Funded Firm V1 VIP EA MT4 – Built to Pass Prop Challenges

Introduction: Why this EA exists

If you’ve tried a prop-firm evaluation, you already know the deal—tight daily loss limits, strict max drawdown, no hedging at certain firms, news restrictions, minimum trading days… and zero tolerance for sloppy risk. Funded Firm V1 VIP EA MT4 was built specifically around those constraints. Instead of chasing lightning-fast gains that blow up on day three, this Expert Advisor favors rule-compliant execution, steady risk pacing, and clean trade management so you can focus on consistency. It won’t promise moonshot results (and it shouldn’t), but it gives you sensible guardrails, configurable safety stops, and automation that doesn’t fight the rules. In other words: pass the challenge first; keep the account next.

What it does (in plain English)

Funded Firm V1 VIP EA is a rules-aware trading robot for MetaTrader 4 that prioritizes risk control over raw trade frequency. Under the hood, it blends momentum confirmation with volatility-scaled stops so entries are not only technically valid but proportionate to current market conditions. It aims to avoid overtrading—especially during choppy sessions and high-impact news—while using smart breakeven and trailing logic to protect open profit. You can run it on major pairs and gold; it’s most comfortable on liquid symbols with tight spreads. The EA’s execution engine is designed for raw/ECN accounts, and it’s VPS-friendly for 24/5 uptime.

Key features you’ll actually use

- Prop-firm guardrails: Daily loss and overall max loss caps; when tripped, the EA stops trading automatically.

- No martingale or grid: Fixed, proportional risk per trade. No doubling down, no stacking into drawdown.

- Volatility-based SL/TP: ATR-aware stops scale to current conditions; avoid one-size-fits-all pitfalls.

- Breakeven + trail combo: Lock in gains as trades move; reduce give-back without suffocating winners.

- News filter (optional): Pause around major events to respect firm rules and high-slippage windows.

- Session filters: Focus on London/NY, skip thin or erratic sessions based on your preference.

- Drawdown pause: If equity drawdown exceeds your threshold, the EA parks itself until conditions reset.

- Max trades per day: Limit exposure and avoid overtrading when you’ve already hit daily targets.

- Magic Number & comments: Cleanly separate instances and symbols for tidy reporting.

- Broker safety: Instant SL/TP placement when possible; fallback logic if broker rules disagree.

- Set files included: Baseline configurations for majors and gold to get started quicker.

- VPS-ready: Stable performance with low latency, ideal for prop firm servers.

Recommended pairs, timeframe & risk (starter blueprint)

- Pairs/Symbols: EURUSD, GBPUSD, USDJPY, XAUUSD (Gold).

- Timeframes: M5–M15 for more signals; H1 if you prefer calmer pacing.

- Risk per trade: 0.25%–0.75% on evaluation; up to 1% only after passing and only if your firm allows.

- Max trades/day: 2–6 per symbol (evaluation) to keep psychology and limits in check.

- VPS: Yes—choose a host near your broker/prop server.

- Broker type: ECN/raw spread with fast execution and low commissions.

How it manages prop-firm rules (the big obstacles)

Daily loss & max loss: You can set both. When the equity boundary is reached, the EA halts trading for the day (or for the session). This is core to not failing challenges by accident.

News restriction: If your prop forbids trading around CPI, NFP, FOMC, or similar, enable the news filter and add your blackout offset (e.g., 15–30 minutes before/after).

Minimum trading days: Use Max profit per day or soft daily target. Once reached, the EA can reduce risk or stop for the day so you don’t overshoot.

No martingale/grid: Fully compliant; each trade is independent with fixed fractional risk.

Consistent lot sizing: The EA uses percentage risk; lots scale off account equity to remain consistent and rule-friendly.

