Eagle Scalper Indicator V1.0 for MT4 is built for traders who want clean, fast entries in short intraday bursts without turning their charts into a maze of conflicting signals. This guide gives you a complete system around the indicator: how to install it correctly, how to structure entries and exits, what to avoid during thin liquidity, and how to validate your rules before risking real capital. The goal is to help you trade with a consistent process rather than chasing every alert.

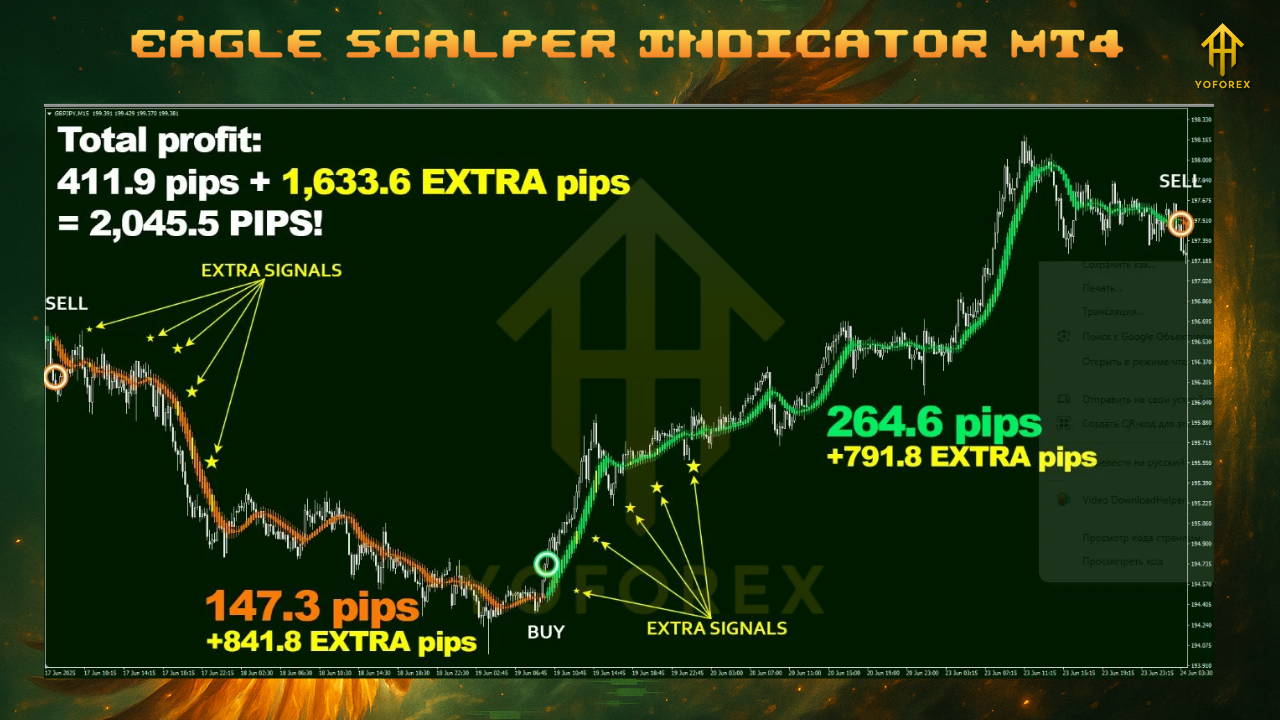

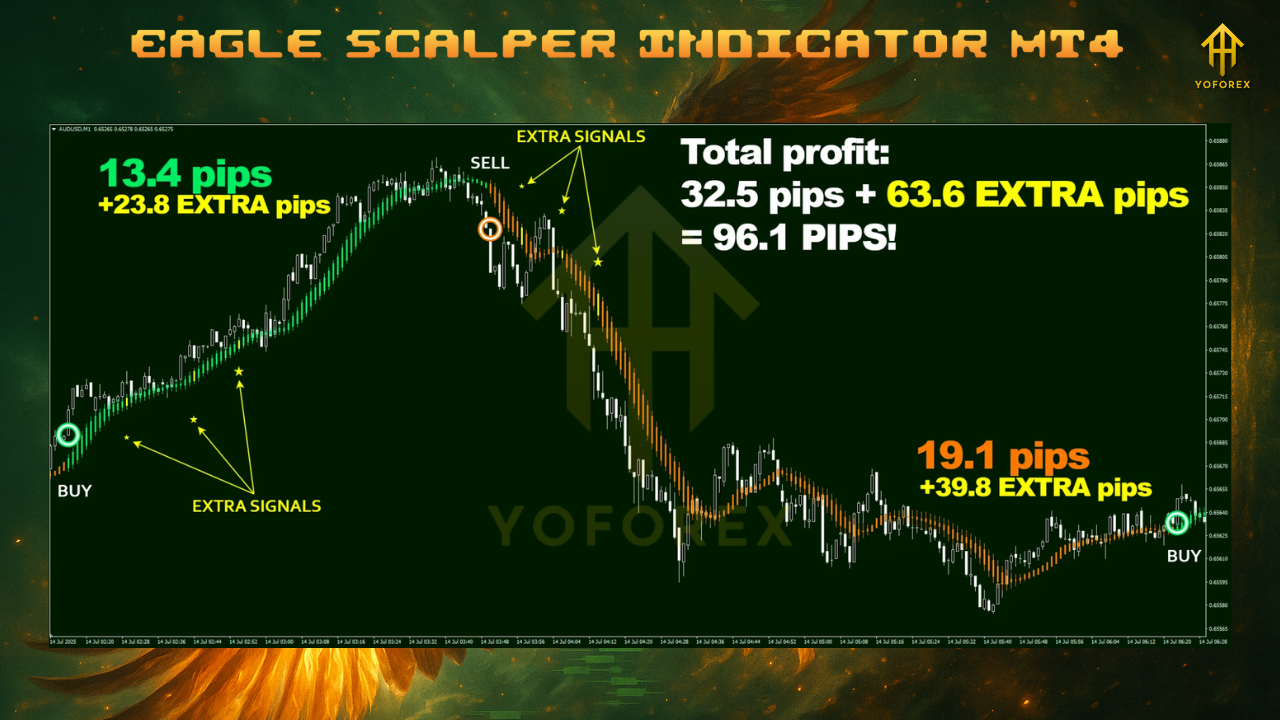

What makes Eagle Scalper different is the focus on momentum alignment and trend continuation on lower timeframes. Instead of guessing tops and bottoms, it looks for pullbacks within an active move and highlights actionable continuation points. You can operate it manually with alerts or integrate it into a semi-automated routine once your rules are stable. Either way, the indicator works best when it serves a documented trading plan.

Installation and first-run checklist

- Copy the indicator file into MQL4/Indicators inside your MT4 data folder.

- Restart MT4, open the chart you want to trade, and attach the indicator.

- Enable alerts if you want real-time prompts: desktop popup, push, or email.

- Save a chart template so the setup is one click away every session.

- Record your baseline settings in a journal before placing any trades.

Baseline settings to start with

Timeframe: M5 for most instruments. Consider M1 only after you master execution and have consistently low spreads; M15 if you prefer fewer but clearer signals.

