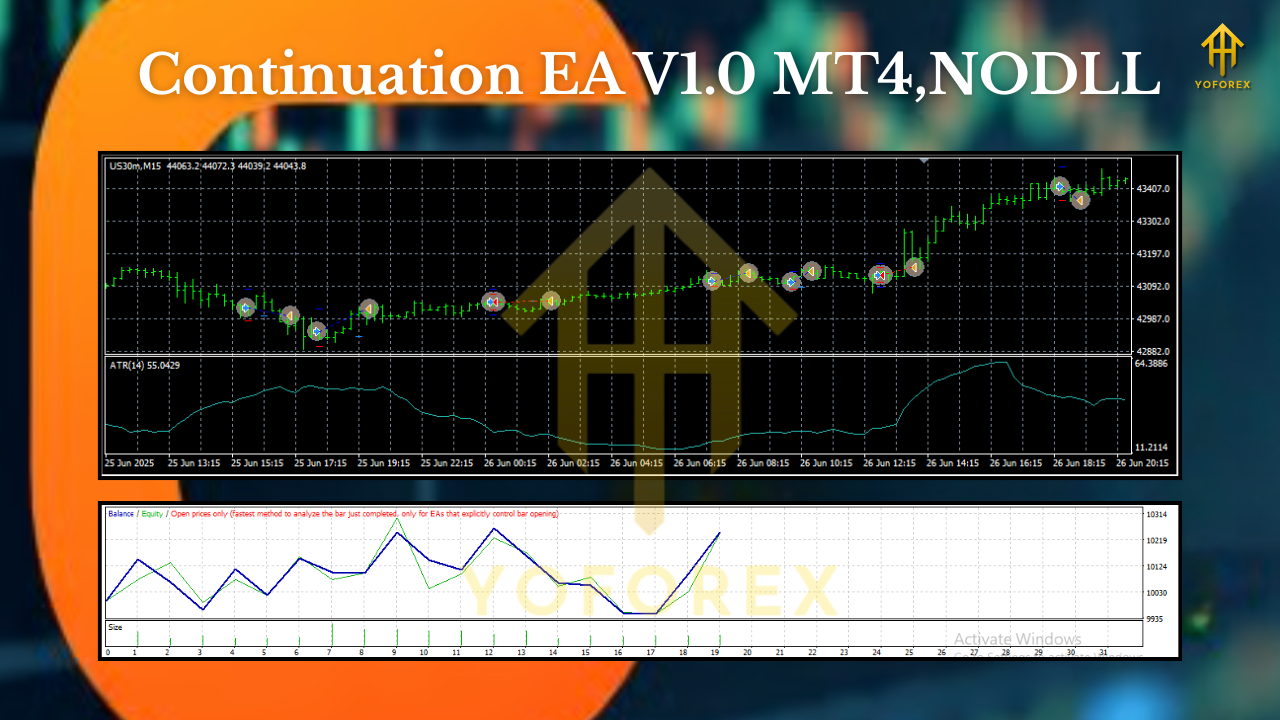

Continuation EA V1.0 MT4 — Ride the Trend, Skip the Noise (M15)

If you’ve ever caught a strong move on EURUSD or watched XAUUSD melt up while you hesitated, you know the pain of missing clean continuation legs. Continuation EA V1.0 MT4 is built exactly for that: spotting when an established trend has the fuel to keep going and jumping on board with disciplined entries and exits. It runs on MetaTrader 4, targets EURUSD, XAUUSD, and US30 on the M15 timeframe, and focuses on low-stress execution without martingale or reckless grids. You get a focused, momentum-friendly approach that tries to ride waves, not predict tops and bottoms.

Below, you’ll find how the EA works, the logic behind its entries and exits, installation steps, recommended settings per symbol, and best practices for risk. Keep reading if you want a trend follower that’s practical for day traders yet robust enough for semi-automation.

What is Continuation EA V1.0 MT4?

