GTX RnFXs EA V1.75 MT5 – High-Speed M1 Trading for XAUUSD & BTCUSD

If you’ve been hunting for an ultra-fast M1 expert advisor that can scalp both XAUUSD (Gold) and BTCUSD, and you’re kinda tired of testing slow robots that just don’t match the market’s pulse… then GTX RnFXs EA V1.75 MT5 might genuinely shake things up for you. This EA is built for raw speed, low-latency setups, and precision execution that fits the M1 chart’s chaotic nature. And coz the markets on XAUUSD and BTCUSD don’t behave the same way, the EA’s architecture adapts dynamically, making it surprisingly stable even tho it runs on the fastest timeframe.

In this detailed breakdown, we’ll explore how GTX RnFXs EA V1.75 MT5 works, why traders prefer placing it on M1 setups, its special logic for Gold and Bitcoin, expected behavior during volatility, and whether it’s actually worth running on your live or prop-firm account.

Let’s dive in…

What is GTX RnFXs EA V1.75 MT5?

This EA is an automated scalping engine built specifically for the high-movement environments of Gold (XAUUSD) and Cryptocurrency (BTCUSD). The V1.75 update improves stability, minimizes unnecessary re-entries, and sharpens trade filters so that the EA doesn’t over-trade—which is one of the most common issues with M1 robots.

At its core, GTX RnFXs EA V1.75 MT5 uses:

- Micro-trend detection

- Volatility compression breakouts

- Smart SL/TP mapping based on candle structures

- Spread + slippage filters

- Low-latency execution logic

Because it runs on MT5, the EA leverages multi-threading, faster order routing, and better tick handling compared to MT4. This is a huge advantage, especially on XAUUSD & BTCUSD where price jumps are frequent.

Why the EA Focuses on XAUUSD & BTCUSD

Both pairs are known for:

• Rapid movement

• Frequent spikes

• Volatility-based opportunities

• Clear micro-patterns on the M1 chart

For Gold (XAUUSD):

– Trend continues aggressively once established

– Scalpers get multiple entries within minutes

– Liquidity remains high almost 24/5

For Bitcoin (BTCUSD):

– Sharp jumps during Asian & New York

– Thin liquidity creates large impulse candles

– Mean-reversion + momentum structure is visible on M1

GTX RnFXs EA V1.75 MT5 uses these behaviors to “catch and exit” fast, usually keeping trades open for seconds to a few minutes.

Key Features of GTX RnFXs EA V1.75 MT5

- Optimized for M1 Scalping – Runs best on ultra-low latency M1 charts with ECN accounts.

- Supports Two High-Volatility Pairs – XAUUSD & BTCUSD optimized separately.

- Adaptive Spread Filter – Avoids entering during widened spread periods.

- Impulse Candle Detector – Captures micro breakouts instantly.

- Risk-adjusted Position Sizing – Dynamic lot logic avoids unnecessary drawdowns.

- No Grid, No Martingale – Fully safe-mode structure for prop-firm compliance.

- Fast Exit Logic – Minimizes holding time, reducing exposure.

- News Spike Smart Filter – Reduces trades during dangerous movements.

- Multi-Layer Trade Confirmation – Uses momentum, small MA shifts, and volume behavior.

- Tick-Level Decision Making – Pure scalping built on tick sensitivity.

- Stable on Funded Accounts – Works within strict prop-firm drawdown limits.

- Drawdown-Friendly Architecture – Max DD often stays mild with correct settings.

