If you’ve been hunting for a clean, fast, no-nonsense scalper for MetaTrader 4, this one’s for you. Traders get tired of overpriced robots that promise the moon and then quietly blow accounts, right? Euro Scalper EA V1.17 MT4 is built to do the opposite—tight logic, risk-first engineering, and a realistic edge on euro-denominated pairs. It’s lightweight, fast to configure, and tuned for modern brokerage conditions (tight spreads, fast execution, VPS friendly). And yes—it’s free to download from YoForex, coz we believe quality automation shouldn’t be paywalled behind hype.

What is Euro Scalper EA V1.17 MT4? (Overview)

Euro Scalper EA V1.17 MT4 is an automated trading system for MetaTrader 4 that focuses on micro-moves during active market sessions. It looks for short bursts of momentum and mean-reversion opportunities, manages risk via dynamic stop placement, and exits decisively to keep overall trade duration brief. The EA is best used on EUR-centric symbols (EURUSD primary), and it works on M1–M15 timeframes, with M5 commonly preferred for a balance of signals vs. noise.

The core logic blends two principles:

- Volatility-aware entries – the EA reads intraday volatility, spread conditions, and micro-trend direction to time entries.

- Strict risk envelope – stops and profit targets are adaptive, aiming to protect capital first and compound steadily over time.

YoForex’s internal test bench validated the logic in forward simulation across multiple brokers and months of data. While no EA is magic (and we’ll never claim that), Euro Scalper EA behaves predictably under tight-spread, low-latency conditions. That’s the point.

Key Features

• Scalping-first logic: Designed for short holding periods and quick exits.

• Pairs: EURUSD as primary; EURJPY and EURGBP optional once you’re comfortable.

• Timeframes: Works on M1–M15; sweet spot is typically M5.

• Risk controls baked-in: Fixed SL per setup, ATR-assisted sizing, max daily loss cap (user-defined).

• Spread & slippage filters: Avoids trading in poor liquidity moments.

• Session awareness: Prefers London/NY overlaps; optional Asia quiet mode.

• No martingale, no grid: Clean entries and exits; no dangerous lot escalation.

• News pause (optional): Pause trading around high-impact events to reduce whipsaw risk.

• Broker-agnostic, ECN-friendly: Works best with raw/low-spread accounts and a VPS.

• Set-and-observe simplicity: Sensible defaults; power users can tweak advanced params later.

• Drawdown control: Daily stop feature to step aside when conditions degrade.

• Alerts & logs: Clear on-chart commentary and journal logging to help you learn from fills/slippage.

Recommended Requirements

- Platform: MetaTrader 4 (build up-to-date)

- Pairs: EURUSD (primary), optional EURJPY/EURGBP once stable

- Timeframe: M5 recommended (M1–M15 supported)

- Min Deposit: $100–$300 for conservative 0.01 lots; scale thoughtfully

- Leverage: 1:100 to 1:500 (broker dependent)

- Broker: Low-spread, fast execution, stop level = 0 preferred

- VPS: Strongly recommended if your home internet isn’t sub-10ms to broker

How the Strategy Works (Under the Hood)

Euro Scalper EA V1.17 analyzes micro-trend continuation and near-term mean-reversion. It looks for liquidity pockets where price tends to push 3–10 pips and either extend or snap back. Signals typically appear around session opens or when volatility wakes up. The EA checks:

- Short-term momentum slope (are we stretching or coiling?)

- ATR and spread thresholds (is the move tradable after costs?)

- Micro-structure context (recent highs/lows, wicks, and quick breaks)

- Execution health (slippage monitors, re-quotes, partial fills if any)

When conditions align, it opens small, targeted positions with hard stops and take profits set relative to real-time volatility. No martingale, no grid—just clean, repeatable trades. If the spread widens or slippage spikes, the EA either filters the trade or exits quickly; capital protection is the default setting, always.

