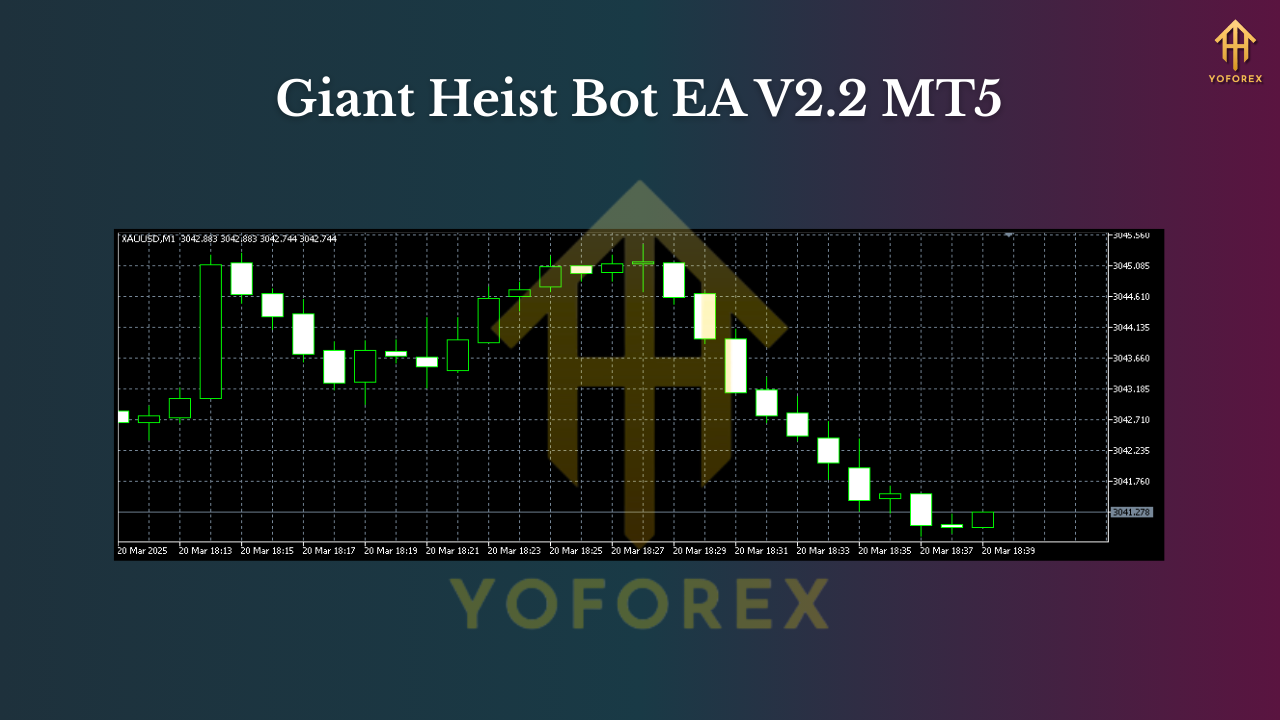

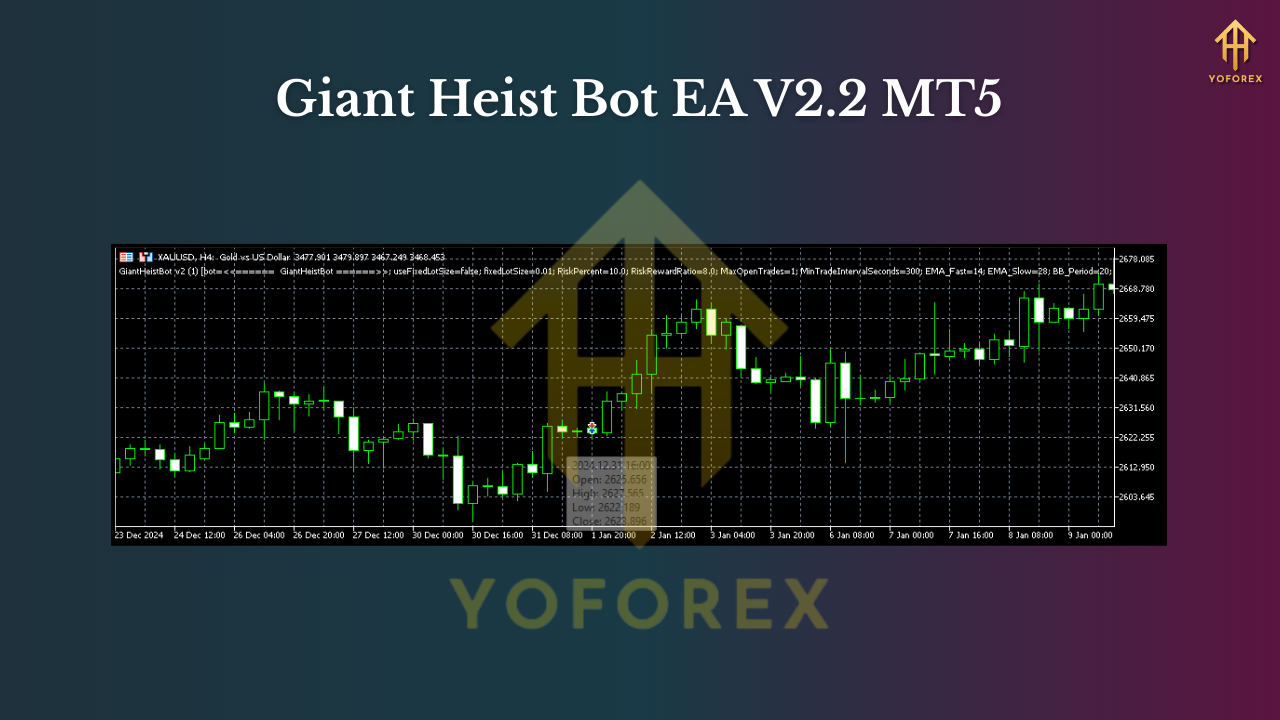

Giant Heist Bot EA V2.2 MT5 — From M1 Scalps to H4 Swings

If you’ve been hunting for an MT5 Expert Advisor that doesn’t lock you into a single style, meet Giant Heist Bot EA V2.2. It’s designed to operate across EUR/USD, GBP/USD, and USD/JPY and adapts seamlessly from M1 to H4. That means you can let it scalp London open volatility, catch a New York continuation, or sit in a cleaner H1/H4 swing when markets trend. In short, it’s built for real-world conditions: different sessions, different spreads, different moods.

Below, you’ll find a practical breakdown of what the bot aims to do, how the logic works, and how to set it up responsibly so you can start testing quickly and iterate with confidence.

What is Giant Heist Bot EA V2.2?

Giant Heist Bot EA V2.2 is an MT5 expert advisor that blends short-term momentum entries with multi-timeframe confirmation. The name nods to its “heist” philosophy: identify high-probability liquidity pockets and “steal” pips with disciplined, risk-first tactics. The EA supports EURUSD, GBPUSD, and USDJPY and is calibrated to work from M1 to H4, so you can use one engine for both scalping and swing approaches.

Core idea: filter out poor-quality conditions, time entries around real liquidity shifts (session opens, volatility expansions), and manage trades with consistent risk controls. No wild bets; no “hope and pray.”

Supported Pairs & Timeframes

- Pairs: EUR/USD, GBP/USD, USD/JPY

- Timeframes: M1, M5, M15, M30, H1, H4

When to use which:

- M1–M5: Best for disciplined scalping during London or early New York; spreads must be tight and execution snappy.

- M15–M30: A balanced mode for intraday flow—less noise, still multiple trades per day.