Continuation EA V1.0 MT4 is an automated strategy that looks for trend continuation instead of reversals. It filters for momentum, structure, and volatility to decide whether the current push has a high chance of extending. In short: it waits for a trend, avoids chasing the very first burst, then engages once pullbacks / micro-consolidations resolve back in the trend’s direction.

A typical pipeline looks like this:

- Trend Filter: Measures directional bias (e.g., EMA slope plus higher-high/lower-low structure) to confirm a genuine trend.

- Volatility Gate: Uses an ATR-style filter to avoid entries during dead ranges or extreme, whipsaw-heavy spikes.

- Continuation Trigger: Enters on a pullback break or micro-structure continuation pattern after a brief pause.

- Risk Control: No martingale, no grid stacking. Position sizing is fixed-lot or percentage-risk based on stop distance.

- Exit Logic: Combines dynamic stop placement with a measured take-profit (R-multiple targets) and optional trailing stop after price makes a new impulse.

This methodology aims to skip chop and lean into momentum; it’s not trying to pick tops or bottoms, it’s trying to surf the middle of a move with consistency.

Key Features

- Built for MT4: Runs smoothly on MetaTrader 4 with minimal overhead.

- Pairs & Index Covered: Optimized focus on EURUSD, XAUUSD (Gold), and US30.

- Timeframe: Designed for M15—a sweet spot between signal quality and trade frequency.

- True Trend-Following: Confirms direction before entering; no knife-catching.

- No Martingale / No Grid: Capital preservation first; each trade stands on its own merit.

- Volatility-Aware Entries: ATR-based filters help filter out low-quality setups.

- Adaptive Stops: Initial SL based on structure/ATR; optional breakeven and trailing once price moves.

- Smart Profit Taking: TP can be set via R-multiples (e.g., 1.5R/2R) or trailing exit for extended runners.

- News Avoidance Window (optional): Set a buffer period around high-impact events if you wish.

- VPS-Ready: Lightweight enough to run 24/5 with stable connectivity.

- Prop-Firm Friendly Defaults: Conservative risk and no pyramiding by default (tuneable).

- Clear Logging: Trade rationales are recorded (entry trigger, filters passed), helping you audit behavior.

Recommended Markets & Sessions

- EURUSD (M15): Consistent liquidity, reacts well during London and New York sessions.

- XAUUSD / Gold (M15): Powerful trends; be mindful of news-driven spikes. Consider slightly wider ATR multipliers.

- US30 (M15): Index momentum can be explosive. The EA favors trend legs after the New York cash open once the first impulse settles.

Tip: If you’re new to continuation trading, start with EURUSD for its cleaner structure, then layer in XAUUSD and US30 as you gain confidence.

How Continuation EA Finds Trades (The Logic, Plain English)

- Confirm the Trend

The EA checks whether price is printing higher highs/higher lows (uptrend) or lower highs/lower lows (downtrend). It also references a fast/slow EMA slope to avoid “flat” periods. - Wait for a Pullback or Pause

After an impulse, the market usually breathes. The EA looks for a small retracement or a tight consolidation (flags, small boxes). No rush, no chasing. - Continuation Trigger

Once the pause resolves (e.g., break of a micro-high in an uptrend), and ATR conditions are healthy, the EA enters with pre-defined risk. - Risk & Exit

- Stop-Loss: Typically under/over the minor structure or an ATR multiple (e.g., 1.5× ATR).

- Take-Profit: Set in R-multiples (like 1.8R–2.5R) or let a trailing stop capture extended moves.

- Breakeven (optional): After ~1R, nudge SL to breakeven to defend capital.

This keeps the system aligned with the flow and naturally filters out the “one-candle wonders” that fade immediately.

