If you’ve ever blown a prop-firm challenge on Day 4 after a tiny drawdown spike… yeah, we’ve all been there. The Funded Firm EA V1 for MT4 is built for one job: help traders respect prop-firm rules while still taking quality trades. Instead of gambling on a “moonshot” strategy, this EA focuses on consistency, daily loss protection, and a clean, repeatable process you can actually stick with. It won’t promise miracles; it does promise structure—risk caps, timing filters, spread checks, and trade logic that’s designed around what funded-account programs actually allow. And coz it’s MT4-native, setup is simple, the dashboard is familiar, and you can customize it quickly for your broker’s conditions.

Below you’ll find a full, no-fluff overview: how the EA works, recommended pairs/timeframes, prop-firm friendly settings, and how to backtest it correctly so you don’t fool yourself. By the end, you’ll have a practical way to trade more like an algorithm and less like an emotional human (we all know how that goes).

What Is Funded Firm EA V1 MT4?

Funded Firm EA V1 is a MetaTrader 4 Expert Advisor engineered for proprietary trading firm rules—things like max daily loss, overall drawdown, maximum lot size constraints, news sensitivity, and consistency requirements. Its logic blends trend-following entries with volatility filters and a risk-aware exit engine that tries to secure gains early on choppy days and let winners breathe when conditions are clean.

The EA isn’t a black box that hides everything. You’ll see:

- A clear on-chart panel with current risk, session, and status (enabled/disabled).

- Input parameters for daily loss caps, max trades per session, and auto lot sizing tuned to your account balance.

- Filters for spread, slippage, and news timing—so it simply refuses to trade in bad conditions.

- Optional time windows (e.g., London session only), which is helpful if your prop firm monitors overnight exposure or session behavior.

Think of it as a safety-first engine. You can nudge it more aggressive, sure, but the default spirit is to protect your challenge first—and scale later once you’re funded.

Why It’s Prop-Firm Friendly (The Philosophy)

- Daily Loss Limit — Don’t exceed it. Ever.

- Total Drawdown — Stay well below the max equity drawdown.

- Consistency — Avoid one giant outlier day; aim for smooth equity growth.

- News & Spreads — Don’t get wrecked during red-flag events or when spreads blow out.

- Risk Controls — Fixed risk per trade, controlled exposure, and no reckless martingale.

Funded Firm EA V1 is constructed around those constraints. The EA can pause itself after a defined equity drawdown or after hitting its daily target (smart if your firm wants you to “lock in” consistency). It also uses a volatility band + trend filter to pick entries that align with directional momentum rather than fighting it.

Key Features (At a Glance)

- Risk-First Design with Daily Loss Guard and Equity Drawdown Guard.

- Auto Lot Sizing based on balance/equity and your risk-per-trade input.

- Time Filters for London/NY sessions; pause during rollover or illiquid hours.

- Spread & Slippage Filters to avoid poor-quality fills.

- News Buffer (optional) to pause X minutes before/after high-impact releases.

- Max Trades Per Day / Per Session to keep things tidy and compliant.

- Partial Close + Trailing Logic to bank gains without killing winners too early.

- No Martingale, No Grid by default (you can enable add-ons, but not recommended for challenges).

- Trade Comments & Magic Numbers for clean tracking inside MT4.

- Dashboard Panel showing status, P/L today, next session state, and risk.

How the Strategy Works (Under the Hood)

- Market Bias: The EA detects short-term trend direction via moving-average slope and a volatility envelope. If price is expanding in one direction and pullbacks remain shallow, entries are allowed in trend direction only.

- Entry Timing: It looks for a small retracement back toward a dynamic midline. If the pullback aligns with low spread and stable volatility (no wild spikes), it places a market or limit order (depending on your setting).

- Stops & Targets: Initial SL is technical (just beyond the recent structure) plus a volatility buffer. TP is adaptive; part of the position can be clipped at R:R 1.0–1.2 while a runner trails behind a structure-based stop. You can make it tighter during challenges and slightly looser after you’re funded.

