Gold Straddle EA V1.0 MQ4: Catch Gold’s News-Time Breakouts (Without Guesswork)

Tired of guessing where gold will explode during NFP, CPI, Fed days, or sudden risk-on/off swings? The Gold Straddle EA V1.0 (MQ4 for MT4) automates the classic straddle approach—placing pending Buy Stop and Sell Stop orders around the current price before volatility hits—so you don’t have to pick a side. You simply define the distance, lot, and risk rules; the EA does the fast, boring, milliseconds stuff. No martingale, no funny business; just clean execution logic, built-in spread/slippage guards, and easy-to-tune parameters that suit both small accounts and prop-firm rules. If you love XAUUSD but hate whipsaw, you’ll like this.

What the Gold Straddle EA Actually Does (and why it matters)

At its core, a straddle is a neutral stance: place two pending orders, one above and one below price, cancel the opposite side once one triggers, and ride the burst. Gold—being the drama queen it is—often makes a decisive push when a catalyst lands. That’s where Gold Straddle EA V1.0 shines:

- It arms the market with pre-measured breakout orders, so when spreads behave and momentum shows up, you’re positioned already.

- It auto-cancels the opposite pending and manages stops on the live position.

- It can trail, lock breakeven, and close partials, coz not every spike is a marathon.

- It refuses to trade when your max spread guard is exceeded—super useful on gold where spreads can widen seconds before news.

In short, it’s rules first, emotions never.

Key Features (quick hit list)

- Two-sided pending logic: Buy Stop above / Sell Stop below, auto-cancel opposite on fill.

- Distance by points: Set how far from current price to place orders (e.g., 150–350 points on most gold quotes; broker digits vary).

- Smart risk: Fixed lot or percent risk per straddle; one-click breakeven + trailing stop.

- Spread filter: Pause entries if spread exceeds your threshold (protects from ugly fills).

- Slippage guard: Optional slippage limit—if exceeded, EA can skip/exit to avoid bad fills.

- Time-based arming: Arm X minutes before events; auto-expire pending orders after X seconds if nothing triggers.

- No martingale: Prop-friendly by design; stable risk profile.

- News-window lock (optional): Pause after a win/loss during the same event window.

- Partial close: Scale out at predefined RR levels to bank something and let runners breathe.

- Trade comment + magic number: Clean tracking across multiple charts/accounts.

- Simple dashboard: Quick view of armed state, spread, distance, risk, and next actions.

Recommended Pairs & Timeframes

- Pairs: XAUUSD (Gold) is the primary market. Advanced users sometimes experiment on XAGUSD or indices, but this EA is built and tuned for gold.

- Timeframe: M1–M5. The chart timeframe doesn’t affect entries (it’s event logic), but lower TFs help you see what’s happening more clearly.

Broker/Exec Tips:

- ECN/RAW account with low latency helps.

- A VPS near your broker’s server is strongly recommended for news trading.

- Use a fixed spread cap to avoid being filled in the twilight zone.

How to Set It Up (step-by-step)

- Attach the EA to XAUUSD on M1 or M5 in MT4.

- Enable AutoTrading and confirm you see the smiley icon.

- Input your core parameters:

- Order Distance (points): e.g., 200–300 (test and adapt per broker’s digits/spread).

- Lot Mode: Fixed lot (e.g., 0.01 per $300–$500) or Risk % (e.g., 0.5–1% per straddle).

- Spread Max: e.g., 50–120 points on RAW accounts; raise/lower as per broker behavior.

- Expiry (seconds): e.g., 60–180—cancel pending if no trigger to avoid drift.

- SL/TP: Commonly fixed SL (e.g., 250–500 points) + dynamic TP (RR 1:1 to 1:3), or use trailing.

- Breakeven/Trail: Breakeven at +100 to +200 points, trail after +200 to +400 points (tune to your taste).

5. Arm the EA 1–5 minutes before the anticipated move (or let the built-in arming timer do it for you).

6. Monitor spread & fill quality during event seconds; the EA will block entries if spread explodes beyond your cap.

7. Review logs, tweak, repeat. Tiny adjustments in distance and spread caps can make a big difference on gold.

Minimum deposit: As low as $300–$500 for 0.01 lots, but news slippage can be brutal—size responsibly.

Leverage: 1:200–1:500 typical for gold; follow your broker’s risk disclosure and your own risk plan.

Why Straddle Gold at All?

