If you’ve ever felt stuck choosing between early entries on H1 and stronger, cleaner trends on H4… you’re not alone. Lower timeframes give you more setups but, let’s be honest, they can be noisy; higher timeframes filter noise but arrive a tad late. The H4 H1 Trend Indicator for MT4 bridges that gap by combining signals from both H4 and H1 so you can act with more context and fewer second guesses. It’s simple, fast, and doesn’t spam alerts—you get trade-ready confirmation without babysitting charts all day.

What is the H4 H1 Trend Indicator (MT4)?

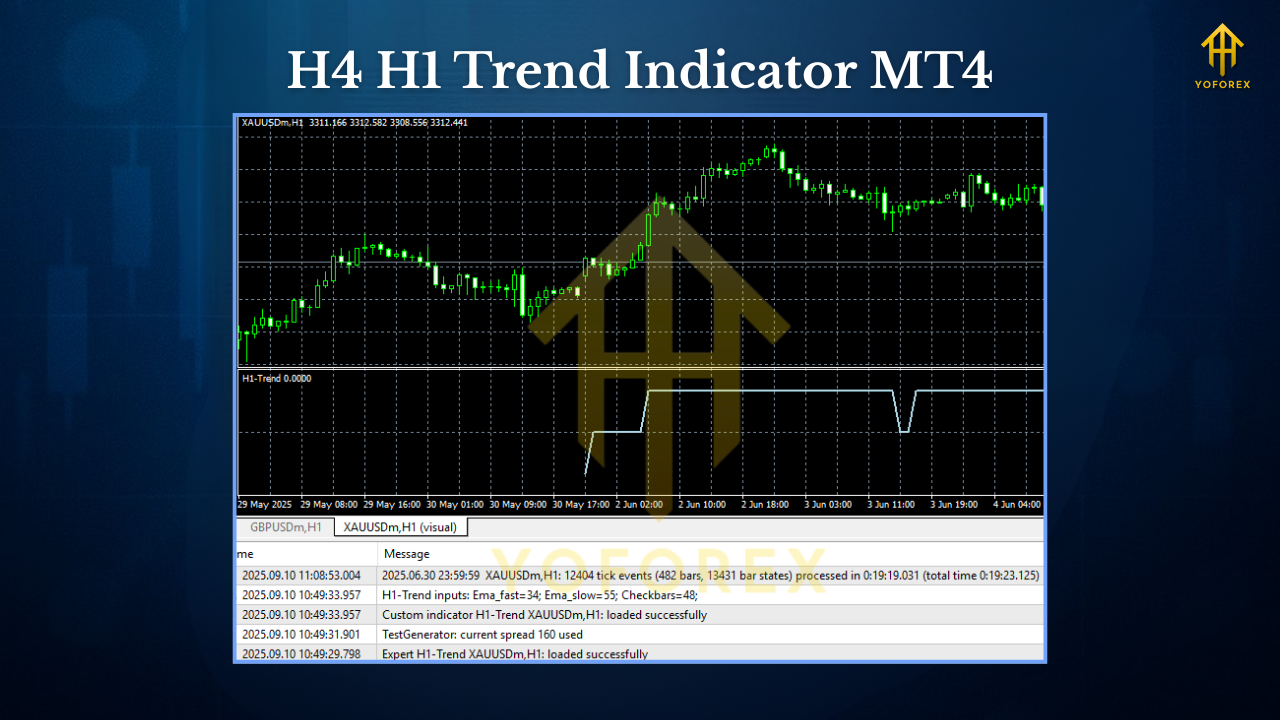

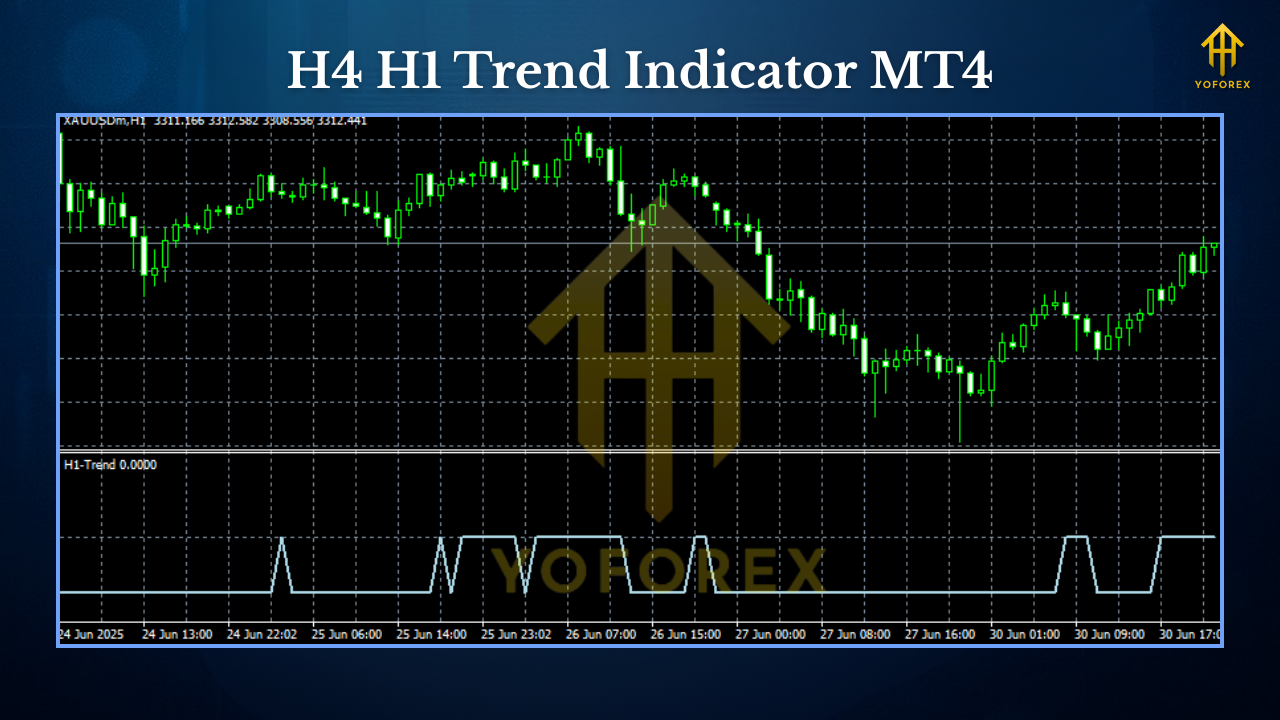

At its core, this tool reads trend direction from H4 and H1 and then syncs them on your chart (any working timeframe, tho best on H1 and M30). When both timeframes align bullish or bearish, you get a clearly marked signal zone on your active chart. That means less “is this a fakeout?” and more “this is a high-prob setup.” The indicator focuses on trend continuation, so you can ride moves with a plan instead of chasing candles.

- Designed for MetaTrader 4 (MT4)

- Works on any pair; popular on XAUUSD, EURUSD, GBPUSD, US30

- Best used on H1 and M30 for entries; H4 confirms the overall bias

- No martingale, no grids—just directional confluence and clean visuals

Why use dual-timeframe confirmation?

Because it cuts noise. When H4 calls the broader bias and H1 agrees, the odds of a smooth move increase. You’ll still use stops (always!), but the context helps you filter weak pullbacks and avoid entries smack into higher-timeframe resistance/support.

Key Features

- True H4 + H1 Confluence — Only flags signals when both timeframes align.

- Directional Zones & Arrows — Clean bullish/bearish zones with entry arrows; easy to eyeball.

- Multi-Pair Compatible — Major FX pairs, gold (XAUUSD), indices—works wherever you trade.

- Alerts That Matter — Push/email/sound alerts on confluence; no spammy ping-pong.

- Customizable Sensitivity — Tweak period lengths and smoothing to suit your style.

- Smart Filtering — Optional ADR filter to avoid overextended entries.

- Risk Tools — On-chart ATR stop suggestion and optional breakeven hint.

- Object-Light — Lightweight coding so your MT4 doesn’t slow to a crawl.

- Backtest-Friendly — Indicator buffers exposed for strategy tester visuals.

- Beginner-Friendly UI — Clear colors, minimal params, readable labels.

How It Works (Plain English)

- H4 sets the macro bias. If H4 is bullish (based on moving-average slope/structure filter), we only care about bullish opportunities.

