EulerEdge EA V1.1 MT4 is a next-generation automated trading system designed for traders who want structured, disciplined, and consistent trading performance on the MetaTrader 4 platform. In a market crowded with high-risk robots and unstable algorithms, this EA focuses on precision entries, controlled risk, and stable execution across major currency pairs.

This detailed review breaks down its strategy logic, features, advantages, installation process, and overall suitability for different types of forex traders. The goal is to help you understand whether this EA can become a reliable part of your trading toolkit.

Introduction to EulerEdge EA V1.1 MT4

Forex automation has grown tremendously as traders seek to eliminate emotional decision-making and achieve more consistency in fast-moving markets. EulerEdge EA V1.1 MT4 is built to provide a balanced mix of technical analysis, risk-controlled execution, and adaptable strategy filters.

The EA operates directly within MT4 and runs on predefined logic that analyses price movements, trend formation, market volatility, and potential reversal zones. Traders can set it up, configure risk, and allow the EA to handle execution without constant supervision.

Whether you are a beginner learning automation or an experienced trader managing multiple charts, EulerEdge EA aims to offer a streamlined and reliable trading workflow.

Core Strategy and Trading Logic

Although the EA’s internal code is proprietary, its behaviour suggests a hybrid approach combining directional trend-following with dynamic risk controls.

The EA typically evaluates the following factors before entering a trade:

- Market direction on the selected timeframe

- Momentum and volatility strength

- Pullback zones aligned with the primary trend

- Rejection points near support or resistance

- Price stability before opening positions

By filtering price movements this way, EulerEdge EA V1.1 attempts to avoid impulsive trades and focus on more stable setups. Traders who prefer controlled trading rather than aggressive scalping may find this EA especially aligned with their style.