- Daily Behavior: If the EA hits your daily profit target, it can go flat and stop trading. If daily drawdown hits your max, it disables itself for the rest of the day. Simple, safe, predictable.

Recommended Pairs, Timeframes, and Risk

- Pairs: EURUSD, GBPUSD, XAUUSD (gold), USDJPY.

- Timeframes: M15 and M30 for challenges (more signals, still reasonable noise control). H1 for funded scaling (cleaner structure, fewer trades).

- Risk per Trade (during challenges): 0.25%–0.5% per trade; cap daily loss at 1%–2% depending on firm rules.

- Max Daily Trades: 3–6 for FX, 2–4 for gold (gold moves big—less is more).

- News Handling: Pause 15–30 minutes before and after tier-1 events (NFP, CPI, FOMC, rate decisions).

Installation & Setup (MT4)

- Copy Files: Place the EA file into

MQL4/Expertsin your MT4 data folder. - Restart MT4: Or hit Refresh in the Navigator panel.

- Attach to Chart: Open your preferred symbol/timeframe, drag the EA onto the chart, and enable algo trading.

- Broker Settings: Ensure your prop firm’s broker feed is selected in MT4. Check spread in the Market Watch—if it’s consistently high, consider a different session.

Inputs (Core):

- Daily Loss Limit (% or amount)

- Daily Profit Target (optional)

- Risk per Trade (%)

- Max Trades per Day / per Session

- Spread Limit (points) and Slippage (points)

- Session Start/End (e.g., 06:30–10:30, 13:30–16:30 UTC)

- News Pause (minutes before/after)

