Diamond PRO EA V7.0 MT4 — Precision Trading on H1 for Serious FX Traders

If you’ve outgrown entry-level robots and need something sharper for live markets, Diamond PRO EA V7.0 for MT4 deserves a hard look. It’s an enhanced, more powerful evolution of the classic Diamond—rebuilt for advanced users who want reliable logic, flexible control, and cleaner execution on EURUSD, GBPUSD, and USDJPY. The Pro version brings optimized cores, improved entry-point filters, and a multistage profit-closure algorithm that aims to capture moves while shedding risk step by step. Minimum deposit? $200. Primary operating timeframe: H1. Let’s unpack how it works, what’s new, and how to set it up right on MetaTrader 4.

What Makes Diamond PRO “Pro”?

At its core, Diamond PRO focuses on quality entries, disciplined exits, and parameter transparency. Many EAs hide behind vague logic and martingale traps; Diamond PRO takes the opposite route—keeping risk contained and decisions explainable.

- Optimized engine: The latest core rework removes redundant checks, trimming latency on order handling and indicator reads. In practice, that means cleaner fills and fewer “almost” signals.

- Refined entries: Updated filters reduce false starts in noisy sessions, with improved confluence across trend, volatility, and momentum conditions.

- Multistage profit closures: Positions scale out across multiple checkpoints. You don’t need a perfect take-profit to bank; partials lock in gains and protect equity if the move stalls.

- External control parameters: From lot sizing to max spread and news protection, you can fine-tune behavior without touching code.

Who’s it for? Advanced traders who want a configurable, rules-driven EA for H1 swing-to-intra-day flows on EURUSD, GBPUSD, USDJPY. If you like to supervise risk and tweak parameters per pair, you’ll feel at home.

Strategy Overview (Plain English)

Diamond PRO searches for high-probability continuation or reversal setups after volatility conditions stabilize. It does not spam trades. Instead, it waits for a confluence—trend bias + momentum confirmation + acceptable spread and slippage—then fires a single structured position. Once in, the multistage exit handles the heavy lifting:

- Initial protective stop is placed immediately.

- As price moves in favor, the EA takes partial profits at predefined targets.

- A break-even shift can kick in after the first partial is booked.

- A trailing logic (optional) attempts to ride extended trends.

This way, you’re not “all-or-nothing” on every trade. The outcome curve tends to be smoother, especially during choppy weeks.

Key Features at a Glance

- + Optimized Cores: Faster decision loop, leaner calculations, better stability on H1.

- + Improved Entry Filters: Reduces low-quality trades in sideways or erratic conditions.

- + Multistage Profit Closure: Scale out into strength; protect capital if momentum fades.

- + External Controls: Adjust risk per trade, spread filters, magic numbers, and session filters.

- + Non-Martingale, Non-Grid: No dangerous position pyramids that can blow accounts.

- + Pair-Focused Logic: Tuned for EURUSD, GBPUSD, USDJPY where H1 structure is reliable.

- + Minimum Deposit $200: Sensible entry point; risk scales with your settings.

- + News/Spread Protection (configurable): Avoid bad fills around spikes and widenings.

- + Alert & Logging Suite: Clean trade logs and alerts for transparency.

- + VPS-Friendly: Stable under 24/5 market conditions; low overhead footprint.

Recommended Market Conditions & Timeframe

- Timeframe: H1. The signal logic is optimized for this frame; lower frames add noise without improving expectancy.

- Pairs: EURUSD, GBPUSD, USDJPY. Liquidity is robust, spreads are tight, and reaction patterns are well-researched—ideal for Diamond PRO’s confluence checks.

- Sessions: London and early New York often produce the best follow-through. You can gate trading hours if your broker’s execution is session-sensitive.

Suggested Risk & Money Management

A good EA can still misfire if risk is off. Keep it disciplined:

- Risk per trade: Start at 0.5%–1.0% of equity. Scale only after several weeks of stable performance.

- Max concurrent positions: 1 per symbol (default). This avoids strategy overlap and chaotic drawdowns.

- Stop-loss discipline: The EA places a hard SL at entry. Don’t remove it. Ever.

- Daily loss cap: Consider a soft stop (e.g., 2%–3% of equity). If hit, pause for the day to avoid tilt.

- VPS & latency: Use a reliable VPS near your broker’s server. Clean execution = fewer slippage surprises.

Setup & Configuration (MT4)

- Install files: Copy the Diamond PRO EA V7.0 file into

MQL4/Experts/. - Restart MT4: Or refresh the Navigator.

- Attach to chart: Open EURUSD H1 (repeat for GBPUSD, USDJPY if you want). Drag the EA onto the chart.

- Enable live trading: Check “Allow live trading” and confirm auto-trading is on.

