Golden Leopard Brushing EA V1.0 MT4 – A Comprehensive Guide for Forex Traders

The Golden Leopard Brushing EA V1.0 is a cutting-edge MetaTrader 4 (MT4) trading robot designed to automate forex trading strategies across multiple currency pairs and timeframes. This sophisticated algorithmic tool aims to streamline trading processes, enhance consistency, and potentially improve profitability for traders operating in volatile markets. Specifically optimized for the pairs XAUUSD (Gold vs US Dollar) and USDJPY (US Dollar vs Japanese Yen), along with four distinct timeframes (H1, H4, M1, M5), this EA combines trend-following and scalping methodologies to capture both medium-term and short-term market movements. By leveraging multi-timeframe analysis, the Golden Leopard Brushing EA seeks to filter out false signals and capitalize on strong trends, making it suitable for both experienced and novice traders seeking automation in their forex strategies.

Overview of the Golden Leopard Brushing EA

The Golden Leopard Brushing EA represents a modern approach to automated forex trading, utilizing advanced algorithms to execute trades based on predefined rules and technical indicators. Unlike traditional manual trading, this EA eliminates human error and emotional decision-making, ensuring consistent execution of trading strategies. The term “Brushing” likely refers to the EA’s ability to capture small, sustained price movements (“brushes”) within broader trends, or a specific signal-generation technique focused on trend continuation. By integrating multiple timeframes, the EA provides a comprehensive view of market conditions, helping to confirm signals and validate trade setups.

For traders, the EA’s design prioritizes adaptability, allowing customization of parameters such as risk tolerance, lot size, and signal sensitivity. This flexibility ensures the EA can be tailored to individual trading styles and account sizes, whether for scalping (short-term trades) or swing trading (medium-term positions).

Technical Specifications: Pairs and Timeframes

The Golden Leopard Brushing EA is specifically configured for two major currency pairs and four timeframes, each chosen for their volatility and liquidity characteristics:

Currency Pairs:

- XAUUSD: Gold is a safe-haven asset sensitive to economic news and interest rates, making it ideal for trend-following strategies.

- USDJPY: A widely traded cross-currency pair known for its stability during market fluctuations, suitable for both scalping and longer-term trends.

Timeframes:

- H1 (1-Hour): Medium-term perspective, useful for identifying short-to-medium trends.

- H4 (4-Hour): Long-term perspective, helpful for confirming broad market directions.

- M1 (1-Minute): Scalping opportunities, capturing quick price movements.

- M5 (5-Minute): Short-term scalping, focusing on intraday volatility.

Using multiple timeframes allows the EA to filter trades, reducing false signals and increasing the probability of successful trades. For instance, a buy signal on the H4 may be confirmed by a buy signal on the H1, while the M1 or M5 timeframes provide entry points for scalping.

How the Golden Leopard Brushing EA Works

At its core, the Golden Leopard Brushing EA employs a multi-timeframe strategy to generate trading signals. Here’s a breakdown of its methodology:

- Trend Identification: On the H4 timeframe, the EA identifies the primary trend using technical indicators like Moving Averages (MA) or Relative Strength Index (RSI). If the trend is upward, the EA focuses on buying opportunities; if downward, selling.

- Signal Confirmation: The H1 timeframe is used to confirm the H4 trend. If the H1 signal aligns with the H4 trend, the EA generates a stronger signal.

- Entry Execution: For scalping, the M1 or M5 timeframes are utilized. When a signal matches the broader trend (from H4 → H1), the EA enters the trade at the current price or near support/resistance levels.

- Exit Management: Stop-loss and take-profit levels are automatically calculated based on volatility metrics, ensuring risk is managed while maximizing profit potential.

This layered approach minimizes the risk of entering trades against the broader market trend, increasing the likelihood of profitable outcomes.

Key Features and Benefits

The Golden Leopard Brushing EA offers several standout features that make it appealing to forex traders:

- Multi-Timeframe Analysis: Combines multiple timeframes to filter signals, reducing false breakouts and improving trade quality.

- Automated Signal Generation: Eliminates manual analysis, saving time and reducing emotional trading.

- Customizable Parameters: Allows traders to adjust risk tolerance, lot size, and signal sensitivity to suit their preferences.

- Advanced Risk Management: Built-in stop-loss and take-profit calculations help control potential losses.

- User-Friendly Interface: Easy installation and configuration on MT4, even for beginners.

The benefits extend beyond convenience; the EA’s focus on trend-following and scalping can lead to consistent profits across different market conditions. Additionally, the multi-timeframe approach helps traders stay aligned with broader market trends while capitalizing on short-term opportunities.

