FMM Ultimate Pro Scalper EA V1 MT4 — High-Frequency Scalping That Fits $100 Accounts

If you’ve been hunting for a practical scalping bot that doesn’t demand a huge balance or months of tinkering, FMM Ultimate Pro Scalper EA V1 for MetaTrader 4 is built for that exact sweet spot. It scans the market at every new candlestick, reads complex candlestick formations, and fires only when conditions align—keeping entries sharp and execution quick. Whether you’re a retail trader starting with $100 or a funded-account aspirant looking for clean risk discipline, this EA aims to give you a fast, rules-first framework without the fluff.

What Makes FMM Ultimate Pro Scalper Different?

Clarity and control. The EA focuses on high-frequency opportunities that come from fresh candles—where spreads, volatility, and micro structure matter most. Instead of chasing every tick, it waits for specific pattern clusters (think engulfings, pin bars, inside/outside combinations) combined with spread and volatility checks. That way you’re not overtrading when the market is sleepy or spreads are nasty.

Flexibility. It’s designed to run on any timeframe and any pair, so you can align it with your broker conditions and your personal risk. Prefer EURUSD M1 at London open? Go for it. Want to slow things down on H1 for indices or gold? Also fine. The parameters are there to help you adapt without rewriting the playbook.

Prop-firm aware. Many traders use scalpers to pass challenges but get tripped up by daily drawdown rules. This EA is intentionally light on risk by default and can be tuned with strict daily loss limits, max trades per day, and “pause after loss” controls (described below) to keep your equity curve smoother when the pressure’s on.

At a Glance (Specs & Requirements)

- Platform: MetaTrader 4 (MT4)

- Method: Short-term scalping with HFT-style decision frequency (evaluates at each new candle)

- Time Frame: Any (M1–M15 popular for scalping; H1–H4 for calmer pace)

- Pairs/Markets: Any currency pair (also works on metals/indices if your broker allows)

- Minimum Deposit: $100 (start small; scale once stable)

- Leverage: 1:100+ recommended (check your broker/risk rules)

- Account Types: ECN/RAW preferred for tight spreads and fast execution

- Infrastructure: VPS strongly recommended (aim for <10 ms to your broker)

How the Strategy Works (Without the Hype)

1) Pattern logic at candle open

On every new candlestick, the EA reads the last N bars for context: momentum, wick length, body-to-range ratios, and specific patterns (e.g., engulfing/inside bars) that tend to precede short bursts of continuation or mean-reversion. The chosen direction isn’t random; it’s based on a confluence of these micro-signals.

2) Spread & volatility filters

It will not fire in poor trading conditions. If spread exceeds your threshold (say, 1.5–2.0 pips on majors) or volatility drops below a minimum ATR level, it stands down. Quiet sessions and widened spreads can crush scalpers—this filter is your guardrail.

3) Risk is front-loaded

Each trade is placed with a defined stop-loss and take-profit. You can choose a fixed TP/SL (e.g., TP 6–12 pips, SL 8–15 pips on majors) or ATR-based dynamic settings, which adapt to market conditions. Optional breakeven and trailing rules help protect open profit—useful on M1/M5 when momentum is fast but fragile.

4) Trade frequency management

For funded accounts, the EA supports limiting max trades per day, max concurrent positions, and daily loss cut (e.g., stop all trading for the day if equity drops by 2–3%). These simple governors help you stay compliant with prop-firm rules and keep drawdowns orderly.

Recommended Setups (Kick-Start Presets)

Low-spread majors (EURUSD, USDJPY, GBPUSD)

- Timeframe: M1 or M5

- Risk per trade: 0.5%–1.0%

- TP/SL: Start with TP 7–10 pips, SL 10–14 pips (tweak by pair)

