GoldUXE EA V2.0 MT4 Review: Unleashing Automated Gold Trading Potential

The world of forex and commodities trading is a dynamic landscape, constantly presenting both opportunities and challenges. Among the most sought-after assets is gold (XAUUSD), prized for its historical stability, safe-haven status, and significant daily volatility. Capturing this volatility profitably, especially through intraday trading, requires discipline, speed, and often, sophisticated analysis – elements that can be demanding for manual traders. This is where automated trading solutions, like Expert Advisors (EAs), step in. Today, we delve into the GoldUXE EA V2.0 MT4, an automated trading system specifically designed to navigate the unique characteristics of the gold market.

What is GoldUXE EA V2.0?

GoldUXE EA V2.0 is an Expert Advisor designed to operate within the MetaTrader 4 (MT4) platform. It is explicitly engineered for the gold market, trading the XAUUSD pair. As its name suggests, it epitomizes "full automation," meaning once configured and deployed, it can independently analyze market conditions, identify trading signals based on its internal logic, execute trades, manage open positions (including setting stops and limits), and close trades – all without requiring constant human intervention.

The developers position V2.0 as a significant evolution, potentially incorporating refinements, optimizations, and perhaps new features over previous versions, aiming to enhance performance, robustness, and user experience. Its core philosophy revolves around harnessing the predictable (though not always easily tradable) patterns and volatility inherent in the gold market to generate consistent profits through a meticulously crafted intraday strategy.

The Core Strategy: Capitalizing on Gold's Intraday Dynamics

The GoldUXE EA V2.0 operates on a specific, predefined intraday trading strategy. While the exact proprietary algorithms are not disclosed (as is common with commercial EAs), we can infer its focus based on its parameters:

- Asset Focus: XAUUSD (Gold vs. US Dollar). Gold is known for its sensitivity to global economic news, inflation data, interest rate decisions (particularly from the Federal Reserve), geopolitical events, and currency fluctuations. The EA is built to interpret these factors as reflected in the price action of XAUUSD.

