FastWay EA V1.23 MT5 – A Set-and-Forget Mean-Reversion Powerhouse for M15

Tired of juggling a dozen chart windows and second-guessing your entries? If you’ve been hunting for a smart, low-maintenance Expert Advisor that doesn’t blow up your risk budget, FastWay EA V1.23 for MT5 may just be your new daily driver. It’s built on a robust mean-reversion engine and tuned for M15 execution on highly correlated pairs—AUDCAD, AUDNZD, EURGBP, and NZDCAD. The goal is simple: identify statistically stretched moves, fade the excess, and exit with consistent, realistic gains. No drama. No gimmicks. Just disciplined math, tight risk practices, and a workflow you can actually live with.

In this deep-dive, we’ll cover how the EA works, what makes it tick, the pairs/timeframe logic, risk settings, installation, optimization ideas, backtest hygiene, and day-to-day best practices. I’ll also share a pragmatic setup you can mirror on demo and then scale—coz that’s the smart path before you go live.

What is FastWay EA V1.23?

FastWay EA V1.23 is a MetaTrader 5 automated trading system that uses a mean-reversion strategy to exploit short-term overextensions in price. On M15, markets often create micro-trends and quick surges driven by orderflow bursts. Those bursts frequently revert toward a local equilibrium; FastWay scans for these stretched situations across AUDCAD, AUDNZD, EURGBP, and NZDCAD, then enters counter-moves with pre-defined risk and exit logic.

Key design ideas:

- Confluence-based stretch detection: combines volatility filters, recent range analysis, and correlation context.

- Protect-first execution: hard stop-loss on every order; dynamic take-profit linked to realized volatility.

- Position sizing discipline: fixed or %-risk per trade, with optional equity guards.

- No martingale: scaling is conservative and conditional—no runaway lot multipliers.

If you like the “set it and let it run (with guardrails)” approach, FastWay was genuinely made for you.

Why These Pairs? Why M15?

AUDCAD, AUDNZD, EURGBP, and NZDCAD share two traits that are gold for mean-reversion:

- Structural correlation and range behavior

Crosses like EURGBP and commodity-adjacent pairs like AUDCAD/AUDNZD/NZDCAD often oscillate within recognizable intraday bands. When they overshoot, reversion probabilities rise. - Cost & micro-volatility balance

On most reputable brokers, spreads are moderate, and M15 offers a sweet spot—fast enough to produce opportunities, slow enough to avoid whipsaw noise you get on M1/M5.

M15 also reduces the computational burden while keeping signal frequency healthy. You’ll typically see multiple quality setups per week per pair, not dozens of low-quality pings per day.

Core Features at a Glance

- Mean-reversion engine tuned for M15 on AUDCAD, AUDNZD, EURGBP, NZDCAD

- Pre-trade filters: volatility, session timing, spread, and trend context

- Hard SL / dynamic TP: always-on stop-loss; take-profit scales with ATR or realized range

- Position sizing: fixed lots or %-risk per trade with equity-based caps

- Max exposure control: limits on concurrent trades per pair and across the portfolio

- News avoidance (optional): pause entries around high-impact events (if broker time & calendar integration allow)

- Equity protector: daily drawdown stop, weekly loss cap, and “cool-off” periods after a losing streak

- Broker-agnostic design: works on most MT5 brokers (low spread + fast execution recommended)

- Simple UI: readable status panel showing symbol, risk, spread, and session state

How FastWay Finds Its Edge

1) Detecting Stretch

The system measures short-term deviation from a rolling mean using ATR-normalized distance and z-score-style filters. When price extends beyond a threshold—especially if a correlated pair cluster is also extended—probabilities tilt toward reversion.

2) Confirming Context

No single metric is enough. FastWay adds guardrails:

- Spread check (skip if too wide)

- Volatility floor/ceiling (skip dead zones or chaos spikes)

- Session awareness (focus on London/NY overlaps where liquidity normalizes reversion)

- Mini-trend bias (fades extremes but avoids stepping in front of steamrollers)

3) Exits that Respect the Tape

Take-profit scales with real-time volatility. If the market breathes, TP breathes. Stop-losses are hard and independent. You’ll never see “I swear it’ll come back, let’s double down” logic—FastWay doesn’t do hopium.

