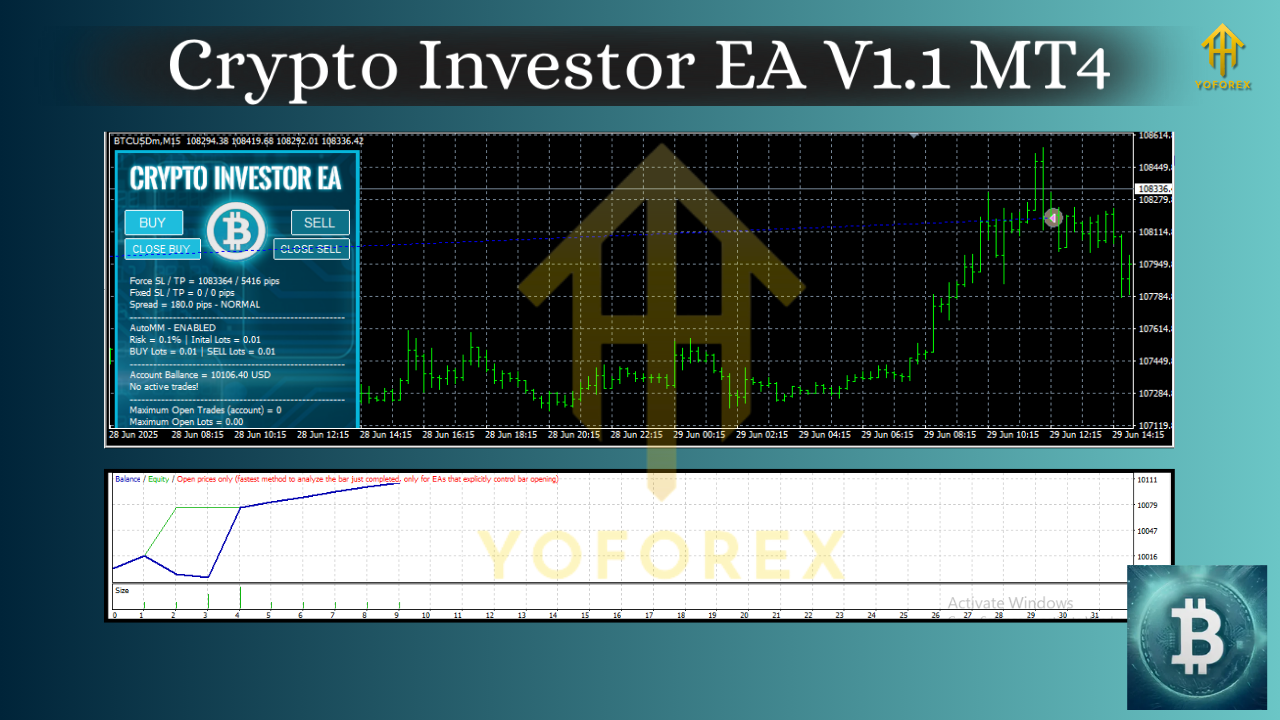

Crypto Investor EA V1.1 MT4 — Precision Bitcoin Trading on M15

Tired of bots that melt down the moment Bitcoin gets jumpy? Same. Crypto Investor EA V1.1 for MT4 is built specifically for BTCUSD on the M15 timeframe—no diluted, “works on everything” promises; just one market, done right. Powered by high-performance algorithms, it reads order-flow-like momentum, adapts to volatility spikes, and executes faster than human reflexes can blink. If you’ve ever wished for a robot that actually respects Bitcoin’s personality—its momentum bursts, its fakeouts, its weekend mayhem—this one’s for you. And coz it runs on MetaTrader 4, you can drop it into your existing workflow, hook it to a trusted crypto-enabled broker, and go.

Below you’ll find what it does, how it trades, recommended settings, risk management tips, and a pragmatic setup guide. No fluff, no martingale, no grid. Just rule-based BTC trading engineered for consistency.

What Makes Crypto Investor EA Different?

Laser focus on BTCUSD (M15). Most EAs try to cover dozens of symbols and timeframes; this one doesn’t. It’s fine-tuned for Bitcoin’s rhythm on 15-minute candles—where intraday swings are big enough to matter but noise is still controllable.

Volatility-aware logic. The EA scales entries and exits to the current volatility regime—agile during expansions, conservative during chops. That means fewer impulse trades at the worst times and more conviction when momentum is clean.

Momentum confirmation + mean-reversion safety. The core engine hunts for breakouts that actually follow through, then uses reversion signals to tighten risk if momentum fades. So you don’t just “buy highs and pray”; you buy strength with a plan.

Serious risk control. Fixed (or dynamic ATR-based) stop loss, trailing logic, hard daily loss caps, optional equity guard, and time-based cool-downs after fast moves. It is coded to survive, not just impress on pretty charts.

Key Features (Quick Hits)

- • BTCUSD only, M15 timeframe — hyper-tuned for one job

- • No martingale, no grid, no averaging down — risk stays sane

- • Adaptive volatility filter — expands SL/TP when BTC runs, tightens in chop

- • Momentum + structure confirmation — filters fake breakouts

- • ATR-based stop loss & trailing — dynamic protection as conditions change

- • Breakeven engine — lock in trades once price moves in your favor

- • Session throttling & cool-down — optional trade pauses after large spikes

- • Daily loss cap & equity guard — stop trading if plan limits are hit

- • Spread & slippage checks — skip bad-quality fills during thin liquidity

- • 24/7 crypto-ready — trades seamlessly across weekends

- • Manual override friendly — pause/resume switches without breaking logic

- • Low-resource footprint — runs light on a VPS

How the Strategy Works (In Plain English)

At its core, Crypto Investor EA measures short-term momentum and structure on M15. When price expands with volume-like velocity (proxied by range/vol filters) and clears nearby structure, the EA considers a trade only if risk-to-reward remains favorable. It avoids forced entries when BTC is ranging tightly—those are the hours that chew up equity with fee churn and whipsaws.