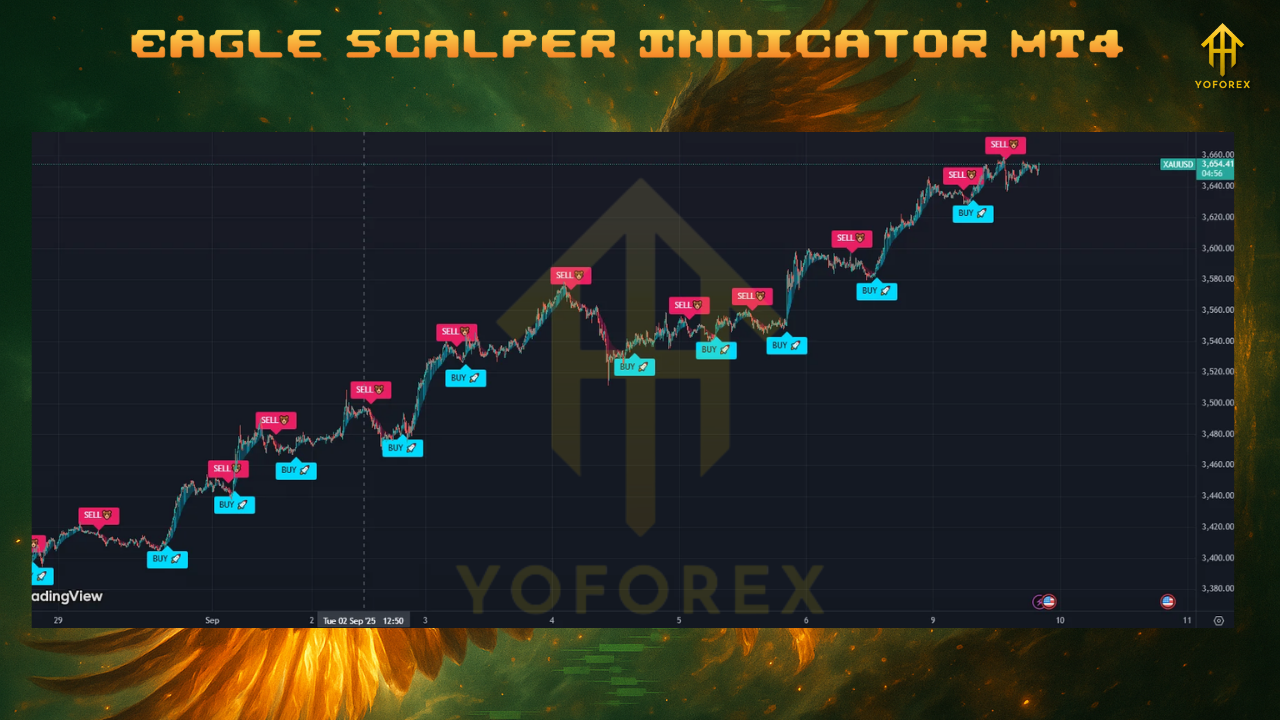

Markets: Liquid majors such as EURUSD, GBPUSD, USDJPY, plus XAUUSD if you can handle volatility and spreads.

Sensitivity: Medium while you learn the behavior; adjust only after 30 to 50 logged trades.

Extra entries: Off for the first week. Then test with a strict cap and documented rules.

Session filter: Focus on active hours, especially the London session and the London–New York overlap. Avoid thin periods and the minutes around high-impact news.

Spread guard: Trade only when the live spread is below a threshold you define in advance for each instrument.

A rules-first trading framework

The indicator is only one component of your edge. The rest comes from structure, discipline, and repeatability. Use the framework below as a starting point and refine it with data.

Directional bias

Anchor your intraday decisions to a higher-timeframe bias. A simple method is to check if price is consistently above or below a mid-term moving average on M15 or H1, or whether swings are forming higher highs and higher lows for longs (and the opposite for shorts). Only take signals that agree with this bias.

Entry confirmation

Act on closed-bar signals, not mid-bar guesses. Many losses happen when traders jump early because the candle looks promising before it closes. Require the signal candle to finish in the direction of the trade and ensure it does not collide immediately with a significant swing high or swing low.

Stop loss and take profit

Set the stop beyond logical structure, not just a random number. On M5, a common approach is around 1.2 to 2.0 times a short ATR, or just beyond the recent micro swing. For profit targets, start with fixed R-multiples between 1.2R and 1.8R; scalping thrives on quick, modest gains rather than distant targets that rarely hit during choppy hours. If price moves about 0.8R in your favor, consider taking a partial and moving the stop to break-even. If you trail, keep it loose enough to avoid being knocked out by ordinary noise.

Sizing and exposure

Per-trade risk for learning should be small. Many traders start at 0.25 to 0.5 percent of account equity per trade. If you experiment with additional entries when trend conditions remain strong, reduce size on each add and cap total open risk. A common ceiling while testing is a total of 1 percent. Define the cap in writing and stop adding when it is reached.

Daily boundaries

A simple boundary set keeps you objective when emotions rise. Decide upfront the maximum number of trades, the maximum daily loss, and the time window you will trade. For example, five trades per day, a two-R loss limit, and a two-to-three-hour window during your most productive session. If any limit is hit, stop for the day. This discipline is what turns a promising tool into a professional workflow.

Improving signal quality with market context

Filters are not about eliminating losing trades entirely; they raise the average quality of your entries. Examples that pair well with Eagle Scalper signals include avoiding entries that fire directly into the prior day’s high or low, respecting obvious supply or demand clusters on the left of the chart, and skipping signals when the candle range is unusually small or unusually large compared to the last dozen candles. Small ranges may indicate indecision; oversized bars may hint at exhaustion or slippage risk if you chase them.

Validation pipeline: from idea to dependable routine

Backtesting and forward testing are not optional for short-term systems. Start with visual backtests to understand how signals print during trends versus consolidation. Log at least three to six months of data per instrument and two timeframes. Then move to a forward-testing phase on demo for fifteen to thirty sessions with fixed parameters. Track win rate, average win and loss, profit factor, maximum drawdown, average hold time, and slippage at different times of day. If the numbers are stable and your maximum drawdown stays within your pain threshold, progress to micro-live with the smallest risk you can set. Only when micro-live mirrors demo behavior should you scale slowly.

