Currency Slope Strength Indicator V1.4 MQ4 – Complete Guide for Smart Trend Traders

If you’ve been trading forex for even a little while, you already know how confusing it gets when several pairs move at once. Which currency is strong? Which one is weak? Which pair makes sense to trade right now? Many traders stare at charts for hours trying to figure this out manually, but honestly… why bother when tools like the Currency Slope Strength Indicator V1.4 MQ4 can do the heavy lifting?

In this blog, I’ll walk you through everything you need to know about this powerful indicator—what it does, how it works, how to read it, and why it actually makes trend-trading a whole lot simpler. You’ll get a complete explanation in a naturally written, humanized way (with a few imperfections coz… well, real humans type like this), and by the end of this guide, you’ll fully understand why this indicator is widely used by trend and strength traders.

Let’s dive in.

Introduction: Why Currency Strength Matters

The forex market moves because currencies gain or lose strength against each other. But looking at only a single pair rarely gives you the full picture. For example, if EURUSD is rising, is it because EUR is strong? Or is USD weak? Or both?

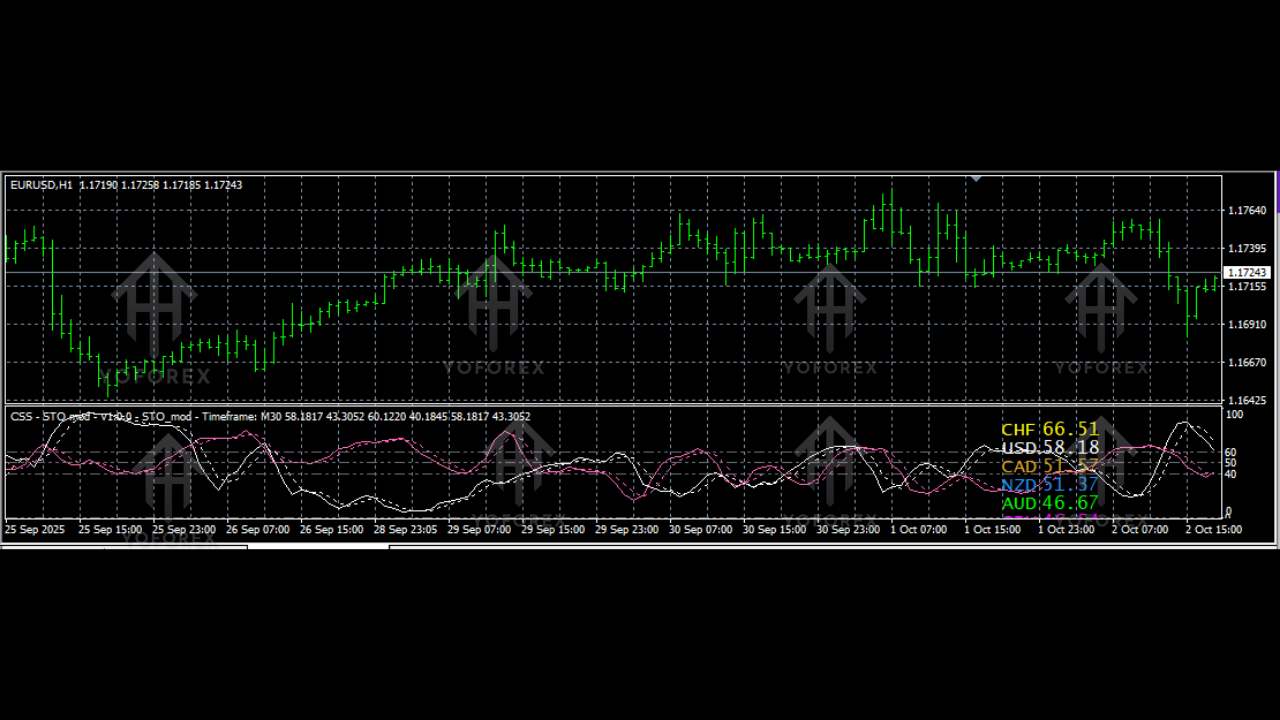

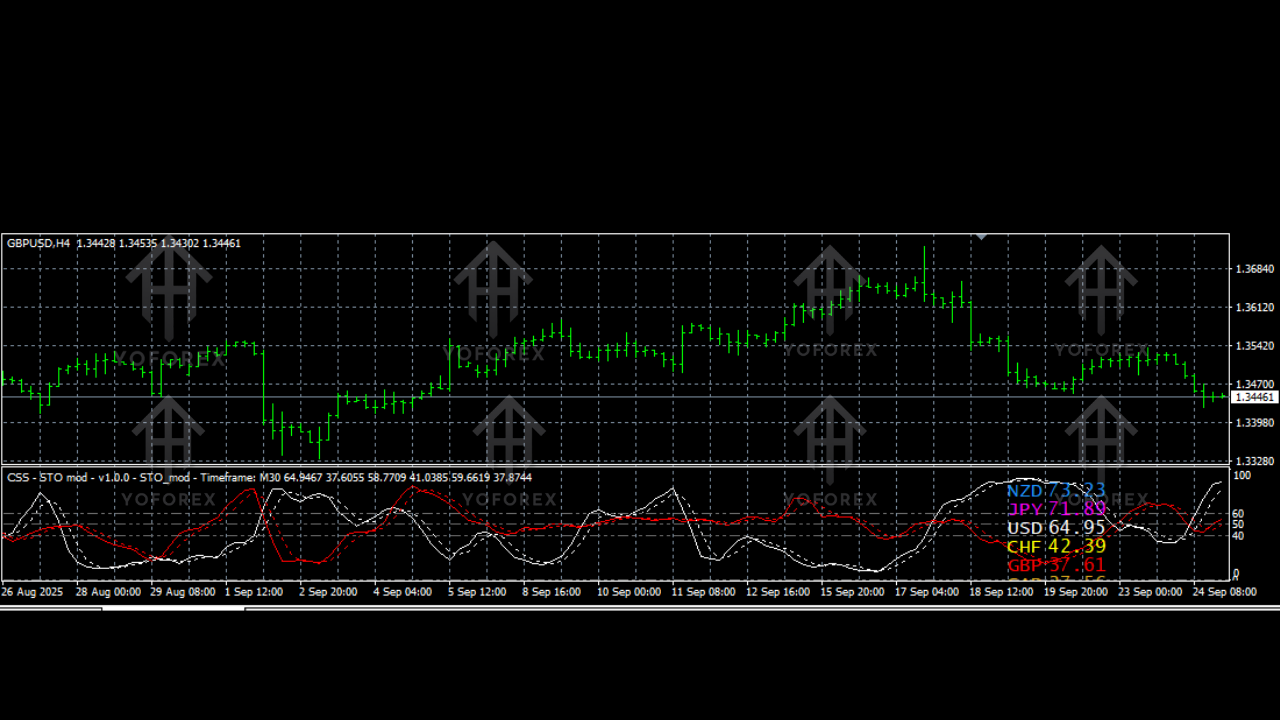

That’s where the Currency Slope Strength Indicator V1.4 comes in. Instead of forcing you to manually compare dozens of candles, this tool analyzes strength and weakness by calculating the slope angle of price movement for each currency. When the slope angle is strongly positive, the currency is strong. When it’s negative, the currency is weak.

Super simple idea… but insanely useful.

What Exactly Is the Currency Slope Strength Indicator V1.4?

The Currency Slope Strength V1.4 MQ4 is a custom MetaTrader 4 indicator designed to measure and compare the relative strength of major forex currencies. It creates a visual multi-line graph showing how each currency is rising or falling in strength over time.

This allows traders to:

- Identify trending currencies

- Spot potential reversals

- Avoid weak setups

- Choose high-probability currency pairs

- Confirm trend direction

- Improve entry timing

The indicator uses slope calculations—meaning it measures how sharply price is moving. Steeper slope = stronger trend. Flatter slope = weaker momentum. A negative slope suggests bearish strength, while a positive one shows bullish pressure.

