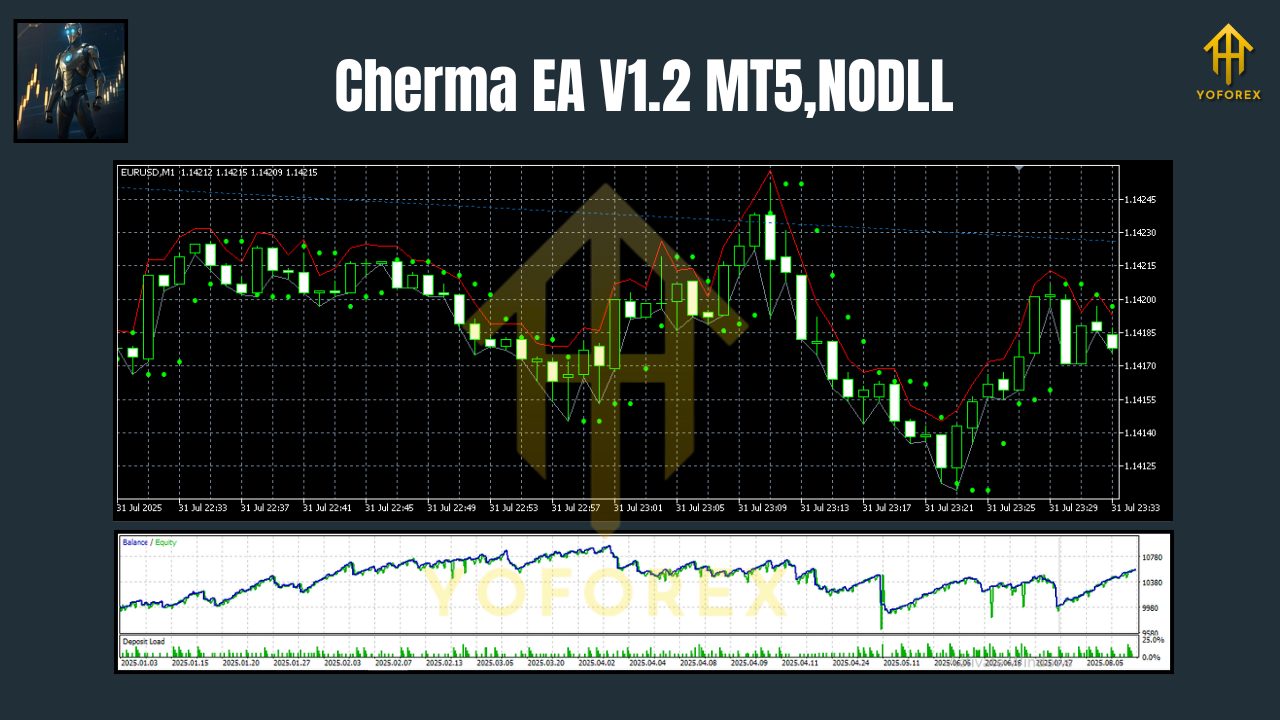

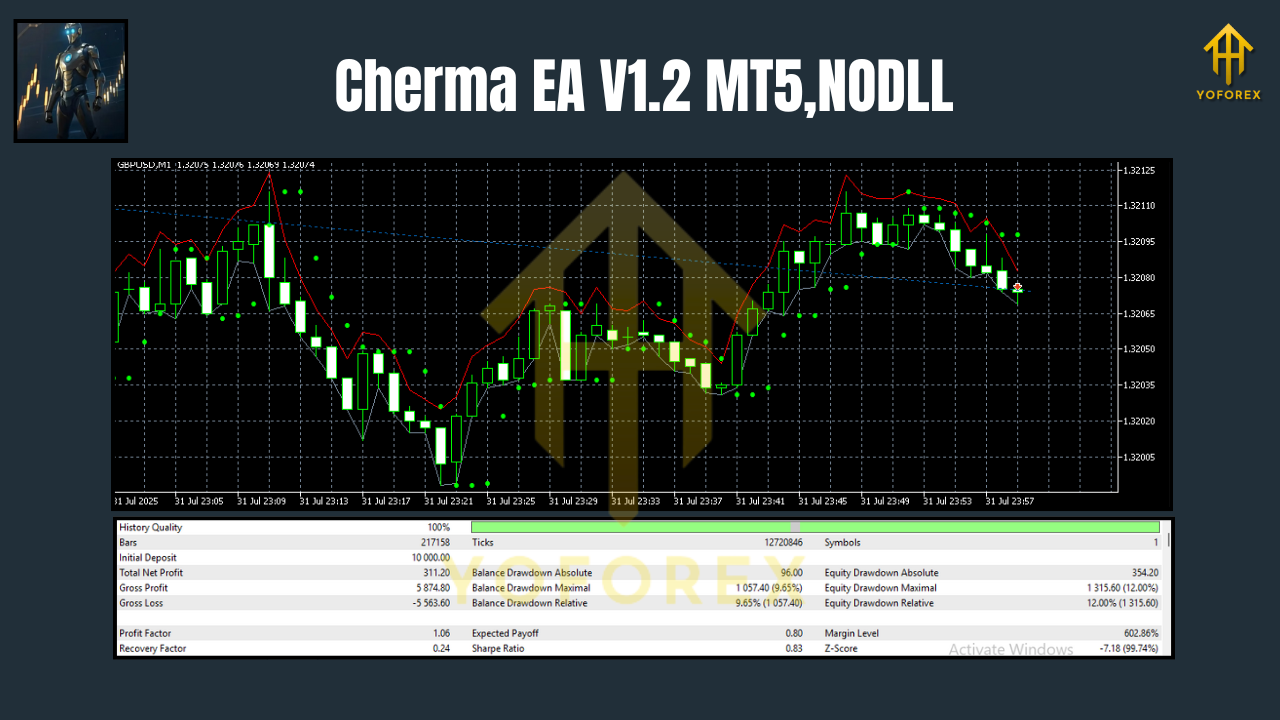

Cherma EA V1.2 MT5 – High-Frequency Scalping on Gold & Major Pairs

If you’ve ever watched price whip up and down on the M1 chart and thought, “there’s money in those micro-moves… if only I could catch them fast enough,” Cherma EA V1.2 MT5 is built for exactly that. It’s a cutting-edge Expert Advisor for MetaTrader 5 tailored to XAUUSD (Gold), EURUSD, and GBPUSD—designed specifically for high-frequency scalping on the M1 and M5 timeframes. The ethos is simple: get in fast, manage risk tightly, take the meat of the move, and get out even faster.

Below you’ll find a practical, trader-friendly breakdown of what Cherma EA is about, how it approaches entries and exits, suggested configuration ideas, and the best practices to keep it running smoothly in live markets.

What Is Cherma EA?

Cherma EA V1.2 MT5 is an algorithmic trading system that focuses on rapid execution and short holding times. Rather than “swinging for the fences,” this EA aims to compound small, consistent wins during the most active sessions of the day. It’s tuned for:

- Instruments: XAUUSD (Gold), EURUSD, GBPUSD

- Timeframes: M1 and M5 (its scalping “sweet spot”)

- Platform: MetaTrader 5 (MT5)

At its core, Cherma EA scans for micro-trends and liquidity shifts that tend to repeat intraday. Scalping systems live or die by two things: execution speed and risk discipline. That’s why the configuration approaches you’ll see below emphasize broker latency, spreads, and protective stops just as much as entries and exits. The beauty of Cherma is its simplicity: it works best when it’s laser-focused on a few pairs and avoids messy over-optimization.

