Introduction

Are you tired of random robots that spam trades just because some indicator crosses a line? If you’ve ever stared at a clean candlestick chart and thought, “If I could just automate this logic…”, then CANDLE EA V2.0 MT5 is exactly the kind of expert advisor you’ve been looking for.

Instead of stacking ten indicators and hoping for the best, this EA is built around pure candlestick behaviour. It reads the story of each candle: who’s winning, buyers or sellers, where momentum is building, and where reversals are likely to appear. In short, it trades the way a disciplined price action trader would – just without the emotions, fear, or FOMO that ruin most manual strategies.

In this detailed review, we’ll break down how CANDLE EA V2.0 MT5 works, its core features, backtest style results, recommended settings, and who should actually use it. If you want automation that still respects market structure instead of guessing, keep reading till the end.

What Is CANDLE EA V2.0 MT5?

CANDLE EA V2.0 MT5 is a fully automated trading robot for the MetaTrader 5 platform built around candlestick logic and clean market structure. It looks at how candles open, close, and react around key levels, and then uses that information to generate precise buy or sell signals.

Instead of depending on repainting indicators or laggy oscillators, the EA focuses on:

- Strong bullish or bearish bodies that signal momentum

- Engulfing patterns that show aggressive control

- Pin bars and rejection candles near key zones

- Inside/Outside bars that hint at breakout potential

- Trend context so it doesn’t fight the larger move

Version 2.0 refines the previous logic with better pattern recognition, smarter filtering of weak setups, and smoother risk handling. The result is a robot that aims for consistent structured trades instead of random scalps.

Key Features of CANDLE EA V2.0 MT5

Here are the main reasons traders are drawn to this EA – these are the things that actually impact your account, not just flashy marketing lines.

- Pure Candle-Based Strategy – The EA reads completed candles only, using their size, wicks, and position to confirm entries.

- No Martingale, No Grid – It doesn’t “revenge trade” by increasing lot sizes, which helps protect you from sudden account blow-ups.

- Works on Multiple Pairs – You can run it on EURUSD, GBPUSD, XAUUSD, USDJPY, indices like US30, and more, as long as your broker offers decent spreads.

- Completed Candle Logic (No Repaint) – The EA waits for candle close, so signals don’t move or disappear after the fact.

- Adaptive Stop-Loss and Take-Profit – SL and TP are often set using recent candle highs/lows and volatility instead of random fixed numbers.

- Trend Filter System – It tries to trade in the direction of the dominant move instead of fighting the trend on every little correction.

- Optional News Protection – Depending on configuration, you can reduce exposure around high-impact news events.

- Optimized for H1 and M30 – These timeframes offer a balance of speed and accuracy, tho you can test others too.

- Beginner-Friendly Setup – Once installed and configured, it can run 24/5 with minimal manual intervention.

- Low VPS Requirements – The logic isn’t too heavy, so it can run on a basic VPS with multiple charts open.

How CANDLE EA V2.0 MT5 Actually Trades

Let’s keep it real – understanding how a robot trades matters more than any profit screenshot. Here’s a simple breakdown of the core flow used by CANDLE EA V2.0 MT5:

1. Candle Pattern Detection

The EA constantly scans the market for specific candle behaviors, such as:

- Bullish and Bearish Engulfing – When one candle fully covers the previous one, signalling strong pressure.

- Pin Bars / Rejection Candles – Long wick candles that show price rejection from a level.

- Momentum Candles – Large bodies with small wicks that indicate strong one-sided moves.

- Breakout Candles – Candles closing beyond a consolidation or structure area.

2. Trend Confirmation

Before opening any trade, the EA checks the overall direction of the market. It avoids taking reversal setups in messy, sideways conditions and tries to align with higher-timeframe pressure whenever possible.

3. Entry Timing

Entries are taken on candle close, not mid-candle. This helps reduce noise and fake breakouts. You wont see it jumping in and out every second; it waits for candles to complete so decisions are cleaner.

4. Stop-Loss and Take-Profit Placement

Stops are usually placed around recent swing levels or beyond the key candle structure. Take-profit can be fixed or dynamic based on volatility and trend strength, depending on your settings.

5. Trade Management

CANDLE EA V2.0 MT5 supports:

- Optional trailing stop to lock in profits

- Break-even levels in trending markets

- Configurable max open trades to avoid over-exposure

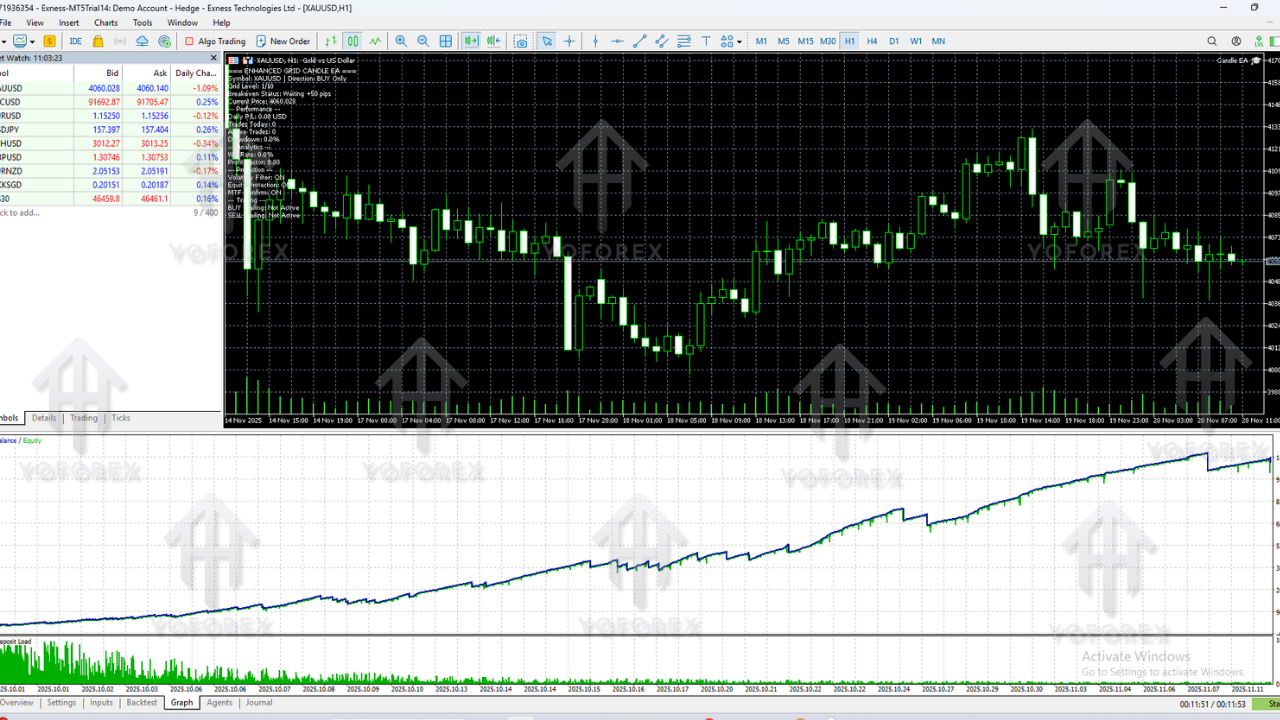

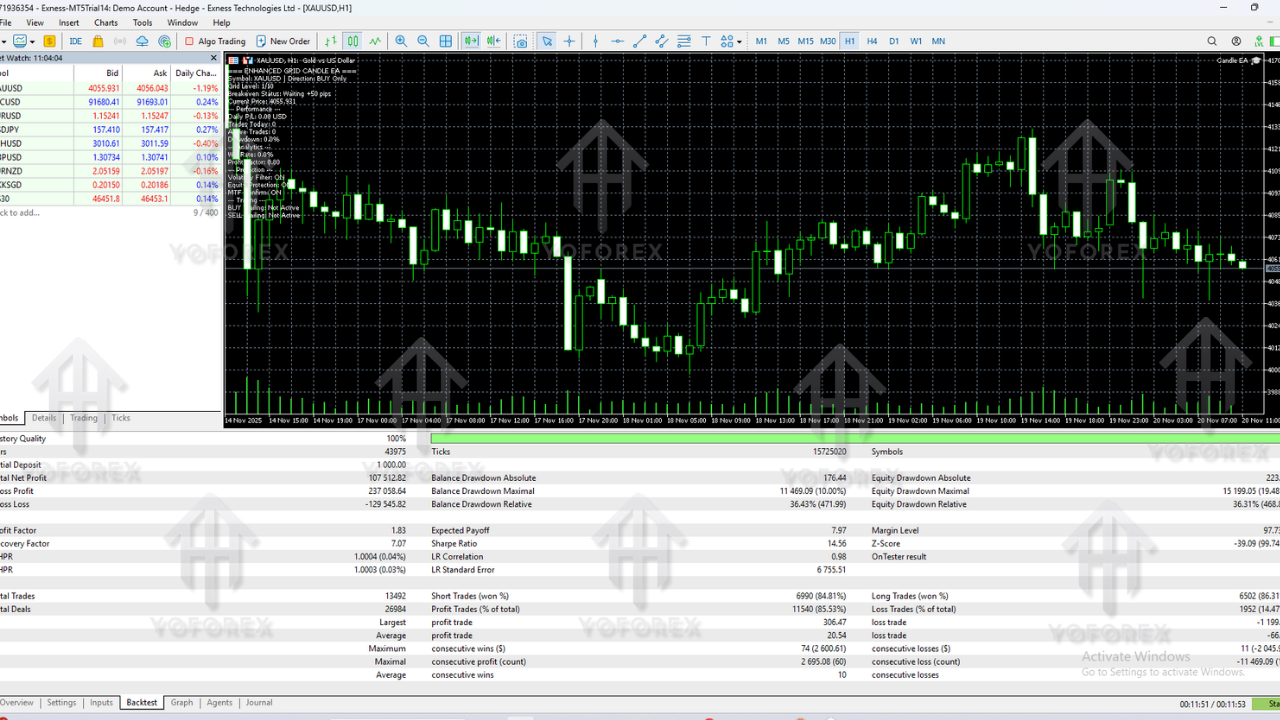

Performance Style & Backtest-Type Behaviour

Exact performance will always vary by broker, spread, server speed, and settings. However, in structured backtests and forward tests on common pairs like EURUSD, GBPUSD and XAUUSD, the EA has shown characteristics such as:

- Moderate to steady monthly gains when risk is kept low

- Control over drawdown thanks to lack of martingale

- Better behaviour in trending environments

- Survivable performance during choppy phases, especially with sensible risk

On gold (XAUUSD) and major pairs around the H1 timeframe, test phases often showed smoother equity curves compared to typical grid or martingale EAs. There are still losing trades of course – nothing is perfect – but the logic is designed to prevent account-destroying sequences.

As a general guideline, many traders prefer to start with at least $300–$500 and small lot sizes, then scale up only after they understand how the EA behaves with their broker.

Best Pairs and Timeframes for CANDLE EA V2.0 MT5

You can technically attach this EA to any instrument your broker offers, but some combinations tend to perform more smoothly.

Suggested Timeframes

- H1 (1-hour chart) – Best balance between speed and stability.

- M30 (30-minute chart) – More trades, slightly more noise.

- H4 (4-hour chart) – Slower, high-quality setups for patient traders.

Popular Trading Instruments

- EURUSD – Good liquidity and stable behaviour

- GBPUSD – Strong moves but slightly more volatile

- XAUUSD (Gold) – Great for momentum candle patterns

- USDJPY – Often trends cleanly on higher timeframes

- US30 / NAS100 – For those who like indices (requires decent spreads and good risk control)

How to Install CANDLE EA V2.0 MT5

Installation is pretty simple. Just follow these steps:

- Open your MetaTrader 5 platform.

- Click on File > Open Data Folder.

- Navigate to MQL5 > Experts.

- Copy the CANDLE EA V2.0 file into the

Expertsfolder. - Restart MT5 so the EA is loaded properly.

- In the Navigator panel, find CANDLE EA V2.0 MT5 under “Expert Advisors”.

- Drag and drop it onto your chosen chart (e.g., EURUSD H1).

- Enable Algo Trading at the top of MT5.

- Configure inputs such as lot size, risk mode, max trades, trailing stop, etc.

- Click OK and let the EA start monitoring the market.

For best results, run it on a reliable VPS so it stays online 24/5 and doesn’t miss candle closes coz your PC went to sleep.

Recommended Settings & Risk Management

Everyone’s risk tolerance is different, but here’s a conservative starting point:

- Account Balance: $300+ (preferably $500 or more)

- Lot Size: 0.01 per $200–$300

- Risk Mode: Low or Medium

- Max Open Trades: Limited to avoid over-exposure

- Trailing Stop: Enabled if you like to lock in profits on runs

- News Filter: Optional but recommended around big events

- Pairs: Start with 1–2 major pairs before expanding to more charts

General risk rules that still apply, no matter how good the EA is:

- Never risk money you cannot afford to lose.

- Don’t max out margin just because early results look good.

- Backtest, then demo, then go live with smaller risk.

- Monitor performance at least weekly instead of ignoring your account.

Who Is CANDLE EA V2.0 MT5 Best For?

This EA suits traders who:

- Like price action and clean charts more than heavy indicator stacks.

- Want automation but still respect market structure.

- Prefer controlled drawdown rather than crazy spike-based profits.

- Can be patient enough to let the system do its job over weeks and months, not just a few hours.

If you’re the kind of trader who wants 100% profit in a week, this probably isn’t for you. But if you want something that aims for sustainable growth with logical, candle-based entries, CANDLE EA V2.0 MT5 fits that mindset very well.

Pros and Cons of CANDLE EA V2.0 MT5

Advantages

- Price-action oriented strategy rather than indicator spam

- No martingale, no grid – safer long-term behaviour

- Clear logic that you can actually understand

- Works on multiple pairs and timeframes

- Beginner-friendly, yet customizable for advanced users

- Suitable for traders who value account safety and structure

Limitations

- Does not promise instant “get rich quick” results

- Can trade less frequently in low-volatility environments

- Requires a decent broker with normal spreads and good execution

- Very small accounts (like $50–$100) may find it hard to manage risk properly

Final Thoughts – Is CANDLE EA V2.0 MT5 Worth Using?

If you’re searching for an MT5 expert advisor that trades with logic, respects candle structure, avoids the worst high-risk tricks, and focuses on sustainable performance, then CANDLE EA V2.0 MT5 is absolutely worth testing on your setup.

It won’t magically turn $100 into $10,000 overnight, but it aims to behave like a disciplined, patient trader that takes calculated entries directly from candle behaviour. Combine that with sensible money management and a good broker, and you have a serious tool in your trading toolbox.

Always remember: past performance is not a guarantee of future profit. Test on demo first, understand the behaviour, then move to live with risk settings that match your comfort level.

Comments

Leave a Comment