Elise EA V6.2.04 MT5 — Discipline-First Automation, Now on MT5

If you’re done with bots that spray orders and pray, Elise EA V6.2.04 for MT5 is your calmer option. It waits for trend alignment, checks volatility with ATR, and demands a clean structure confirmation before entering. When conditions are messy, Elise simply… skips. No martingale, no grid “recovery,” no drama—just rules you can audit and tweak.

Below is your trader-first tour: what’s inside V6.2.04, why the MT5 build feels snappier, suggested settings, install steps, testing tips, a practical risk playbook, FAQs—and copy-paste meta data for your CMS.

What Is Elise EA V6.2.04 (MT5)?

Elise is a MetaTrader 5 Expert Advisor designed to capture trend–pullback–continuation moves with strict execution filters. It lives by three gates:

- Directional bias (trade with the flow, not against it)

- Volatility sanity (ATR) so stops aren’t silly-wide (or micro-tight)

- Structure confirmation (break–retest / decisive close / clean engulf)

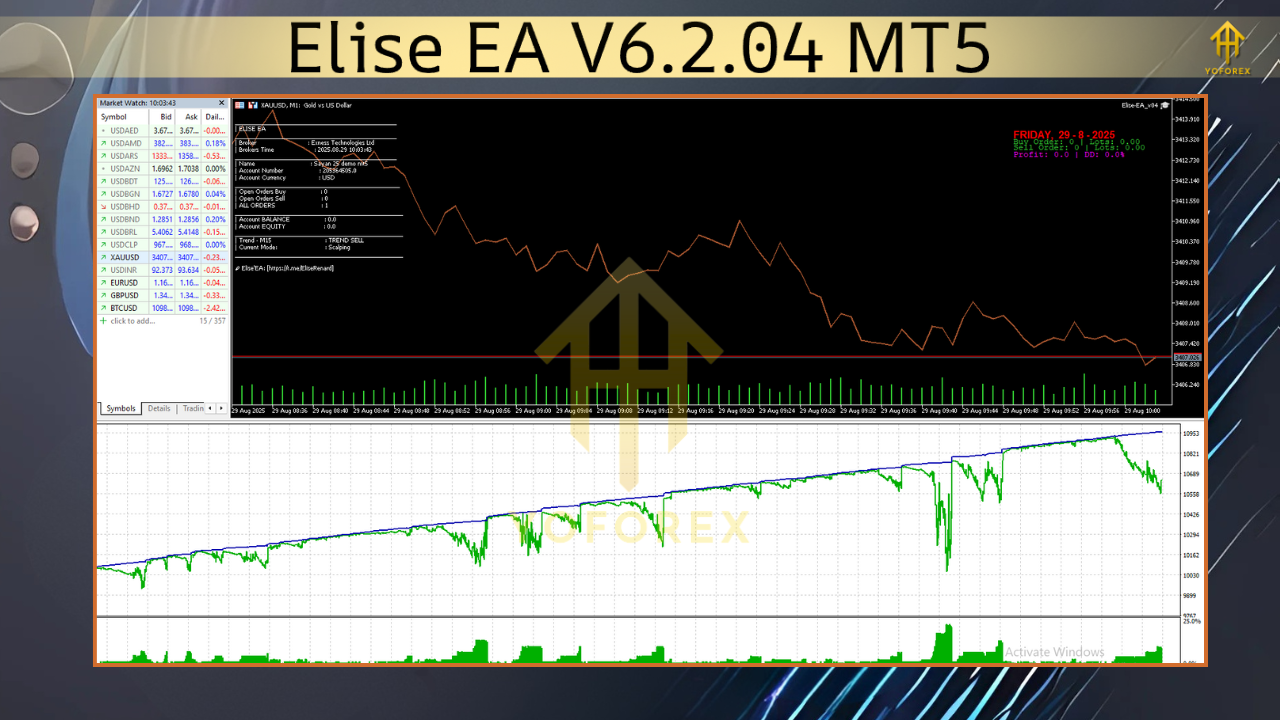

Best markets & TFs

- FX majors: EURUSD, GBPUSD, USDJPY (primary focus)

- Gold (optional): XAUUSD if your costs are reasonable

- Timeframes: M15–H1 for majors; M30–H1 for gold (balances costs vs. quality)

Who it’s for

Traders who want non-martingale automation, transparent logs, and fewer but cleaner trades. If you prefer calm compounding over fireworks, you’ll vibe with Elise.

Why the MT5 Version?