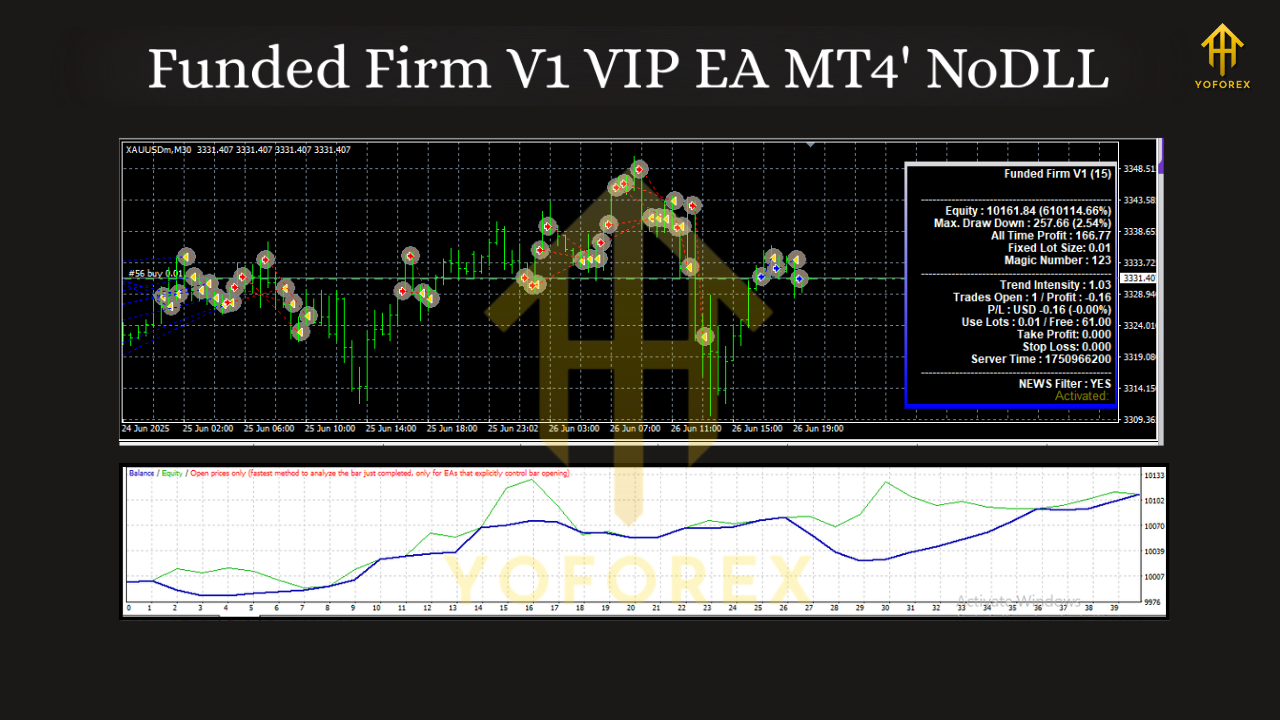

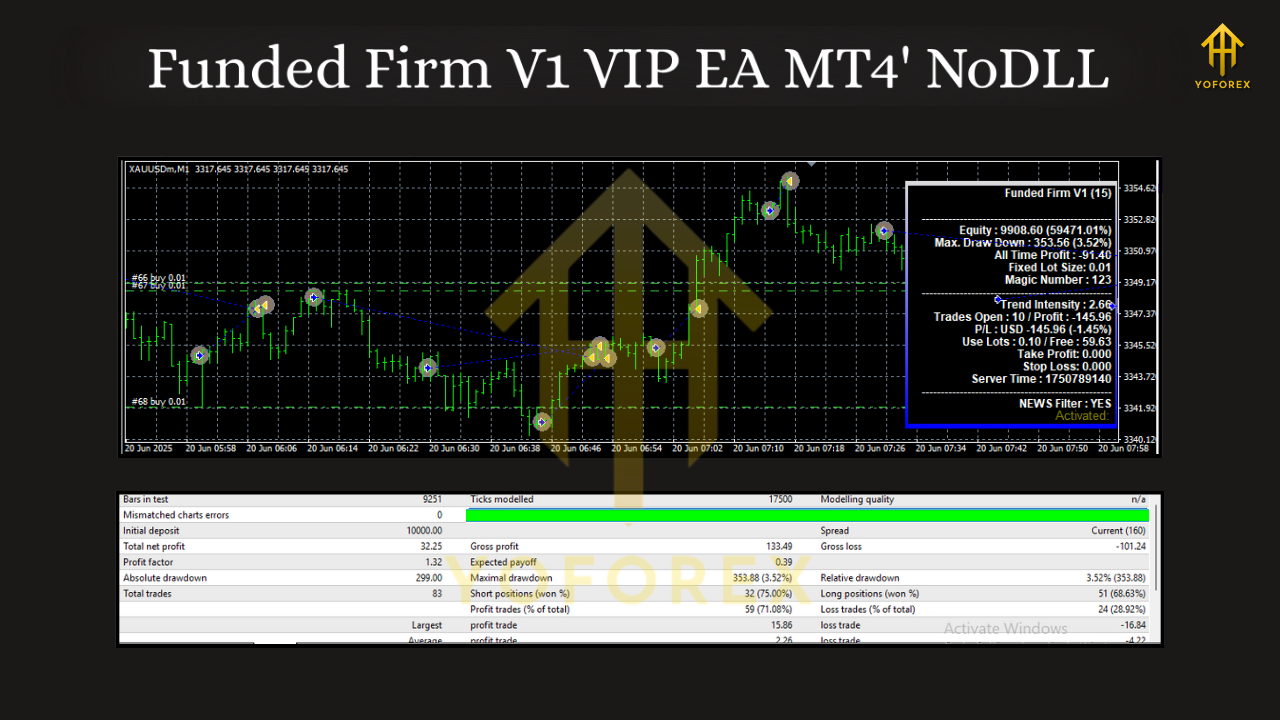

Backtest & forward logic (what results to expect)

Backtests are great for sanity checks, not prophecy. We recommend:

- 5–10 years of data if you can get quality tick data, especially for EURUSD and USDJPY; for gold, at least 3–5 years to capture volatility cycles.

- Modeling quality: Use high-quality ticks with variable spreads and realistic commissions.

- Stress runs: Double spread, add slippage, and confirm the equity curve doesn’t collapse.

- Forward demo: Minimum 2–4 weeks on your target symbols with the news filter and session times you’ll actually use.

Typical shape to aim for in a “prop-friendly” configuration: a gradually rising equity curve with shallow pullbacks, modest trade frequency, and a daily loss breach near zero because the hard stop kicks in. If your curve looks like a rollercoaster, you’re running too hot—dial down risk per trade and max trades/day.

Tip: Many evaluations fail not because of strategy “edge,” but due to risk discipline. Start conservative; you can always scale when you’re in control.

Setup in a few steps

- Install: Place the EA file into MQL4/Experts, restart MT4.

- Enable algo trading: Check AutoTrading is green; allow DLL if your news filter needs it.

- Attach to chart: Open your chosen symbol/timeframe and attach the EA.

- Load a set file: Start with the provided baseline (e.g., EURUSD-M15 or XAUUSD-M5).

- Risk configuration: Set risk per trade (e.g., 0.5%), daily loss cap (e.g., 3–4% below firm rule), and max loss cap (1–2% below firm rule).

