Danesha XAUUSD EA V3.0 MT4 is an advanced automated trading system created for traders who focus on gold. Built exclusively for MetaTrader 4, this Expert Advisor (EA) uses a disciplined and technical structure to handle the volatility of XAU/USD. Instead of relying on guesswork or emotion, Danesha EA operates using defined algorithms that detect trends, manage risk, and adapt to changing market momentum.

Gold is one of the most dynamic instruments in forex trading. Its frequent volatility provides immense profit opportunities but also exposes traders to sudden reversals. The Danesha XAUUSD EA V3.0 is designed precisely for this environment — using a mix of precision entry logic, time-based confirmations, and a multi-layered recovery system that keeps trading consistent, even when markets fluctuate unpredictably.

Understanding How Danesha XAUUSD EA Works

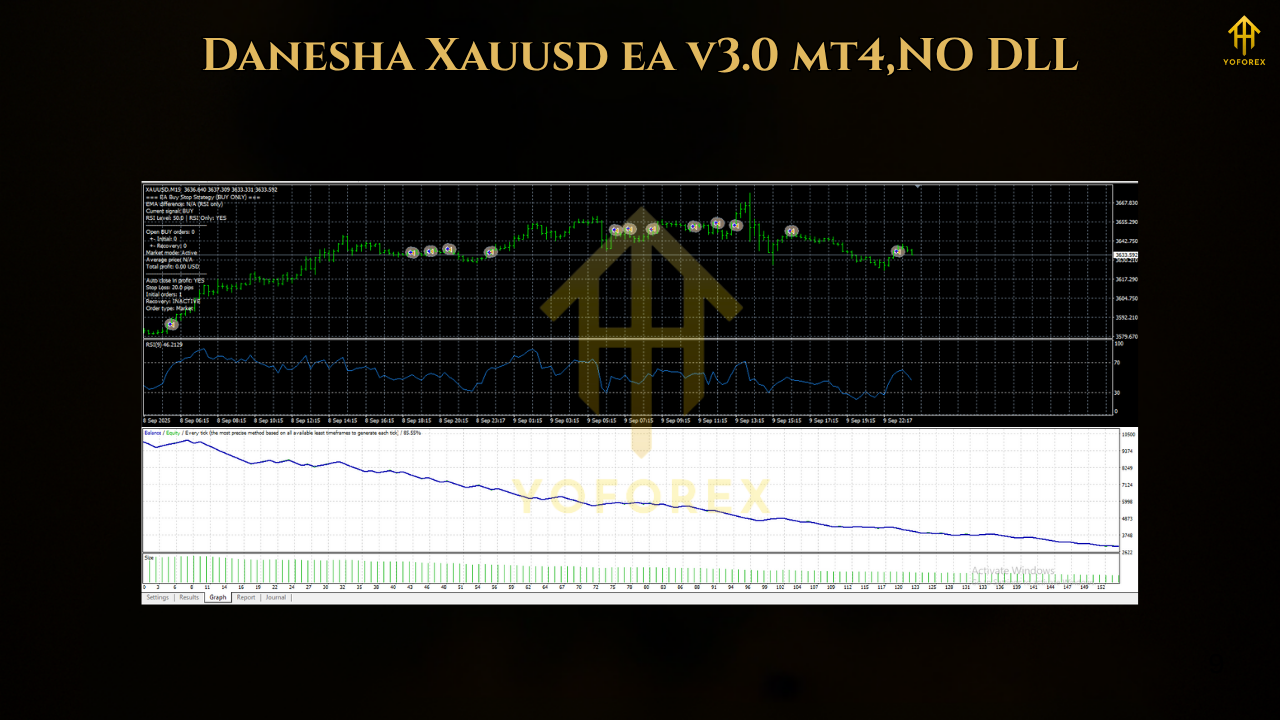

Danesha XAUUSD EA V3.0 MT4 is engineered to work on the H1 timeframe, making it a medium-term system that avoids noise from lower timeframes while still catching significant moves. The EA identifies potential breakout zones using a combination of exponential moving averages (EMA) and relative strength index (RSI) confirmation.