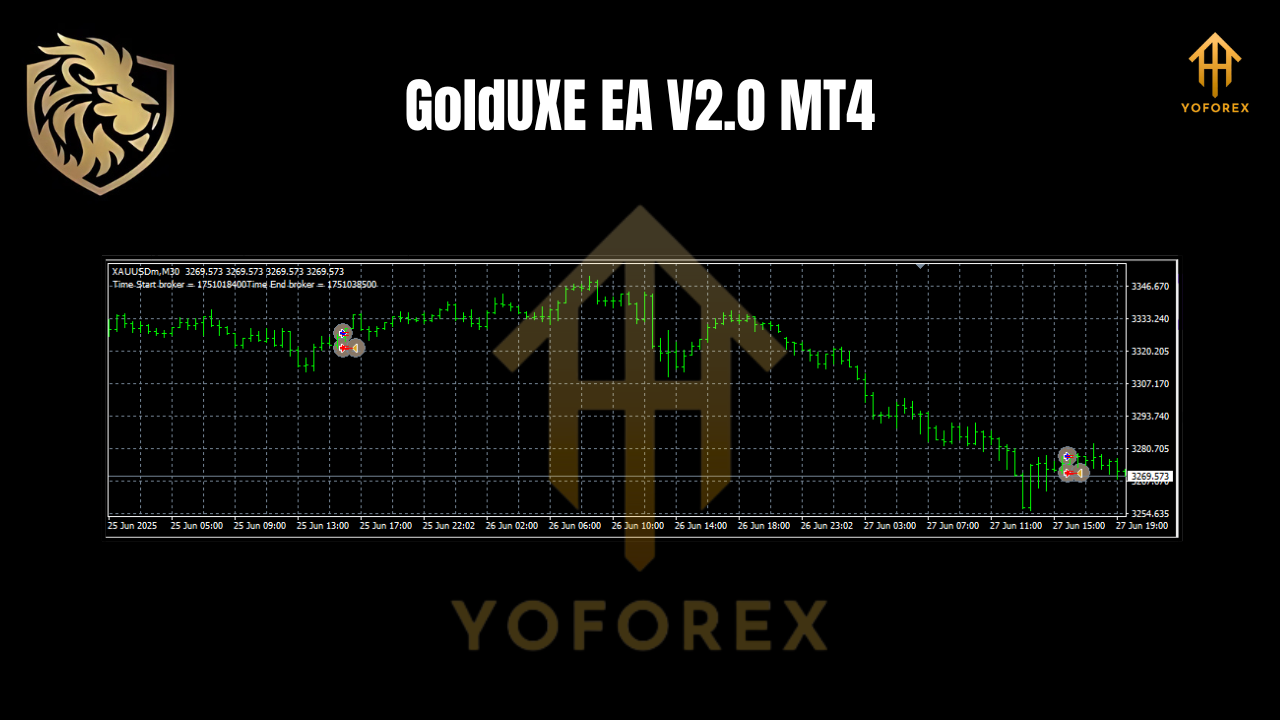

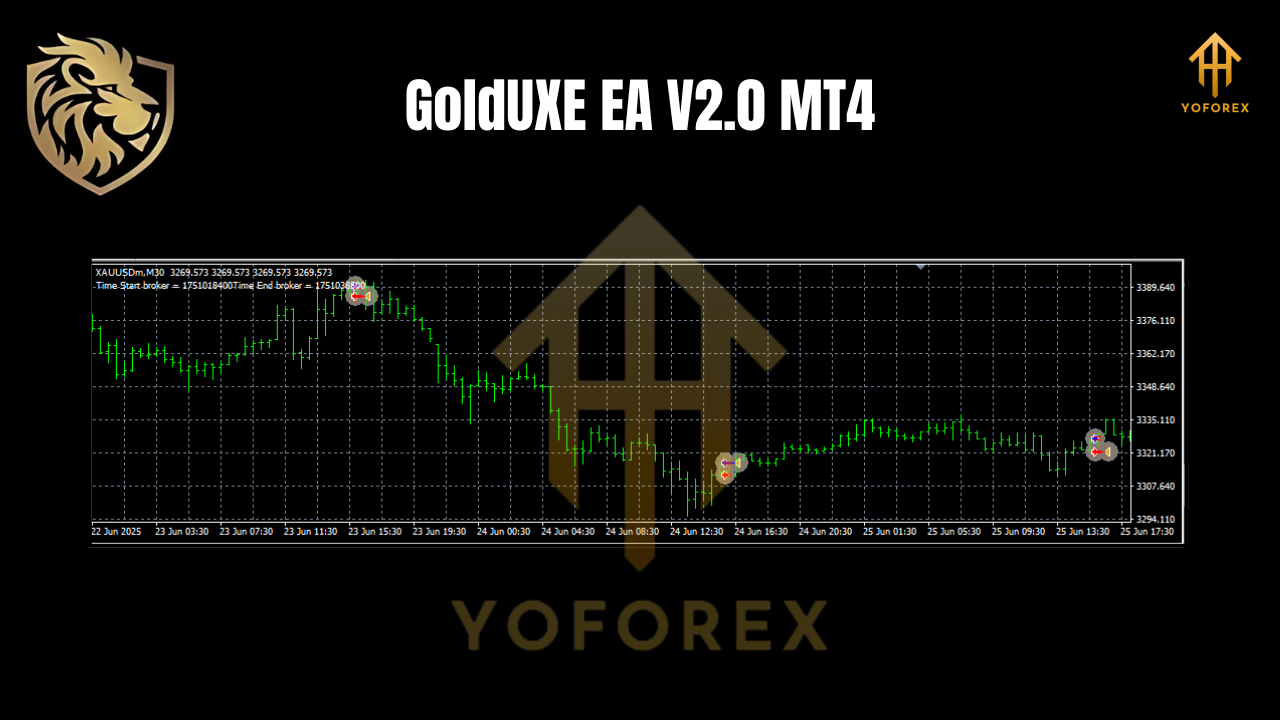

- Timeframe: M30 (30-minute chart). This timeframe is a popular choice for intraday traders. It offers a balance between providing enough data points to identify trends and patterns (unlike lower timeframes like M1 or M5) and allowing for a reasonable number of potential trading opportunities within a single trading day (unlike higher timeframes like H4 or D1). The M30 allows the EA to react relatively quickly to price movements while potentially filtering out excessive market noise.

