Golden Apex EA V1.0 MT4 — Built for Fast, Confident Gold Trades

If you’ve been hunting for a clean, no-nonsense automated strategy for gold that doesn’t blow up your risk budget, Golden Apex EA V1.0 MT4 deserves a real look. It’s a lightweight, game-ready bot designed for short-term charts, built to read momentum and volatility on the lower timeframes where XAUUSD shines. You get the speed of scalping with rules that keep a lid on risk; and because the logic isn’t hard-coded to a single symbol, it also handles GBPUSD quite well on the same M1/M5 windows. Bottom line: it trims the fluff and focuses on consistent execution—coz that’s what actually moves the needle.

Working pairs: XAUUSD (Gold), GBPUSD

Recommended timeframe: M1, M5

Minimum deposit: $500

What is Golden Apex EA?

Golden Apex EA V1.0 is an MT4 expert advisor crafted for the realities of gold trading—rapid moves, sharp pullbacks, and frequent liquidity surges around sessions. The EA’s core philosophy is simple: trade when conditions are favorable, step aside when they’re not. It blends momentum confirmation with micro-structure filters so entries don’t feel “chased,” and it manages exits with predefined stop-loss and dynamic take-profit logic. For traders who want rules, repeatability, and fewer emotional decisions, this EA is a solid fit.

Unlike heavy grid/martingale robots that look great until they don’t, Golden Apex favors fixed-risk, incremental gains. That means you can dial in lot size to match your balance and risk appetite—especially important on M1/M5 where markets can turn on a dime. Whether you’re testing on a demo or looking to add a small, consistent strategy to your live portfolio, the aim is the same: tight control, high discipline, and clean execution.

Why XAUUSD and GBPUSD?

- XAUUSD (Gold): Gold is fast, liquid, and frequently respects intraday momentum—perfect for a nimble scalper that can trail profits quickly.

- GBPUSD: Sterling is historically volatile with clear session rhythms (London & NY). That gives Golden Apex structured bursts of opportunity without forcing trades when the market’s asleep.

Both pairs demand low spreads and solid execution. If your broker conditions are sub-par, even great logic can get sliced up by slippage. Keep that in mind (and consider a VPS) if you want to see the EA at its best.

How Golden Apex EA Approaches the Market (in plain English)

- Momentum + Micro-Pullback Entries

The EA waits for a push, then looks for a small retrace to enter with better price efficiency. You’re not buying the exact high or selling the exact low; you’re entering where the follow-through odds are still decent. - Volatility Gate

It won’t fire in dead zones. When volatility drops below a threshold (think post-news cooldowns or pre-session lulls), the EA reduces or skips signals. No over-trading just to keep busy. - Spread & Slippage Guard

If spreads are widening (hello, rollover), the EA backs off. Scalpers live and die by costs—this guard can be the difference between a green day and death-by-a-thousand-cuts. - Fixed SL + Adaptive TP

Each position has a hard stop. The take-profit adapts to volatility so you’re not using the same 10-pip target in a 30-pip candle storm or vice-versa. - Session Awareness

More weight around London and New York where range expansion is common. The EA can be configured to be quieter in Asia if you prefer. - No Martingale, No Grid

Position sizing is controlled; the EA doesn’t “double down” to win back losses. That’s a conscious design choice for account safety.

Recommended Setup (quick start)

- Account & Balance: Start with $500+. If you’re new, begin on demo to learn the rhythm, then size up live.

- Timeframes: M1 for max opportunities, M5 for a calmer flow.

- Pairs: XAUUSD first; add GBPUSD once you’re comfortable.

- Broker Conditions: Low-spread, fast execution, and stable quotes. A VPS helps keep latency predictable.

- Risk Per Trade: 0.5%–1.0% is sane on M1/M5. If you’re more conservative, 0.25% works, tho you’ll need patience.

- News: Consider pausing during high-impact events (NFP, CPI, rate decisions). Scalpers don’t need the chaos.