Once in a position, the EA lets winners breathe using a trailing model that references ATR and recent swing points. If momentum stalls, the breakeven safeguard kicks in to protect capital. If volatility explodes (think sudden news or exchange hiccups), the cool-down prevents revenge trades for a set period. The goal: capture the middle of a move, not predict tops or bottoms.

Recommended Setup & Environment

- Broker: Use a reputable broker/bridge that offers BTCUSD on MT4 with tight, consistent spreads and reliable weekend liquidity.

- Account Type: Hedging or netting is fine; check your broker’s symbol settings (contract size, digits).

- Leverage: Crypto leverage varies—choose conservatively; don’t let leverage trick you into oversizing.

- VPS: Strongly recommended. Low latency reduces slippage on fast Bitcoin bursts.

- Symbol Settings: Confirm “BTCUSD” naming on your platform (some brokers use “BTCUSD.r” or similar). Attach EA to the exact market the broker provides for spot/CFD BTC.

Position Sizing & Risk Management

Baseline: Start with 0.01 lots per ~$1,000–$1,500 of equity as a conservative reference, then scale only after at least 4–6 weeks of live forward results. Crypto is volatile; small is smart.

Per-Trade Risk: 0.5%–1.0% of equity per trade is a sensible range for BTC. If you’re new or running prop constraints, use 0.25%–0.5%.

Daily Loss Cap: Enable the EA’s daily loss limit (e.g., 2%–3%). If hit, the EA stops trading for the day. Sounds boring; saves accounts.

Drawdown Planning: Decide your absolute max drawdown (e.g., 10%–15%) and size positions backwards from that. If your sizing violates that limit on backtests or forward stats, reduce.

Installation (Step-by-Step)

- Open MT4 → File → Open Data Folder.

- Navigate to MQL4 → Experts and copy the Crypto Investor EA V1.1.ex4 file there.

- Restart MT4 (or right-click Experts in the Navigator and hit Refresh).

- Drag Crypto Investor EA V1.1 onto a BTCUSD M15 chart.

- In the Common tab, enable Allow live trading and (if used) Allow DLL imports.

- In Inputs, set your LotSize (or risk %), StopLossATR, TrailATR, DailyLossLimit, CoolDownMinutes, and MaxSpread.

- Click OK, ensure the smiley face is active, and keep the platform/VPS online 24/7.

Tip: Run the EA on one chart only (BTCUSD M15). Multiple instances on the same symbol can conflict with Magic Numbers if not configured.

Suggested Settings (Starter Preset)

- Risk Mode: Fixed lot at first (easier to validate).

- Lot Size: 0.01 per $1,000–$1,500 equity (demo first).

- Stop Loss: ATR-based (e.g., 2.0× ATR(14)).

- Take Profit: Dynamic via trailing; optional partials at 1.5–2.0R.

- Breakeven: Move SL to entry after ~1.0–1.2R.

- Max Spread: Broker-dependent; set tight enough to avoid bad fills.

- Daily Loss Limit: 2%–3%.

- Cool-Down After Spike: 15–45 minutes (your preference).

- Trade Hours: 24/7 (crypto), but you can exclude thin periods if your broker’s liquidity drops.

Backtesting & Forward Expectations

When you backtest BTC on MT4, make sure you’ve got quality tick data (crypto feeds can be messy). Focus on:

- Multi-year test window that includes both bull runs and ugly sideways years.

- Execution assumptions: Reasonable slippage/spread (don’t cheat your model).

- Walk-forward logic: Validate on unseen periods, not just one cherry-picked year.

- Risk stability: Confirm that 0.5% per trade keeps worst-case drawdown within plan.

Forward testing on a demo (then a tiny live account) for 4–8 weeks is your best reality check. Expect streaks—winning and losing. The EA is built to lean into momentum and step aside when noise dominates, but BTC will still dish out clusters of chop. Discipline beats tweaking settings mid-week.

Best Practices (So You Don’t Over-Optimize)

- Avoid cranking risk after a good week. Keep it boring; scale monthly, not daily.

- Don’t disable the EA after two losers. That’s exactly when the next clean trend often hits.

- Keep logs. If you change a setting, write it down with a reason.

- Broker hygiene matters. Sloppy spreads + outages = phantom losses.

- One strategy, one job. Don’t stack it with random EAs on the same symbol unless you really understand correlated risk.

Who Is This For?

- Intraday BTC traders who want rules, not vibes.

- Prop-rule survivors needing hard loss caps, no martingale, and steady risk.

- Busy traders who can’t monitor charts 24/7 but still want in on crypto’s daily moves.

If you’re after lottery-ticket returns or 50% a week, this isn’t it. If you want a professional, repeatable edge with defined risk—welcome.

Disclaimer (Read This, Seriously)

Crypto markets are highly volatile. Past performance does not guarantee future results. Trade only with money you can afford to risk. Always test on demo first, confirm your broker’s symbol specs, and follow the laws/regulations in your region.

Call to Action

Ready to automate BTCUSD the right way? Spin up a demo, attach Crypto Investor EA V1.1 to BTCUSD M15, and let it run through a full market cycle. When you’re confident with results and risk—go live on your terms. Steady settings, steady hands.

Comments

Leave a Comment