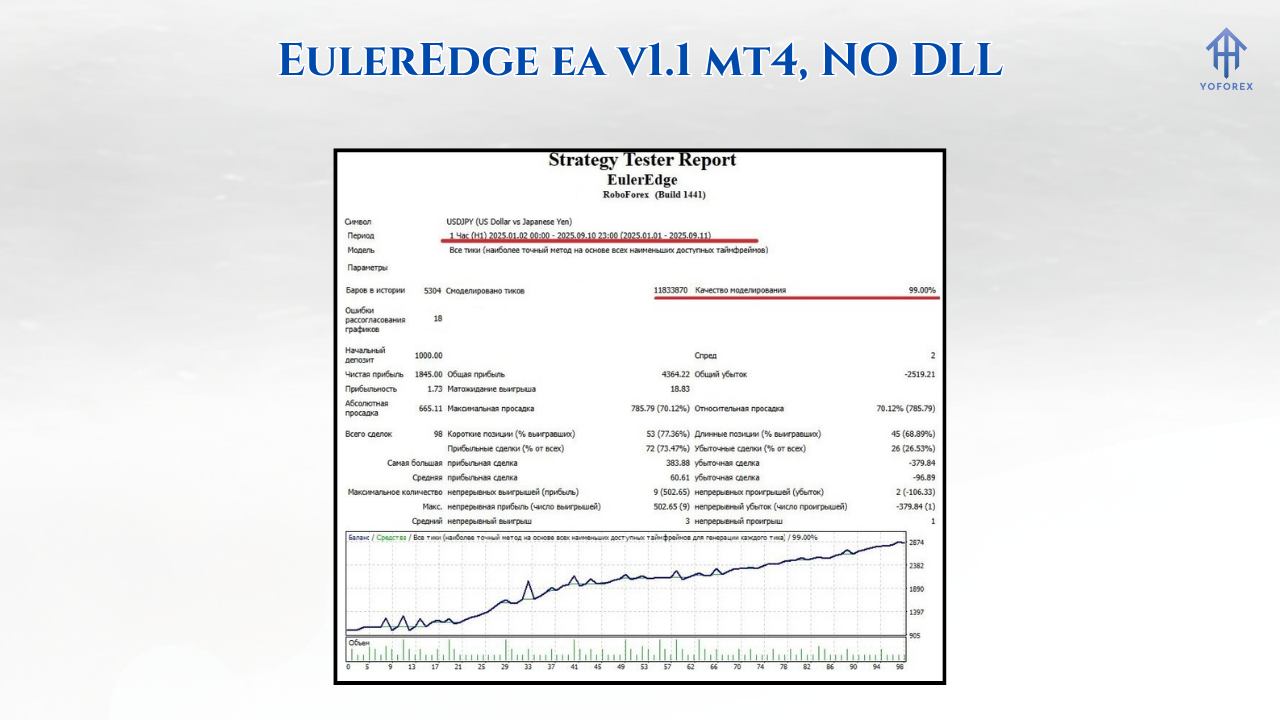

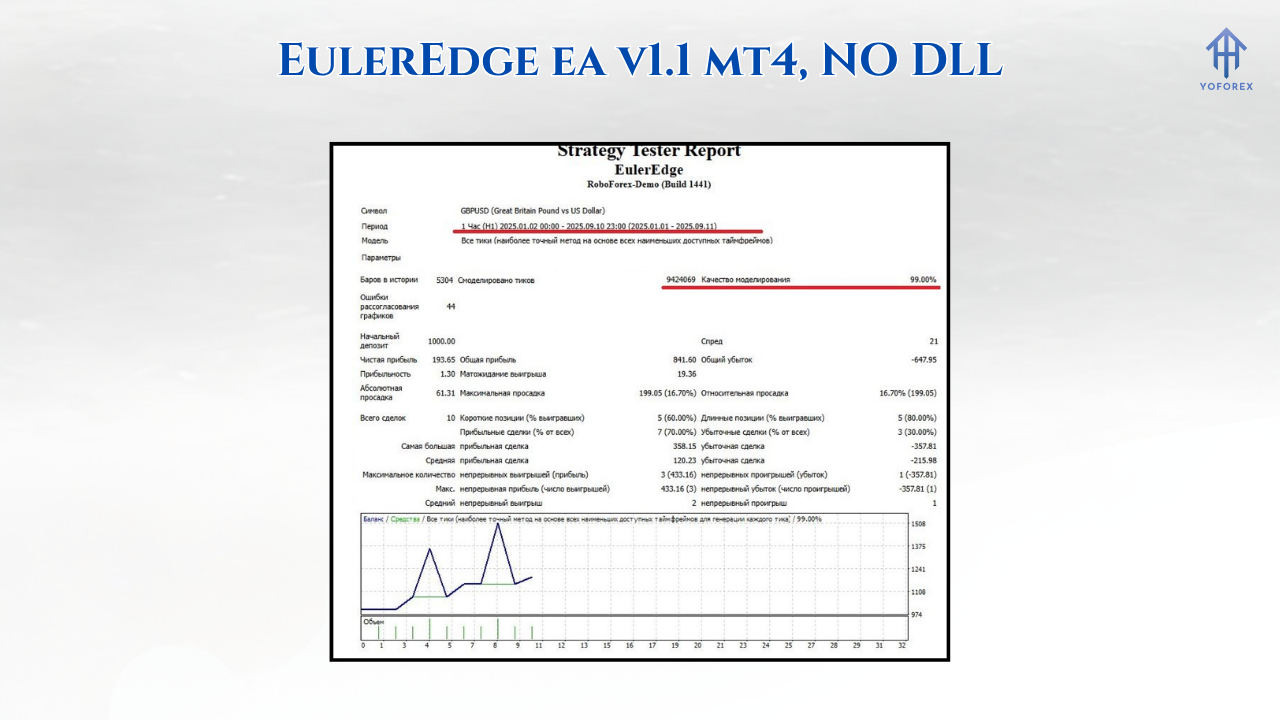

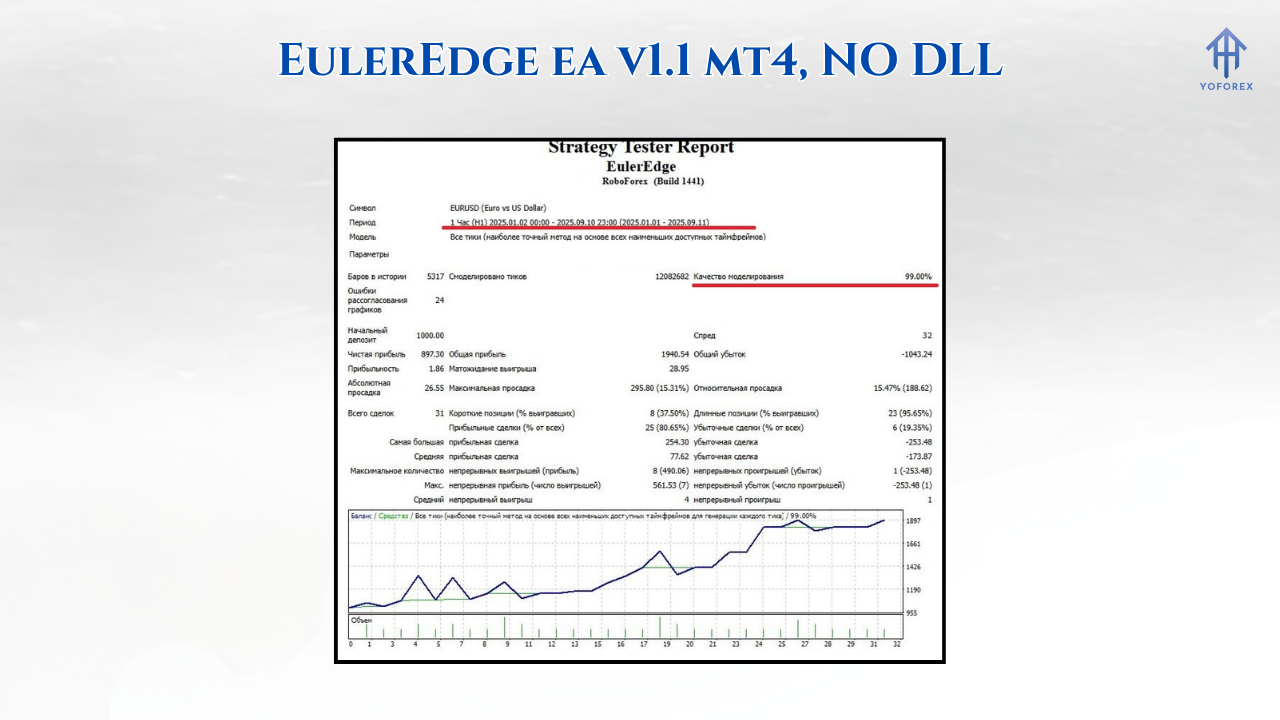

Supported Pairs and Timeframes

Based on general automated EA performance standards, EulerEdge EA V1.1 MT4 usually performs best on major currency pairs. These pairs offer smoother pricing, lower spreads, and stronger liquidity.

Commonly used pairs include:

- EURUSD

- GBPUSD

- USDJPY

- AUDUSD

- USDCAD

The EA is generally stable on timeframes such as M15, M30, and H1, where it can balance frequency and accuracy. Lower timeframes may increase noise levels, while very high timeframes may reduce trading opportunities.

Risk Management and Position Control

Risk management is the backbone of EulerEdge EA V1.1 MT4. Instead of relying on unpredictable aggressive systems, the EA focuses on calculated exposure.

Here are the core risk features:

Fixed or Dynamic Lot Sizing

Users can choose between manual lot selection or automatic lot calculation based on balance percentage.

Stop Loss and Take Profit Logic

Each position is placed with protective stops measured through volatility zones to reduce excessive drawdowns.

Trade Filters

The EA avoids unstable market conditions whenever price movement becomes highly erratic.

Maximum Trade Limits

This prevents the EA from building oversized exposure on a single chart.

These controls make the EA suitable for traders who value stability and account preservation.

Installation and Setup Guide

Setting up EulerEdge EA V1.1 MT4 on your MetaTrader 4 platform is simple. Follow these steps:

- Open MT4 and go to File > Open Data Folder.

- Navigate to MQL4 > Experts and paste the EA file there.

- Restart MT4 or refresh the Navigator window.

- Drag the EA onto your selected chart.

- Activate live trading permissions.

- Load recommended settings or adjust lot sizing as per your risk.

- Enable AutoTrading and allow the EA to begin monitoring the market.