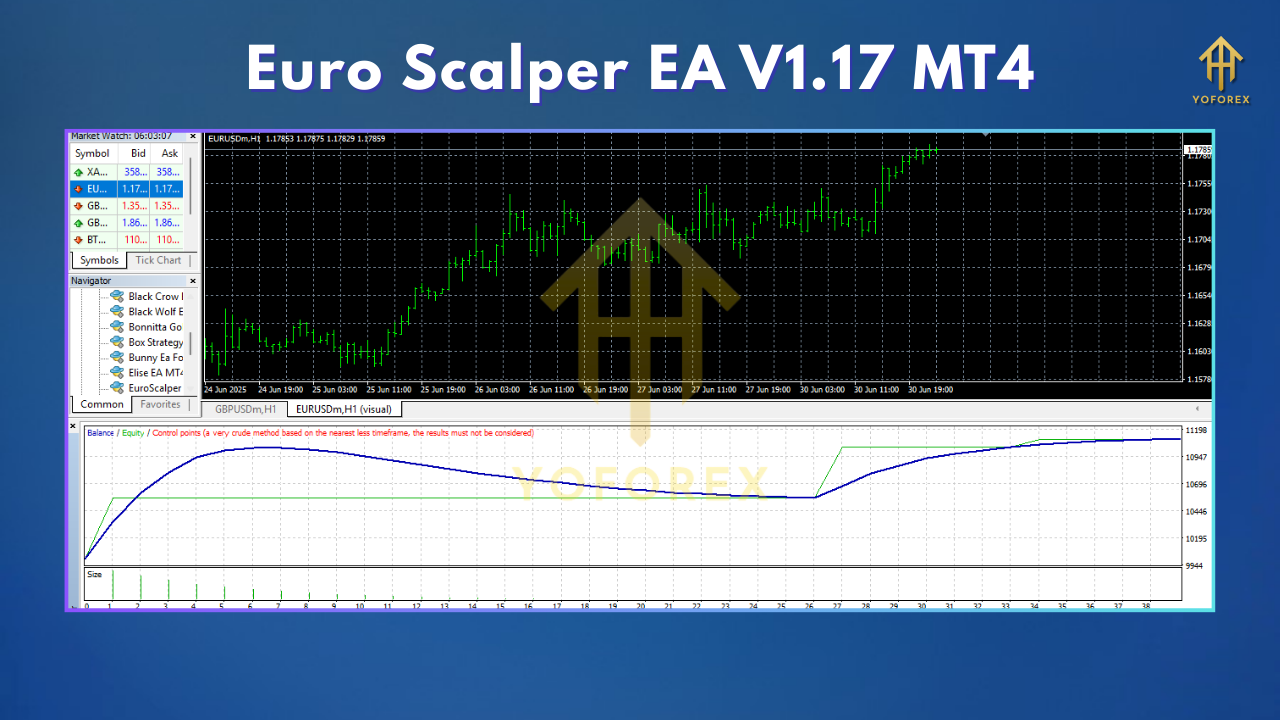

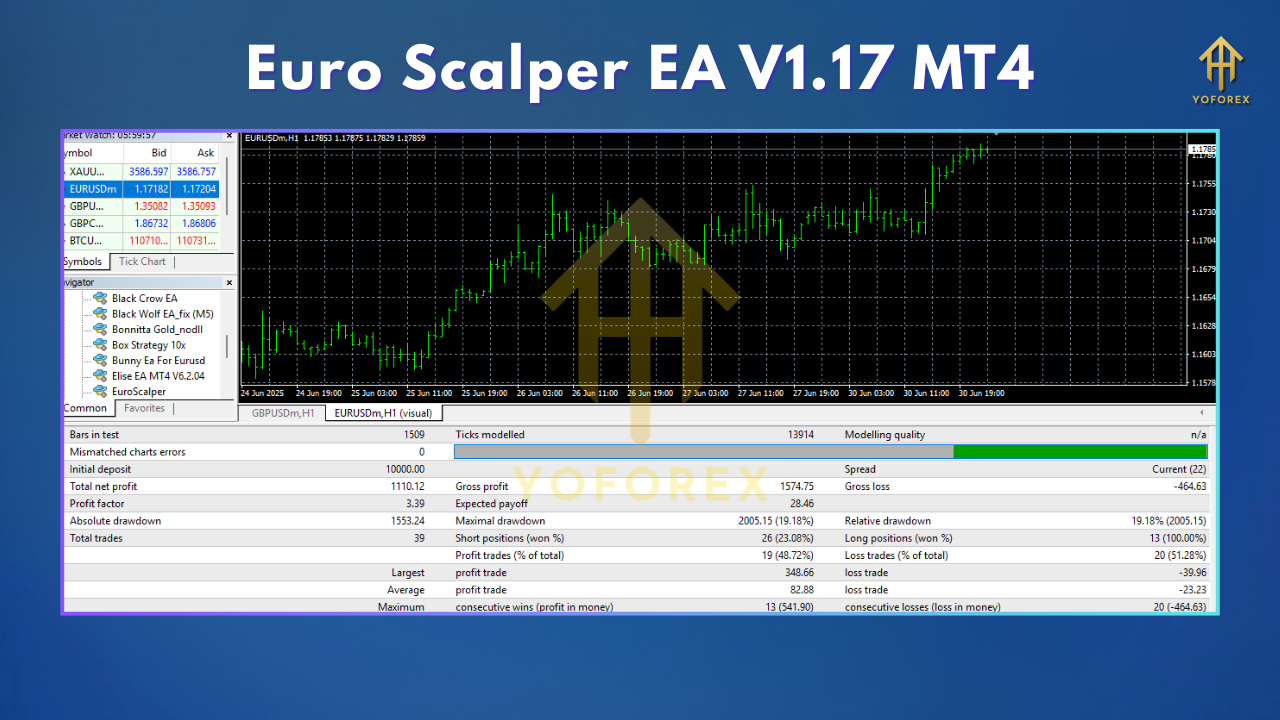

Backtest & Forward Test Snapshot (Narrative)

Internal test runs used tick-quality data with variable spreads over several months. On EURUSD M5, the EA aimed for a high win frequency with modest per-trade R, rather than a few massive winners. The equity curve we saw tended to stair-step as sessions unfolded, with natural flat periods when volatility was poor. Drawdown stayed contained with the daily stop rule enabled. We also ran forward tests on demo accounts during London/NY overlap; fills were consistent under low-spread conditions, tho occasional slippage during news spikes is normal.

What we liked in tests:

- Consistent behavior when spreads are tight (≤ 1.2 pips on EURUSD).

- Fewer trades during dead markets, which is actually a good sign—no forced entries.

- Quick cutting of losers—no averaging down, no hidden recovery logic.

Reality check:

- Spreads and slippage define edge for any scalper. Use a reputable, low-spread broker.

- News spikes are messy—enable news pause or manually turn off trading around high-impact events.

- VPS helps. If your ping is high, expect more variance between backtest and live.

Installation & Quick Start (Step-by-Step)

- Download Euro Scalper EA V1.17 MT4 from the YoForex page (link below).

- Copy files: MT4 → File → Open Data Folder →

MQL4/Experts→ paste the EA file. - Restart MT4 so the EA loads in the Navigator.

- Open EURUSD M5 chart (recommended).

- Enable Algo Trading and drag the EA onto the chart.

- Inputs: Start with the defaults; ensure Risk % and Daily Stop are set to your comfort.

- AutoTrading ON, smiley face green.

- Broker check: Confirm spread ≤ 1.2 pips on EURUSD during active sessions.

- VPS: If possible, run MT4 on a VPS close to your broker’s server.

Recommended Settings (Baseline)

- RiskPerTrade: 0.5%–1.0% (start low; increase only after you see stability)

- DailyLossLimit: 2%–4% (halts trading when reached)

- MaxOpenPositions: 1 (conservative)