- Filters: Spread <= 1.5 pips; ATR filter ON; pause during rollover

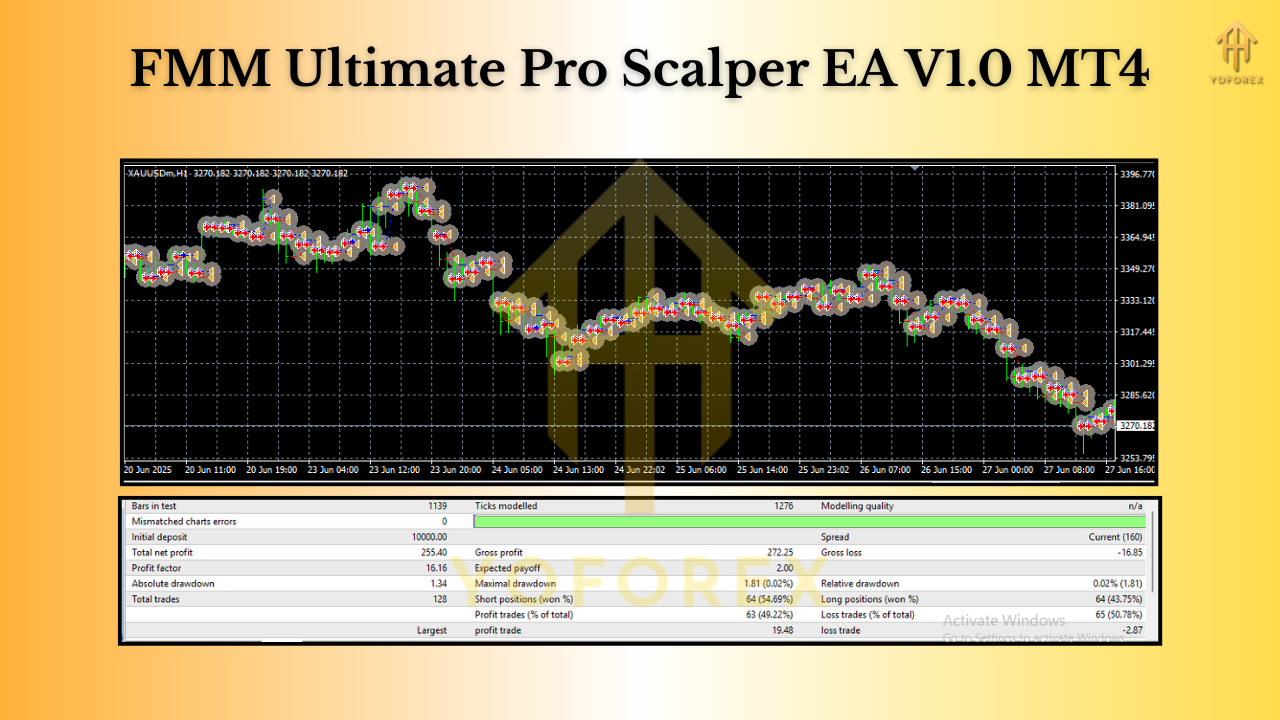

Gold (XAUUSD) or Indices

- Timeframe: M5–M15 (or H1 for calmer trading)

- Risk per trade: 0.25%–0.5% (these instruments move fast)

- ATR-based TP/SL: Aim for 0.5–0.8x ATR for TP, 1.0–1.2x ATR for SL

- News caution: Avoid high-impact releases; volatility spikes can slip entries

Prop-firm safety

- Daily loss cap: 2%–3%

- Max trades/day: 5–10 (depending on session/timeframe)

- Pause after loss: 15–60 minutes cool-down to avoid revenge sequences

Tip: Always forward-test on a demo while you refine broker, VPS, and session choices. Once you like the equity behavior, switch to small live risk and grow from there.

Installation & Quick Configuration (MT4)

- Copy the EA into

MQL4/Expertsinside your MT4 data folder. - Restart MT4 so it appears under Navigator → Expert Advisors.

- Attach to chart (start with EURUSD M1 or M5 for testing).

- In the Inputs tab, set:

- Lot/Risk mode: fixed lots for tiny accounts; %-risk as you scale.

- TP/SL style: fixed pips or ATR-based.

- Filters: spread limit, ATR minimum, session times (e.g., focus on London/NY overlap).

- Safety: max trades/day, daily loss stop, pause after loss.