Setup and Configuration Guide

To maximize the EA’s effectiveness, proper setup and configuration are essential. Follow these steps:

- Install MT4: Ensure you have the latest version of MetaTrader 4 installed on your computer.

- Download the EA: Obtain the Golden Leopard Brushing EA V1.0 file from a trusted source.

- Add to MT4: Open MT4, navigate to the “File” menu, select “Open Data Folder,” then “MQL4,” and finally “Experts.” Copy the EA file into the “ Experts” folder.

- Configure Parameters:

- Open a chart for one of the supported pairs (e.g., XAUUSD on H4).

- Go to the “Insert” menu, select “Indicators” > “Custom,” then find “Golden Leopard Brushing EA.”

- Configure parameters: Set the timeframes (H4, H1, M1, M5), risk percentage per trade, lot size, and signal strength. Adjust these based on your account size and risk tolerance.

5. Enable EA on Chart: Check the “Allow Live Trading” box and “Allow Automated Trading” before activating the EA.

Proper configuration ensures the EA operates efficiently without conflicts with other indicators or scripts.

Risk Management and Safety

While automated trading can increase consistency, risk management remains crucial. The Golden Leopard Brushing EA includes built-in safety features:

- Stop-Loss and Take-Profit: Automatically sets stop-loss levels to limit potential losses and take-profits to secure gains.

- Lot Size Adjustment: Allows customization of position size based on account balance, preventing over-leveraging.

- Backtesting Capabilities: Enables testing the EA on historical data to assess performance before live trading.

Traders should also consider setting daily loss limits and monitoring the EA regularly, especially when first implementing it. Starting with smaller accounts and gradually increasing exposure can help mitigate risks.