- H1–H4: Swing structure; fewer trades, more patience, often cleaner risk-to-reward.

How the Strategy Engine Works (Plain English)

- Market Regime Detection: The EA checks if the market is trending or ranging using a blend of moving-average slope, structure breaks, and ATR volatility.

- Session Awareness: Optional session filters prefer London and New York hours where liquidity is deeper and moves are more meaningful.

- Momentum + Pullback Logic: Entries often combine a momentum confirmation (break of micro-structure) with a pullback into a fair-value area to avoid late chases.

- Spread & Slippage Filters: Trades only fire when trading conditions meet thresholds, reducing poor fills on fast spikes.

- News Avoidance (Optional): Pause around high-impact releases to dodge random slippage and spread blowouts.

This blend helps the bot keep entries clean on M1–M5 while still behaving sensibly on H1/H4.

Key Features

- Multi-style engine: Scalps on lower timeframes, swings on higher ones.

- Pair specialization: Tuned for EURUSD, GBPUSD, USDJPY—liquid pairs with robust sessions.

- Regime filter: Detects trend vs range to avoid forcing trades.

- Session filter: Focus on London/NY for tighter spreads and better follow-through.

- ATR-based risk: Dynamic stop sizing aims to keep risk consistent across volatility changes.

- Hard daily risk cap: Optional max daily drawdown stop to lock in safety limits.

- No dangerous martingale: Position sizing remains controlled; no “double-or-nothing.”

- Partial close + trailing exit: Secure partial profits and let runners capture larger legs.

- Spread/slippage guard: Skip low-quality market conditions.

- News pause (optional): Auto-avoid high impact announcements.

