Funded X 99 EA V1.0 MT4: Built for Prop-Firm Rules, Tuned for Consistent Execution

If you’ve ever blown a funded account because a bot over-traded during news or ignored daily loss limits—you’re not alone. Funded accounts are amazing, but the rule sets can be brutal: daily drawdown caps, max overall loss, consistency metrics, time restrictions… the list goes on. Funded X 99 EA V1.0 for MT4 was designed precisely for that world: it helps you trade within prop firm rules while still aiming for steady, scalable performance. Not a “get rich overnight” gizmo; rather, a disciplined machine that focuses on risk-first execution and clean entries on the major pairs most prop traders rely on.

This EA runs on MetaTrader 4 (MT4) and supports EUR/USD, GBP/USD, USD/JPY, and AUD/CAD. It works across multiple timeframes—H1, M30, M15, M5, and M1—so you can tailor the trade frequency to your account rules and personal risk tolerance. With a minimum deposit of $500, it’s accessible to most funded-account sizes and can be scaled up or dialed down through lot sizing and trade filters. Let’s break down what makes Funded X 99 a strong fit for both challenge phases and funded phases.

What is Funded X 99 EA V1.0?

Funded X 99 EA is an automated trading system for MT4 that uses advanced trading algorithms to identify and execute high-probability trades while keeping risks in check. It prioritizes rule-compliant behavior for prop firms—think trade frequency control, session filters, risk caps, and optional news avoidance windows—so you don’t accidentally trip a daily loss limit because of a single volatile candle. In short, it’s an EA that takes discipline seriously.

Core intent:

- Deliver consistent, structured entries on highly liquid pairs.

- Enforce risk parameters that align with common prop firm criteria.

- Allow traders to tune aggressiveness via timeframe choice, lot sizing, and optional filters.

At a glance:

- Platform: MetaTrader 4 (MT4)

- Timeframes: H1, M30, M15, M5, M1

- Pairs: EURUSD, GBPUSD, USDJPY, AUDCAD

- Minimum Deposit: $500

Who Is It For?

- Prop firm challengers: Need to pass phase 1 & 2 without spiking drawdown.

- Funded traders: Need steady execution and drawdown-aware operations.

- Discretionary traders who want rules: If you want a bot that won’t “go rogue,” this is for you.

- Scalpers & swing traders: Choose lower timeframes for more opportunities or H1 for fewer, cleaner signals.

Key Features You’ll Actually Use

- Rule-aware design: Built to help respect daily and overall drawdown limits common to prop firms.

- Multi-timeframe support: H1 down to M1 so you can adjust trade frequency to fit your plan.

- Major pairs only: EURUSD, GBPUSD, USDJPY, AUDCAD—liquid spreads, consistent fills.

- Risk-first engine: Position sizing and risk per trade are front-and-center, not an afterthought.

- Session filters: Option to trade London/NY overlap or avoid low-liquidity hours.

- Volatility guardrails: Optional filters to slow down when volatility spikes.

- News-time caution window: Avoid entering new trades around major events (configurable).

- Equity protection: Daily equity halt and max trades per day options to help keep you safe.

- Clean management: Break-even and trailing options for risk compression after entry.

- Dashboard clarity: Clear readouts of risk, active filters, and current exposure on MT4.

Strategy Notes (The Practical Stuff)

Funded X 99 EA targets structured, rule-based entries on liquid pairs. It looks for momentum and mean-reversion opportunities differently across timeframes: for example, on H1 you might get fewer trades with stronger context, while on M5/M1 you’ll see more frequent setups with tighter stops and smaller targets. The idea is consistency—keeping variance contained and avoiding major news whipsaws when configured to do so.

- H1/H30: Fewer, higher-quality trades; suitable for stricter drawdown limits.

- M15/M5: Balanced frequency; good for challenges where you need activity without going wild.

- M1: High frequency and granularity—use only if your prop’s rules and your temperament support it.

Recommended Setup (Start Here)

- Account & Balance

- Start with at least $500 (or your prop account’s base).

- Use conservative risk (e.g., 0.25%–0.5% per trade) during challenge phases.

2. Timeframe Choice

- H1 for calmer execution; M15 if you want slightly more entries without overdoing it.

- Move to M5/M1 only if you fully understand the implications for drawdown and frequency.

3. Pair Selection

- Begin with one pair (e.g., EURUSD) to learn the EA’s rhythm, then add GBPUSD or USDJPY.

- Consider AUDCAD as a diversifier due to unique session characteristics.

4. Risk Controls

- Set a daily loss cap below your prop’s limit (e.g., 60–70% of their stated max).

- Enable max trades per day and pause after X consecutive losses.

5. News & Sessions

- Activate pre-news cooldown (e.g., 15–30 minutes before/after major events).

