Dark Gold EA V1.0 MT4 — High-Frequency Scalping on Gold, Bitcoin & Majors

If you’ve ever watched a perfect breakout on gold or a violent BTC pullback and thought, “ugh, I should’ve been in that,” Dark Gold EA V1.0 MT4 is built to catch exactly those fast, high-probability moments. This Expert Advisor automates high-frequency scalping on volatile instruments like XAUUSD and BTCUSD, while staying nimble enough to trade EURUSD and GBPUSD when opportunities pop up. It blends precise support-and-resistance analysis with both trend-following and counter-trend entries, so it can adapt when markets are surging… or snapping back to the mean.

Quick facts:

- Platform: MetaTrader 4 (MT4)

- Pairs: XAUUSD, BTCUSD, EURUSD, GBPUSD

- Timeframes: M5, M15, H1

- Minimum/Recommended Deposit: $100

- Core Edge: High-frequency scalping with structured S/R logic and configurable risk

Why traders pick a scalper like Dark Gold EA

Scalping thrives on speed, structure, and strict risk. Gold and Bitcoin are famously volatile; spreads can widen and momentum can vanish, then reappear in seconds. Dark Gold EA focuses on the micro-edges that occur around well-defined zones—previous highs/lows, intraday ranges, liquidity pockets—so it isn’t just chasing candles. It’s reacting to price where it matters, with the discipline of a machine and the setup logic of a seasoned S/R trader.

Because it supports trend and counter-trend behavior, you’re not locked into one market regime. Strong trend? The EA rides momentum. Choppy session? It looks for mean-reversion scalps from key levels with tight stops. That mix gives you more trade opportunities without forcing the same playbook on every market day.

How Dark Gold EA approaches entries & exits

Support & resistance mapping: The EA watches the most reactive areas and treats them as “decision zones.” When price hits those zones, it evaluates volatility, recent momentum, and micro-structure to decide whether a breakout continuation or a quick reversal is more probable.

Trend-following model: When directional bias is obvious (e.g., gold in a strong NY session push), the EA seeks with-trend pullbacks or breakout continuations. It avoids late chases by requiring micro-confirmations before entry.

Counter-trend model: In range-bound or overextended markets (hello BTC spikes), the EA waits for exhaustion signals at S/R, then looks for quick reversion scalps. Stops are tight; targets are modest; the idea is many small wins, minimal drag.

Risk-first exits: You define your risk per trade, while the EA can enforce a protective stop, dynamic take-profit, and optional tools like break-even and trailing logic. The aim is to cut losers fast and let winners breathe just enough to capture the move.

Recommended use by timeframe

- M5: Highest signal frequency; best for active sessions and news-adjacent volatility. Demands a low-latency environment (consider a VPS and a low-spread broker).

- M15: Balanced pace; cleaner reads in normal liquidity. Good middle ground for most traders.

- H1: Fewer but often higher-quality signals; useful when you can’t monitor positions often or prefer higher R:R per trade.

Tip: Start on M15 to observe behavior, then decide whether you want more action (M5) or calmer entries (H1).

Key features at a glance

- High-frequency scalping engine tuned for XAUUSD & BTCUSD, adaptable to EURUSD & GBPUSD

- Dual strategy modes: trend-following and counter-trend reversion from S/R

- Configurable risk: fixed lot or %-risk per trade

- Protective stops & TP: tight SL, dynamic TP logic suited for scalps

- Optional break-even & trailing stop to lock profit during bursts

- Session filters (e.g., focus on London/NY where volatility is richest)

- Spread guard & slippage control to avoid poor fills in thin liquidity

- Magic number support for multi-chart / multi-pair deployment

- News-aware trading window (optional) so you can pause around major releases

- Minimal resource footprint so MT4 stays responsive even with several charts attached

Setup guide (MT4)

- Install & enable: Copy the EA file to

MQL4/Experts, restart MT4, and enable AutoTrading. - Attach to chart(s): Start with XAUUSD M15 and BTCUSD M15 to watch behavior; add EURUSD/GBPUSD as you gain confidence.

- Broker & account: Use a low-spread, fast-execution broker; ECN or RAW accounts can help. A $100 minimum deposit is supported, but more headroom reduces risk of margin stress.

- Risk config: Choose either fixed lots (e.g., 0.01 on small accounts) or % risk (common: 0.5%–1% per trade).

- Trade filters:

- Spread guard around gold/crypto news hours.

- Time/session filter to focus on London and New York.

6. Optional protections: Break-even after price moves 1R; gentle trailing for runners.

7. VPS recommended: For M5 scalping and BTC, a near-exchange VPS can cut latency meaningfully.

Risk management that respects volatility

Gold and Bitcoin can sprint, stall, then sprint again. That’s the game. To keep equity curves smoother:

- Position sizing: On small accounts ($100–$300), consider 0.01 lots or ≤0.5% risk/trade.

- Max exposure: Limit concurrent trades across pairs to avoid correlated drawdowns.