Recommended Setup (Start on Demo)

- Timeframe: M15 (mandatory)

- Pairs: AUDCAD, AUDNZD, EURGBP, NZDCAD

- Account type: ECN/Raw spread preferred

- Leverage: 1:100–1:500 (use responsibly)

- Starting balance (demo/live): Start where your percent-risk translates cleanly (e.g., $500–$2,000 demo is fine to learn).

- Risk per trade: 0.5%–1.0% as a baseline; conservative is cool.

- Max concurrent trades: 1–2 per symbol, 3–4 portfolio-wide.

- Daily loss stop: 2%–3% (EA stops new entries for the day).

- Weekly loss stop: 5%–8% (EA pauses for the week—review settings).

Pro tip: trade a basket (all four symbols) with low correlated exposure per side. The whole point of these pairs is to let mean-reversion “average out” across a portfolio, not to bet the farm on one candle.

Installation & First Run

- Copy EA files:

In MT5, go to File → Open Data Folder → MQL5 → Experts and paste FastWay EA V1.23.ex5 there. - Restart MT5:

Or right-click Experts in the Navigator and choose Refresh. - Attach to charts:

Open M15 charts for AUDCAD, AUDNZD, EURGBP, NZDCAD. Drag FastWay EA V1.23 onto each chart. - Allow algo trading:

Check “Allow Algo Trading” in both the platform and EA properties. - Set risk & guards:

- Risk Mode: PercentPerTrade

- Risk %: 0.5–1.0

- Max Trades per Symbol: 1–2

- Daily Loss Stop: 2.5%

- Weekly Loss Stop: 6%

- News Filter (if available): Enabled with 15–30 min pre/post buffer.

6. Run on demo:

Let it cycle through at least 4–6 weeks of mixed conditions before moving to live. Tho it’s tempting to rush, patience here pays.

Parameter Cheatsheet (Suggested)

- RiskMode: FixedLot / PercentPerTrade (choose PercentPerTrade)

- RiskPercent: 0.5–1.0

- SL_Multiple_ATR: 1.2–1.8 ATR(14)

- TP_Multiple_ATR: 0.8–1.2 ATR(14) (dynamic; can trail if enabled)

- MaxSpread (points): broker-dependent; keep tight (e.g., 20–25 points on 5-digit pricing)

- MaxOpenTradesPerSymbol: 1–2

- MaxPortfolioTrades: 3–4

- PauseOnHighImpactNews: true

- NewsBufferMinutes: 20/20

- DailyLossStopPercent: 2–3

- WeeklyLossStopPercent: 5–8

- CoolOffAfterLosingStreak: 1–2 hours after 2 consecutive losses

These aren’t absolutes; they’re pragmatic defaults. Always test on your broker feed—liquidity, spread, and execution quality change outcomes.

