In today’s fast-evolving world of forex trading, automation has become more than just a convenience—it’s a necessity for precision and discipline. Among the many tools available to traders, one Expert Advisor is quietly building momentum due to its smart reversal logic: Hammer Candle EA v2.40 for MetaTrader 5.

Suppose you’re interested in learning how to trade price action without relying on risky strategies like Martingale or grids, and want a system based purely on technical behaviour. In that case, this EA might be exactly what you’re looking for.

This guide breaks down the concept, functionality, and application of Hammer Candle EA so that even beginners can understand how to use it effectively.

What is Hammer Candle EA v2.40?

Hammer Candle EA v2.40 is an automated trading system built to identify and trade based on hammer-type candlestick patterns—specifically bullish and bearish hammers. These are single-bar reversal formations that often appear at the end of trends and suggest a potential shift in direction.

This Expert Advisor is coded for the MetaTrader 5 platform and focuses solely on price action. It does not include any risky grid techniques, Martingale logic, or high-frequency scalp behaviour. Instead, it applies a set of filters and structured entry logic to detect clean hammer patterns and open trades accordingly.

What makes this EA unique is its level of customizability. From wick size to candle body position and entry offsets, every variable can be adjusted to match the volatility of the instrument being traded.

The Concept Behind the Strategy

To understand how this EA works, you first need to grasp what a hammer candle represents.

A bullish hammer appears after a downtrend. It has a small real body, located near the top of the candle, and a long lower shadow, which shows price was pushed down and buyers stepped in with strength. The bearish version is its mirror image—commonly known as an inverted hammer or hanging man, which forms after an uptrend.

The EA uses these visual price signals as entry opportunities, assuming a reversal is likely. It sets orders just beyond the high or low of the hammer and includes risk controls to exit if the trade fails to move in the desired direction.

Why Use Hammer Candle EA?

This EA is ideal for traders who prefer reversal trading and want an automated way to enter setups without staring at charts all day. Because it does not rely on external indicators, it can respond quickly to new price action.

Here’s why it may suit your trading approach:

- Trades are based only on candles, reducing over-dependence on lagging indicators

- Every trade includes a predefined stop loss and take profit

- No doubling down or dangerous equity-based compounding

- Suitable for volatile instruments and fast-moving pairs

- Capable of adapting to different timeframes with input adjustments

If you’ve struggled with emotional trading decisions or missed reversal entries, this EA provides a mechanical alternative that can run consistently on your MT5 terminal.