- Set parameters:

- RiskMode / LotSize: Choose fixed lot or risk-based percent. Beginners: start with small fixed lots.

- MaxSpread: Set just above your broker’s typical H1 spread for each pair.

- TradeHours: Optional—restrict to high-liquidity sessions.

- PartialTP levels: Default is fine to start; later, you can nudge levels based on your broker’s execution.

- BreakEven & Trailing: Start conservative; enable once you’re confident with fills.

6. Run on demo first: Forward-test at least 2–4 weeks to validate broker behavior and your settings.

Multistage Profit Closure (Why It Matters)

“Let winners run” sounds great—until markets snap back. The multistage exit lets you cash partials at objective levels, then protect the remainder. If a move trends, the trailing logic tries to collect more. If it fizzles, you’ve already banked. Over many trades, this reduces variance and smooths equity growth.

Sample Parameter Philosophy (Per Pair)

- EURUSD (H1): Calm pair; consider slightly tighter MaxSpread. Partial profits can be closer due to consistent micro-swings.

- GBPUSD (H1): More volatile; allow a bit more room on stops and partial distances. Consider a wider break-even trigger to avoid being whipped.

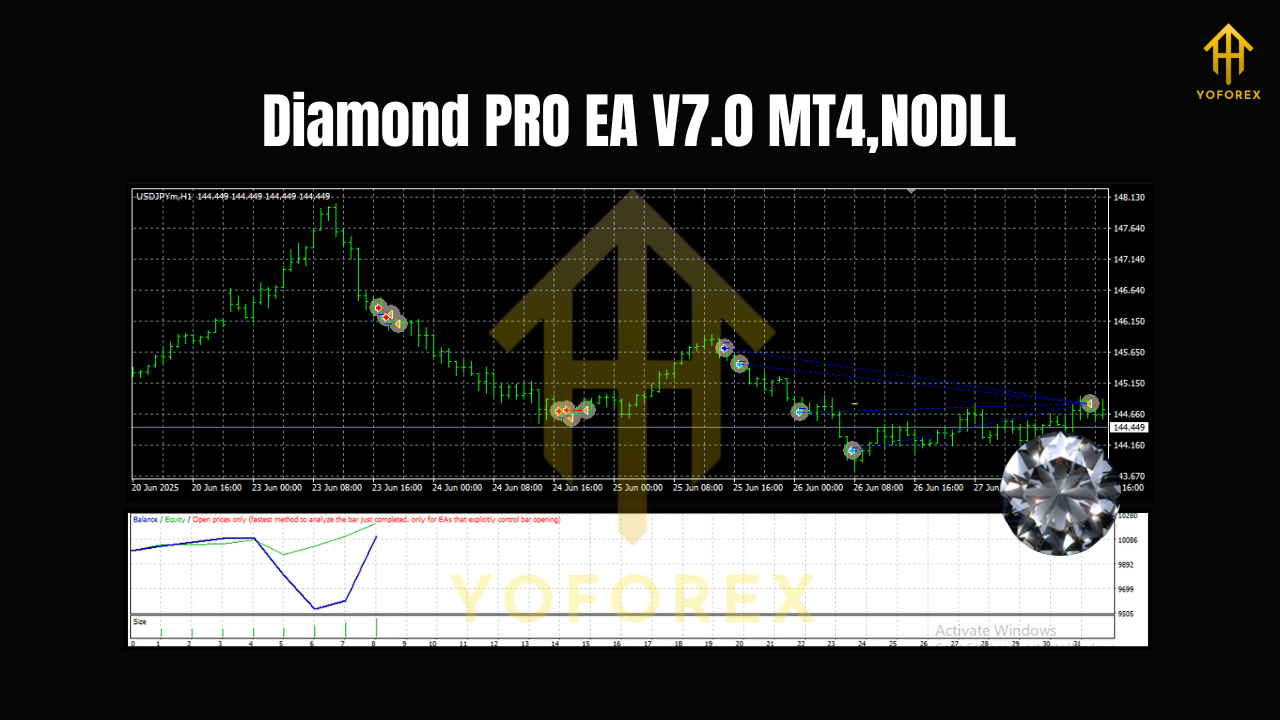

- USDJPY (H1): Momentum can be clean. A modest trailing can add value on trend days. Watch for Asia session nuances.

Tip: Keep a journal. If you nudge a parameter (say, trailing step), record date, pair, and reason. Review weekly.