- Trade London/NY sessions for best liquidity and fills.

6. Management

- Use break-even after price moves in your favor; consider gentle trailing on H1.

- Keep take-profits realistic; consistency > hero targets.

Passing Challenges vs. Trading Funded

- Challenge Phase

- Prioritize capital preservation over fast returns.

- Choose H1 or M15, conservative risk, and strict max trades/day.

- Avoid trading during tier-1 news altogether.

- Funded Phase

- Maintain the same discipline (you’re protecting a salary now).

- Consider small scaling after a stable streak—don’t jump lot sizes abruptly.

- Keep equity protection on at all times.

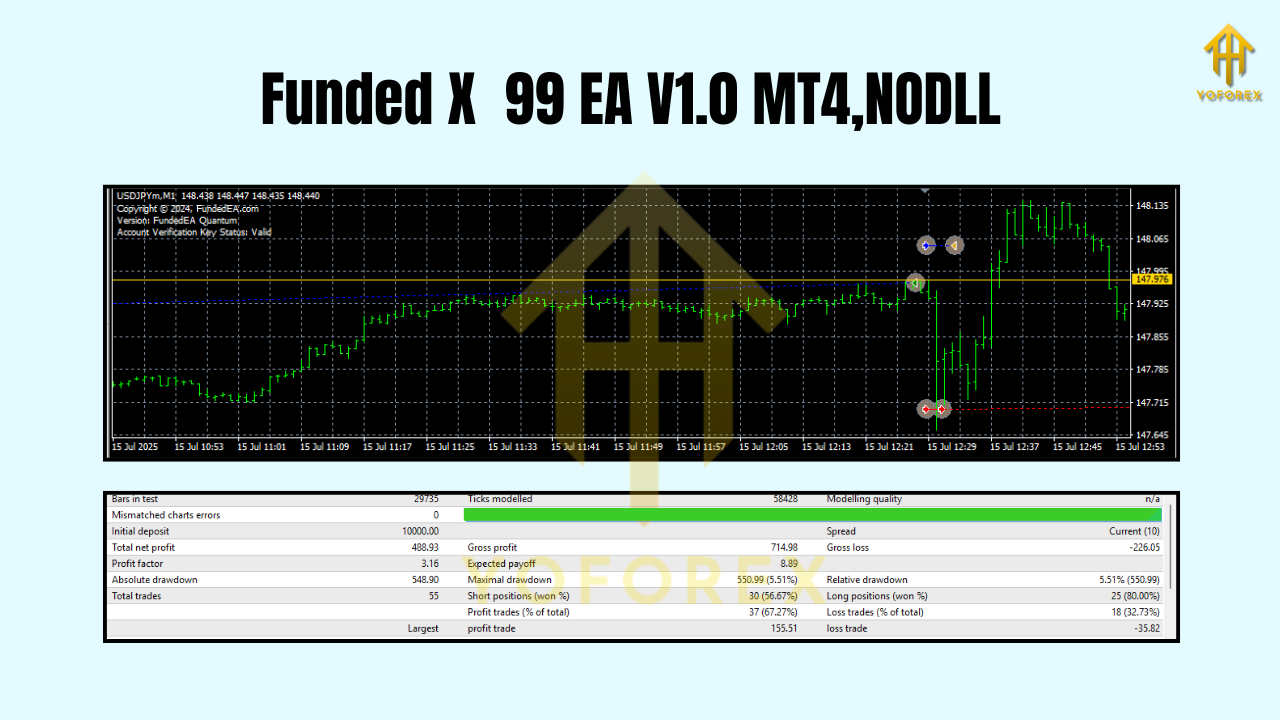

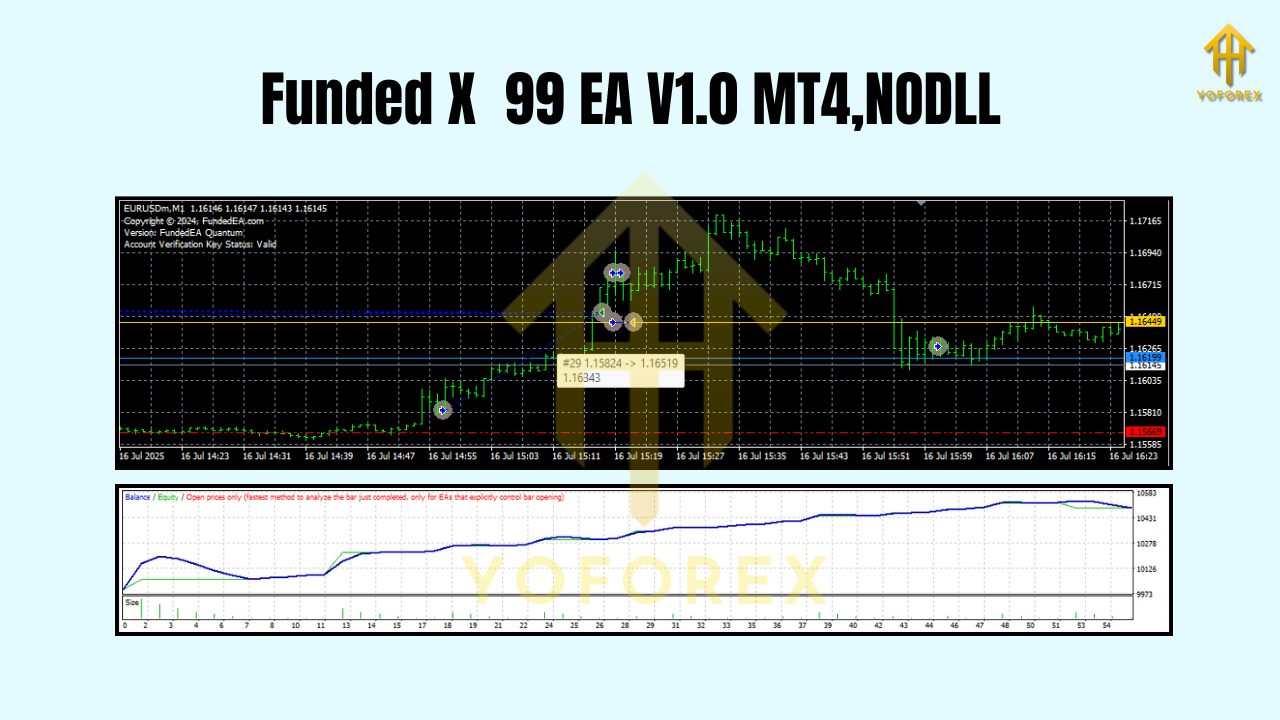

Backtesting & Forward Testing Tips

- Backtest per pair & timeframe to understand variance and typical streaks.

- Walk-forward test using a recent period (last 3–6 months) to gauge adaptability.

- Forward test on demo for 2–4 weeks before going live with a challenge.

- Track key stats: win rate, avg RR, max drawdown, max daily loss streak, and distribution of trade times.

- Use identical settings in demo/live to avoid confounding results.

Example Configurations (Starter Ideas)

- Low-Stress Mode (Challenge)

- Timeframe: H1

- Risk: 0.25% per trade

- Max trades/day: 3–5

- News filter: On (strict)

- Pairs: EURUSD only, add GBPUSD after 2 stable weeks

- Balanced Mode (Funded)

- Timeframe: M15

- Risk: 0.3%–0.5%

- Max trades/day: 5–7

- News filter: On (moderate)

- Pairs: EURUSD + USDJPY, consider AUDCAD

- Active Mode (Experienced Only)

- Timeframe: M5/M1

- Risk: ≤0.25%

- Max trades/day: 8–10

- News filter: On

- Pairs: EURUSD + GBPUSD (tight spreads recommended)