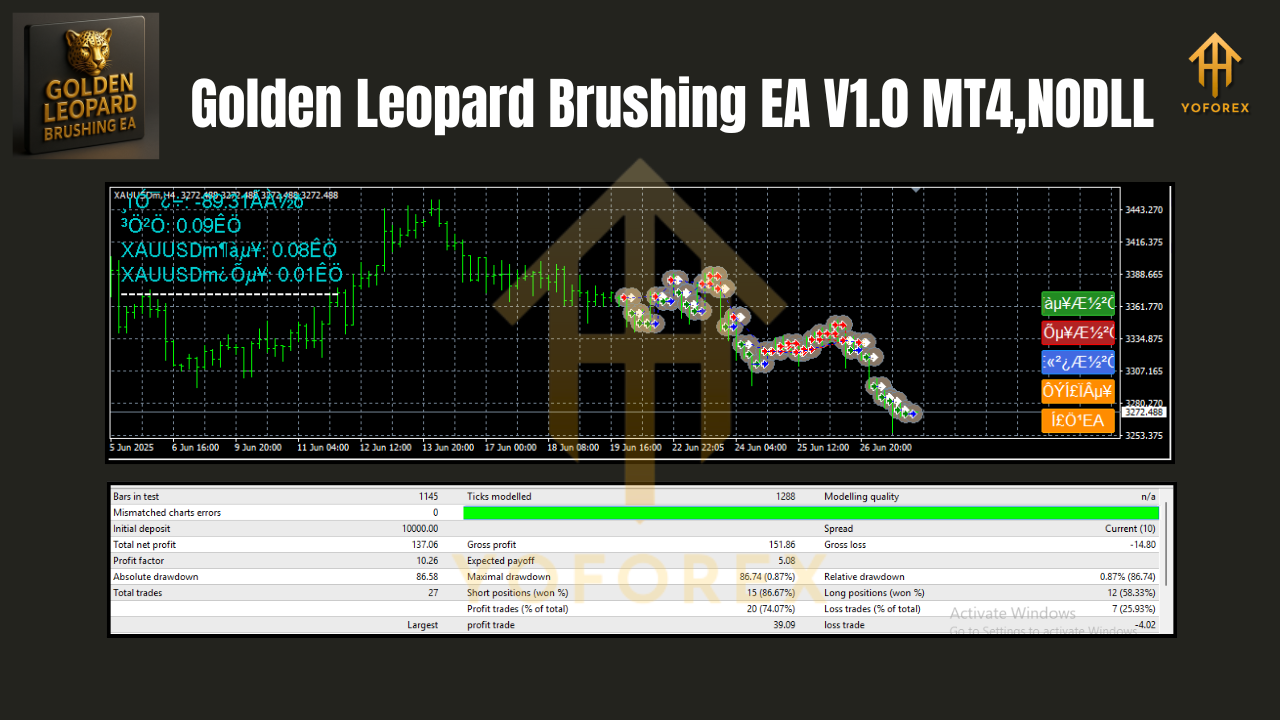

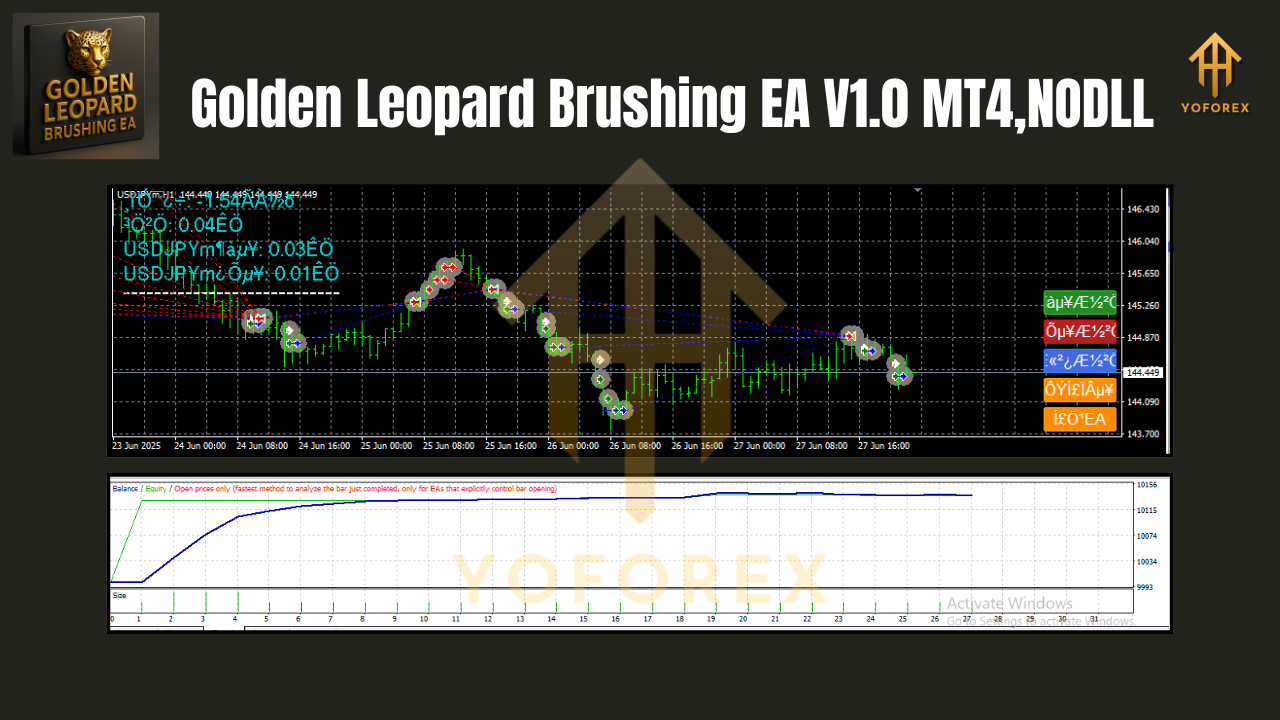

Backtesting and Performance

Before deploying the EA in live trading, backtesting is essential to evaluate its performance. Using historical data, the Golden Leopard Brushing EA can simulate trades across the specified pairs and timeframes.

Backtesting reveals the EA’s win rate, average profit per trade, and drawdown. For example, if tested on XAUUSD over a year, the EA might show a 60% win rate with an average profit of $50 per trade and a maximum drawdown of 15%. These metrics help traders understand the EA’s potential profitability and risk levels.

However, backtesting has limitations, as past performance does not guarantee future results. Therefore, it’s recommended to use a demo account for live testing before transitioning to real money.

Real-World Applications

The Golden Leopard Brushing EA is versatile and can be applied in various trading scenarios:

- Swing Trading: Use the H4 and H1 timeframes to identify medium-term trends and hold positions for days or weeks.

- Scalping: Leverage M1 and M5 timeframes to capture quick profits within minutes, ideal for active traders.

- Day Trading: Combine all timeframes to trade intraday, capturing both morning and afternoon trends.

Its adaptability makes it suitable for different trading styles, from conservative to aggressive approaches.

Conclusion

The Golden Leopard Brushing EA V1.0 is a robust automated trading solution for MT4 users targeting XAUUSD and USDJPY across multiple timeframes. Its multi-timeframe strategy, customizable features, and risk management tools make it a valuable addition to any trader’s toolkit. While no trading system guarantees profits, the EA’s design prioritizes consistency and adaptability, helping traders capitalize on market opportunities more effectively. As with any forex trading tool, thorough testing and risk management are critical for success. Whether you’re a beginner exploring automated trading or an experienced trader seeking optimization, the Golden Leopard Brushing EA offers a promising avenue for enhancing your trading performance.

Join our Telegram for the latest updates and support

Comments

Leave a Comment