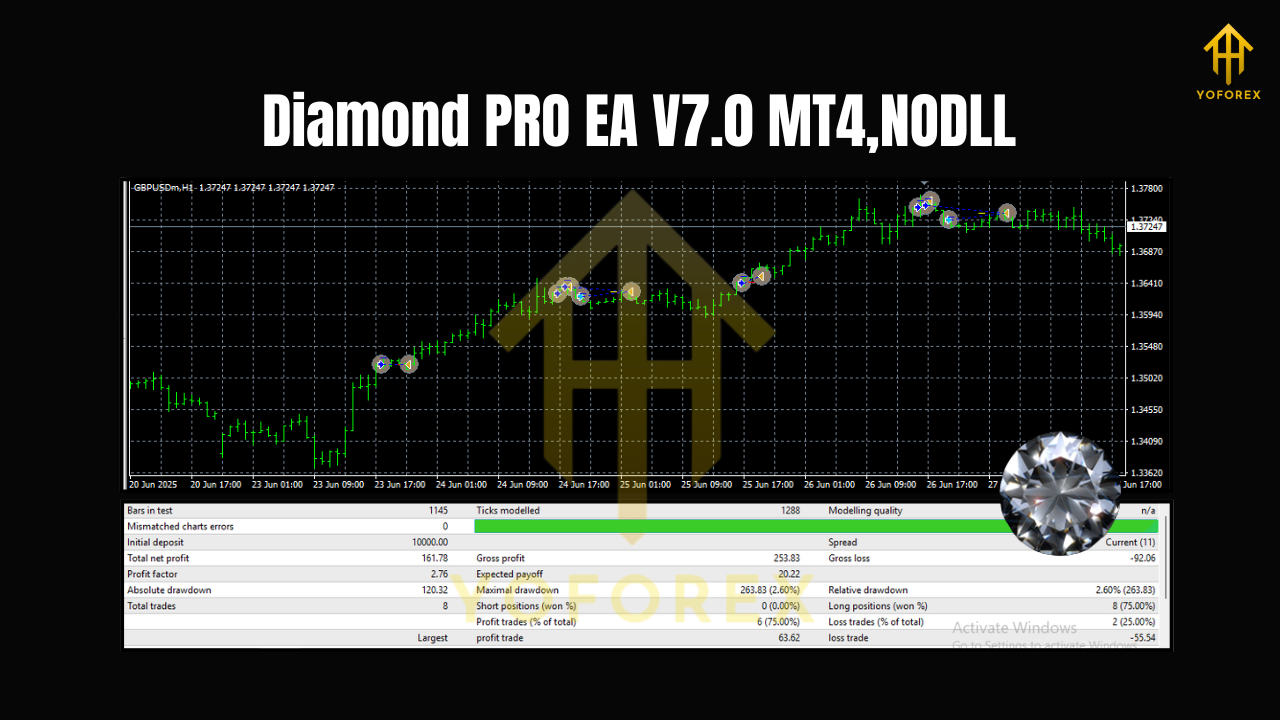

Backtesting vs. Forward Testing

Backtests are helpful for sanity checks, but forward-test is king. Markets shift; spreads and slippage vary by broker; news regimes change. Use backtests to understand relative behavior (e.g., how often partial TP1 gets hit on H1). Then run the EA live on demo to mirror your broker’s reality before committing real capital. After 2–4 weeks, evaluate:

- Win rate vs. your risk per trade

- Average R-multiple captured per position

- Frequency of partials vs. full take-profits

- Drawdown depth during quiet or whipsaw weeks

If you’re hitting soft loss limits often, pull back risk and re-check MaxSpread and session filters.

Good Practices Most Traders Skip

- One change at a time: If you tweak five parameters and results improve, you won’t know which mattered.

- Broker alignment: Use ECN/Raw spread accounts where possible. Commission + tight spreads usually beat “zero commission” accounts with fat spreads.

- Keep MT4 lean: Fewer custom indicators and charts running = more stable EA behavior.

- Protect psychology: Adhere to daily loss caps and stop trading after large wins too; over-confidence is as dangerous as tilt.

Pros & Cons

Pros

- Robust entry filtration reduces low-quality trades.

- Multistage exits keep equity smoother than all-or-nothing TP.

- Transparent, configurable parameters—no black-box martingale.

- Sensible minimum deposit ($200) with room to scale.

Cons

- Not a “plug-and-forget” system—benefits from supervision and occasional tuning.

- Slower trade frequency than scalpers; patience required.

- Performance varies by broker quality and execution conditions.

Final Word: Who Should Use Diamond PRO EA V7.0?

If you want measured risk, strong control, and clean H1 logic on major pairs, Diamond PRO EA V7.0 is a solid, professional-grade choice. It won’t chase every candle. It won’t balloon positions with grid/marti tricks. It waits, enters when conditions align, and manages exits like a pro—which is exactly what most traders need to stay in the game long enough to grow.

Join our Telegram for the latest updates and support

Comments

Leave a Comment