- Faster, more realistic backtests (tick-by-tick, multi-threaded, variable spreads)

- 64-bit stability for multiple charts/symbols running together

- Cleaner symbol specs (lot steps, tick value) for metals/indices

- Smoother event handling for session/news windows and logging

What’s New in V6.2.04

- Sharper trend baseline — filters counter-trend chop earlier

- Improved ATR gating — smarter skip logic when implied SL is too wide/tiny

- Refined confirmation engine — cleaner break–retest / decisive close detection

- Partial-TP & trailing polish — trail engages post +1R with smoother steps

- Equity guard upgrades — cleaner pause/resume after daily/floating DD limits

- Spread/slippage veto — faster “nope” in hostile execution

- Magic/Order hygiene — tidier MagicNumber routing on multi-chart setups

- Logging clarity — human-readable reasons for entries, exits, vetoes

Key Features (At a Glance)

- Confluence engine: Direction → ATR sanity → Structure confirmation

- ATR-aware SL/TP: Stops sized to current volatility

- No martingale / no grid: Optional light add-ons to winners on fresh confirmation only

- Equity guard & daily stop: Auto-pause new entries past your limits

- Spread/slippage caps: Hard veto when costs spike

- Session/news windows: Favor London/NY; optionally block CPI, NFP, FOMC minutes

- Readable logs: You’ll know why a trade happened—or didn’t

How the Strategy Works (Under the Hood)

1) Direction First

A dual-MA baseline (medium + slow) plus a momentum nudge decides whether longs or shorts are even allowed. Optional higher-TF bias keeps you with the bigger flow.

2) Volatility Gate (ATR)

Elise sizes SL via 1.5×–2.5× ATR (configurable). If implied SL is absurdly wide—or unrealistically tiny—she skips. You’re not forced into bad math.

3) Structure Confirmation

No confirmation, no trade. Elise wants proof:

- Break–retest continuation, or

- Decisive close beyond a micro-level, or

- Clean engulf that clears prior indecision.

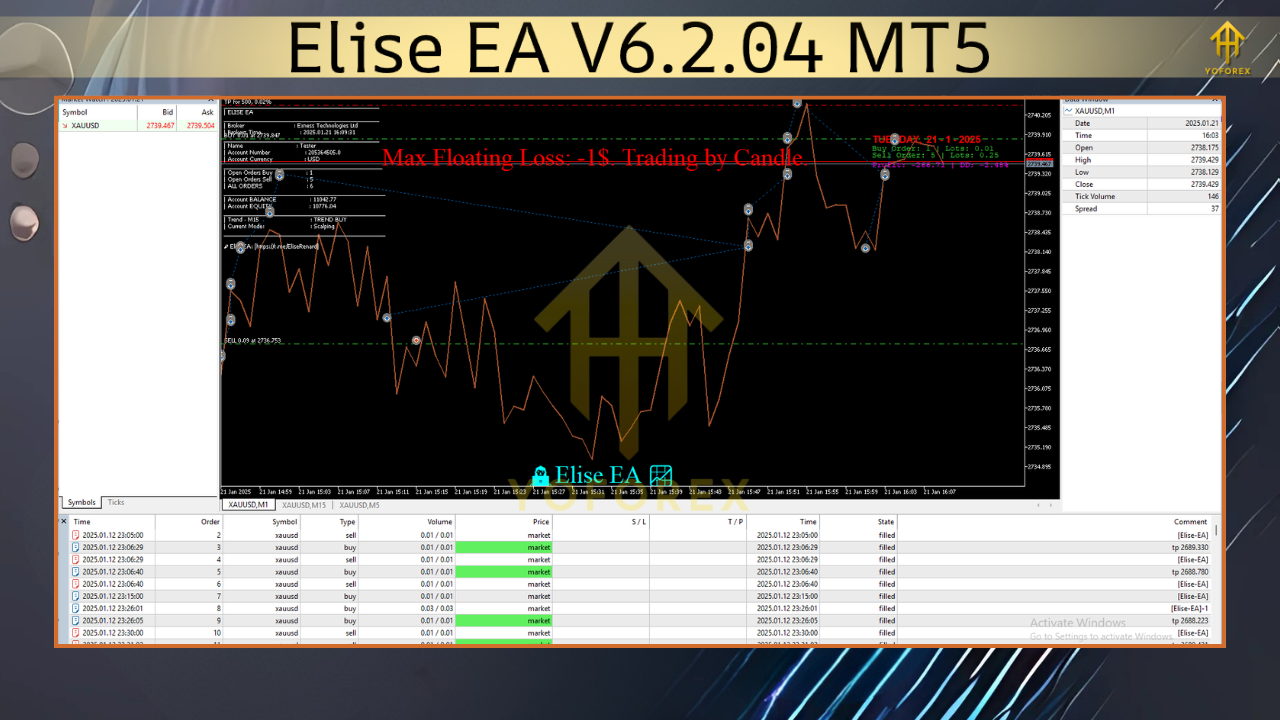

4) Lifecycle Management

- Risk as % of equity (not random lots)