Key Features at a Glance

- • Short-term momentum engine tuned for XAUUSD/GBPUSD on M1/M5

- • Fixed stop-loss with adaptive take-profit to match live volatility

- • Spread/slippage filters to avoid poor fills

- • Session-aware logic for better timing

- • No martingale, no grid (risk stays bounded)

- • Position sizing controls (risk % or fixed lot)

- • Optional trailing stop to capture extended runs

- • Trade frequency moderation (avoids over-trading in chop)

- • Friendly to small accounts (min deposit $500)

- • Clean logs & alerts to review what happened and why

Risk Management Tips (seriously, read this)

- Respect the stop. Don’t widen it after entry. Golden Apex is calibrated with the assumption that SLs are real.

- Cap daily risk. A simple daily loss limit (e.g., 2%–3%) prevents emotional tweaking.

- Use one symbol at a time while learning. Master the behavior on gold, then turn on GBPUSD.

- Avoid overlapping exposure. If you’re trading another gold EA, offset sessions or reduce risk so you’re not doubling volatility exposure.

- Scale size only after 30+ days of forward results that match your expectations.

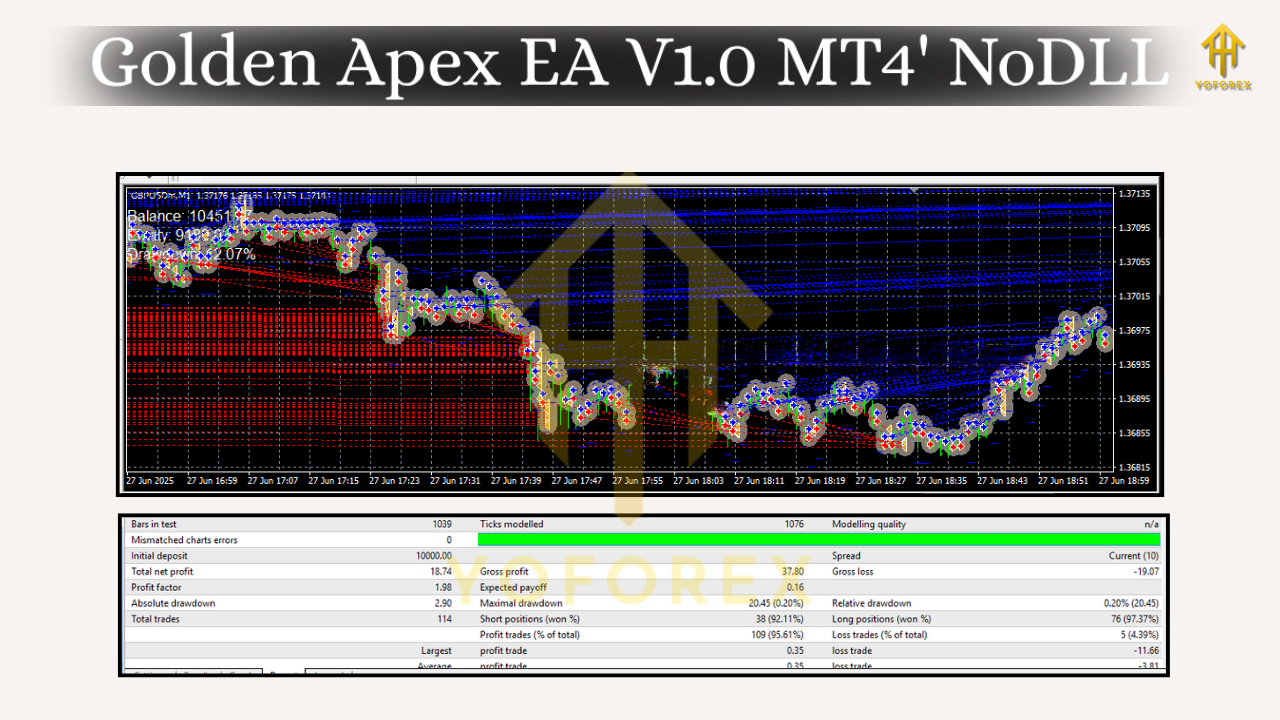

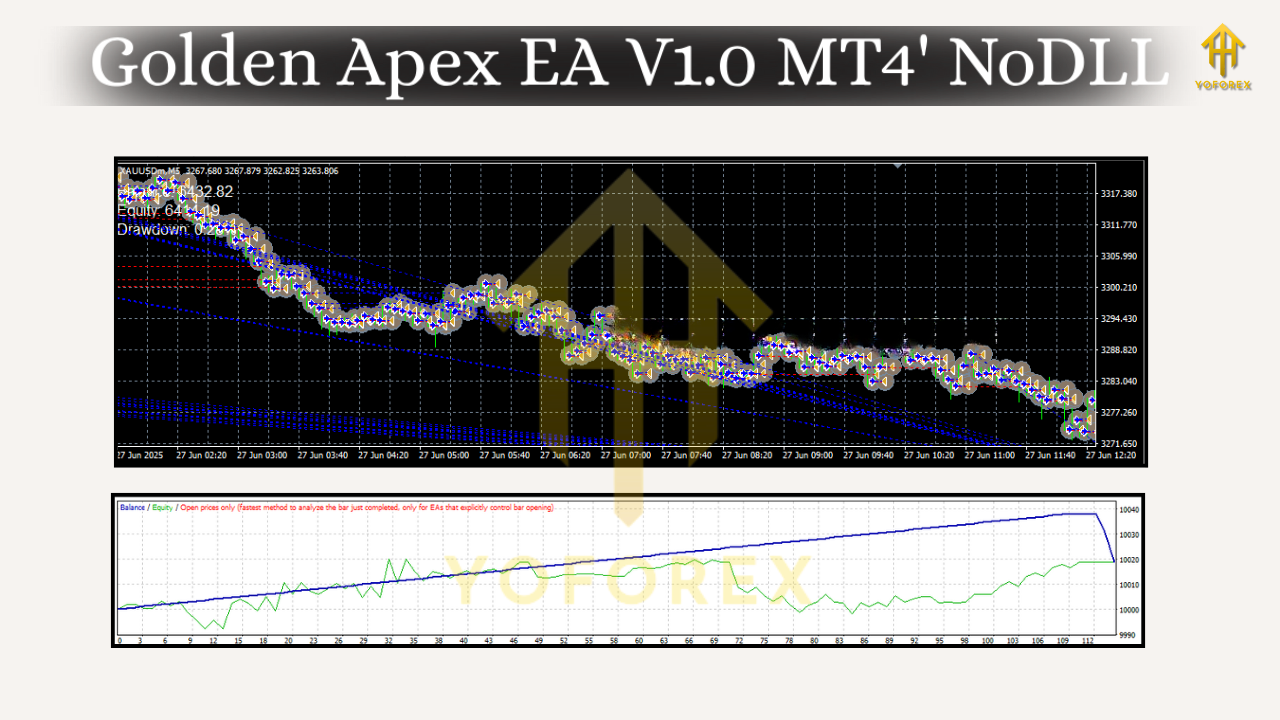

Backtesting & Forward-Testing Guidance

Even the best backtest is just a map; the road has potholes. For a fair read:

- Modeling Quality: Use highest-quality tick data if you can. Gold scalping is sensitive to spread & slippage assumptions.

- Costs: Set realistic spreads/commissions to avoid fantasy equity curves.

- Walk-Forward: Don’t over-optimize. Validate on out-of-sample periods to reduce curve-fit risk.

- Forward Test: Run the EA on demo or micro-live for 2–4 weeks before scaling. You’re checking execution quality (the part backtests can’t fully capture).

- Journal: Track trade times, spreads, and news overlaps. You’ll spot easy wins like turning off during rollover if needed.

Who Will Love Golden Apex EA?

- Hands-on traders who like reviewing logs, nudging session times, and routinely checking broker conditions.

- Risk-first scalpers who care about consistent execution over lottery-ticket days.

- Portfolio builders looking to add a short-term, low-risk-per-trade strategy beside swing or trend EAs.

If you’re chasing “triple your account in a week,” this isn’t that. Golden Apex aims for repeatable edges, not fireworks.

Final Thoughts

Golden Apex EA V1.0 MT4 is a disciplined, low-drama way to trade gold (and GBPUSD) on fast charts. It’s not trying to be clever with dangerous position sizing; it’s trying to be consistent. Pair it with a sensible broker setup, keep your risk lean, and let the system do the boring, repeatable work. That’s the point of automation anyway.

Comments

Leave a Comment