When the fast EMA crosses the slower EMA and RSI confirms trend strength, the EA places pending Buy Stop or Sell Stop orders above or below the current market price. This method ensures trades are only triggered during genuine momentum shifts rather than false breakouts.

Each order comes with a pre-set take profit and optional stop loss. If price movement turns against the initial position, the EA activates its built-in recovery mode — a feature that opens new positions at calculated intervals to average the overall entry price and recover from temporary drawdowns.

The combination of structure, trend analysis, and adaptive recovery allows Danesha to remain flexible without taking unnecessary risks.

Key Features of Danesha XAUUSD EA V3.0 MT4

1. Designed Exclusively for Gold (XAU/USD)

This EA focuses purely on gold. Every algorithm, variable, and filter is tuned for XAU/USD’s unique volatility and liquidity. It does not dilute its performance across other pairs, making it far more consistent for traders who specialise in gold.

2. EMA + RSI Trend Logic

The EA waits for technical alignment before entering trades. It does not chase random signals but follows structured rules that combine trend confirmation and momentum strength.

3. Pending Order Execution

Instead of instant market entries, the EA sets pending orders. This ensures execution only happens when the market moves decisively in the expected direction. It helps reduce fake signals and avoid premature trades.

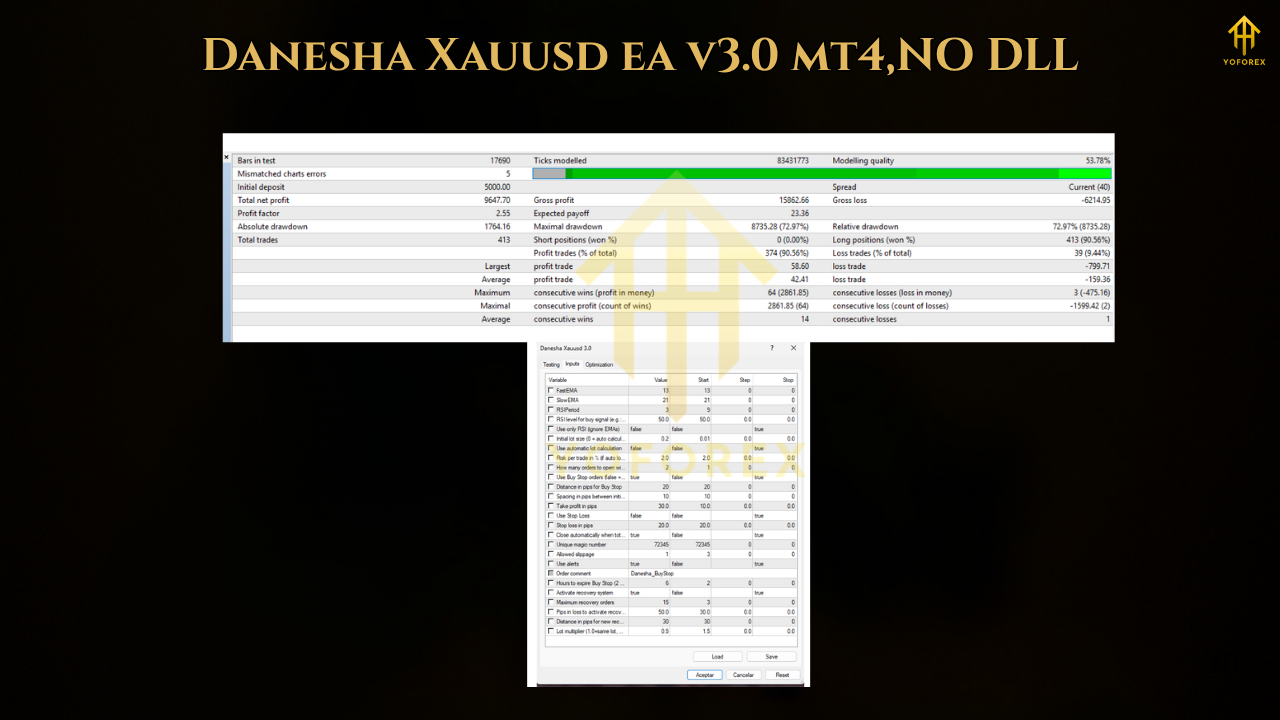

4. Smart Recovery System

The recovery mechanism is intelligently designed — it does not double lot sizes aggressively like a martingale. Instead, it uses a gradual multiplier below 1.0, ensuring safer averaging and reduced exposure.