Because gold moves—often fast—when liquidity thins and institutions reprice risk. Picking direction before a release is basically coin-flip; straddling is the neutral, rules-first way to engage volatility. The tradeoff? You must respect execution risk: spreads widen, slippage happens, and whipsaws exist. That’s why this EA is obsessed with filters, expiries, and risk limits.

Parameter Guide (practical ranges to test)

- Distance: 150–350 points (tight spreads = smaller distance; wider spreads = larger distance).

- Spread Filter: 50–150 points depending on your broker account type.

- SL: 250–600 points; TP: start 1:1 to 1.5:1, add trailing for runners.

- Breakeven: +100 to +250 points (don’t set too tight; gold breathes).

- Trailing: Start modestly (step 50–100 points), widen during spike extensions.

- Risk per straddle: 0.25–1.0% is common. More than 1% on gold news can feel spicy, just saying.

- Cool-down: 5–30 minutes after entry/exit on event candles to avoid chop.

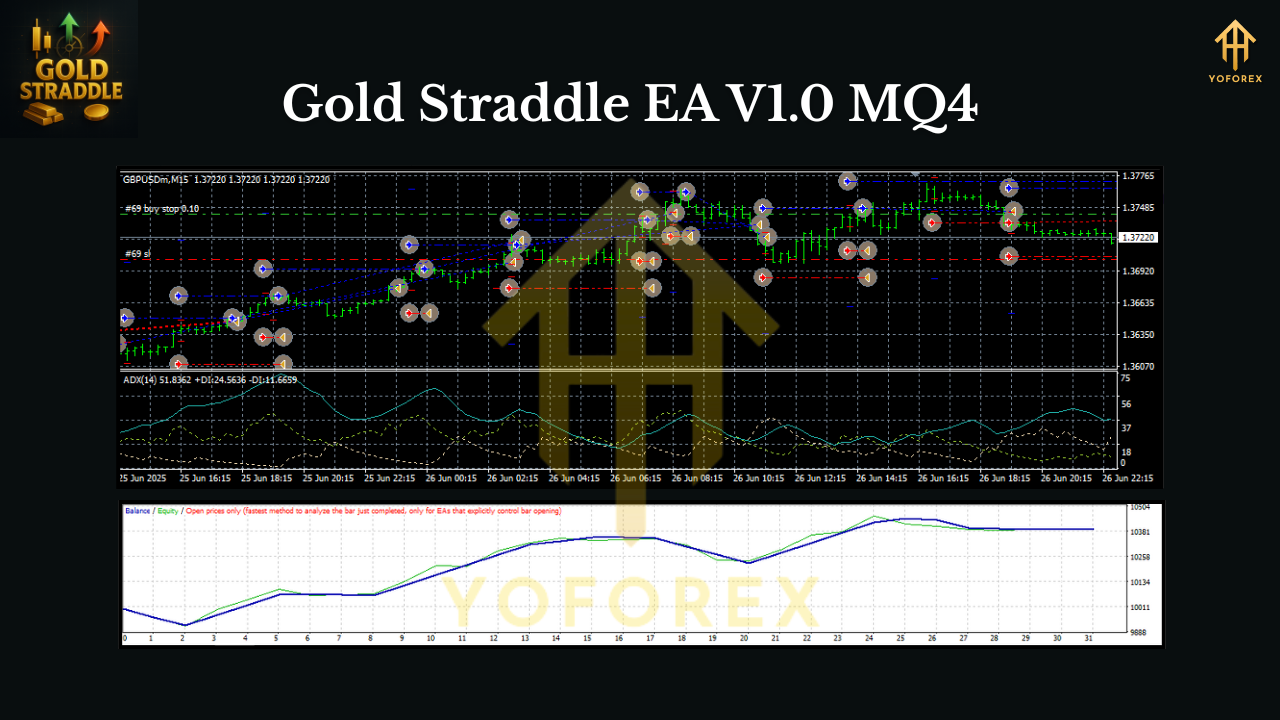

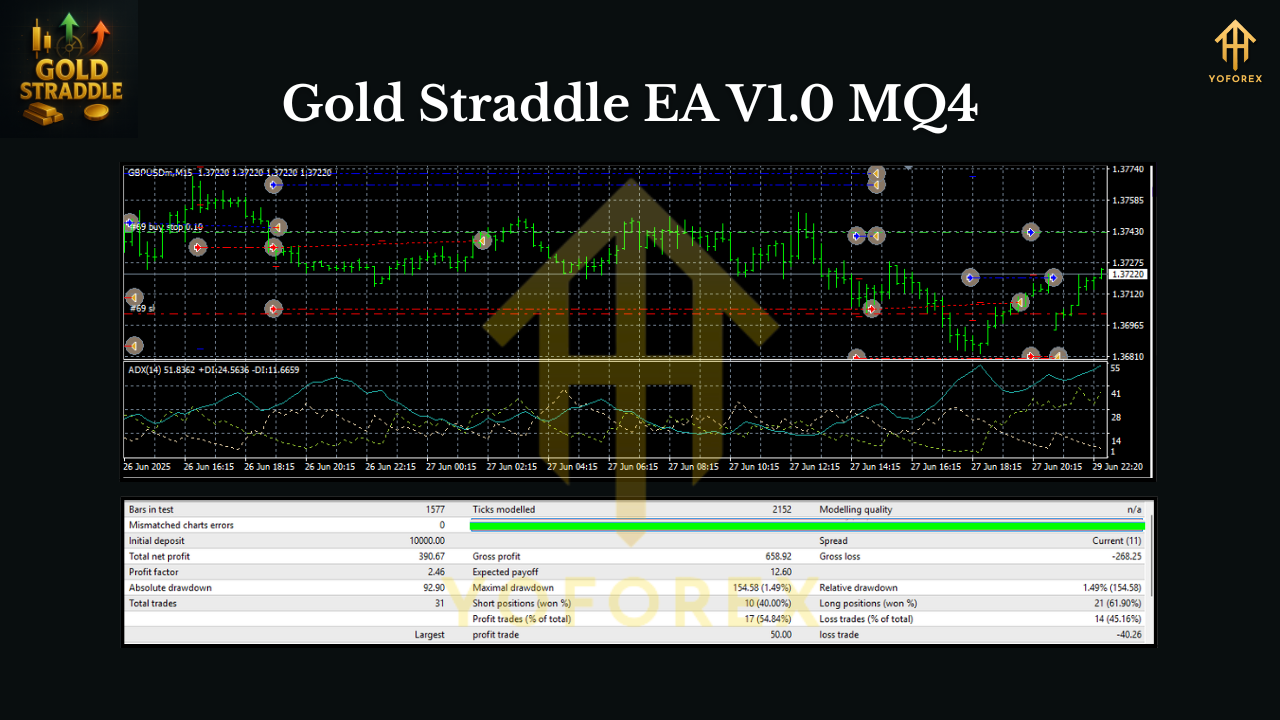

Backtest vs. Live Reality (keep it honest)

Backtesting straddle systems on gold can be misleading if you use 1-minute bars without real tick quality, realistic spreads, and latency modeling. That’s why we recommend:

- Tick-quality backtests (variable spread + slippage simulation) just to establish baseline behavior;

- Forward demo on your actual broker for at least 2–4 weeks across multiple releases;

- Incremental lot sizing—start tiny, then scale if fill quality proves decent.

The EA’s job is consistent pre-positioning, cancellations, and risk control. Your job is to set sane distances, spread caps, and position sizing that match your broker’s reality.