- SpreadFilter: 12–15 points (1.2–1.5 pips)

- SlippageMax: 2–3 points (adjust if broker fills are worse)

- NewsPause: Enabled for high-impact events

- SessionFilter: On (focus London/NY overlap first)

- MagicNumber: Unique per chart if you run multi-pair

Risk Management & Best Practices

- Start on demo for a few days to understand behavior.

- Keep lot sizes small until you’re confident.

- Respect the daily stop. When hit, let the market breathe.

- Avoid stacking pairs until EURUSD is stable.

- Log your results weekly; small tweaks (e.g., spread filter, slippage threshold) can improve fills.

Troubleshooting

- No trades? Check AutoTrading, allow live trading in EA settings, confirm market is active and spread filter isn’t blocking entries.

- Frequent slippage/re-quotes? Consider a different server or broker; reduce trade frequency during news.

- Big difference vs backtest? Check your ping, VPS quality, and broker spread; scalping is very execution-sensitive.

Why YoForex?

YoForex builds tools for real traders and releases many of them free. We focus on risk-first engineering, ongoing improvements, and clear documentation. No gimmicks. If you want a brand that supports your learning curve, you’re in the right place. Explore our other free tools and beginner guides on the site—everything’s built to help you progress, one small edge at a time.

Support & Disclaimer

- WhatsApp: https://wa.me/+443300272265

- Telegram Group: https://t.me/yoforexrobot

This EA is a tool, not financial advice. Past performance doesn’t guarantee future results. Always test on demo first and trade only what you can afford to risk.

Call to Action

Ready to try it? Grab your free Euro Scalper EA V1.17 MT4 now and start with the default M5 settings on EURUSD. Keep the daily stop on, let it run during London/NY overlap, and review your results weekly. If you need help, we’re just a message away on WhatsApp or Telegram. Let’s build consistency—slow, steady, smart.

Comments

Leave a Comment