- Equity-based lot scaling: Grow size only as equity grows (and within your own caps).

- Readable logs: Transparent logic and clean comments to speed up optimization.

Recommended Setup & Requirements

- Account Type: ECN/RAW-style with tight spreads.

- Leverage: 1:200–1:500 typical; always size lots conservatively.

- VPS: Yes—low-latency VPS improves fill quality, especially for M1–M5.

- Minimum Capital: Start with what you can afford to test; many traders begin with $200–$500 on micro lots to learn behavior.

- Broker Conditions: Fast execution, stable connectivity, and fair commissions are key.

Tip: If you’re new to automated trading, run it on a demo for at least 2–4 weeks to understand rhythm and drawdowns before going live.

Installation & First Run (MT5)

- Open MT5 → File → Open Data Folder.

- Go to MQL5 → Experts and paste the EA file.

- Restart MT5 or right-click “Expert Advisors” → Refresh.

- Drag Giant Heist Bot EA V2.2 onto EURUSD, GBPUSD, or USDJPY.

- Allow Algo Trading.

- Load the provided or your saved .set file (optional), check inputs, and press OK.

- Make sure the smiley icon shows on the chart—then monitor the Journal/Experts tab.

Settings Cheat-Sheet (Starting Points)

These are example baselines to help you get moving. Always forward-test and refine:

M1–M5 (Scalp Mode):

- Risk per Trade: 0.3–0.7%

- ATR Period: 14; ATR multiplier for SL ~ 1.2–1.8

- Take Profit: fixed TP or partial close at 1R, trail remainder

- Session Filter: On (London/NY)

- News Filter: On for high-impact

M15–M30 (Intraday):

- Risk per Trade: 0.5–1.0%

- ATR multiplier for SL: 1.5–2.0

- Partial close at 1R–1.5R, trailing stop after break-even

- Session Filter: Optional

H1–H4 (Swing):

- Risk per Trade: 0.5–1.0%

- ATR multiplier for SL: 2.0–3.0

- Wider trailing logic; target 2R–3R+

- Session Filter: Off (swings can develop any time)

Global Safeties:

- Max Daily Drawdown Stop: 2–4% (choose your comfort)

- Max Open Trades: 1–3 (avoid overexposure)

- Max Spread Filter: Set per pair (e.g., EURUSD ≤ 1.2 pips, GBPUSD ≤ 1.8 pips, USDJPY ≤ 1.5 pips)

Backtesting & Optimization Tips

- Data Quality: Use tick-by-tick with variable spreads where possible. The closer to your live broker conditions, the better the read.

- Walk-Forward Logic: Optimize on one period (e.g., 12–18 months), validate on a separate period you did not touch.

- Session vs No Session: Test both—some brokers and pairs behave better when session filters are strictly on; others have decent off-hours flow.

- Stability Over Perfection: Aim for robustness across months, not perfect equity curves in one month.

- Risk Sensitivity: Re-run backtests with +/- 50% ATR multipliers and spread increases to see how fragile or sturdy your setup is.

Live Trading Workflow (Keep It Simple)

- Sunday Setup: Load charts, verify VPS uptime, confirm settings, check calendar for high-impact events.

- Daily Check: Glance at logs, spreads, and whether session filters match your plan.

- Weekly Review: Export trades, note average R, win rate, and whether you respected your daily risk cap.

- Monthly Tune-Up: Small parameter tweaks only if backed by clear data—no knee-jerk changes after one bad day.

Who Is Giant Heist Bot EA For?

- Scalpers who want rules and tight controls on M1–M5.

- Intraday traders seeking consistent logic on M15–M30.

- Swing traders aiming for calmer execution on H1–H4 without hand-holding every candle.

- Risk-aware users who want built-in safeties, no martingale, and transparent logs.

Pros & Cons (Quick Reality Check)

Pros

- Flexible across M1→H4; one EA for multiple styles

- Strong risk tooling (daily cap, spread/slippage filters)

- News/session awareness reduces randomness

- Clean partial-close/runner framework

Cons

- Requires a good broker + VPS for best fills

- Over-optimization temptation—resist curve-fitting

- Lower trade frequency on H1/H4 might test patience

- Still subject to market shocks—no EA is invincible

Final Thoughts

Giant Heist Bot EA V2.2 MT5 is a versatile, risk-first Expert Advisor that can grow with you. Start small, keep logs, and let data guide refinements. If you respect spreads, latency, and risk caps, this bot can be a reliable engine for structured trading—whether you prefer the rapid-fire of M1–M5 or the calmer rhythm of H1/H4.

Join our Telegram for the latest updates and support

Comments

Leave a Comment