5. Enable AutoTrading (green). Confirm Allow live trading is ticked.

6. Use a VPS for stability and low latency. Keep your MT4 running 24/5.

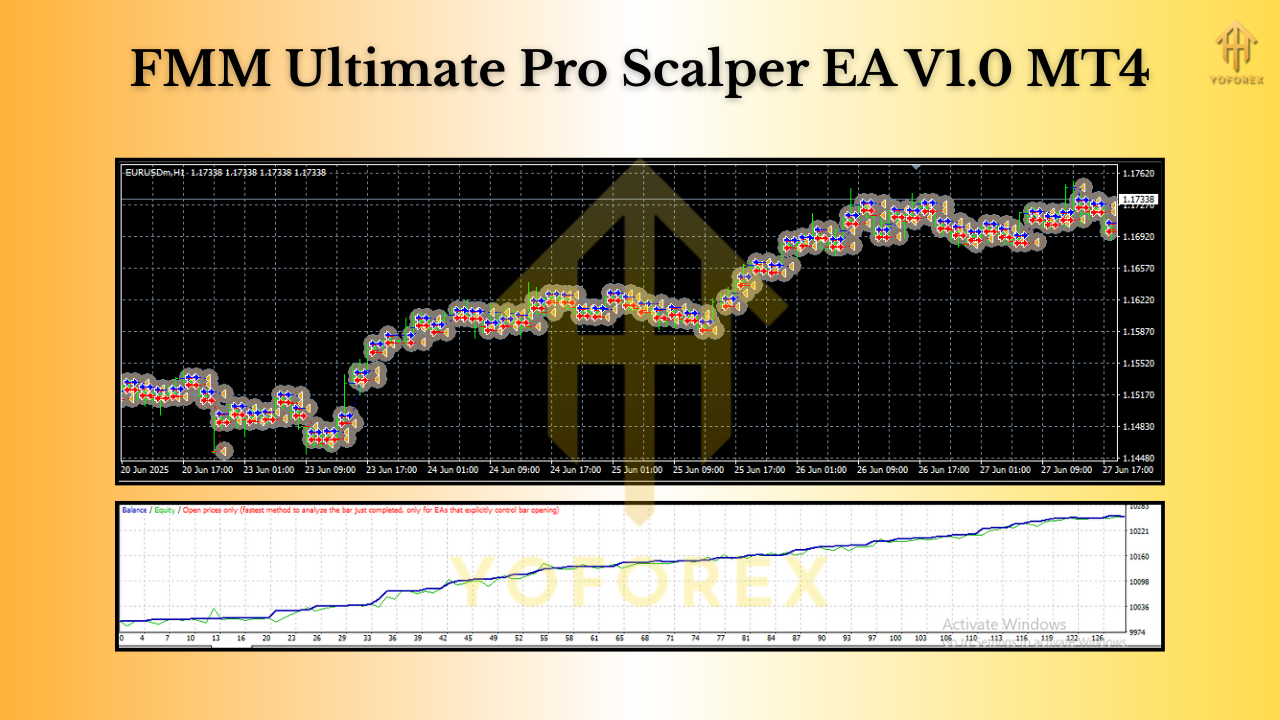

Backtesting & Forward-Testing Best Practices

- Modeling quality: Use tick-by-tick with variable spread and realistic slippage.

- Data range: At least 2–3 years per pair/timeframe to see different regimes.

- Session specificity: If you’ll only trade London, backtest that session window (e.g., 07:00–11:00 UTC).

- Robustness checks: Slightly perturb settings (±10–20%) and confirm equity holds up—this reduces the risk of curve-fit parameters.

- Forward test: Demo for 2–4 weeks on the exact broker/VPS you’ll use live; validate fills and behavior around rollovers and minor news.

Risk & Money Management (The Real Edge)

Scalping edges are thin; risk discipline is the amplifier. Keep these rules front and center:

- Small position sizing: 0.25%–1.0% risk per trade is plenty for scalping.

- Daily stop: Stop trading for the day if you’re down 2–3%. Tomorrow’s a new market.

- Trade fewer pairs: Depth beats breadth for scalping. Start with 1–2 symbols and master execution conditions.

- Avoid chaotic windows: Rollover, spreads spikes, and major news—stand aside.

- Journal everything: Time, spread, slippage, TP/SL outcomes, and session context.

Who Is This EA For?

- Small-account traders who want to start with $100 and compound carefully.

- Prop-firm candidates who need rule-friendly controls (max daily loss, limited trades).

- Busy professionals who prefer rules-driven entries without manual chart-watching.

- Advanced users who want a modular base they can tune for different symbols.

Final Thoughts

FMM Ultimate Pro Scalper EA V1 MT4 keeps things simple where it counts: clean entries, strict filters, and risk controls you can actually live with. If you’ve been burned by over-promised bots, this approach—scalping at new candles with spread and volatility guardrails—can feel refreshingly sane. Start small, test properly, and scale only when the equity curve proves itself on your broker and your VPS.

Join our Telegram for the latest updates and support

Comments

Leave a Comment