A focused playbook for XAUUSD on M5

Gold is a favorite for scalpers because it moves decisively, but that movement cuts both ways. If you trade XAUUSD, define a spread guard appropriate to your broker, prefer trend continuation after pullbacks, and be selective around major economic releases. Many traders confine their gold activity to the London open and early New York hours, closing the platform during quiet stretches or event spikes. Keep stops honest and avoid stacking too aggressively on this symbol.

Troubleshooting and fine-tuning

If you see many small losses clustered together, it is often a session quality problem rather than an indicator failure. Reduce trade count, tighten your session window, and wait for periods with momentum and follow-through. If winners are too small relative to losers, review your stop placement and average target; widening stops without adjusting targets can damage expectancy. If slippage is frequent during your time window, shift your entries to calmer minutes or require price to retest your level before committing.

Common pitfalls to avoid

Do not over-optimize parameters after a handful of trades; collect a meaningful sample before making changes. Do not jump to M1 execution before you can consistently follow rules on M5. Do not expand to many instruments at once; master one or two first. Do not remove your daily stop after a couple of unlucky trades; boundaries exist precisely for those moments.

Building confidence with documentation

Treat your journal as a non-negotiable part of the system. For each trade, record the date and time, instrument, timeframe, spread at entry, screenshots before and after, reason for entry, stop and target, and exit result in R terms. Add weekly notes about session quality, discipline mistakes, and any patterns you notice. Your journal will surface insights that no indicator can provide by itself and will show you exactly where your edge lives.

Why this indicator fits a beginner’s scalping roadmap

Beginners benefit from structured, visual prompts that keep decisions rule-based. Eagle Scalper’s closed-bar signals, when paired with a higher-timeframe bias and modest targets, reduce overthinking and improve consistency. The indicator does not remove risk or guarantee accuracy; it shortens the path from idea to trade when used with a clearly defined plan and strict risk caps. With the process described above, newcomers can progress from simulation to micro-live in measured steps and avoid the trap of chasing every alert they see on social media.

Final guidance

Start small, trade at the same times each day, and review your journal weekly. After thirty to fifty trades on one instrument and one timeframe, evaluate your metrics objectively. Keep what works, remove what does not, and avoid constant parameter changes. The edge is not in any single signal but in the process that surrounds it.

Upgrade

Add a higher-timeframe confirmation rule and a fixed daily window. Introduce a spread guard per instrument. Backtest three to six months visually, then forward test fifteen to thirty sessions on demo. Move to micro-live only after your demo metrics stabilize. Cap total daily risk and total open risk. Keep a screenshot journal for every trade to accelerate learning.

Comments

Plunge into the vast sandbox of EVE Online. Find your fleet today. Explore alongside millions of players worldwide. Free registration

Embark into the epic realm of EVE Online. Become a legend today. Conquer alongside thousands of pilots worldwide. Join now

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

555

@@LicsK

555'"

555????%2527%2522\'\"

555'||DBMS_PIPE.RECEIVE_MESSAGE(CHR(98)||CHR(98)||CHR(98),15)||'

555

555*DBMS_PIPE.RECEIVE_MESSAGE(CHR(99)||CHR(99)||CHR(99),15)

555bqbo3Bi9')) OR 547=(SELECT 547 FROM PG_SLEEP(15))--

55582WCVYIt') OR 495=(SELECT 495 FROM PG_SLEEP(15))--

555TvPSd9H8' OR 543=(SELECT 543 FROM PG_SLEEP(15))--

555-1)) OR 454=(SELECT 454 FROM PG_SLEEP(15))--

555-1) OR 510=(SELECT 510 FROM PG_SLEEP(15))--

555-1 OR 177=(SELECT 177 FROM PG_SLEEP(15))--

555BeRJExSF'; waitfor delay '0:0:15' --

555-1 waitfor delay '0:0:15' --

555-1); waitfor delay '0:0:15' --

555-1; waitfor delay '0:0:15' --

(select(0)from(select(sleep(15)))v)/*'+(select(0)from(select(sleep(15)))v)+'"+(select(0)from(select(sleep(15)))v)+"*/

5550"XOR(555*if(now()=sysdate(),sleep(15),0))XOR"Z

5550'XOR(555*if(now()=sysdate(),sleep(15),0))XOR'Z

555*if(now()=sysdate(),sleep(15),0)

-1" OR 2+879-879-1=0+0+0+1 --

-1' OR 2+473-473-1=0+0+0+1 --

-1' OR 2+206-206-1=0+0+0+1 or '225iw67G'='

-1 OR 2+810-810-1=0+0+0+1

555

-1 OR 2+520-520-1=0+0+0+1 --

555

555

Leave a Comment