Core Functional Features

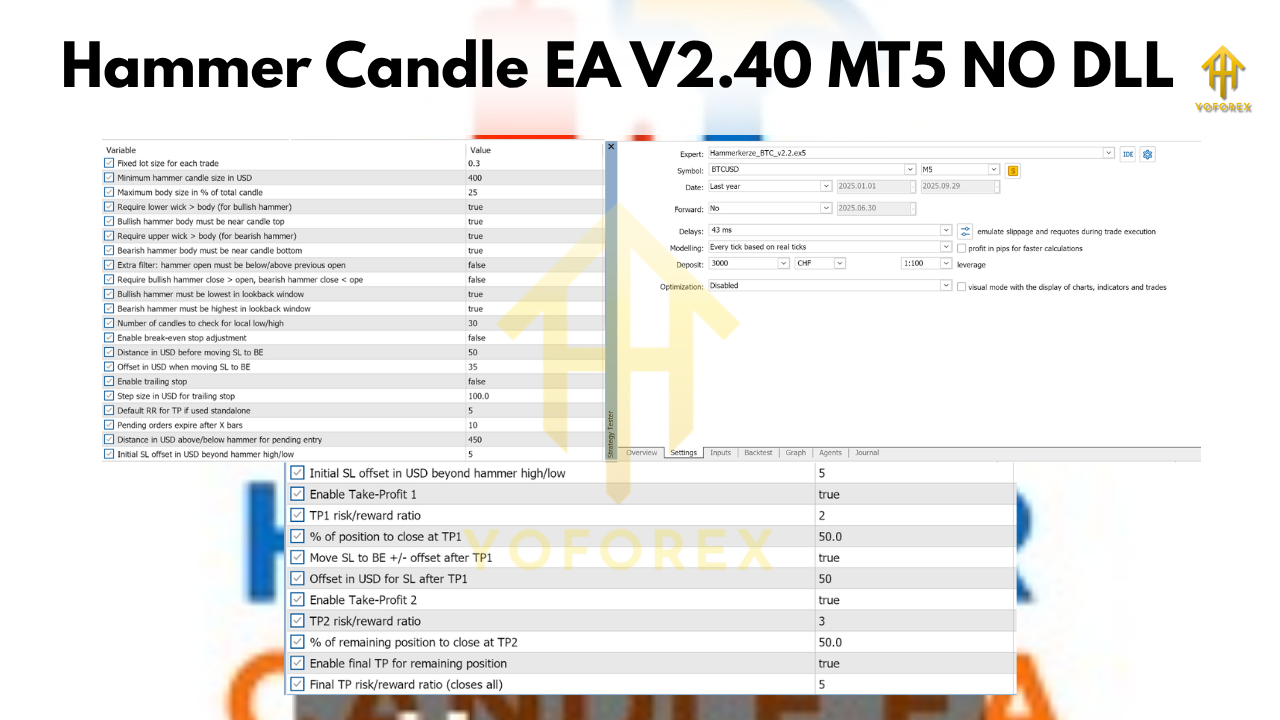

The Hammer Candle EA v2.40 includes a wide array of input settings that give you full control over how it selects trades. Here’s what you can expect when configuring it:

- Candle Filters: Set requirements for the size of the wick, the body, and whether the candle body must be at the top or bottom.

- Entry Logic: Use a buffer distance above or below the candle high/low to place pending orders.

- Stop Loss: Choose how far the stop should be from entry in USD or pip equivalents.

- Take Profit Levels: Define up to three levels of profit targets (TP1, TP2, Final TP) with partial close percentages.

- Break-Even & Trailing Stop: Automatically adjust stop loss when price moves in your favor.

- Time-Based Exit: Close trades after a set number of candles if the target hasn’t been hit.

These parameters make it easier to adjust the strategy for different markets. For example, cryptocurrencies might require a higher wick-to-body ratio due to volatility, while forex majors may work better with tighter filters.