Key Advantages & Capabilities

- High-Frequency Scalping Logic – Targets small, repeatable moves; built for quick in-and-out trades on M1/M5.

- Multi-Pair Coverage – Optimized for Gold (XAUUSD) plus two liquid majors (EURUSD, GBPUSD) to spread opportunity and reduce pair-specific risk.

- Tight Risk Framework – Encourages fixed Stop Loss and Take Profit values; supports break-even and trailing logic (if you choose to use them).

- Session Awareness – Performs best around London and New York overlaps where spreads and liquidity are generally favorable.

- Spread & Slippage Conscious – Works best with tight spreads and low latency; ideal for ECN/STP brokers with reliable execution.

- Magic Number Control – Keeps positions organized, especially if you run multiple systems on the same account.

- VPS-Ready – Designed for 24/5 hands-off operation on a low-latency VPS.

- Simple Tuning – A handful of parameters matter most: lot size (or risk %), TP/SL distance, trade filters, and session windows.

- Scalability – Start conservative; scale lot size or risk after a meaningful forward-test period.

Note: The EA’s efficiency depends heavily on your broker, account type, and server location. A good VPS near your broker’s servers is a big plus.

How Cherma EA Approaches the Market (Strategy Snapshot)

Cherma EA V1.2 MT5 thrives in micro-trends—those short bursts where price accelerates for a few candles before snapping back or flattening. The EA typically:

- Detects Intraday Momentum: Looks for fresh impulse waves on M1/M5 after consolidations or during session opens.