- Trading Style: Intraday. This implies the EA aims to enter and exit trades within the same trading session or day. It focuses on capturing smaller price movements that occur frequently throughout the day, relying on volume and momentum within the M30 candles. This style generally requires tighter risk management due to the higher frequency of trades.

The "meticulously crafted" nature of the strategy, as claimed by the developers, suggests it likely incorporates multiple technical indicators or price action patterns to confirm entry and exit points, manage risk (like setting stop-losses), and potentially optimize trade timing based on volatility or market conditions specific to the M30 XAUUSD chart.

Key Features and Claims of GoldUXE EA V2.0

Based on the information typically provided for such EAs, GoldUXE V2.0 likely boasts several features aimed at providing a comprehensive automated trading solution:

- Full Automation: As mentioned, it handles all aspects of trading from signal generation to trade execution and management.

- XAUUSD Specialization: Tailored specifically for the gold market, potentially leveraging unique volatility patterns.

- M30 Timeframe Focus: Optimized for intraday trading on the 30-minute chart, balancing speed and signal quality.

- Proprietary Algorithm: Utilizes a unique set of rules and calculations (indicators, price action analysis) developed by the creators.

- Risk Management Tools: Likely includes parameters to set stop-losses and take-profits, and possibly features like trailing stops to lock in profits.

- User-Friendly Interface (within MT4): EAs are typically configured via simple input parameters in the MT4 Experts tab, allowing users to adjust settings like lot size, risk percentage, or specific strategy parameters (if available).

- Backtesting Capability: While not a feature of the EA itself, the MT4 platform allows users to backtest the EA's performance on historical data to get an idea of its potential effectiveness under past market conditions.

Performance Claims: High Win Rates and Profit Factors

The promotional material for GoldUXE EA V2.0 often highlights impressive performance metrics:

- High Win Rates: A high percentage of winning trades is a desirable characteristic. However, it's crucial to approach this claim with caution. A very high win rate often comes paired with smaller profits per trade and potentially wider stop-losses, which can still lead to an unprofitable system if not managed correctly. A realistic win rate for a robust system often falls in the 50-70% range.

- Impressive Profit Factor Ratios: The profit factor is a key metric indicating how much profit a trading system generates for every unit of risk taken. It's calculated by dividing the total profit of winning trades by the total loss of losing trades. A profit factor above 1.5 is generally considered good, above 2.0 is very good, and above 3.0 is excellent. A high profit factor suggests that the system's average winning trades are significantly larger than its average losing trades, or that it wins frequently enough to compensate for losses.

- Robustness and Stability: This refers to the system's ability to perform consistently well across different market conditions (trending, ranging, volatile, calm) and over extended periods, without significant drawdowns or sudden performance degradation. A robust system is less likely to "blow up" or stop working effectively due to changing market dynamics.

While these claims are attractive, potential users must critically evaluate them. Look for verifiable evidence such as:

- Detailed backtesting reports.

- Forward testing results (demo accounts).

- Live account statements (MyFxBook, ForexFactory, etc.) shared by the developers or users.

- Understand the specific conditions under which these metrics were achieved (e.g., specific time period, account size, risk settings).

Getting Started with GoldUXE EA V2.0

To use the GoldUXE EA V2.0, you will need:

- MetaTrader 4 Platform: Download and install MT4 from a reputable broker that offers the XAUUSD (Gold) pair.

- Compatible Broker Account: Open a trading account with a broker that supports MT4 and trades XAUUSD. Ensure the broker has reasonable spreads and reliable execution.

- GoldUXE EA V2.0 File: Purchase or acquire the EA file (usually a

.ex4or.mq4file). - Installation:

- Save the EA file to the

MQL4/Expertsfolder in your MT4 installation directory (usually found inC:\Program Files\MetaTrader 4\or similar). - Restart the MT4 platform.