Installation & Setup (MT4)

- Copy Files

Place the EA file intoMQL4/Expertsinside your MT4 data folder. Restart MT4. - Enable AutoTrading

Click the “AutoTrading” button (green) and allow live trading in Tools → Options → Expert Advisors. - Attach to Chart (M15)

Open EURUSD, XAUUSD, or US30 charts on M15, then drag/drop Continuation EA V1.0 onto each chart. - Broker & VPS

Use an ECN/Raw-spread account with tight spreads, reliable execution, and a VPS for 24/5 uptime. - Inputs

- Risk Mode: Fixed lot (e.g., 0.01 per $1,000) or %-risk (e.g., 0.5% per trade).

- ATR Period & Multiplier: Common baseline: ATR(14), 1.5×–2.0× for SL placement.

- EMA Periods: For trend slope, a practical starting point is EMA 20/50.

- Breakeven & Trailing: Enable once comfortable; try BE at 1.0R, trail at 1.5R or use ATR trailing.

Suggested Baseline Settings (Start Here, Then Optimize)

EURUSD (M15)

- Risk: 0.5% per trade (or 0.01 lots per $1k as a crude fixed-lot baseline).

- SL: ~1.5× ATR(14) or below last swing low/high.

- TP: 1.8R–2.2R, optional trailing after 1.5R.

- Sessions: Focus London → early New York.

XAUUSD / Gold (M15)

- Risk: 0.25%–0.5% per trade (Gold is jumpy).

- SL: 1.8×–2.2× ATR(14) to account for spikes.

- TP: 1.8R–2.5R, trailing is recommended.

- News Window: Consider pausing around high-impact USD events.

US30 (M15)

- Risk: 0.25%–0.5% per trade; keep it tight.

- SL: Structure + ATR buffer (1.8× ATR is common).

- TP: 2.0R+ targets are realistic on strong trend days; trail aggressively after 1.5R.

- Sessions: New York is king; let the open play out before entries.

Important: These are starting points. Always demo-test, then calibrate based on your broker’s ticks, spread, and slippage profile.

Backtesting & Forward Testing Tips

- Model Quality: Use Every tick (or your best available) for more realistic fills.

- Data Span: Backtest at least 12–24 months to include different regimes (ranging, trending, high volatility).

- Symbol-Specific Tuning: Keep one set of inputs per symbol; Gold and indices behave differently than EURUSD.

- Walk-Forward: Don’t over-optimize. Validate parameters out-of-sample, then run forward on demo for 2–4 weeks.

- Risk Scenarios: Simulate higher spreads and latency (coz real life is messy) to see if the edge survives.

- News Filter: If your setup supports it, try excluding trades minutes before/after major events on XAUUSD/US30.

Risk Management Philosophy

Continuation EA V1.0 is conservative by design. It never doubles down via martingale or stacks grid orders. Your wins come from catching multiple clean legs over time; your losses are capped tightly per trade. Keep risk small (0.25%–0.5% for Gold/US30, 0.5%–1.0% for EURUSD if you’re comfortable) and let the math work. Scaling position size is fine only after consistent forward results.

Who Should Use This EA?

- Day traders who like momentum plays without staring at charts all day.

- Part-time traders wanting disciplined rules that don’t chase every candle.

- Prop-firm hopefuls who must control drawdown and avoid martingale at all costs.

- Systematic traders who prefer mechanical rules and clear audit trails.

Final Notes & Best Practices

- Run it on a stable VPS with low latency to your broker.

- Stick to M15—that’s where the logic is tuned.

- Avoid tinkering daily. Let a sufficiently large sample of trades build before judging performance.

- Journal your inputs and outcomes; even with automation, the trader’s mindset and data discipline makes the difference.

Conclusion

Continuation EA V1.0 MT4 aims to do one thing well: join real trends and hold on long enough to matter. If you’re tired of fading moves that rip against you or chasing breakouts that snap back instantly, this approach may feel refreshingly sane. Start on demo, collect data, tune per symbol, and graduate to live only when you’re satisfied with the consistency.

Comments

Leave a Comment