DoIt Alpha Pulse AI EA V1.0 MT5 — Adaptive AI Trading for Gold

Platform: MT5

Pair: XAU/USD (Gold)

Style: AI-powered, trader-style amplification

Version: V1.0

The DoIt Alpha Pulse AI EA V1.0 is a next-gen Expert Advisor designed for XAU/USD trading that adapts to you rather than forcing you into a rigid strategy. Built with an AI core, it identifies, filters, and executes based on your preferred trading personality — whether that’s aggressive momentum trading or conservative prop-firm style rules.

The idea is simple but powerful: you set the framework, the AI magnifies it.

Why It’s Different

- Strategy Amplifier, Not Dictator

Most bots impose their own strategy. DoIt Alpha Pulse AI listens to your chosen parameters (risk, style, targets) and scales execution around them. - Aggressive or Conservative? Both Work.

The EA has shown in testing that it can run high-octane strategies for fast growth or strict prop-style setups for rule compliance. - AI Core

Uses machine-learning pattern recognition to refine entries and optimize exits, reducing the emotional bias that manual trading introduces. - Adaptive Risk

Whether you’re aiming for quick compound growth or steady prop-funded consistency, the EA respects drawdown limits and adapts trade frequency accordingly.

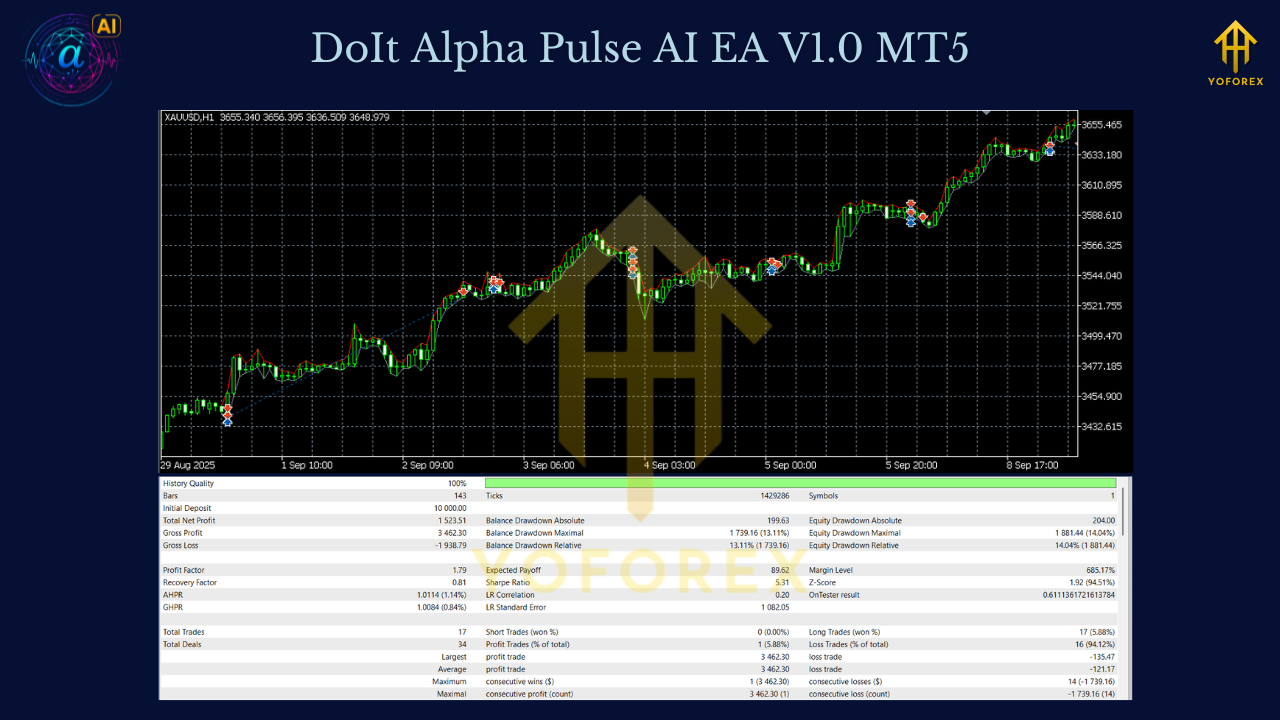

Real-World Examples

Week 1 – Aggressive Trader

- Return: +29.85% on Gold momentum strategy

- Best Day: +19.25% in a single session

- Drawdown: –8.3% (fully recovered within the same day)

- Trade Count: 47 trades, all executed with conviction

Week 2 – Conservative Trader (Prop Firm Settings)

- Return: +8.2%

- Max Drawdown: –2.1%

- Win Rate: 73%

- Compliance: Zero breaches of daily loss or equity limits

- Conclusion: Prop firm compatible, rule-safe execution

Key Features

- XAU/USD Optimized → Specifically tuned for gold’s volatility.

- AI-Driven Decisions → Trade entries/exits dynamically adjusted to live market conditions.

- Multi-Style Modes → Aggressive compounding vs. conservative capital preservation.

- Risk Controls → Automatic monitoring of max drawdown, equity limits, and daily loss caps.

- High Trade Frequency (Aggressive Mode) → Up to 40–50 trades per week.

- Low Risk Frequency (Conservative Mode) → Selective entries, 70%+ win rate potential.

- Prop Firm Friendly → Meets strict loss-limit requirements.

Recommended Settings

- Pair: XAU/USD (Gold)

- Timeframes: M15, M30, or H1 (depending on aggressiveness)

- Aggressive Mode:

- Risk: 1–2% per trade

- Higher frequency, more compounding potential

- Conservative Mode:

- Risk: 0.25–0.5% per trade

- Designed to pass prop firm challenges

- Capital Requirement:

- Min $500 for retail accounts

- Min $10,000 for prop evaluations (depending on firm rules)

- Execution: VPS strongly recommended for stability

Installation (MT5)

- Place EA file in

MQL5/Experts→ restart MT5. - Open XAU/USD chart → select timeframe (M15/H1 recommended).

- Attach EA → tick Allow Algo Trading.

- Choose mode: Aggressive or Conservative (Prop).

- Set risk % of balance or fixed lot size.

- Monitor results via Experts/Journal logs.

Who It’s For

- Aggressive Traders who want to push growth on gold with momentum strategies.

- Prop Firm Candidates seeking a rule-compliant EA that respects daily loss and drawdown.

- Hybrid Users who may switch between aggressive and conservative depending on account size and objectives.

Pros & Cons

Pros

- AI adapts to your style

- Optimized for gold volatility

- Two clear use cases: compounding vs. prop safety

- Strong risk controls

- VPS-friendly, multi-timeframe

Cons

- Optimized for XAU/USD only (not multi-asset)

- Aggressive mode can lead to higher drawdown if unmanaged

- Requires proper VPS + broker conditions for best execution

Final Word

The DoIt Alpha Pulse AI EA V1.0 for MT5 is not your average “one-size-fits-all” robot. Instead, it mirrors your strategy — whether you’re chasing fast growth with higher risk or aiming for slow, steady prop-firm-approved results. With a tested record of both double-digit weekly returns and tight risk compliance, it’s a versatile tool for traders serious about gold.

Join our Telegram for the latest updates and support

Comments

Leave a Comment