- In the "Navigator" window (usually on the left), find the "Experts" folder, then locate the GoldUXE EA V2.0.

- Drag and drop the EA onto the XAUUSD M30 chart.

- A settings window will appear. Configure the parameters (like lot size, risk percentage, stop-loss/take-profit values, etc.) as per the developer's recommendations or your own risk tolerance. Caution: Do not increase risk parameters beyond recommended levels, especially initially.

- Click "OK" to attach the EA to the chart. Ensure that "Allow Live Trading" and "Allow DLL imports" (if required by the EA) are enabled in MT4's "Tools" > "Options" > "Expert Advisors" menu.

Minimum Deposit and Risk Management

The stated minimum deposit is $100. While this makes the system accessible, it's essential to understand the implications:

- Risk Concentration: A $100 account is very small. A single significant losing trade, or a series of consecutive losses, could quickly deplete a large portion or even all of the capital.

- Position Sizing: The EA will likely calculate position size based on the account balance and risk parameters (like risk percentage per trade). Even with conservative settings, the position size on a $100 account will be very small, meaning profits will also be small initially.

- Leverage: Trading gold (XAUUSD) often involves leverage. While leverage magnifies profits, it equally magnifies losses. A small account is highly sensitive to leverage and market volatility.

Strong Risk Management is Non-Negotiable:

- Never Risk More Than You Can Afford to Lose: Treat trading capital as money you are willing to lose entirely.

- Use Stop-Losses: Ensure the EA is configured with appropriate stop-loss levels. Do not override these settings.

- Start Small: If possible, test the EA first on a demo account with virtual money to understand its behavior and your comfort level with its risk profile.

- Understand Leverage: Be aware of the leverage offered by your broker and how it affects your position size and potential margin calls.

- Diversification: Do not put all your trading capital into a single EA or a single asset, especially with a small account.

Potential Advantages of Using GoldUXE EA V2.0

- Automation: Frees up time and removes the emotional element (fear, greed) from trading decisions.

- Consistency: Executes trades based on predefined rules without deviation.

- Speed: Can react to market changes faster than a human trader.

- Specialization: Focused on the XAUUSD pair, potentially benefiting from deep analysis of that specific market.

- Accessibility: Low minimum deposit makes automated trading potentially accessible to more traders.

Potential Disadvantages and Considerations

- Past Performance is Not Indicative of Future Results: This is a fundamental disclaimer. Market conditions change, and an EA that performed well in the past may not continue to do so.

- Over-Optimization ("Curve Fitting"): EAs can sometimes be overly optimized to perform well on specific historical data, leading to poor performance in live, dynamic markets.

- Market Adaptation: No EA is perfect. The strategy may struggle during periods of extreme volatility, sudden news events, or prolonged ranging markets that don't fit its ideal conditions.

- Dependence on Broker and Platform: Performance can be affected by broker spreads, slippage (price difference between expected and executed price), re-quotes, and MT4 platform stability.

- Lack of Transparency: The exact trading logic is usually hidden. Users must trust the developers based on provided evidence and reputation.

- Initial Setup and Monitoring: While automated, initial setup requires care, and occasional monitoring is advisable, especially in the beginning.

- Cost: Commercial EAs usually have a purchase price or a subscription fee.

Conclusion: Is GoldUXE EA V2.0 Right for You?

The GoldUXE EA V2.0 MT4 presents itself as a sophisticated tool for automated intraday trading of gold (XAUUSD) on the M30 timeframe. Its claims of high win rates, strong profit factors, and robust performance are certainly appealing, especially for traders seeking to automate their strategies or capitalize on gold's volatility without constant monitoring.

However, potential users must approach it with a healthy dose of skepticism and due diligence. The claims of high win rates and profit factors need verification through independent testing and review of live results. The $100 minimum deposit, while low, necessitates extremely careful risk management due to the high potential for rapid capital depletion.

Join our Telegram for the latest updates and support

Comments

Leave a Comment