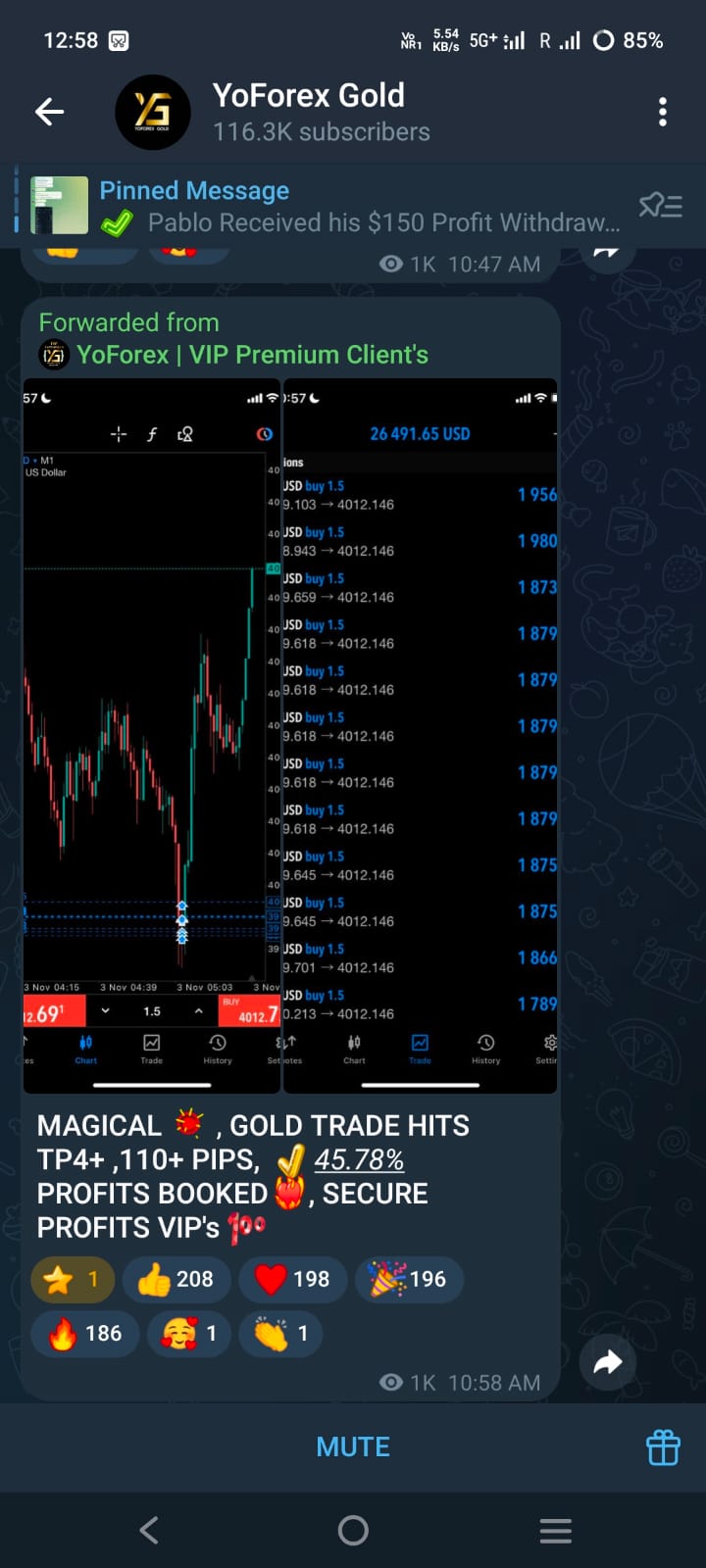

When configured correctly, Hedge EA V3.03 MT5 can deliver stable month-to-month gains with controlled drawdown. Many traders using similar hedging models report average gains of around 5–12% monthly on conservative settings.

The performance is heavily influenced by:

- Market conditions

- Grid spacing

- Lot multiplier

- Timeframe

- Pair volatility

Best results generally come from using moderate risk and wide grid spacing, without trying to chase unrealistic profits.

Recommended Trading Conditions

To get the most from this EA, traders usually follow some guidelines:

1. Use a low-spread broker

Hedging + grid combines many trades, so cheaper execution helps maximize net profit.

2. Keep leverage between 1:200 – 1:500

Higher leverage supports grid expansions more safely.

3. Use VPS if needed

Since the EA runs continuously, stable uptime improves trade accuracy.

4. Avoid news spikes

Even tho the hedging system can handle volatility, extreme spikes like NFP or CPI can push grids too far.

5. Start with demo

This is crucial — every trader must adjust:

- grid spacing

- lot size

- recovery mode

according to their own risk comfort.

Advantages of Hedge EA V3.03 MT5

- Works in ranging and trending markets

- Fully automated, hands-free trading

- Excellent for recovering losing positions

- Flexible settings for beginner and advanced traders

- Grid + hedge combo reduces psychological pressure

- Hidden stops protect against manipulation

- Easy installation and simple dashboard

- Good for long-term steady returns

Disadvantages / Risks You Should Know

No EA is perfect, and hedging systems come with their own challenges:

- Can open many trades during strong trending markets

- Requires a decent account balance to survive extensions

- High volatility can expand the grid beyond comfort

- Not suitable for users who prefer strict SL-only systems

- Slightly complex to configure for complete beginners

- Over-aggressive settings can result in heavy drawdown

But with proper lot size and careful setup, these risks become manageable.

Is Hedge EA V3.03 MT5 Worth Using?

If you’re someone who:

- struggles with emotional manual trading

- hates getting stuck in sideways markets

- wants a smoother equity curve

- prefers low maintenance automated trading

…then yes, this EA can be a reliable tool in your portfolio.

Just remember — hedging EAs require patience, stable risk management, and realistic expectations. Don’t go for crazy multipliers or tight grids. Use the EA the way it's meant to be used — controlled and consistent.

Final Thoughts

Hedge EA V3.03 MT5 is a solid hedging-based Expert Advisor designed for traders who want a more forgiving, volatility-friendly approach to the forex market. The EA doesn't rely only on perfect directional entries; instead, it builds a structured hedge system that adapts when price reverses.

Comments

Leave a Comment