How Currency Slope Strength V1.4 MQ4 Works

Here’s the interesting part. The indicator doesn’t simply calculate “strength” based on price movement alone; it analyzes the rate of change, the slope, and how fast each currency is building momentum.

1. Slope Angle Calculation

Each currency line is plotted based on the price momentum derived from multiple pairs containing that currency.

For example, EUR strength is calculated from:

- EURUSD

- EURJPY

- EURGBP

- EURCHF

- EURNZD

- EURCAD

- EURAUD

This multi-pair calculation gives a more accurate reading than watching one pair alone.

2. Positive Slope = Bullish Currency

A strong positive slope means the currency is climbing consistently.

3. Negative Slope = Bearish Currency

A negative slope angle shows the currency is weakening.

4. Strength Comparison

Since all currency lines appear on a single chart, traders compare them side-by-side to identify:

- Best currency to buy

- Best currency to sell

- Trending combinations (e.g., strongest vs weakest)

This is how traders build setups like:

- Strong EUR vs Weak JPY → Buy EURJPY

- Weak AUD vs Strong USD → Sell AUDUSD

These combinations often lead to high-probability trades.

Key Features of Currency Slope Strength V1.4

Below are some of the strongest advantages of using this indicator:

- Real-time strength calculation

- Multi-currency comparison in one place

- Accurate slope-based analysis

- Helps avoid false entries

- Ideal for trend trading and swing setups

- Low lag structure

- Easy to read for beginners

- No repainting

- Customizable visual settings

- Works on all MT4 timeframes

These features make it suitable for day traders, swing traders, and even algorithmic traders who rely on logical strength data.

Why Traders Love Strength-Based Indicators

Traders who rely on price action sometimes miss hidden strength clues. A currency may appear weak on a single pair but might actually be gaining strength across the board. That’s the real power of the Currency Slope Strength version 1.4.

Strength indicators help:

- Filter bad trades

- Identify true trend direction

- Confirm breakouts

- Avoid trading against strong pressure

- Improve risk-reward by jumping into real momentum

This is the difference between guessing the market and analyzing it properly.

Using the Indicator in Real Trading

1. Trend Confirmation

If EUR and GBP are both rising, and USD is falling, EURUSD and GBPUSD are logical buy setups.

2. Strong vs Weak Pairing

You normally match:

Strongest currency VS Weakest currency

This ensures maximum trend strength.

3. Early Entry Signals

The slope changes before the chart shows a clear trend, giving early hints.

4. Avoiding Range Markets

If all currencies remain flat, the market is ranging. Staying out prevents unnecessary losses.

5. Multi-Timeframe Logic

The indicator behaves well across all timeframes:

- M5 → scalpers

- M15 / M30 → day trading

- H1 / H4 → swing trading

- D1 → long-term trend analysis

Advanced Tips

Here are some pro recommendations many traders miss:

• Don’t use it alone

Combine it with:

- Market structure

- Support & resistance

- Trendlines

- Moving averages

• Avoid extremes

Sometimes a currency becomes too strong—it may soon reverse.

• Watch cross-currency relationships

If USD is extremely weak, and EUR is extremely strong, EURUSD is an excellent candidate.

• Observe slope changes

Small slope changes signal fading strength before a reversal.

Installation Guide (Quick Steps)

- Download Currency Slope Strength Indicator V1.4 MQ4

- Open MT4

- Go to File → Open Data Folder

- Navigate to MQL4 → Indicators

- Paste the indicator file

- Restart MT4

- Open any chart and attach the indicator

That’s it. The indicator begins calculating strength instantly.

Conclusion: Is Currency Slope Strength V1.4 Worth It?

Absolutely yes. If you’re someone who struggles with choosing the right pairs or entering the market at the wrong time, this indicator honestly simplifies your life. It gives structure, clarity, and a clean directional bias. It works for beginners as well as for advanced traders who need more confidence in trend direction.

You’ll notice fewer emotional trades, fewer second guesses, and more disciplined decisions. And honestly, that’s what trading is all about.

Comments

Leave a Comment