5. H1 Timeframe Optimisation

Operating on a one-hour chart gives the system balance — fewer false signals than M5 or M15 charts but more frequent opportunities than daily charts.

6. Risk Management Control

The EA allows users to define lot sizes, percentage-based risks, and maximum open trades. These parameters make it adaptable to both small accounts and prop firm accounts.

Recommended Setup for Traders

- Platform: MetaTrader 4

- Trading Pair: XAU/USD

- Timeframe: H1

- Minimum Deposit: $5,000 for standard parameters (can be reduced with smaller lot sizing)

- Account Type: ECN or Raw Spread account

- Broker Environment: Low latency, fast execution

- Hosting: VPS (Virtual Private Server) strongly recommended

- Leverage: 1:500 or higher for flexibility

To maximise results, traders should run Danesha EA continuously during active market sessions, preferably during the London–New York overlap when gold has the highest liquidity.

Performance Behaviour and Market Adaptation

Unlike systems that open dozens of positions, Danesha XAUUSD EA prioritises precision over quantity. It performs best in markets showing strong directional bias — typically following economic data, interest rate decisions, or global events affecting gold prices.

During consolidation phases, the EA’s entry logic filters out noise, waiting patiently until a new trend emerges. Its adaptive recovery helps navigate sideways conditions without overexposing capital.

For long-term users, the EA can be left to run continuously as part of a diversified portfolio. It can complement manual strategies or serve as the main automated system for traders focusing solely on XAU/USD.

Advantages of Using Danesha XAUUSD EA V3.0 MT4

- Fully Automated Trading – Once configured, it handles trade entry, exit, and management independently.

- Prop-Firm Friendly – The system is designed with controlled drawdown and steady equity growth in mind, suitable for accounts following strict prop-firm rules.

- Customizable Parameters – Every aspect, from order distance to recovery multipliers, can be adjusted to match the trader’s style and capital.

- Emotion-Free Execution – The EA removes fear, greed, and hesitation — common pitfalls in manual trading.

- Strategic Consistency – It follows one strategy rigorously, ensuring data-driven trading decisions over impulsive actions.

- Stability Over Scalping – The one-hour chart ensures trades have meaningful weight rather than dozens of low-value scalps.

Risks and Precautions

While Danesha XAUUSD EA V3.0 MT4 offers a well-balanced design, it’s important to manage expectations realistically:

- High Volatility Events: Gold can move sharply during major news releases. Disabling the EA during such periods can protect open positions.

- Broker Conditions: Performance can vary based on spreads, execution delays, and slippage. Always use a high-quality broker.

- Recovery Mode Caution: Although the EA’s recovery system is controlled, traders should still monitor margin usage. Ensure enough equity to sustain multiple recovery layers.

- Backtesting & Optimisation: Every broker’s feed differs slightly. Run your own optimisation before live deployment to align settings with your market conditions.

With these precautions, the EA can deliver steady and predictable outcomes without frequent manual intervention.

Best Practices for Long-Term Results

- Use the EA only for XAU/USD on the H1 timeframe.

- Run it on a reliable VPS to avoid disconnects.

- Keep risk levels low; use 1–2% per trade maximum.

- Recheck parameter optimisation every 3–4 months.

- Disable during high-impact news such as FOMC, NFP, or CPI releases.

- Withdraw profits periodically and compound gradually.

Final Thoughts

Danesha XAUUSD EA V3.0 MT4 is a mature Expert Advisor for traders who want methodical gold trading without the noise of unpredictable systems. Its strength lies in balance — strong enough to capture momentum, yet conservative enough to avoid excessive drawdowns.

For serious traders who understand that automation is about consistency, not overnight fortune, Danesha provides a reliable structure to grow capital systematically. Whether you’re trading individually or managing multiple accounts, this EA can become a cornerstone of a disciplined trading framework.

Comments

Leave a Comment