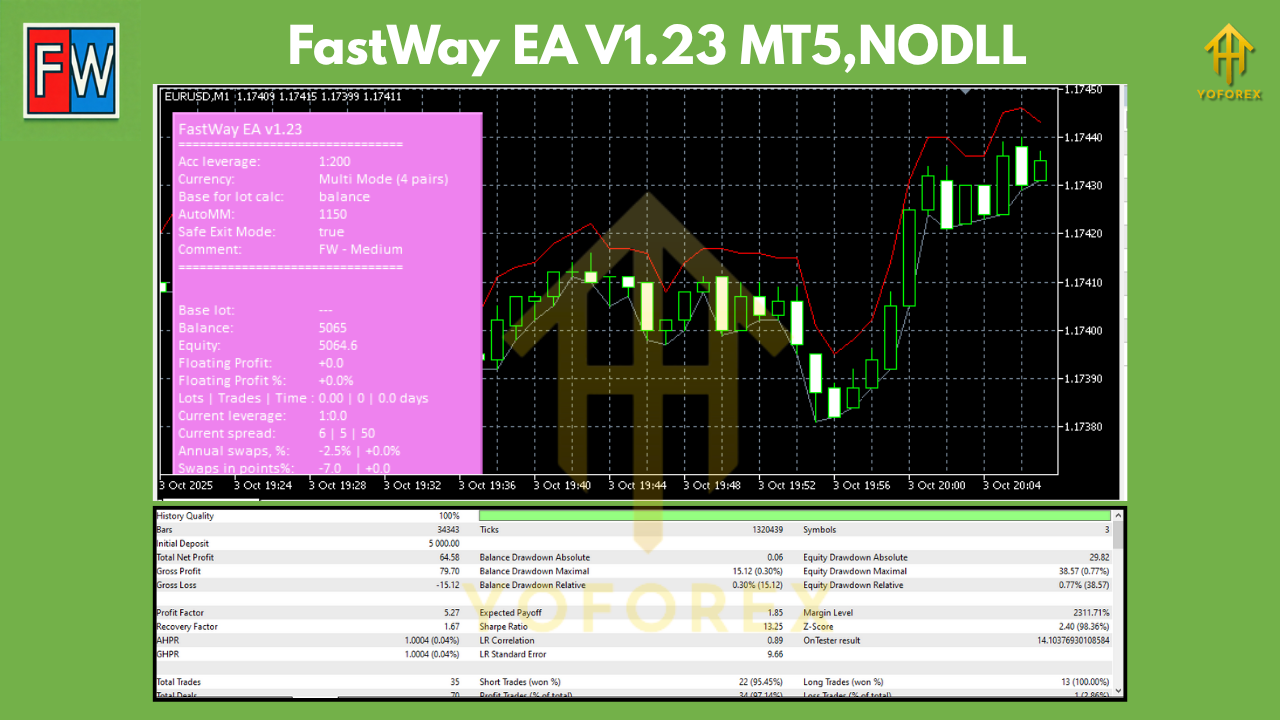

Backtesting Like a Pro (and What to Expect)

Backtests are only as good as your data quality and modeling choices. For a fair view:

- Use tick-data or at least 1-min with variable spreads

- Model real slippage (0.1–0.3 pips typical on liquid pairs, can be higher in news)

- Run long windows (2–5 years) plus recent forward-period (last 6–12 months)

- Test by symbol and in portfolio—the whole design leans on a basket effect

What you’re hunting for in reports:

- Equity curve: steady staircase rather than vertical rockets

- Max drawdown: contained and proportional to your risk %

- Trade count: a healthy sample (hundreds), not a handful of lucky hits

- Per-pair contribution: none should dominate 80%+ of profits—diversity is your resilience

Backtests with the above sanity checks typically show moderate, repeatable gains with contained DD when risk is held at ≤1% per trade. Remember, the edge is consistency, not lottery tickets.

Live Trading Tips (Where Most People Slip)

- Keep the same chart environment used in testing (M15, same symbols, same session filters).

- Avoid stacking risk across correlated pairs in the same direction at the same time.

- Respect daily/weekly loss stops—they exist to protect your capital and your headspace.

- Review monthly, not daily. One red day doesn’t equal a broken system.

- Update only after evaluation—don’t tweak every other day; log changes and give them time to prove value.

Strengths & Trade-Offs

What FastWay does really well

- Turns noisy M15 impulses into tradable, repeatable mean-reversion snapshots

- Puts risk first: hard SL, equity guards, and no martingale

- Keeps operator effort low—once configured, it’s set-and-forget with periodic checks

- Works as a basket system—natural diversification across four correlated pairs

What to keep in mind

- Mean-reversion can underperform in strong, one-way macro trends—your filters mitigate this, but they don’t eliminate it

- Slippage and spread during news can dent edge—hence the optional news buffer

- Requires discipline: profits stack over weeks/months, not hours

A Simple Starter Playbook

- Demo for 4–6 weeks with the default risk profile (0.5% per trade).

- Journal weekly: note spread behavior, session outcomes, and any slippage spikes.

- Move to small live once demo matches expectations—don’t rush.

- Scale slowly: increase risk by 0.25% steps only after stable months.

- Keep your cool: if a rough week hits, the EA’s equity guards and your plan protect you. Review, don’t react.

Final Thoughts

FastWay EA V1.23 MT5 is for traders who want evidence-based mean-reversion, tight risk, and straightforward operations on M15 across AUDCAD, AUDNZD, EURGBP, and NZDCAD. It won’t promise the moon; instead it aims for clean, sustainable execution that respects your capital and time. If you’ve been burned by over-optimized, martingale-ish gizmos, this is refreshingly different. Give it a proper demo cycle, keep your risk small, and let the edge compound. That’s the FastWay.

Comments

Leave a Comment