Best Use Cases for Hammer Candle EA

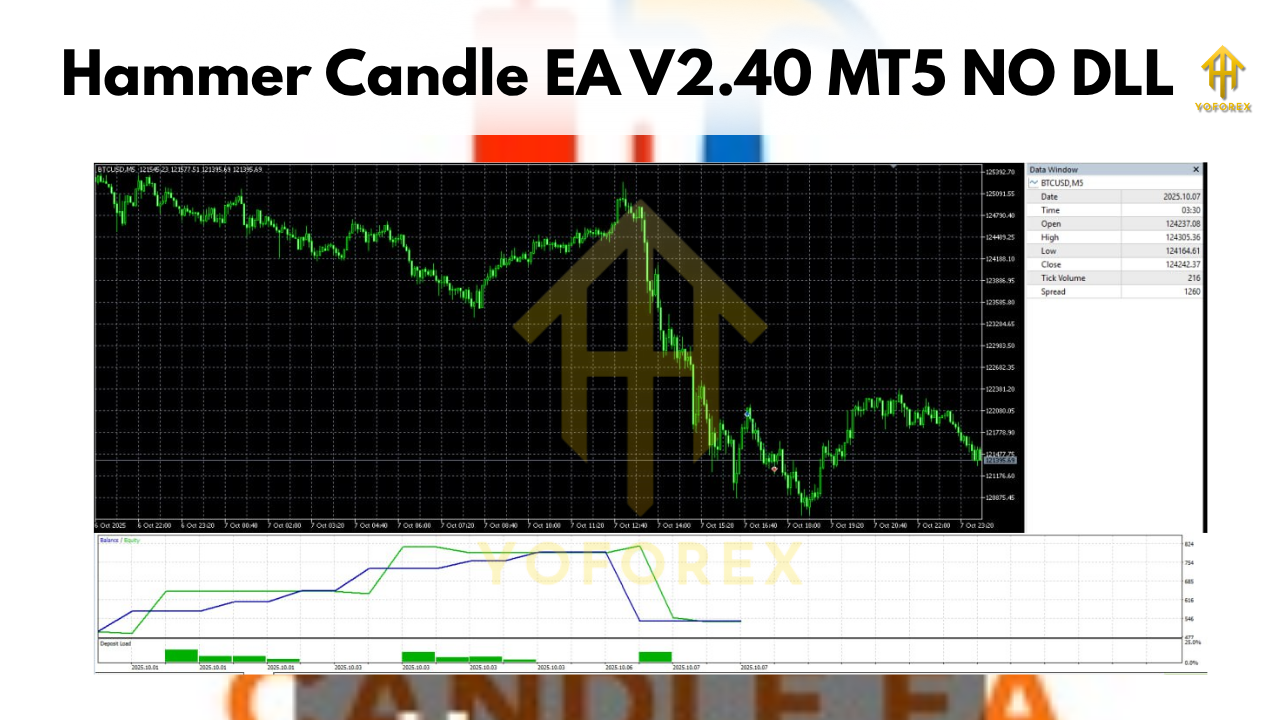

Although the EA can be used on many instruments, it is particularly effective on:

- BTCUSD

- ETHUSD

- Major currency pairs like EURUSD or GBPUSD

- Gold (XAUUSD), when handled with caution

The recommended timeframe is M5 to H1, though it is most often tested and optimized on M5 charts, where hammer formations appear more frequently.

If you use the EA on instruments outside of cryptocurrency, it’s crucial to backtest thoroughly and fine-tune each input.

Installation and Setup Guide

- Load the EA onto your desired chart in MetaTrader 5.

- Set your preferred timeframe (start with M5 or M15 for crypto).

- Adjust candle filters based on your strategy (e.g., increase minimum wick size for BTC).

- Define your SL and TP logic before activating auto-trading.

- Run the EA in a demo environment first to see how it behaves live.

You should avoid using the same settings across all instruments. Instead, develop separate configurations for each market pair you plan to trade.

Pros of Hammer Candle EA v2.40

- Highly customizable and not tied to one market or condition

- Safe entry logic without risky compounding

- Includes full stop loss, partial exits, and breakeven logic

- Works with both bullish and bearish reversals

- Runs on any MT5-compatible broker

Limitations to Be Aware Of

Like any strategy, this one also comes with some limitations:

- Hammer candles are not always reliable without confirmation

- Strong trending markets can cause false reversal entries

- Requires fine-tuning for every instrument

- No built-in trend filter—this must be handled externally

- Results will vary based on spread, broker execution, and slippage

- For the best results, pair this EA with some discretionary knowledge or at least basic trend awareness.

Final Thoughts

Hammer Candle EA v2.40 is not an overhyped plug-and-play robot that promises unrealistic returns. It’s a carefully constructed tool for traders who understand reversal patterns and want to automate their execution. The EA provides both control and structure, allowing you to take emotion out of the trade while relying on historically proven candle behaviour.

When combined with proper backtesting, a clean market structure, and responsible risk management, this EA can be a strong addition to your algorithmic toolbox.

Remember—automation doesn't replace trading skills, but it does enhance your ability to act consistently and without bias.

If you’re ready to build a strategy based on real market behaviour instead of artificial curve-fitted logic, then Hammer Candle EA might just be your next edge.

Comments

Leave a Comment