- Partial close around +1R (configurable)

- ATR/swing trailing once the trade earns it

- Optional light scale-in on new confirmation (never to rescue losers)

Recommended Settings (Starter Template)

Environment

- Broker: ECN/Raw-spread with consistent liquidity

- VPS: Strongly recommended (stability + low latency)

- Leverage: 1:200–1:500 (leverage ≠ edge; position sizing is)

Symbols & Timeframes

- EURUSD / GBPUSD / USDJPY: M15–H1 (H1 cleaner, M15 more active)

- XAUUSD (optional): M30–H1 to offset gold costs

Risk Controls

- Risk per trade: 0.5%–1.0% (new users: 0.5%)

- Max concurrent positions: 3–5 (all charts)

- Max add-ons per symbol: 1–2 (winners only)

- Daily loss stop: 2%–3% (auto-pause for the day)

- Equity guard (floating DD): 5%–8% (pause new entries until recovery)

Execution Filters

- Max spread (majors): EURUSD ≤ 15–20 pts; GBPUSD ≤ 20–25; USDJPY ≤ 15–20

- Max spread (gold): 35–60 pts (broker quoting dependent)

- Max slippage: 1–3 pts

- Sessions: Prefer London/NY overlap; avoid rollover

- News block: 10–15 min before/after major releases

Stops & Targets

- SL: 1.5×–2.5× ATR or just beyond last clean swing

- TP: 1.5R–2.0R baseline; partial at +1R, then trail remainder

Ready-Made Profiles

A) H1 Conservative (majors)

- Risk 0.5% | SL 2.2× ATR | TP 1.6R | partial at +1R | ATR trail

- Sessions: London/NY | News block: ON

B) M15 Standard (majors)

- Risk 0.6% | SL 2.0× ATR | TP 1.5R | partial at +1R | ATR trail

- Slightly tighter spread/slippage caps

C) XAUUSD H1 (cost-aware)

- Risk 0.5% | SL 2.3× ATR | TP 1.6R | partial at +1R | swing-based trail

- Higher spread veto; extend news block to 20 min

Installation & Setup (MT5)

- Copy

Elise_EA_V6_2_04.ex5toMQL5/Experts/(File → Open Data Folder). - Restart MT5, check Navigator → Experts.

- Enable Algo Trading (toolbar).

- Attach Elise to each symbol chart (one symbol per chart).

- Inputs: Load a profile or apply the Starter Template above.

- Permissions: Allow DLL imports only if you’re using a news/calendar module.

- Forward-test on demo for 1–2 weeks to validate spreads, slippage, and fills.

Backtesting & Optimization (MT5 Edge)

- Use Every tick based on real ticks with variable spread—fixed spreads look too pretty.

- Include event windows (CPI/NFP/Fed) in your review—even if you block them live—to gauge slip risk.

- Optimize lightly (trend periods, ATR multipliers, structure strictness, session windows). Then walk-forward: optimize on Period A, test on Period B.

- Track net edge after costs (spread + commission + avg slippage). If costs eat >35–45% of gross R, go up a timeframe or tighten filters.

- Run forward tests on a VPS to mirror real latency and broker behavior.

Risk Management Playbook (Pin This)

- Small, constant risk (0.5%–1.0%) beats hot-and-cold sizing—always.

- Respect circuit breakers: daily stop + equity guard protect the month.

- Cost discipline: if spreads/slippage creep up, reduce risk or pause.

- Avoid curve-fit fever: pretty backtests often fail out-of-sample—tune lightly.

- Withdraw periodically (if live) so effective risk stays sane as equity grows.

FAQs

Does Elise use martingale or a recovery grid?

No. Elise may lightly add to winners on fresh confirmation—never to rescue losers.

Will it trade every day?

Not guaranteed. Elise skips weak/hostile conditions; that patience is part of the edge.

Minimum deposit?

Demo any size. For live, many start $500–$1,000 with 0.5% risk and a VPS, then scale gradually.

Best timeframe?

H1 is calmer and cost-tolerant; M15 is more active but more spread-sensitive. For gold, start H1 unless your costs are stellar.

Disclaimer

Trading Forex/CFDs involves risk. Past performance is not indicative of future results. Always forward-test on demo, size conservatively, and never trade funds you can’t afford to lose.

Call to Action

Ready for calmer automation that waits for trend, volatility, and structure to align? Install Elise EA V6.2.04 on MT5, run the H1 Conservative profile on demo, and watch it across sessions. When fills and behavior look steady, go live gradually—tight risk, tight rules, and let Elise’s confluence do the heavy lifting.

Comments

Leave a Comment