Installation (MT4) & Quick Start

- Copy Files: Download the EA file, then in MT4 go to File → Open Data Folder → MQL4 → Experts and paste it there.

- Restart MT4: Close and reopen MT4 so it recognizes the EA.

- Enable Algo Trading: Make sure AutoTrading is on and “Allow live trading” is enabled in EA properties.

- Attach to Chart: Open your chosen pair/timeframe (e.g., EURUSD H1) and attach Funded X 99 EA.

- Set Risk & Filters: Configure lot sizing, daily loss cap, max trades, and news/session filters.

- Run on Demo First: Observe at least a couple of weeks before using on a challenge.

Best Practices (So You Don’t Break Rules)

- Respect daily loss caps with margin—don’t run them to the exact limit.

- Keep logs of settings and changes; consistency helps with support and troubleshooting.

- Avoid stacking pairs during high-impact news.

- One change at a time: When optimizing, tweak one parameter and re-observe.

Disclaimer

Trading involves risk. No EA can guarantee profit. Prop firm rules vary—always verify requirements and adjust settings accordingly. Test on demo before going live, and never trade money you can’t afford to lose.

Final Word

Funded X 99 EA V1.0 is about control, clarity, and compliance. It gives you the tools to trade funded accounts with discipline—multi-timeframe flexibility, liquid pairs, and risk-first controls—so you can focus on executing your plan without nasty surprises. Start on H1 with modest risk, get your data, then scale sensibly. Simple, steady, sustainable—that’s the goal.

YoForex – empowering traders worldwide, one free tool at a time.

Join our Telegram for the latest updates and support

Comments

Leave a Comment