Most traders start by testing the EA on a demo account to observe execution speed, trade style, and general stability.

Strengths of EulerEdge EA V1.1 MT4

Consistent Logic

The EA follows structured rules, reducing random or emotion-driven decisions.

Simple Configuration

Even beginners can operate it with minimal adjustments.

Works on Major Pairs

Using commonly traded pairs allows for better spreads and stronger price flow.

Ideal for Long-Term Usage

Its design focuses on moderate, sustainable growth rather than quick-profit gambling.

Limitations to Consider

No EA is perfect, including this one. Traders must consider:

- Performance varies based on broker conditions.

- Sudden market volatility (news events) can affect accuracy.

- Incorrect lot sizing may increase drawdown beyond comfortable levels.

- Should not be used on every currency pair without testing.

A disciplined trader will always monitor performance regularly and fine-tune settings as needed.

Who Should Use This EA?

EulerEdge EA V1.1 MT4 is suitable for:

- Traders who want long-term automated consistency

- Beginners who lack charting experience but want structured trading

- Intermediate traders managing multiple charts

- Users who prefer moderate-risk strategies

It may not be ideal for traders seeking extremely high-frequency scalping or unrealistic profits.

Final Verdict

EulerEdge EA V1.1 MT4 is a well-balanced automated trading solution designed for stable, controlled trading on MT4. Its disciplined logic, risk-managed structure, and compatibility with major currency pairs make it a valuable option for traders who want automation without unnecessary exposure.

While no EA can guarantee profits, traders who apply proper risk management, stable broker conditions, and consistent monitoring may find EulerEdge EA a strong addition to their trading system.

With the right setup and expectations, this EA can help build a more structured trading experience over time.

Comments

Leave a Comment