- News & sessions: Turn the news filter on (if required) and define sessions; skip illiquid hours.

- VPS deploy: Run on a stable VPS close to your broker/prop server for lower slippage.

- Monitor the first week: Verify logs, broker execution, and that the guardrails behave exactly as you expect.

Operating tips from real-world evaluations

- Soft targets > hard targets: Stop trading once you’re up 1–2R on the day; don’t “gift back” gains.

- Avoid stacking correlated risk: Running the EA on EURUSD and GBPUSD simultaneously? Consider staggered sessions.

- Respect news: Spreads explode on releases; even “good” strategies get bad fills.

- Weekend gaps: Disable late Friday entries unless you absolutely want swing exposure (most firms frown on weekend risk).

- Document everything: Keep a quick journal (symbol, risk, reason) for disputes and self-review.

Who should use Funded Firm V1 VIP EA?

- Traders attempting prop-firm evaluations who want a rules-aware, automated assistant.

- Funded traders who prioritize preserving the account over hitting home runs.

- Newer algo users needing clean risk defaults and minimal babysitting.

- Busy professionals who can’t stare at charts all day but still want structured, rule-compliant execution.

Final word

Passing an evaluation isn’t about being the smartest trader in the room; it’s about making fewer unforced errors. Funded Firm V1 VIP EA MT4 was built to lower those errors—risk spikes, news traps, revenge trading, and overexposure. Set it up once, verify your guardrails in demo, and let the process do the heavy lifting. Slow is smooth; smooth is fast.

Comments

Leave a Comment