Prop-Firm Friendly?

Yes—no martingale, fixed risk, spread filter, breakeven/partial logic, and you can easily set daily loss stops by external risk tools if needed. Just remember: many firms restrict news trading in their rules. Always read the small print (really).

Who Should Use Gold Straddle EA?

- News/event traders who prefer rules over opinions.

- Gold lovers who want a mechanical way to engage big moves.

- Busy traders who can’t manually stage orders fast enough or cleanly cancel the opposite side.

- Prop/funded traders needing deterministic risk control (no grid, no martingale).

Final Tips (from the desk)

- Practice on demo during 2–3 major events (NFP, CPI, FOMC) to fine-tune distance and spread caps.

- Consider time-window arming rather than leaving straddles on all day.

- Keep your VPS ping low; every millisecond helps on gold.

- Log everything. The EA’s comments + journal tell you what to tweak next.

Quick Specs

- Name: Gold Straddle EA V1.0

- Platform: MT4 (.mq4)

- Market: XAUUSD (Gold)

- Style: News-time breakout via pending orders

- Risk Model: Fixed lot or % risk; no martingale

- Best Use: Event windows (NFP/CPI/FOMC), key session opens, sudden risk shifts

- Support: Standard MT4 expert logs + on-chart status panel

Call to Action

Ready to let rules handle the fireworks? Install Gold Straddle EA V1.0, arm it before events, and let it execute the plan you set. Start small, collect data, tighten the edges. When in doubt—reduce risk, widen distance, and protect fills. Trade smart.

Join our Telegram for the latest updates and support

Comments

Leave a Comment