- Daily loss cap: Pre-define a maximum daily equity loss (e.g., 3%) and stop for the day if reached.

- Session discipline: Focus on the sessions your broker fills best; skip illiquid hours.

Remember, scalping is about frequency + discipline, not home runs. Dozens of small, well-managed edges add up.

Who is Dark Gold EA best for?

- Active day traders who want a rules-driven way to harvest micro-moves on gold/crypto.

- Hybrid traders who like to monitor but prefer automation for entries/exits.

- Prop aspirants seeking tight risk and consistent behavior on M5/M15.

- Swing-leaning traders who still want exposure to high-quality H1 level plays.

If you prefer very long holds or dislike frequent trades, you may lean more on the H1 setup or pair this EA with a swing system.

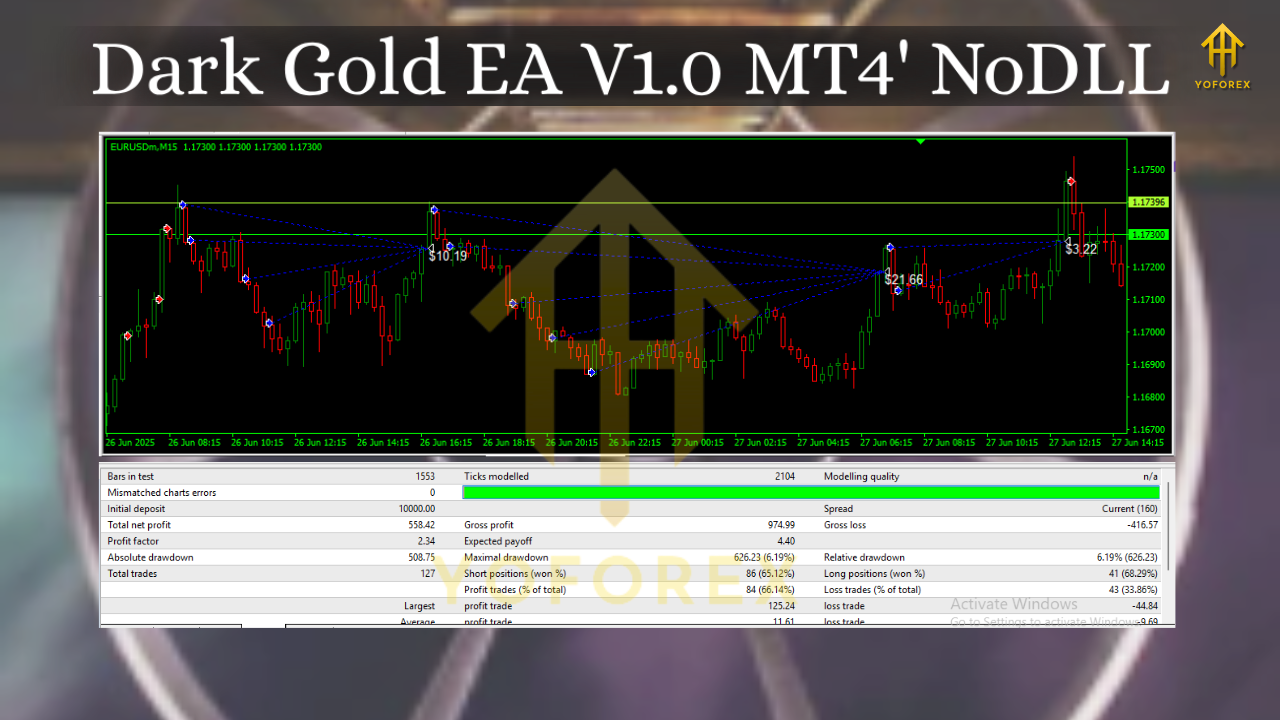

Backtesting & forward evaluation tips

- Use real tick data (or the highest quality available) and model realistic spreads.

- Segment tests by session: London-only vs NY-only can produce very different stats.

- Walk-forward: Re-opt minor parameters quarterly; don’t over-fit.

- Forward demo first: Run the EA on a demo or small live account to observe fills, slippage, and broker quirks before scaling.

Best practices & common pitfalls

Do:

- Start conservative on lot size; scale only after consistent weeks.

- Keep pairs you genuinely understand (XAU & BTC first, majors once confident).

- Regularly export trade history to review spreads, slippage, and average hold time.

Avoid:

- Running the EA through illiquid holiday hours.

- Trading major high-impact news without a plan.

- Over-stacking correlated risk (e.g., gold + GBPUSD during USD events).

Final word

Dark Gold EA V1.0 MT4 doesn’t promise magic; it offers structure. With a disciplined S/R engine, dual-mode entries, and configurable risk, it gives scalpers a serious shot at converting volatility into repeatable opportunities. Start on M15, stay conservative, and let data guide your tweaks. Trade responsibly, always test first, and grow with a process—not guesses.

Comments

Dive into the expansive realm of EVE Online. Forge your empire today. Trade alongside millions of players worldwide. Join now

Leave a Comment