- H1 confirms momentum. When H1 tilts in the same direction, the indicator marks a “green zone” (for buys) or “red zone” (for sells).

- You enter on your chart. Most traders will enter on H1 or M30 once a new arrow prints inside the active zone.

- Risk, then ride. Place stops beyond recent swing or at ATR-based distance; trail under structure if the trend extends.

Recommended Settings (Starter Preset)

- Entry Timeframe: H1 (or M30 if you prefer more setups)

- H1 Smoothing: 14–21 (EMA or LSMA depending on taste)

- H4 Bias Filter: 50–100 period slope filter (EMA recommended)

- ADR Filter: On (skip entries when price is >100–120% of ADR for the day)

- ATR Stop Suggestion: 1.5–2.0× ATR(14)

- Alerts: On push + sound; email optional

How To Trade Signals

Buy Setup (Example)

- H4 bias flips bullish → H1 turns bullish → green zone paints

- Wait for price to pull back into the zone and print an up-arrow

- Stop below the zone or recent swing low (or ATR stop)

- Take profit in stages: 1R at first resistance, trail remainder under swing lows

Sell Setup (Example)

- H4 bias turns bearish → H1 aligns bearish → red zone appears

- Enter on the first clean down-arrow within the zone

- Stop above the zone/recent swing high (or ATR)

- Scale out near key support; trail above lower highs

Avoid…

- Trading against obvious higher-timeframe supply/demand extremes

- Entering right into news spikes (NFP, CPI, rate decisions)

- Entering after a long candle that just exhausted ADR

Installation & Setup (MT4)

- Download the indicator file (MQ4/EX4).

- In MT4, go to File → Open Data Folder → MQL4 → Indicators.

- Copy-paste the file into the Indicators folder; restart MT4.

- In Navigator, drag H4 H1 Trend Indicator onto your chart.

- Inputs: pick your smoothing method, enable alerts, toggle ADR/ATR options.

- Save as a template so you can reuse the layout in one click.

Best Pairs & Timeframes

- XAUUSD (Gold) — Excellent momentum; watch news risk.

- EURUSD / GBPUSD / USDJPY — Consistent sessions; H1 entries are smooth.

- US30 / NAS100 — Works, but use wider stops and smaller lots due to volatility.

Sweet spot: entries on H1, confirmation from H4. If you need more frequency, drop to M30 for the click but keep H4/H1 logic intact.

Risk & Money Management (Don’t skip this)

- Risk 0.5–1.0% per position while you learn the rhythm.

- Let winners breathe; the H4 bias tends to carry.

- If a signal forms right at ADR extremes or into daily S/R, pass or reduce size.

- Consider a 2-target approach: partial at 1R, trail for runners.

- Keep a journal—track which pairs/time windows give you the cleanest follow-through.

FAQs

Does it repaint?

No. The signal is printed once the candle closes. Intra-bar visual cues may shift as price moves, but closed-bar arrows/zones remain fixed.

Can I use it for scalping?

You can on M15/M30 (with H1/H4 context), but the design shines on H1 where noise is naturally lower.

Works on prop-firm rules?

It’s an indicator, not an EA. If you respect max daily loss and use conservative risk, the confluence logic fits most prop-firm styles.

Can I add my own entry trigger?

Totally. Many traders add RSI divergences, round numbers, or candle patterns to refine entries.

Example Workflow (Repeatable)

- Pre-London: mark key daily S/R and ADR levels.

- Check H4 trend; note bullish/bearish bias.

- Wait for H1 to align; trade only in that direction.

- Enter on first arrow inside the zone; stop via ATR or swing.

- TP1 at 1R; trail remainder under swings until H1 momentum fails.

Support & Disclaimer

If you need setup help, parameter advice, or want feedback on a chart, just say so. We’ll walk you through it step by step. Trading involves risk; past results don’t guarantee future returns. Always test on demo first, and never risk money you can’t afford to lose.

Call to Action

Ready to trade with less noise and more confidence? Download the H4 H1 Trend Indicator MT4 and start building entries that actually align with higher-timeframe direction. Keep your risk tight, follow the plan, and let trends do the heavy lifting.

Comments

Leave a Comment