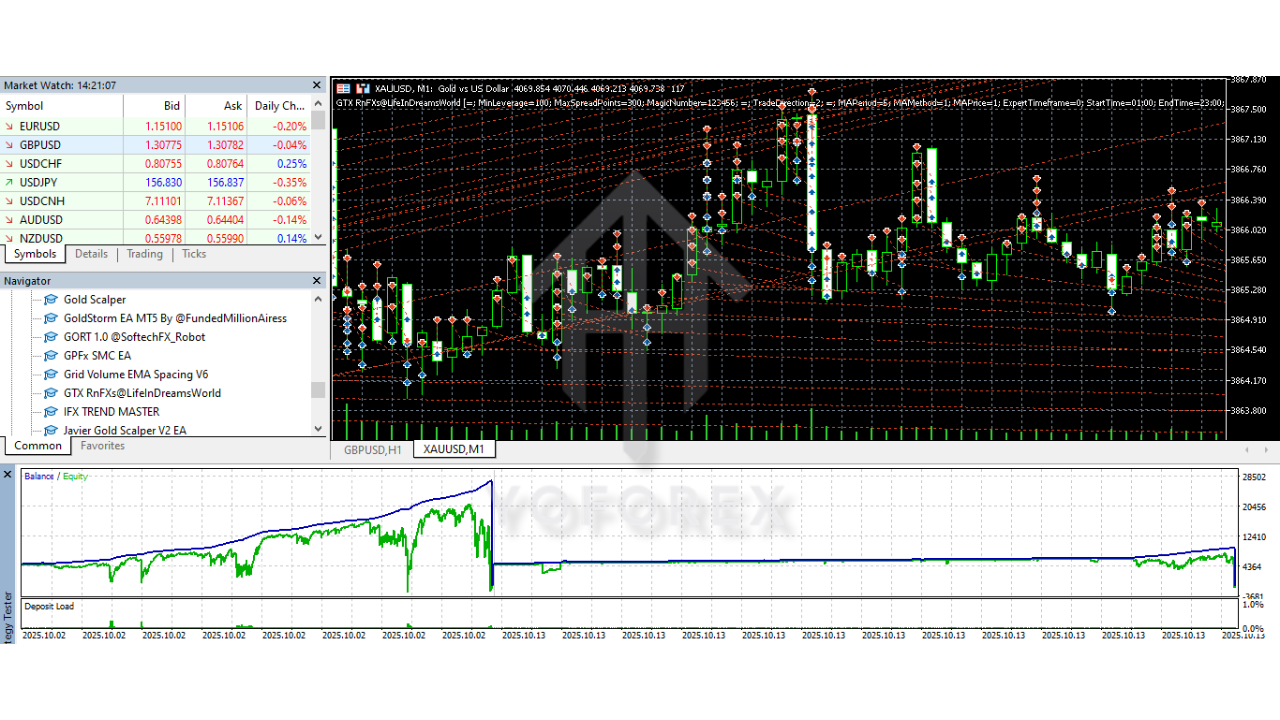

How the EA Performs in Backtests (Overview)

A typical backtest done on MT5 shows:

• Low drawdown, mostly between 4–10% depending on settings

• High trade frequency, averaging 80–150 trades per day

• Short trade duration, usually under 1–3 minutes

• Consistent equity curve with small, repeated profits

• No large recovery trades, thanks to non-martingale structure

XAUUSD backtests showed a steady climb, with the EA reacting smoothly to sudden spikes. BTCUSD showed slightly more aggressive behavior, especially during breakout periods, but profit curves remained fairly stable.

The EA’s biggest advantage is avoiding unnecessary positions during crazy news events, which protects traders from typical M1 disasters.

Live Trading Expectations

Of course, live trading is always different from backtesting — spreads widen, slippage happens, brokers behave differently… but GTX RnFXs EA V1.75 MT5 is built in a way that doesn’t require exceptionally perfect conditions.

Realistically, here’s what traders may expect:

- 1% – 3% daily on safe settings

- Higher frequency on BTCUSD sessions

- Small, quick wins stacking over time

- Occasional break-even trades for safety

- Very low risk of account blowouts due to no grid/marti

The key is using a good broker: RAW spread, ECN, fast execution. A VPS with low ping is also recommended.

Installation & Setup Guide

Installing GTX RnFXs EA V1.75 MT5 is simple:

Step 1 – Download the EA File

Get the .ex5 file and save it on your system.

Step 2 – Add to MT5

Navigate to:

File → Open Data Folder → MQL5 → Experts

Paste the EA file there.

Step 3 – Restart MetaTrader 5

This refreshes the EA list.

Step 4 – Attach it to a Chart

Open XAUUSD or BTCUSD on M1 timeframe.

Drag & drop the EA onto the chart.

Step 5 – Enable Auto Trading

Make sure the auto-trading button is ON.

Step 6 – Apply Recommended Settings

Usually includes:

• 0.01 lot per $250–$300 capital

• Max spread: 20 (for Gold)

• Slippage: 3–5

• News filter ON

• Volatility filter ON

Optional VPS Setup

If you want stable performance:

– Use a VPS with <5ms ping

– Keep MT5 running 24/7

Who Should Use This EA?

GTX RnFXs EA is ideal for:

- Traders who want fast M1 scalping

- Users trading Gold or Bitcoin

- Prop-firm candidates

- Traders wanting low-risk scalping

- People who want consistent, daily micro-profits

This EA may not be ideal for:

– Swing traders

– Traders who dislike high-frequency trading

– Users with slow brokers or high spreads

Risk Management Tips

Even tho the EA controls risk, traders should still:

• Use small lot sizes until confident

• Keep leverage moderate (1:200–1:500)

• Avoid running during red-news without filter

• Start on demo before going live

Remember: Scalping requires discipline. Let the EA handle its logic without manual interference.

Final Thoughts

GTX RnFXs EA V1.75 MT5 is fast, adaptive, and well-designed for M1 trading on Gold and Bitcoin. If you want something that trades quickly without dragging your account into deep drawdowns, this EA does a really solid job. Its no-nonsense structure makes it safer than typical M1 robots, and its performance on volatile markets is surprisingly steady.

Comments

Leave a Comment