- Filters Noise: Aims to avoid chasing extended moves; prefers clean continuation or quick reversion setups with tight invalidation.

- Executes Quickly: Once the signal fires, speed matters; slippage control and spread filters become important here.

- Exits Decisively: Takes predefined profits (small but frequent) and honors stops without hesitation, minimizing drawdown spikes.

This style doesn’t need perfect win rates; it needs consistency and discipline. A dozen small, tidy wins can outweigh one controlled loss when the R-profile is balanced.

Recommended Pairs, Timeframes & Sessions

- Pairs: XAUUSD, EURUSD, GBPUSD

- Timeframes: M1 (aggressive) and M5 (balanced)

- Best Hours: London open through early New York (typically higher liquidity/lower spreads).

- Avoid: Illiquid late-session hours, high-impact news minutes, and abnormal spread spikes.

Setup Guide (Step by Step)

- Broker & Account Type

Choose a reputable ECN/STP broker with raw/tight spreads and solid MT5 infrastructure. - VPS

Deploy on a low-latency VPS near your broker’s servers to reduce slippage. - Install

- Open MT5 → File → Open Data Folder

- Drop the EA file into MQL5/Experts/

- Restart MT5 and confirm it appears in the Navigator → Experts list

4. Chart & Timeframe

Open dedicated charts for XAUUSD, EURUSD, GBPUSD on M1 or M5.

5. Attach the EA

Drag Cherma EA onto each chart. Enable Algo Trading.

6. Core Inputs to Review

- Risk Mode: fixed lot or % risk per trade

- SL/TP: start conservative; e.g., XAUUSD often needs slightly wider stops than EURUSD/GBPUSD

- Session Filter: trade only during your preferred windows

- Max Spread: don’t allow entries above a set spread threshold

- Magic Number: unique per chart/pair

7. Forward Test (Demo First)

Run at least 2–4 weeks on demo/cent before going live. Collect data, adjust modestly, and avoid over-fitting.

Risk & Money Management

- Position Sizing: Begin with fixed micro lots or 0.2%–0.5% risk per trade. Add size only after stable equity growth.

- Daily Loss Cap: Consider a daily drawdown stop (e.g., 2–3%). When it’s hit, stop trading for the day.

- Trade Limits: Limit concurrent trades per pair to maintain tight control during volatile bursts.

- News Awareness: Many scalpers stand aside during high-impact news; either disable trading around events or widen safety margins.

- Compounding Carefully: Weekly or monthly compounding beats daily “flip-the-switch” increases. Keep it boring and consistent.

Example Configuration Ideas

These are not prescriptions—just common starting baselines many scalpers explore. Always validate on demo.

XAUUSD (M1)

- Risk: 0.2% per trade (or 0.01–0.05 lots on small accounts)

- TP/SL: Smaller TP, slightly wider SL than majors to account for gold’s volatility

- Trading Window: London open to early NY

- Max Spread: Strict; gold can widen quickly

EURUSD / GBPUSD (M1/M5)

- Risk: 0.2%–0.4% per trade

- TP/SL: Balanced, with optional trailing if your tests support it

- Trading Window: London + NY overlap

- Max Spread: Tight; avoid entries during spread spikes

Who Is Cherma EA For?

- Intraday Scalpers who like fast feedback loops and plenty of trade frequency.

- Traders with Good Infrastructure (ECN account + VPS).

- Risk-Disciplined Operators who can stick to a plan and avoid over-tweaking.

- Portfolio EA Users wanting a high-frequency component alongside swing/mean-reversion bots.

If you prefer slow, swing-style trades or dislike monitoring broker conditions, this may not be your style. And that’s okay—edge comes from alignment with your temperament.

Best Practices & Tips

- Keep Charts Clean: Too many overlays can slow terminals; Cherma likes a lean environment.

- One Change at a Time: When optimizing, change one variable per week so you can attribute results.

- Document Everything: A simple journal (date, pair, timeframe, risk, SL/TP, session, results) helps you find the sweet spot faster.

- Respect the Off Switch: If spreads are ugly, news is imminent, or your daily loss limit hits—call it a day.

Final Word

Cherma EA V1.2 MT5 brings a no-nonsense, high-frequency approach to XAUUSD, EURUSD, and GBPUSD on M1–M5. With the right broker conditions and strict risk controls, it can become a dependable workhorse for scalpers who value speed, discipline, and steady compounding. Start small, track everything, and let the data guide your refinements. When the market gets noisy, your edge is consistency.

Join our Telegram for the latest updates and support

Comments

Leave a Comment