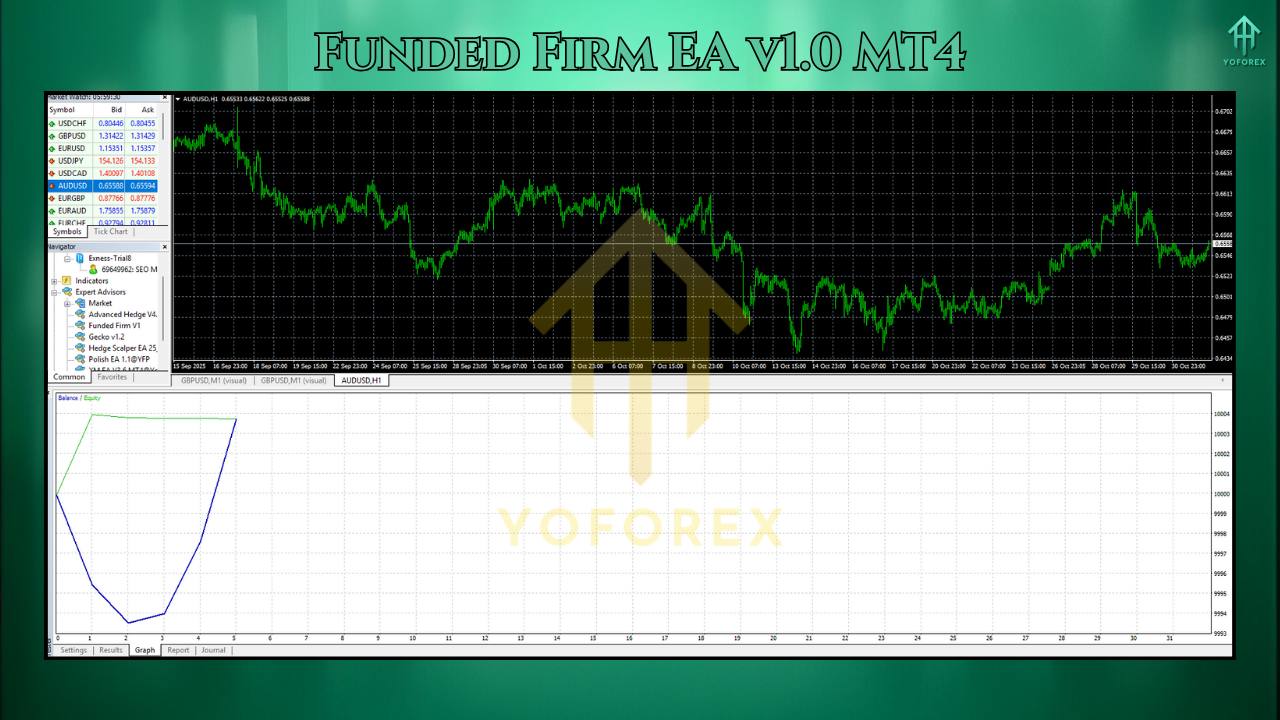

Backtesting the Right Way (So You Don’t Fool Yourself)

- Modeling Quality: Use high-quality tick data if possible.

- Spread: Don’t leave it at “current.” Use a realistic average or variable spread if your tool supports it.

- Execution: Add slippage (1–3 points for majors, can be more for gold).

- News Pauses: If your firm forbids trading during specific events, replicate the pause windows.

- Risk Rules Enforced: Script your daily loss stop and max trades per day—make sure the test respects your prop rules.

- Sample Size: Don’t “optimize” on 2 weeks and call it a day. Run at least 6–12 months across different sessions, then walk-forward on a fresh period with no parameter tweaking.

- Multiple Symbols: Test EURUSD, GBPUSD, USDJPY, and XAUUSD separately; then decide which two produce the cleanest, most consistent curve under your risk caps.

Live Trading Tips for Prop Challenges

- Pick Two Symbols Max: For challenges, focus. EURUSD + XAUUSD is a common combo, but if gold feels too wild, switch to USDJPY.

- Start Conservative: First 3–5 days at 0.25% risk. Build a buffer. Increase slightly only if the curve behaves.

- Respect Time Windows: Avoid the last 10–15 minutes before session change or rollover; spreads often spike.

- Lock Wins: If you bag 0.7%–1% early in the day, consider enabling the EA’s Day Lock (stop trading after daily target).

- No Revenge: If the EA takes two losers early, it’s probably not the day. Let the daily loss guard protect you; tomorrow is another session.

Troubleshooting (Fast Fixes)

- “No trades placed” — Your spread/slippage filters are too strict or the session window is closed. Loosen slightly or wait for London/NY.

- “Frequent break-even exits” — Volatility bands might be narrow. Widen the trailing step a touch, or reduce partial close size.

- “Hit daily loss quickly” — Risk per trade too high or news filter too short. Cut risk to 0.25% and increase the news pause.

- “Big slippage on gold” — Trade gold only in the most liquid hours; consider slightly wider stops and smaller lot sizes.

Who Is This For?

- Challenge Takers: You want a rules-aware, low-stress system that won’t sabotage you.

- Funded Traders: You want to protect the account, avoid violation triggers, and scale slowly.

- Busy Professionals: Prefer set-and-forget with defined windows instead of manual entries all day.

- Risk-Aware Newcomers: You need an EA that enforces discipline and teaches consistency.

Pros and Cons

Pros

- Built-in daily loss/target guardrails

- Clean session control and spread/slippage filters

- No martingale/grid by default

- Partial close + trailing for practical cash-flow

Cons

- Fewer trades on tight spread rules (patience required)

- News pauses can skip big moves (by design—safety first)

- Needs proper backtests (with realistic assumptions) to shine

Final Word

Funded Firm EA V1 MT4 is not the “get rich in 7 days” robot. It’s the “don’t blow your challenge, grow steadily, sleep at night” robot. If you’re serious about prop-firm consistency, set your daily guardrails, keep risk modest, and let the EA do its job. You can always scale once you pass and get funded—your first mission is survival.

Call to Action:

Ready to trade smarter within prop-firm rules? Set up the Funded Firm EA V1 on a demo, fine-tune the session and risk filters for your broker, then step into your next challenge with a plan. Pass first, scale second.

Comments

Leave a Comment